SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Данные по ИПЦ и промпроизводству

- 11 января 2017, 16:20

- |

Индекс потребительских цен постепенно стагнирует. Последние 2 года был всплеск и аналитики ожидают, что его цикл подходит к своему завершению:

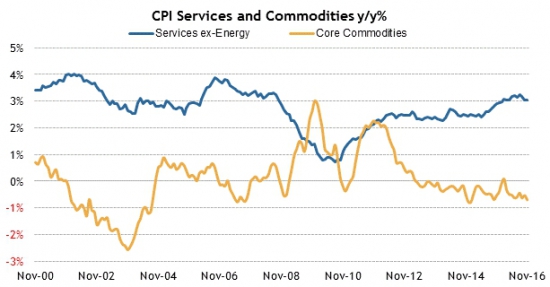

Основной рост цен наблюдается в сфере услуг, в то время как индекс цен на товары медленно и верно идёт на спад:

Ожидается замедление индекса до 0.2% и его дальнейшая балансировка в районе 242:

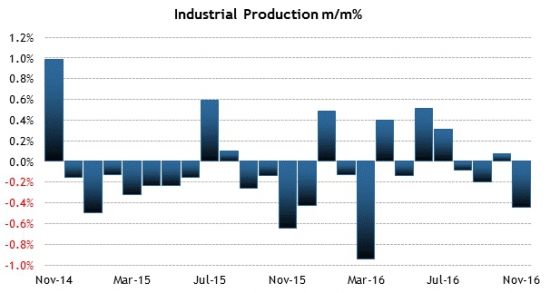

Большее внимание сегодня будет приковано к показателям промышленного производства, находящегося на локальном спаде. :

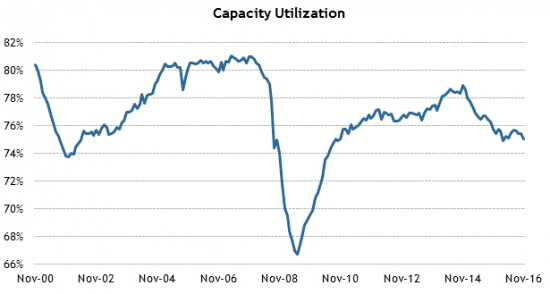

Коэффициент использования производственных мощностей также демонстрирует отрицательную динамику:

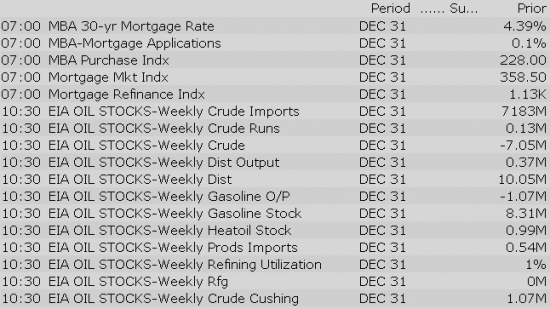

Другие новости:

Данные: Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

«Q4 came in strong with continued success in expanding our customer relationships allowing us to affirm our healthy Q4 outlook and to provide record Q1 guidance that reflects both the Omtool acquisition and the continued growth in our core business,» said Mr. McDonald. «Finally, we are raising our long term Adjusted EBITDA margin target to 35% to reflect the increased customer loyalty and operating efficiency we are seeing as we scale.»

Markets in the Asia-Pacific region ended Wednesday on a mixed note, but the trading day was fairly quiet. The World Bank did lower its GDP growth outlook for 2017 and 2018, but the adjustment only reduced the previous forecast by 10 basis points. The forecast for 2017 was lowered to 2.7% from 2.8%. The U.S. growth forecast for 2017 was maintained at 2.2% due to the expected impact of fiscal stimulus under the new administration.

---Equity Markets---

---FX---

Stocks with favorable mention: ADI, AMD, AVGO, BHP, CAT, CMG, CMI, CWH, EW, FRT, HD, MU, NUE, SLB, TXN, WDC

Stocks with unfavorable mention: AA, ESV, KIM, NVDA, SWKS, TEVA, TWOU, USG, WOR, WTW

Major European indices trade near their flat lines with Germany's DAX (+0.4%) showing relative strength while Italy's MIB (-0.3%) underperforms. Although equity markets have maintained narrow ranges so far, the euro has retreated steadily, falling 0.5% against the dollar to 1.0508. The decline leaves the single currency in the bottom half of its trading range that dates back to early December. The British pound has also retreated against the dollar, surrendering 0.5% to 1.2121, despite above-consensus economic data. On balance, economic data received since the Brexit vote has been strong relative to expectations.

---Equity Markets---

Gapping down: NVDQ -16.3%, ETRM -9.7%, SGNL -8.5%, PFGC -5.8%, ADM -5.6%, BRG -5.5%, GNVC -5.5%, TERP -4.8%, SIG -4.5%, PE -3.8%, CTIC -3.6%, BMY -3.3%, HIMX -3%, VECO -3%, JNPR -2.5%, BBVA -2.2%, RBS -2%, BWA -1.9%, BCS-1.8%, LMNR -1.6%, AZN -1.5%, SHPG -1.3%, F -0.8%, GST -0.7%

Treasuries Tick Higher as Dollar Jumps

Upgrades:

Downgrades:

Miscellaneous:

Equity futures point to a slightly lower open on Wednesday morning as the S&P 500 futures trade two points below fair value. Global markets are mixed with Asia closing on a mostly higher note while European indices hover near their flat lines.

Crude oil is up for the first time in three days amid reports that Saudi Arabia, the world's top exporter, plans to cut supply to Asia. The commodity is higher by 0.4%, trading at $51.03/bbl.

U.S. Treasuries are flat this morning amid an uptick in the U.S. dollar. The 10-yr yield remains unchanged at 2.38%, while the U.S. Dollar Index (102.39, +0.38) is up 0.4%.

Today's only economic data was the MBA Mortgage Index, which crossed the wires at 7:00 am ET this morning. The index came in at 5.8%.

In U.S. corporate news of note:

Reviewing overnight developments:

Reaffirms FY16 guidance:

Issues FY17 guidance:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

2016 Production Highlights (Compared to Full Year 2015)

4Q16 Production Highlights (Compared to Fourth Quarter 2015)

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Select pharma related names showing weakness:

Other news:

Analyst comments:

European Bonds Rally