SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Динамика цен Экспорт/Импорт.

- 12 января 2017, 16:32

- |

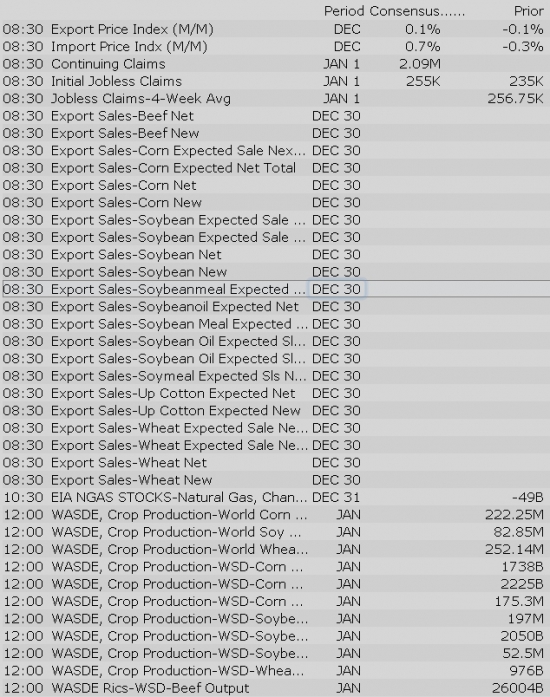

Показатели находятся в сезонном повышающемся цикле. Аналитики ожидают пробитие нулевых отметок:

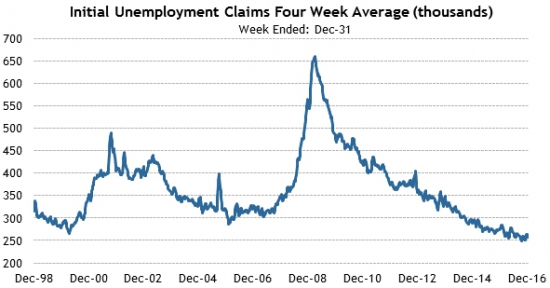

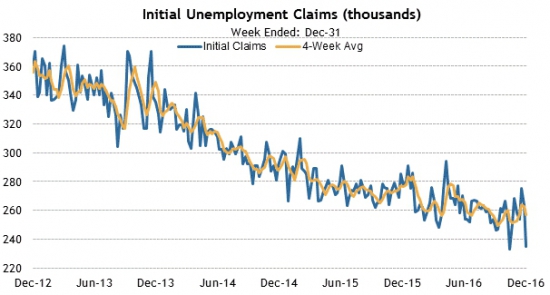

Также выходят еженедельные данные по безработице, находящиеся на своих минимальных значениях:

Количество первичных заявок на пособие ожидается на уровне 245 тысяч:

Основные новости недели выходят завтра, сегодняшний день ожидается с умеренной волатильностью.

Все новости на сегодня:

+

Данные: Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Treasuries Rally as Dollar Drops Again

2016 Performance Highlights

2017 Outlook and Guidance

Equity futures point to a lower open Thursday morning as the S&P 500 futures trade five points below fair value. Investors continue to digest President-elect Trump's first post-election press conference while observing a downtick in overseas markets.

Crude oil is up again today after a sizable gain on Wednesday despite EIA data showing a big inventory build. The energy component is higher by 1.2%, trading at $52.89/bbl.

The Treasury market has seen an uptick in buying interest this morning, with the 10-yr yield lower by four basis points at 2.33%.

Today's economic data will include December Import/Export Prices and Initial Claims (Briefing.com consensus 235k) at 8:30 am ET, followed by the Treasury Budget at 2:00 pm ET.

In U.S. corporate news of note:

Reviewing overnight developments:

Upgrades:

Downgrades:

Miscellaneous:

Eurozone Core/Periphery Spreads Narrow as Industrial Production Jumps

The S&P 500 futures trade five points below fair value.

Just in, import prices excluding oil declined 0.2% in December after ticking down 0.1% in November. Export prices excluding agriculture increased 0.4% in December after declining 0.1% in November (revised from +0.2%).

Separately, the latest weekly initial jobless claims count totaled 247,000 while the Briefing.com consensus expected a reading of 255,000. Today's tally was above the revised prior week count of 237,000 (from 235,000). As for continuing claims, they declined to 2.087 million from the revised count of 2.116 million (from 2.112 million).

Gapping up

In reaction to strong earnings/guidance:

Select metals/mining stocks trading higher:

Select AAOI peers showing strength:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

The S&P 500 futures trade five points below fair value.

Markets in the Asia-Pacific region ended Thursday on a mostly lower note with Japan's Nikkei (-1.2%) pacing the retreat amid an uptick in the yen. The Japanese currency surged during yesterday's Wall Street session, continuing its advance into the night. The yen is up 0.8% against the dollar at 114.44. Standard & Poor's commented on China's bond market, saying there is a need for stronger governance to curb questionable trading practices and excessive risk taking.

---Equity Markets---

Major European indices trade mixed. It is worth noting that London has dropped the demand to retain the ‘financial passport' that allows sales across the single market. The news has contributed to weakness in UK bank stocks. Elsewhere, a presidential poll in France showed that Francois Fillon would be expected to beat Marine Le Pen with a 63-37 vote. However, a tight, three-way race is expected between the two candidates and Emmanuel Macron.

---Equity Markets---

Gapping up

In reaction to strong earnings/guidance:

Select metals/mining stocks trading higher: GFI +4.3%, SBGL +3.3%, MUX +2.9%, RIO +2.9%, CDE +2.6%, HMY +2.5%, KGC +2.4%, AG +2.3%, SLW +2.3%, ABX +2.2%, AUY +2.2%, PAAS +2.2%, GDX +2.1%, BBL +2.1%, BHP +2.1%, AGI +2%, NEM+1.9%, VALE +1.6%, AA +1.3%

Select AAOI peers showing strength: OCLR +3.3%, ACIA +1.5%, LITE +1.2%, NPTN +0.5%

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

Filings:

Offerings:

Pricings: