SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Доходы физических лиц.

- 30 января 2017, 16:44

- |

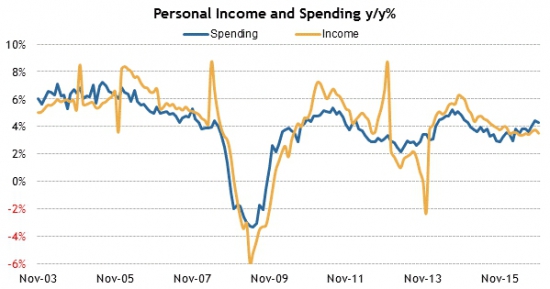

Данные по доходам и расходам населения Америки за декабрь показывают рост последние 9 месяцев и ожидаются на уровнях 0.4%. В годовом исчислении они находятся около 4-хпроцентной отметки:

Расходы растут более хаотично, в росте доходов просматривается плановость:

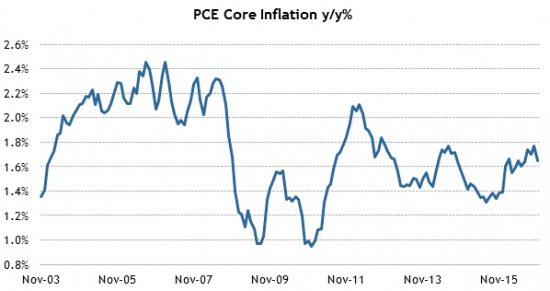

Базовый индекс расходов на личное потребление ожидается аналитиками на отметке 1,7%:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

order by President Trump that put a ban on travel from 7 countries over the weekend. The Dollar saw pressure due to the news early on, but has recovered and currently unchanged.

Market updates:

US Econ Data

Keysight Technologies (KEYS) and Ixia announced a definitive agreement for Keysight to acquire Ixia in an all-cash transaction totaling approximately $1.6 billion in consideration, net of cash. The Board of Directors of both companies have unanimously approved the transaction, which is anticipated to close no later than the end of October 2017 and is subject to customary closing conditions and approvals. Under the terms of the agreement, Ixia shareholders will receive $19.65 per share in cash.

Arginase is an enzyme produced by immunosuppressive myeloid cells, including myeloid-derived suppressor cells and neutrophils, which prevents T-cell and natural killer cell activation in tumors.

Equity indices in the Asia-Pacific region began the week on a quiet note amid Lunar New Year closures in China, Hong Kong, South Korea, and Singapore. The few markets that were open saw cautious action amid uncertainty related to a travel ban that temporarily restricted arrivals to the U.S. from seven Middle Eastern countries. In Japan, the country's cabinet maintained a 61.0% approval rating, according to Yomiuri.

---Equity Markets---

---FX---

Gapping down: TPX -28.8%, RGLS -26.7%, FIT -12.5%, AXAS -4.7%, HIMX -3.5%, ARRY -3%, BCS -2.5%, SDRL -2.4%, DB -2.2%, DEO -2.1%, IHG -2%, STM -1.9%, RIO -1.7%, RDS.A -1.6%, MT -1.5%, AKS -1.5%, BP -1.5%, SSL -1.4%, UN -1.3%, NOK -1.3%, TWO -1.2%, NVO -1.1%, BHP -1%, RBS -1%, BBL -1%

Major European indices trade in negative territory with Italy's MIB (-2.0%) showing relative weakness. Overall investor sentiment has been weighed down by the weekend announcement of a travel ban, which temporarily restricted arrivals to the U.S. from seven Middle Eastern countries. The underperformance in Italy comes amid a spike in yields and speculation that the country is headed for early elections. Italy's benchmark 10-yr yield has jumped ten basis points to 2.31% while Germany's 10-yr yield is flat at 0.47%.

---Equity Markets---

Upgrades:

Downgrades:

Miscellaneous:

Treasuries Vacillate Ahead of Personal Income/Spending Report

Equity futures are lower this morning as global markets digest the implications of President Trump's executive order issued late Friday, which temporarily suspends the U.S. refugee program. The S&P 500 futures trade eight points (0.3%) below fair value.

U.S. Treasuries are flat, with the 10-yr yield unchanged. Similarly, crude oil is also relatively flat this morning, holding a slim 0.1% gain. The commodity currently trades at $53.24/bbl.

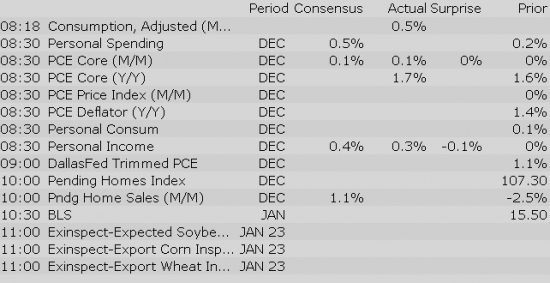

Today's economic data will include December Personal Income (Briefing.com consensus 0.4%) and December Pending Home Sales (Briefing.com consensus 1.3%). The two reports will be released at 8:30 am ET and 10:00 am ET, respectively.

In U.S. corporate news:

Reviewing overnight developments:

DHT +14% premarket… FRO -0.6% premarket.

Yields Jump in Eurozone Periphery

The S&P 500 futures trade ten points (0.4%) below fair value.

Just in, December personal income rose 0.3% while the Briefing.com consensus expected an increase of 0.4%. Meanwhile, December personal spending increased 0.5% while the Briefing.com consensus expected a reading of 0.4%. The November Personal Spending reading was left unrevised at 0.2% while November Personal Income was revised to 0.1% from 0.0%.

Separately, Core PCE prices for December rose 0.1% (Briefing.com consensus 0.2%). The November reading was left unrevised at 0.0%.

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

Filings:

Offerings:

Pricings:

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Select financial related names showing weakness: SAN -2%, RBS -1.4%, DB -2.9%, .

Select metals/mining stocks trading lower: MT -2.1%, AKS -2.1%, RIO -2%, BBL -1.8%, BHP -1.6%, VALE -1.6%, X -1.4%, .

Select oil/gas related names showing early weakness: SSL -1.9%, RDS.A -1.8%, SDRL -1.7%, BP -1.7%, CHK -1%, .

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Select financial related names showing weakness: SAN -2%, RBS -1.4%, DB -2.9%, .

Select metals/mining stocks trading lower: MT -2.1%, AKS -2.1%, RIO -2%, BBL -1.8%, BHP -1.6%, VALE -1.6%, X -1.4%, .

Select oil/gas related names showing early weakness: SSL -1.9%, RDS.A -1.8%, SDRL -1.7%, BP -1.7%, CHK -1%, .

Other news:

Analyst comments:

The S&P 500 futures trade nine points (0.4%) below fair value.

Equity indices in the Asia-Pacific region began the week on a quiet note amid Lunar New Year closures in China, Hong Kong, South Korea, and Singapore. The few markets that were open saw cautious action amid uncertainty related to a travel ban that temporarily restricted arrivals to the U.S. from seven Middle Eastern countries. In Japan, the country's cabinet maintained a 61.0% approval rating, according to Yomiuri.

---Equity Markets---

Major European indices trade in negative territory with Italy's MIB (-2.1%) showing relative weakness. Overall investor sentiment has been weighed down by the weekend announcement of a travel ban, which temporarily restricted arrivals to the U.S. from seven Middle Eastern countries. The underperformance in Italy comes amid a spike in yields and speculation that the country is headed for early elections. Italy's benchmark 10-yr yield has jumped seven basis points to 2.31% while Germany's 10-yr yield is down one basis point at 0.45%.

---Equity Markets---

Upcoming IPOs:

The stock market is poised for a lower open as investors contemplate the implications of President Trump's executive order, which temporarily suspends the U.S. refugee program. The S&P 500 futures trade nine points (0.4%) below fair value.

On the earnings front, Enterprise Products (EPD 28.85, -0.24) is down 0.8% in pre-market trade after the company reported worse than expected earnings per share this morning.

U.S. Treasuries are currently near their overnight highs, hovering just above their flat lines. The 10-yr yield is down one basis point at 2.47%.

Conversely, crude oil has slipped in recent action, descending from positive territory into the red. The commodity is currently at its overnight low, down 0.4% at $52.95/bbl.

On the data front, December personal income rose 0.3% while the Briefing.com consensus expected an increase of 0.4%. Meanwhile, December personal spending increased 0.5% while the Briefing.com consensus expected a reading of 0.4%. The November Personal Spending reading was left unrevised at 0.2% while November Personal Income was revised to 0.1% from 0.0%.

Separately, Core PCE prices for December rose 0.1% (Briefing.com consensus 0.2%). The November reading was left unrevised at 0.0%.

Today's last economic report, December Pending Home Sales (Briefing.com consensus 1.3%), will cross the wires at 10:00 am ET.

The S&P 500 opened Monday's session 0.5% lower as nine of its eleven sectors trade in negative territory.

Non-cyclical sectors have outperformed the benchmark index thus far with the utilities (+0.1%) and telecom services (+0.1%) sectors showing modest gains, while health care (-0.2%), consumer staples (-0.2%), and real estate (-0.4%) also outperform.

On the cyclical side, only the consumer discretionary sector (-0.3%) outperforms the broader market. The remaining growth-sensitive sectors--financials, technology, industrials, energy, and materials--all show losses between 0.6% and 0.9%.

U.S. Treasuries opened the trading day flat with the benchmark 10-yr yield unchanged at 2.48%.

Economic Data Summary:

Upcoming Economic Data:

Other International Events of Interest

Key Points from Last Quarter

Options Activity

Technical Perspective

The tech sector — XLK — trades behind the broader market. Semiconductors, meanwhile, display relative weakness as the SOX index trades -1.46%. Within the SOX index, NXPI (-0.13%) outperforms the rest of the sector yet still trades in the red, while MSCC (-3.11%) lags. Among other major indices, the SPY is trading 0.86% lower, while the QQQ -1.18% and the NASDAQ -0.99% trade modestly lower on the session. Among tech bellwethers, AMX (+0.20%) is showing relative strength, while NVDA (-3.30%) lags.

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

Scheduled to report earnings after the bell:

Scheduled to report earnings tomorrow morning:

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 1.33… VIX: (12.02, +1.44, +13.6%).

February 17 is options expiration — the last day to trade February equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

- Calithera Biosciences (CALA +52.17%) announce global collaboration to develop & commercialize CB-1158; Calithera to receive a $45 mln up-front payment and an $8 mln equity investment from INCY through a share purchase priced at $4.65/share

- Eyegate Pharma (EYEG +16.87%) announces 'positive' top-line data from first-in-human pilot trial of ocular bandage gel in corneal epithelial defects

- Rigel Pharma (RIGL +4.8%) announces updates from the clinical program of fostamatinib in patients with chronic immune thrombocytopenic purpura; Rigel believes the data further validates fostamatinib as a potential new treatment option for some patients with this serious disease

Decliners on news:- Ocera Therapeutics (OCRX -68.29%) announces top-line results for Phase 2b study in Hepatic Encephalopathy; primary and secondary endpoints showed trend and dose-related clinical benefit although not statistically significant

- Pulmatrix (PULM -28.49%) announces $5 mln registered direct offering at $2.50/share

- NeuroMetrix (NURO -4.7%) files for 20.75 mln share common stock offering by holders (10 mln shares issuable upon conversion of Series E Preferred Stock and 10.75 mln shares issuable upon exercise of Warrants)

Upgrades/Downgrades:Biggest point losers: TPX 45.5(-17.69), CXO 136.96(-7.08), OPB 21.1(-6.15), GS 231.91(-5.04), IBB 269.19(-4.89), FANG 101.86(-4.82), TSLA 248.29(-4.66), CHTR 318.97(-4.58), UAL 70.22(-4.2), AVGO 201.55(-4.16), FDX 191.77(-4.15), XIV 58.31(-4.02), ORLY 260.13(-3.66), VMC 130.82(-3.54), GD 181.68(-3.46), NVDA 108.32(-3.45), NFLX 139.03(-3.42), BAH 32.98(-3.28), LRCX 115(-3.24), SLCA 55.69(-3.15), WDAY 81.63(-3.14), BA 164.6(-3.1), BIIB 275.17(-3.04), ILMN 157.99(-3), ACIA 58(-2.98)

Stocks that traded to 52 week lows: ADPT, AKR, AMDA, ANF, ANTH, ASNA, BONT, CBR, CDR, CMRE, CRAY, CRI, DDS, DRNA, DRWI, ENDP, EXPR, EYES, FCEL, FIT, GBSN, GEC, GNC, HGG, HIMX, ICLD, INNL, IPXL, IRMD, JASO, JCP, LB, MDGS, MFIN, NH, NK, NLSN, OCRX, PGLC, PLUG, RAD, RGLS, RNVA, RT, RWLK, SFM, SHLD, SHOS, SMRT, SOL, SPWH, SSI, STKS, STOR, SVU, TPX, TRIL, TUES, VFC, VMEMQ, VSI, WCST, XON

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week highs on High Volume: CFBK, CFCB, CPIX, CWAY, DNBF, FSBK, GGM, HBK, HBMD, IDSY, IROQ, KFS, MFRI, MMAC, SPLP, SYNL, SZC, WBB

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week lows on High Volume: EDUC, EVGN, FXCM, LUB, SRSC

Today's top 20 % gainers

- Healthcare: ATRS (2.02 +4.02%)

- Materials: KGC (3.76 +4.16%), BTG (3.04 +3.23%), IAG (4.61 +3.13%), HMY (2.52 +3.07%), NEM (35.41 +3%)

- Industrials: BGG (21.48 +3.32%)

- Consumer Discretionary: RCII (8.47 +5.74%), FRED (14.73 +4.39%), HIBB (33.75 +3.21%)

- Information Technology: HDP (9.67 +8.65%), NQ (3.89 +7.46%), XXIA (19.45 +6.87%), IPGP (111.42 +6.65%)

- Financials: BANC (15.53 +4.9%), SQQQ (45.15 +3.72%)

- Energy: DHT (4.78 +11.94%)

- Consumer Staples: THS (75.24 +3.87%)

- Utilities: NEP (29.85 +8.28%)

Today's top 20 % losersToday's top 20 volume

- Materials: AKS (10.62 mln -3.1%), FCX (10.05 mln -1.68%), NGD (8.8 mln -19.44%), VALE (8.35 mln -3.37%), X (7.74 mln -4.2%)

- Industrials: GE (9.57 mln -0.4%)

- Consumer Discretionary: F (14.85 mln -1.08%), TPX (11.81 mln -28.69%)

- Information Technology: FIT (21.98 mln -11.51%), AMD (14.14 mln -3.37%), AAPL (11.28 mln -0.71%), MSFT (9.87 mln -1.25%), MU (8.79 mln -1.79%), FB (8.28 mln -1.59%), NOK (8.12 mln -2.37%)

- Financials: BAC (42.58 mln -2.35%), QQQ (9.97 mln -1.23%)

- Energy: CHK (24.22 mln -6.56%), WFT (8.17 mln -4.09%)

- Consumer Staples: RAD (68.59 mln -16.74%)

Today's top relative volume (current volume to 1-month average daily volume)Coach (COH) is set to report Q2 results tomorrow before the open with a conference call to follow at 8:30 AM ET. Co reported last quarter's results at 6:45 AM ET. Current Q2 Capital IQ consensus stands at EPS of $0.74 (vs. $0.68 last year) on revs up 2% to $1.32 bln.

Other Notables from Q1

News During Quarter

Stock Action During Quarter

Analyst Actions

Related Stocks: KATE, KORS, M, JWN

Notable earnings/guidance:

- Trading higher following guidance: TSQ 2.6% (Townsquare Media says meeting with lenders to discuss a possible reduction in the interest rate under its senior secured credit agreement, reaffirms Q4 guidance)

- Trading lower following guidance/news: TPX -32.1% (Tempur Sealy Int'l guides Q4 sales of approx. $770 mln vs $740.95 consensus estimatel terminates contracts with largest customer Mattress Firm), FIT -13.3% (bit lowers Q4 guidance; sees FY17 well below consensus; announces restructuring, cutting 6% of workforce)

- Near unchanged mark following guidance: AMC (expects 2016 revenue in the range of $3.22-3.23 bln, Capital IQ consensus $3.12 bln; Sees EPS above consensus)

In the news:- Leaders: ODP 0.9% (Office Depot appoints Gerry Smith to replace Roland Smith as CEO effective Feb 27, 2017), M 1.2% (sells Frango to Garrett Brands; terms not disclosed), WHR 0.8% (Whirlpool announces a 4-year exclusive contract renewal with Meritage Homes), FRGI 1% (JCP Investment has nominated slate of director candidates for election at annual meeting), FRED 3.1% (WBA/RAD news), RCII 7.2% (Engaged Capital discloses 9.9% active stake, says has engaged, and intends to continue to engage, in communications with the Board and management team regarding means to create stockholder value)

- Laggards: RAD -17.2% and WBA -0.3% (Rite Aid & Walgreens amend and extend definitive merger agreement; parties have agreed to reduce the price for each share of Rite Aid common stock to be paid by Walgreens Boots Alliance to a maximum of $7.00/share and a minimum of $6.50/share; Walgreens Boot Alliance lowers high end of FY17 EPS guidance: $4.90-5.08 from $4.90-5.20 vs. $5.04 consensus), DHI -2% (Chairman sold 2,000,000 shares at $30.98-31.46 worth ~ $63 mln), IHG -2.1% (weak in response to Trump exec orders over weekend), LUX -0.9% (expands its presence in the optical franchise business with ~950 stores; will acquire 100% of Óticas Carol), GM -1.7% and HMC -0.6% (General Motors and Honda confirm plans to establish industry-first joint fuel cell system manufacturing operation in Michigan), OSTK -3.5% (Overstock.com enters into oral agreement to purchase 604,229 shares of its common stock from one or more subsidiaries of Fairfax Financial at $16.55/share)

- Nearly unchanged: LOW (announces new $5 bln share repurchase program)

Analyst related:Looking ahead:

Rumor Activity was slow to start out the week.

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term.

The broader market begins the week in the red, led lower by the Nasdaq Composite which sheds about 58 points (-1.02%) to 5603, the S&P 500 is down about 20 (-0.89%) to 2274, and the Dow Jones Industrial Average loses 167 (-0.83%) to 19926. Action has come on higher than average volume (NYSE 345 vs. avg. of 327; NASDAQ 807 mln vs. avg. of 776), with decliners outpacing advancers (NYSE 686/2299, NASDAQ 547/2243) and new highs outpacing new lows (NYSE 27/26, NASDAQ 38/36).

Relative Strength:

Short-Term Futures-VXX +4.9%, Turkey-TUR +4.5%, Japanese Yen-FXY +1.2%, Jr. Gold Miners-GDXJ +0.8%, Gold Miners-GDX +0.6%, Indian Rupee-ICN +0.5%, Singapore-EWS +0.5%, Canadian Dollar-FXC +0.4%, Gold-GLD +0.4%, India-INP +0.3%, Swiss Franc-FXF +0.2%, Silver-SLV +0.2%, US Diesel/Heating Oil-UHN +0.1%, US Preferred Stock-PFF +0.1%.

Relative Weakness:

Greece-GREK -4.5%, US Nat Gas-UNG -3.8%, Oil Svcs.-OIH -3.3%, Oil&Gas E&P-XOP -3.1%, Italy-EWI -3.0%, Emrg. Mkts. M. East&Africa-GAF -2.7%, Steel-SLX -2.7%, Homebuilders-XHB -2.3%, Clean Energy-PBW -2.2%, US Energy-IYE -2.1%, Egypt-EGPT -1.9%, S. Africa-EZA -1.8%, Poland-EPOL -1.7%, Russia-RSX -1.6%.

The stock market has opened the week under selling pressure as investors digest some of President Trump's latest executive orders. The S&P 500 is lower by 1.0% while small caps underperform with the Russell 2000 falling 1.5%.

On Friday night, Mr. Trump ordered a temporary suspension of the U.S. refugee program in addition to barring travelers from seven countries-- Iran, Iraq, Libya, Somalia, Sudan, Syria and Yemen — from entering the U.S. The executive order has raised global concerns over President Trump's protectionist agenda, which seems to have taken priority over the pro-growth promises of his campaign trail.

To be fair, this week will feature a heavy dose of economic data, a number of quarterly reports, and policy updates from the Bank of Japan and the Federal Reserve, so today's caution may be related to more than just one item.

Succumbing to Monday's broad selling pressure, all eleven sectors are in negative territory. Cyclical sectors have led the retreat, with energy (-2.3%) posting the widest loss. The space has been hurt by a downbeat response to Enterprise Products' (EPD 28.40, -0.68) quarterly earnings report and a 1.0% downtick in crude oil; the energy component currently trades at $52.63/bbl. The consumer discretionary space (-0.6%) is the only growth-sensitive space that trades ahead of the broader market thus far.

On the non-cyclical side, all five spaces outperform the benchmark index. Consumer staples (-0.2%) tops the day's leaderboard, while the remaining four spaces--health care, utilities, telecom services, and real estate--show losses between 0.5% and 0.7%.

Conversely, the Treasury market has profited from the risk-off tone with the benchmark 10-yr yield lower by one basis point at 2.48%. Larger gains have been recorded up front, with the 2-yr yield falling two basis points to 1.20%.

Today's economic data included December Personal Income and December Pending Home Sales:

The following options are exhibiting notable trading, potentially indicating changing sentiment toward the underlying stocks, and/or potentially representing positioning for increased volatility.

Bullish Call Activity:

Bearish Put Activity:

Sentiment: The CBOE Put/Call ratio is currently: 1.09… VIX: (12.37, +1.79, +16.9%).

February 17 is options expiration — the last day to trade February equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

Events and conferences of interest tomorrow, January 31st include:

Conference in progress:

CBL & Associates Properties (CBL) this morning announced that it has closed on a sale-leaseback transaction for five Sears department stores and two Sears Auto Centers located at CBL malls, providing CBL with control of these locations for future redevelopment. CBL has acquired the locations for a total consideration of $72.5 million. Sears will continue to operate the department stores under new 10-year leases. Under the terms of the leases, CBL will receive aggregate initial base rent of approximately $5.075 million, with Sears also responsible for paying common area maintenance charges, taxes, insurance and utilities.

Dollar Rally Stumbles Again