SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Экономические индикаторы и число буровых установок.

- 17 февраля 2017, 16:12

- |

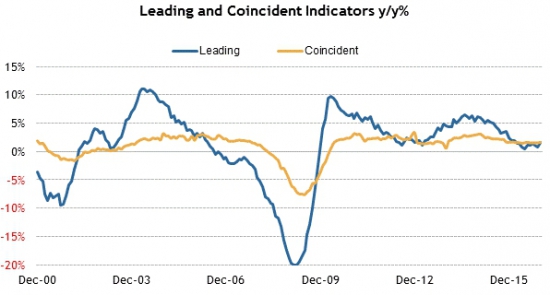

Неделя перед длинными выходными уходит на незначительных новостях. Индекс опережающих экономических индикаторов базируется на данных, вышедших на этой неделе, он только дополняет оптимистичную картину, сведенную в один показатель:

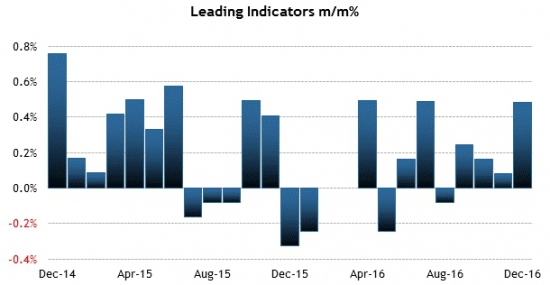

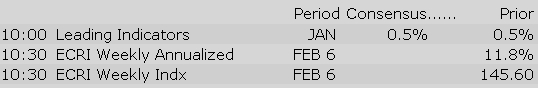

Данные экономических индикаторов с большой вероятностью ожидаются на своих максимальных отметках, +0.5%:

Число новых буровых установок также продолжает расти, новое значение ожидается выше 590:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Full results from the trial will be presented at an upcoming scientific forum.

ArQule to host investor conference call on February 17, 2017 at 8:30 A.M. ET

Misc

For 1Q17, co expects load factors in the range of 80%, with passenger yields in the range of R$24 cents. In January, GOL had load factors of 83% and strong forward bookings for February and March.

FY 17 is based on GOL's capacity plan and the expected demand for its passenger transportation services, driven by the weak Brazilian economic environment.

The global equity appeared reluctant to get out of bed overnight, and now losing momentum heading toward the week's finish line. S&P Futures have seen a slow but steady trip lower, leading to a decline of down 0.3%.

Market updates

US Econ Data

January Leading Index (10am)Equity indices in the Asia-Pacific region ended the week on a mostly lower note. The cautious sentiment in regional stock markets was also reflected by the foreign exchange market, where the yen (113.00) has climbed 0.2% against the dollar after showing a modest loss last evening. In South Korea, Samsung's vice chairman was arrested as part of a bribery case.

---Equity Markets---

---FX---

The Kraft Heinz Company (KHC) notes the recent speculation regarding a possible combination of Kraft and Unilever plc / Unilever NA.

Major European indices trade mostly lower while the UK's FTSE (+0.2%) outperforms as the pound trades lower by 0.6% against the dollar at 1.2415. The euro (1.0645) has also retreated, shedding 0.3% versus the greenback. In France, socialist presidential candidate Benoit Hamon is reportedly discussing a joint candidacy with Jean-Luc Melenchon in order to present a greater challenge to National Front's Marine Le Pen.

---Equity Markets---

Gapping down: NUS -7.4%, MCHX -6.8%, PI -5.3%, AEG -5.1%, HMY -4.4%, ORC -4.4%, FLS -4.2%, LII -4%, CINR -3.8%, SAGE -3.3%, BKD -3.2%, HTZ -3.2%, DB -3%, ERIC -2.8%, SJM -2.8%, ALV -2.5%, BCS -2.4%, K -2.3%, PES -2.3%, BHP -2.2%, MDRX -2.2%, RIO -2%, BBVA -1.9%, BBL -1.9%, HURN -1.9%, TSLA -1.6%, JD -1.6%, SDRL -1.5%, LYG -1.5%, RDS.A -1.4%, SAN -1.4%, AU -1.4%, TOT -1.2%, TRN -1.2%, AMBR -1.2%, CREE -1%,

Treasuries Add to Thursday's Gains

Stocks with favorable mention: AGCO, CMG, CSCO, GLD, GOLD, GOOGL, MCD, MMM, MMP, MOS, MU, PEP, PFG, POT, SHLX, STZ, TWLO

Stocks with unfavorable mention: ABX, BUD, GEO, HLF, RAD

Equity futures point to a lower open on Friday following the stock market's slight pullback on Thursday. The S&P 500 futures trade five points below fair value.

U.S. Treasuries have extended yesterday's gains this morning but still hold losses for the week. The benchmark 10-yr yield is down three basis points at 2.42%.

Conversely, crude oil trades lower this morning as an increase in U.S. drilling has overshadowed reports that OPEC is mulling over a production cut extension and could potentially cut more than previously expected. The energy component is down 0.5% at $53.07/bbl.

Today's lone economic report, January Leading Indicators (Briefing.com consensus 0.5%), will be released at 10:00 am ET.

In U.S. corporate news:

Reviewing overnight developments:

Julia Stewart will resign from the Company, effective March 1, 2017.

Concurrent with this leadership transition, co released prelim 4Q16 results.

Co intends to report definitive 4Q16 and fiscal 2016 results and its outlook on March 1, 2017

Eurozone Core/Periphery Spreads Widen

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

The S&P 500 futures trade eight points below fair value.

Earlier this morning, Kraft Heinz (KHC 87.28, -3.81) announced that it has made a proposal to merge with U.K. consumer products giant Unilever (UL 47.02, +4.44). Unilever declined the initial bid, but Kraft said in a statement that it looks forward to «working to reach agreement on the terms of a transaction.»

Kraft and Unilever have added 4.5% and 9.6%, respectively, following the news while Kellogg (K 72.65, -2.06), General Mills (GIS 58.75, -2.79), and Mondelez Int'l (MDLZ 40.95, -2.25) have slipped between 2.8% and 5.0%.

In earnings news, Deere (DE 112.95, +3.27) is trading higher by 3.0% after it beat on the top and bottom lines and issued upside guidance. Similarly, WebMD Health (WBMD 53.40, +1.89) is up 3.7% after it reported better than expected earnings results and announced it was exploring strategic alternatives.

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Select EU financial related names showing weakness:

Select metals/mining stocks trading lower:

Other news:

Analyst comments:

Dollar Rebounds Along with Yen

Treasuries Rally to Close Slightly Lower on the Week

The Energy Sector (XLE, -0.7%) leads the broader market (SPY, -0.02%) lower in the last hour of the trading day. Crude oil (USO, -0.1%) futures end flat following the release of rig count data summarized below. Lastly, natural gas (UNG, -0.3%) futures extend yesterday's post-EIA losses and end at a fresh 3-month low, modestly lower compared to yesterday's pit trading close.

Rig count data highlights:

Next week/upcoming data reminders:

Notable Gainers:

Notable Laggards:

Closing Energy Prices:

Earnings/News

Broker Calls

The following options are exhibiting notable trading, potentially indicating changing sentiment toward the underlying stocks, and/or potentially representing positioning for increased volatility.

Bullish Call Activity:

Bearish Put Activity:

Sentiment: The CBOE Put/Call ratio is currently: 0.99… VIX: (11.73, -0.03, -0.3%).

Today is options expiration — the last day to trade February equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

The major averages trade mixed at midday. The Nasdaq (+0.1%) shows a modest gain while the S&P 500 and the Dow hold losses of 0.2% and 0.3%, respectively.

Today's modest pullback is unsurprising given the stock market's recent 2.5% climb, which occurred over the course of seven consecutive winning sessions preceding Thursday's downtick. However, below the surface, some uneasiness may be developing among investors as news out of Washington wraps tax reformation in a blanket of uncertainty.

President Trump's proposed border tax, which has become a key component of the new administration's larger tax reform plan, has created a rift within the GOP. And the longer it takes to hash out the border tax adjustment, the longer investors will have to wait for the broader tax reform plan.

The lingering border tax uncertainty has offset poor holiday sales among retailers. The SPDR S&P 500 Retail ETF (XRT 43.67, +0.23) has added 0.5% on the day and now sits near its pre-holiday season levels.

Retailers' outperformance has pushed the consumer discretionary (unch) and consumer staples sectors (+0.4%) past the benchmark index. Consumer staples hold the top spot on today's leaderboard following a morning full of corporate news within the sector.

Kraft Heinz (KHC 93.87, +7.55) has jumped 7.5% after the company confirmed that it made a merger proposal to Unilever (UL 47.55, +4.98). Unilever rejected the initial bid, stating that the offer was fundamentally undervalued, but Kraft aims to keep pursuing the transaction.

UnitedHealth (UNH 157.03, -6.61) also made headlines following reports that the U.S. government filed a lawsuit against the company for allegedly overcharging Medicare by hundreds of millions of dollars. The lawsuit, which was unsealed on Thursday, was filed back in 2011.

However, despite the 4.0% fall in the shares of UNH, the health care sector (-0.2%) has kept pace with the broader market thanks in part to DaVita HealthCare's (DVA 67.33, +2.66) upbeat earnings report. The company has climbed to a fresh six-month high after reporting better than expected earnings after yesterday's close. Shares of DVA trade higher by 4.1%.

The remaining sectors show losses between 0.1% (technology) and 0.8% (energy). The energy sector has moved lower in tandem with crude oil, which has slipped 0.4% to $53.55/bbl ahead of today's Baker Hughes rig count data. The report will cross the wires shortly, at 1:00 pm ET.

Intraday trading volume has been relatively low, suggesting some investors have gotten a jump start on the extended Presidents' Day weekend.

Today's economic data was limited to January Leading Indicators: