SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Объем промышленных заказов.

- 06 марта 2017, 16:29

- |

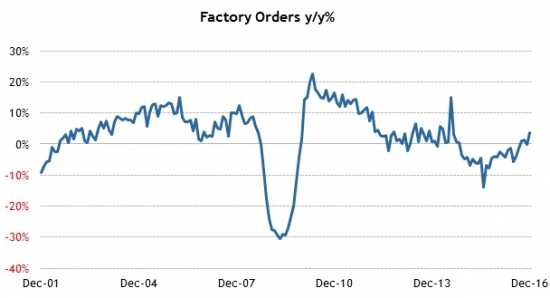

Показатель промышленных заказов находятся в восходящем тренде. Аналитиками прогнозируется продолжение тенденции и показатель ждут на уровне +1%:

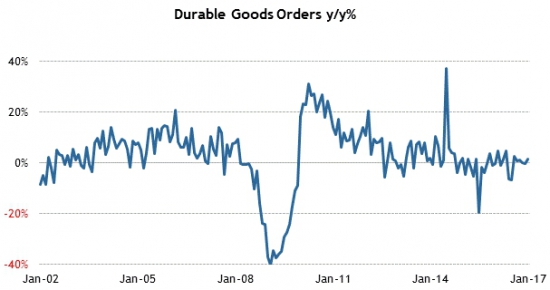

При этом наблюдается, что заказы на товары длительного пользования стоят на месте:

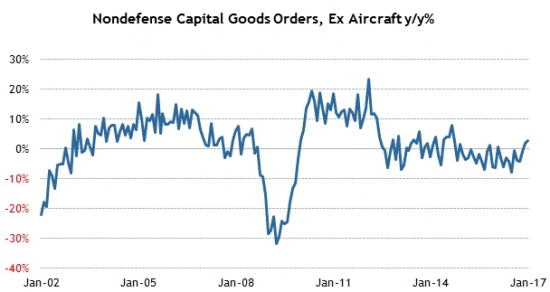

Рост происходит за счет заказов на товары краткосрочного пользования:

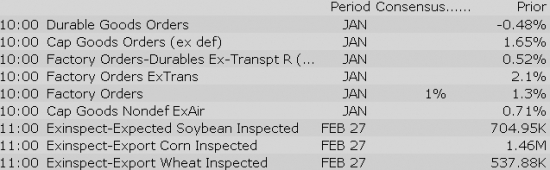

Вместе с этим, не-оборонный сектор также показывает боковую динамику:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Stocks with favorable mention: AMD, EME, EXPE, LYV, MTN, SNAP, TECD, THO, ULTA, UTX

Stocks with unfavorable mention: BA, CBI, DKS, HRB, HZNP, MBLY, SIG, TRIP, URBN

Market updates:

US Econ Data

Equity indices in the Asia-Pacific region ended mostly higher on Monday. The Nikkei closed 0.5% lower, but the rest of regional indices closed on the positive side. Japanese shares were hindered by relative strength in the yen after geo-political tensions increased over the weekend, following missile launches from North Korea falling in Japanese waters. With the currency acting as a safe-haven today, stocks fell in response. China had the most significant economic news out over the weekend with financial projections for 2017 being released from the National People's Congress. These targets include GDP rate of ~+6.5% or higher and CPI goal of +3.0% (unchanged from last year). These targets did not come as a surprise, but perhaps more of a relief, lending to an advance of equities within the region.

---Equity Markets---

---FX---

Gapping down: CS -3.9%, HMY -3.8%, GPRO -3.2%, TSN -3.1%, FCX -2.7%, BBL -2.6%, AUY -2.3%, DRYS -2.2%, RIO -2.2%, BHP -2%, RBS -1.8%, LYG -1.8%, DB -1.7%, AMD -1.5%, AU -1.5%, AG -1.3%, TEVA -1.2%, MET -1.1%, MT -1.1%

Major European indices are registering modest losses, pressured mostly by weakness in financial and basic materials stocks. The weakness in those areas stems from Deutsche Bank's news that it will be rasing $8.5 billion in new capital and China tempering its 2017 GDP growth outlook to about 6.5%. At the same time, the underlying concern that the markets have moved too far, too fast, leaving them ripe for a pullback, is also in the trading mix ahead of Thursday's ECB rate decision. The euro is down 0.4% against the dollar to 1.0586.

---Equity Markets---

Treasuries Tick up as Global Equities Decline

Crude oil futures for April delivery are down about $0.29 (-0.5%) around the $53.04/barrel level, oscillating around levels just above last Thursday's 3-week low, on headlines earlier this morning that China lowered their FY17 growth target to 6.5%, compared to 6.7% last year.

Upgrades:

Downgrades:

Miscellaneous:

Equity futures point to a lower open this morning as investors position themselves for some profit-taking to start the new week. The S&P 500 futures currently trade seven points below fair value.

U.S. Treasuries trade slightly higher on Monday morning with the benchmark 10-yr yield, which moves inversely to the price of the 10-yr Treasury note, down one basis point at 2.47%.

Crude oil has given back a portion of Friday's solid gain in early action amid fears that lower growth targets in China could decrease oil demand. The energy component trades 0.5% lower at $53.08/bbl.

Today's lone economic report, January Factory Orders (Briefing.com consensus 1.0%), will cross the wires at 10:00 ET.

In U.S. corporate news:

Reviewing overnight developments:

European Sovereign Debt Little-Changed

Investors have their eyes on the Asia-Pacific region this morning as uncertainty within the region has contributed to a risk-off sentiment in the United States. The S&P 500 futures currently trade eight points below fair value.

Earlier this morning, North Korea fired four banned ballistic missiles into the sea of Japan with some of the missiles landing as close as 190 miles from Japan's northwest coast. The act marks the third time since August that North Korean missiles have fallen in Japan's exclusive economic zone, the offshore area in which Japan has exclusive resource rights.

Rex Tillerson is scheduled to make his first visit to Japan as Secretary of State later this month to discuss North Korea's threat to the Asia-Pacific region. Mr. Tillerson is also expected to visit China and South Korea.

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Select EU financial related names showing weakness in sympathy with DB (EUR8 bln capital raise) :

Select metals/mining stocks trading lower following China's lowered GDP outlook to ~+6.5%:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Select EU financial related names showing weakness in sympathy with DB (EUR8 bln capital raise) :

Select metals/mining stocks trading lower following China's lowered GDP outlook to ~+6.5%:

Other news:

Analyst comments:

The S&P 500 futures trade nine points (0.4%) below fair value.

Equity indices in the Asia-Pacific region ended mostly higher on Monday. The Nikkei closed 0.5% lower, but the rest of regional indices closed on the positive side. Japanese shares were hindered by relative strength in the yen after geo-political tensions increased over the weekend, following missile launches from North Korea falling in Japanese waters. With the currency acting as a safe-haven today, stocks fell in response. China had the most significant economic news out over the weekend with financial projections for 2017 being released from the National People's Congress. These targets include GDP rate of ~+6.5% or higher and CPI goal of +3.0% (unchanged from last year). These targets did not come as a surprise, but perhaps more of a relief, lending to an advance of equities within the region.

---Equity Markets---

Major European indices are registering modest losses, pressured mostly by weakness in financial and basic materials stocks. The weakness in those areas stems from Deutsche Bank's news that it will be rasing $8.5 billion in new capital and China tempering its 2017 GDP growth outlook to about 6.5%. At the same time, the underlying concern that the markets have moved too far, too fast, leaving them ripe for a pullback, is also in the trading mix ahead of Thursday's ECB rate decision. The euro is down 0.2% against the dollar to 1.0600.

---Equity Markets---

Filings:

Offerings:

The stock market is poised to start the week modestly lower as investors engage in some profit taking in light of the major averages' record high levels. The S&P 500 futures trade nine points (0.4%) below fair value.

Today's risk-off sentiment is most likely due to the belief that the stock market has gone too far, too fast, and is due to get hit with some selling interest. However, some news headlines have helped to support the market's current negative disposition.

Most notably, news of North Korea firing four ballistic missiles into the sea within Japan's economic zone, President Trump alleging that former President Obama ordered a wiretap of his Trump Tower offices, and Deutsche Bank (DB) announcing an $8.5 billion capital raise through the issuance of new stock have contributed to the downtick in equity futures.

On the corporate front, General Motors (GM 37.60, -0.63) is ticking lower in pre-market trade after the company divested its Opel/Vauxhall unit and GM Financial's European operations to PSA Group for $2.3 billion. Also of note, Delta (DAL 49.40, -0.73) is down 1.5% after cutting its first quarter PRASM guidance since unit revenues in February were more moderate than expected.

U.S. Treasuries trade flat this morning after squandering a modest overnight gain. The benchmark 10-yr yield is unchanged at 2.48%.

Crude oil has climbed up to its flat line in recent action after holding a sizable overnight loss earlier this morning. The energy component currently trades 0.2% lower at $52.23/bbl.

Today's lone economic report, January Factory Orders (Briefing.com consensus 1.0%), will cross the wires at 10:00 ET.

The S&P 500 opens the week with a loss of 0.5%.

All 11 sectors currently trade in the red with the financial (-0.7%) and materials (-0.7%) sectors demonstrating relative weakness. Meanwhile, the lightly-weighted utilities group (-0.1%) exhibits relative strength.

U.S. Treasuries trade flat in early action. The benchmark 10-yr yield is currently unchanged at 2.48%.

The tech sector — XLK — trades modestly ahead of the broader market. Semiconductors, meanwhile, display relative strength as the SOX index trades -0.50%. Within the SOX index, QCOM (+0.05%) outperforms, while SIMO (-1.81%) lags. Among other major indices, the SPY is trading 0.47% lower, while the QQQ -0.45% and the NASDAQ +0.06% trade opposite on the session. Among tech bellwethers, TEF (+0.95%) is showing relative strength, while NVDA (-1.68%) lags.

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

Scheduled to report earnings after the bell:

Scheduled to report earnings tomorrow morning:

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

In the news:

- Leaders:

- FRGI +4% (Director — Leucadia Nat'l bought 660,000 shares at $19.83-20.68 worth ~ $14 mln)

- RUTH +4% (provided investor update in presentation)

- CETV 3.4% (Central European Media completes a transaction with Time Warner to reduce, with effect as of March 1 the fees payable to Time Warner as credit guarantor of the Co's currently outstanding senior term credit facilities)

- SPU +22% (signs one-year business agreement with China Aigo O2O Technology)

- EXPE 1.1% (upgraded to Outperform from Neutral at Macquarie)

- Laggards:

- TAP -1% (announces proposed offering of US dollar-denominated senior notes; amount not disclosed)

- WSM -2.1% (Wedbush lowers their WSM tgt to $48 from $53 as they remain cautious on WSM as competitive pressures mount)

- GM -1.2% (General Motors divests its Opel/Vauxhall unit and GM Financial's European ops to PSA Group for $2.3 bln)

- CTAS -0.3% (files mixed securities shelf offering for an undisclosed amount)

- Nearly unchanged:

- MCD (McDonald's Japan February same store sales increased +17.9% vs +12.3% in January)

- CMG (files for 2,882,463 share common stock offering by selling shareholder; Pershing Square files amended 13D confirming prospectus was filed to sell shares of common stock)

Other notable trends:Looking ahead:

Economic Data Summary:

Upcoming Economic Data:

Upcoming Fed/Treasury Events:

Other International Events of Interest

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 0.96… VIX: (11.34, +0.38, +3.5%).

March 17 is options expiration — the last day to trade March equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

Rumor Activity was near average levels to start out the week.

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term

Stocks that traded to 52 week lows: ACUR, AFH, ANFI, ANGI, ASNA, BKE, BPTH, CDR, CFMS, CGEN, CIE, CMLS, CMPR, CVG, DDS, DRRX, DRYS, DXLG, EARS, FNCX, FRT, FSC, FTR, GBSN, GEC, GLBR, GLF, GPRO, GTS, HIVE, HSON, JASN, JCP, KIM, KONA, KRG, LFVN, LTRPA, MAC, MARK, MAV, MHI, MNKD, MRIN, NADL, NAII, NAO, NH, NK, OHRP, OPHT, ORIG, PACD, PANW, PEI, PGLC, PPP, PRGO, PSTG, RGSE, RPT, SBH, SHIP, SNAK, SNCR, SPWH, SVU, SYNT, TAHO, TDW, TGT, TTI, TUES, UAA, ULTRQ, USEG, VDSI, VNCE, VNRSQ, VRA, VRX, WAIR, WMIH, WPG, WPRT, WRI, XCOMQ, YGE, ZOES

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week highs on High Volume: ACV, BCBP, DAX, DYNT, FALN, GHC, IIN, PNTR, PRGX, RFDI, SAMG, SCKT, SPLP, VDTH

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week lows on High Volume: ABIL, AEMD, CGG, EGAN, GSIH, LUB, PNI, REFR, TNH

ETFs that traded to 52 week highs: EZU, IHF

Today's top 20 % gainers

- Healthcare: NOVN (6.8 +6.41%), PTCT (10.37 +6.07%), NERV (8.75 +5.42%), CLDX (3.81 +4.67%), ADXS (9.63 +4.34%), CARA (18.74 +3.88%), NVAX (1.52 +3.06%), LXRX (16.55 +2.73%)

- Industrials: CR (75.27 +3.96%)

- Consumer Discretionary: RUTH (17.7 +4.73%), FRGI (20.58 +3.91%), EDU (51.39 +3.03%), GTN (14.85 +2.77%)

- Information Technology: BITA (22.64 +4.09%), UCTT (13.79 +3.45%), VRTU (32.87 +3.24%), TIVO (18.6 +3.05%)

- Energy: WRD (12.46 +4.25%), RRC (28.47 +4.06%), TOO (5.35 +3.08%)

Today's top 20 % losersToday's top 20 volume

- Healthcare: VRX (18.13 mln -3.52%)

- Materials: FCX (14.15 mln -3.26%), VALE (10.75 mln -2.5%), MT (9.27 mln -1.97%), AUY (7.57 mln -5.34%)

- Industrials: GE (7.53 mln -0.56%)

- Consumer Discretionary: F (12.2 mln -0.87%), GM (10.32 mln -1.97%), JCP (7.56 mln -3.04%)

- Information Technology: AMD (53.88 mln -3.8%), MU (12.3 mln -1%), NVDA (10.37 mln -2.9%), AAPL (8.81 mln -0.75%), XRX (7.49 mln +1.97%)

- Financials: BAC (35.52 mln -1.2%), DB (13.16 mln -3.85%)

- Energy: CHK (12.7 mln +0.09%), SDRL (11.28 mln +0.4%)

- Consumer Staples: RAD (13.41 mln -3.58%)

- Telecommunication Services: FTR (19.98 mln -4.27%)

Today's top relative volume (current volume to 1-month average daily volume)- Concert Pharma (CNCE +71.3%) to sell CTP-656 to Vertex Pharmaceuticals (VRTX) for an upfront payment of $160 mln in cash with the potential for $90 mln in future regulatory approval milestone payments

- Hemispherx Biopharma (HEB +12.02%) announces that it has met a major milestone, the commencement of sales of recently manufactured Ampligen in international programs

- TG Therapeutics (TGTX +76.54%) announces 'positive' topline results from its Phase 3 GENUINE clinical trial of TG-1101 plus ibrutinib in patients with previously treated high risk Chronic Lymphocytic Leukemia

Decliners on news:- Valeant Pharma (VRX -3.75%) completes about $1.1 bln pay down of senior secured term loans from divestitures; to seek refinancing & amendment of credit agreement

- Kura Oncology (KURA -8.5%) reports updated results from the ongoing, Phase 2 trial of tipifarnib and additional preclinical data in HRAS mutant squamous cell carcinomas of the head and neck

- Brookdale Senior Living (BKD -5.87%) Ventas (VTR) in slide presentation says 'not currently in talks to buy Brookdale as reported in the press.'

Decliners on earnings:- Corcept Therapeutics (CORT -4.93%) reports Q4 results; raises FY17 rev guidance

- Adverum Biotech (ADVM -3.51%) reports Q4 results

- Ventas (VTR -1.23%) repeats FY17 guidance

Upgrades/Downgrades:Biggest point losers: AYI 204.58(-4.99), NTES 288.99(-4.49), ULTA 273.96(-4.19), AGN 242.07(-3.56), ALB 101.35(-3.42), IONS 51.3(-3.4), COST 166.89(-3.37), IBB 299.16(-3.33), TTD 41.28(-3.32), UAL 72.33(-3.26), EW 89.29(-3.15), INCY 133.99(-2.92), SAFM 91.49(-2.9), NVDA 95.59(-2.85), TSLA 248.83(-2.74), BIIB 295.14(-2.71), DXCM 77.82(-2.62), PODD 43.77(-2.54), BURL 93.59(-2.48), ALK 96.48(-2.46), MCK 150.17(-2.36), GOLD 88.61(-2.25), CMG 413.85(-2.24), ADSK 83.09(-2.23), TMO 157.95(-2.21)

The broader market starts the week off with modest losses, as the Nasdaq Composite performs the worst thus far, down about 38 points (-0.65%) to 5832, the S&P 500 is lower by 13 (-0.54%) to 2370, and the Dow Jones Industrial Average sheds about 78 (-0.37%) to 20927. Action has come on lower than average volume (NYSE 287 vs. avg. of 307; NASDAQ 765 mln vs. avg. of 781), with decliners outpacing advancers (NYSE 647/2334, NASDAQ 606/2158) and mixed new highs and new lows (NYSE 21/48, NASDAQ 55/42).

Relative Strength:

US Nat Gas-UNG +3.5%, Cotton-BAL +1.6%, Malaysia-EWM +1.1%, US Diesel/Heating Oil-UHN +1.1%, Turkey-TUR +1.0%, India-INP +0.8%, Philippines-EPHE +0.6%, US Gasoline-UGA +0.6%, Indonesia-IDX +0.5%, Mexico-EWW +0.3%, Dollar Index-UUP +0.3%, Grains-JJG +0.3%, Colombia-GXG +0.1%, Uranium/Nuclear Energy-NLR +0.1%.

Relative Weakness:

Jr. Gold Miners-GDXJ -6.7%, Silver Miners-SIL -4.6%, Gold Miners-GDX -3.4%, Copper Miners-COPX -3.2%, Metals&Mining-XME -2.4%, Copper-JJC -2.2%, Steel-SLX -2.0%, Poland-EPOL -1.7%, Peru-EPU -1.5%, Greece-GREK -1.5%, Italy-EWI -1.3%, Russia-RSX -1.2%, Thailand-THD -1.1%, Israel-EIS -1.0%.

The Industrials sector (XLI) is trading -0.5% lower today, in-line with the broader market (SPY -0.5%). In the Industrial Sector airlines (JETS -2.2%) are trading lower after Delta (DAL -3.4%) announced they were cutting Q1 PRASM guidance.

Notable airlines moving today: JBLU -4.9% AAL -4.6% UAL -4.4% VLRS -3.5% DAL -3.4% ALK -3% SKYW -2.7% CEA -2.4% LUV -2.5% HA -1.9% ALGT -1.7% LFL -1.6% CPA -1%

Earnings/Guidance

News

Broker Research

Upgrades

Downgrades

Investors have taken some money off the table in the first half of Monday's session, cashing in on the stock market's record highs. The Dow (-0.3%) has a slight edge on the S&P 500 (-0.5%) while the Nasdaq (-0.6%) lags.

Some news headlines over the weekend may have had a small part in today's mild pullback, but, more than likely, they've just been used as a convenient excuse for investors to rein in a stock market that may have gone too far, too fast.

Nonetheless, it's worth pointing out that North Korea fired four ballistic missiles into the sea within Japan's economic zone early this morning. Also, Deutsche Bank (DB) led Germany's DAX 0.6% lower after announcing an $8.5 billion capital raise through the issuance of new stock.

The financial sector (-0.8%) has once again filled the leadership role in today's session, only this time it is leading to the downside. The sector has frequently found itself in a leadership role since the presidential election on November 8, pacing the stock market's big gains.

Conversely, the utilities (-0.1%) and energy (unch) groups have shown relative strength today.

The energy sector's outperformance has come despite the 0.4% slip in crude oil, which is suffering at the hand of a 0.4% increase in the U.S. Dollar Index (101.72, +0.36). WTI crude currently trades at $53.10/bbl.

On the corporate front, airlines have suffered heavy losses in today's session after news that Delta Air Lines (DAL 48.37, -1.75) cut its first quarter unit revenue guidance in light of more moderate than expected unit revenues in February. Still, despite the negative influence, the industrial sector (-0.6%) performs in line with the broader market.

The remaining sectors--consumer discretionary, materials, technology, health care, consumer staples, telecom services, and real estate-- are showing losses between 0.3% (health care) and 0.7% (materials).

U.S. Treasuries also hold losses, squandering modest overnight gains. The benchmark 10-yr yield trades two basis points higher at 2.50%.

Today's lone economic report, January Factory Orders, crossed the wires this morning:

The following options are exhibiting notable trading, potentially indicating changing sentiment toward the underlying stocks, and/or potentially representing positioning for increased volatility.

Bullish Call Activity:

Bearish Put Activity:

Sentiment: The CBOE Put/Call ratio is currently: 0.85… VIX: (11.39, +0.43, +3.9%).

March 17 is options expiration — the last day to trade March equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

— The dollar index was +0.2% around the 101.72 level.

The Energy Sector (XLE, +0.1%) inched modestly higher while the broader market (SPY, -0.3%) declined in afternoon trading. Crude oil (USO, -0.2%) fell as low as nearly -1% on headlines that China lowered their FY17 growth target to 6.5%, vs growth of 6.7% last year. Crude oil futures turned positive briefly in the morning before selling off again, on track to close the session lower ahead of tomorrow's API. Lastly, natural gas (UNG, +3.7%) futures surge to fresh session highs on updated cooler weather forecasts across much of the US.

Factors affecting the price of oil:

Factors affecting the price of natural gas:

Upcoming data reminders:

Notable Gainers:

Notable Laggards:

In current trade:

Earnings/News

Broker Calls

Dollar Edges Higher as Commodity Currencies Remain Weak

Yield Curve Steepens as Stocks Stabilize