комментарии QCAP на форуме

-

Рыночные данные. Interactive Brokers.

Всем привет!

На сайте IB наткнулся на цены на рыночные данные

Насколько я знаю, все котировки в TWS приходят с задержкой, если вы не подписаны на рыночные данные.

У меня родился вопрос:

Смогу ли я выставить лимитную (или рыночную) заявку на покупку/продажу акций, торгующихся, допустим, на франкфуртской бирже, не подписываясь на рыночные данные Level 1 (Top of Book)? Т.е. получая котировки с опозданием на 15 минут.

Петр Петров, Сможешь! Interactive Brokers "Лежит" уже больше часа....

Interactive Brokers "Лежит" уже больше часа....

Народ паникует - https://downdetector.com/status/interactive-brokers/

www.interactivebrokers.com/en/software/systemStatus.php

downdetector.com/status/interactive-brokers/

Авто-репост. Читать в блоге >>>

У все терминал и сайт interactivebrokers работает?

Сергей, Ни у кого не работает — www.interactivebrokers.com/en/software/systemStatus.php

Interactive Brokers с сегодняшнего дня разрешает шорты OZON на Nasdaq

Interactive Brokers с сегодняшнего дня разрешает шорты OZON на Nasdaq

OZON — SHORT

Авто-репост. Читать в блоге >>>

Подскажите пожалуйста стоимость пункта/тика фьючерса на индекс RTS RIZ20? И стоимость тика на фьючерс рубля SI? Понятно что тик в РТС 10! Спасибо!

Подскажите пожалуйста стоимость пункта/тика фьючерса на индекс RTS RIZ20? И стоимость тика на фьючерс рубля SI? Понятно что тик в РТС 10! Спасибо!

Авто-репост. Читать в блоге >>> У многих требуют вот такое — prnt.sc/u15uar не зависимо гражданином какой страны ты являешся!

У многих требуют вот такое — prnt.sc/u15uar не зависимо гражданином какой страны ты являешся! Хотите торговать Микро CL контракты на CME - Подпишите петицию! CME Group Inc.: CME to launch Micro-Crude Product

Хотите торговать Микро CL контракты на CME - Подпишите петицию! CME Group Inc.: CME to launch Micro-Crude Product

Хотите торговать Микро CL контракты на CME — Подпишите петицию! CME Group Inc.: CME to launch Micro-Crude Product.

chng.it/mKGmjbpqTS

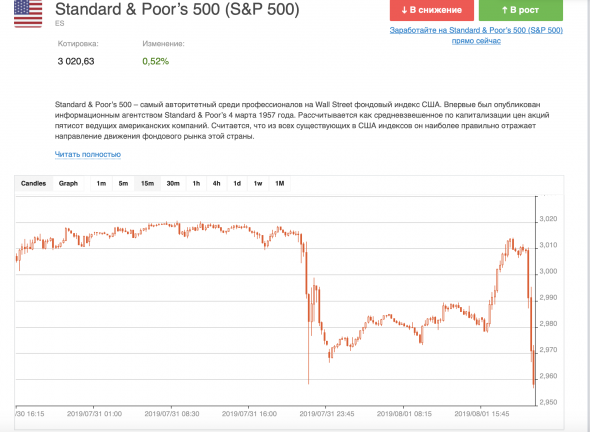

Авто-репост. Читать в блоге >>> Senate Min Leader Schumer (D-NY): calls on Pres Trump to make the Treasury label China an FX manipulator…

Senate Min Leader Schumer (D-NY): calls on Pres Trump to make the Treasury label China an FX manipulator… NYSE volume 326M shares, 34% above its three-month average; decliners lead advancers by 7.7:1.

NYSE volume 326M shares, 34% above its three-month average; decliners lead advancers by 7.7:1.

NASDAQ volume 1.01B shares, 15% above its three-month average; decliners lead advancers by 7.1:1.

VIX index +24% at 21.90 (US) Pres Trump reiterates his belief that tariffs are being paid for by China and the US is taking in billions — Pres Trump tweets: Based on the historic currency manipulation by China, it is now even more obvious to everyone that Americans are not paying for the Tariffs – they are being paid for compliments of China, and the U.S. is taking in tens of Billions of Dollars! China has always used currency manipulation to steal our businesses and factories, hurt our jobs, depress our workers’ wages and harm our farmers’ prices. Not anymore!

(US) Pres Trump reiterates his belief that tariffs are being paid for by China and the US is taking in billions — Pres Trump tweets: Based on the historic currency manipulation by China, it is now even more obvious to everyone that Americans are not paying for the Tariffs – they are being paid for compliments of China, and the U.S. is taking in tens of Billions of Dollars! China has always used currency manipulation to steal our businesses and factories, hurt our jobs, depress our workers’ wages and harm our farmers’ prices. Not anymore!

китайская сделка усе...-))

Авто-репост. Читать в блоге >>>

xxxxx,

Trump: New China 10% tariffs can be raised BEYOND 25%

22:48 (US) Pres Trump: not concerned about drop in the Dow stocks; we'll be 'taxing' China until US can reach a trade deal with them — China devalues its currency — Pres Xi is not moving fast enough — Doesn't know what China's attitude is on Hong Kong; the situation is between Hong Kong and China- I'm not worried about missiles from North Korea; they're short range and 'very standard'

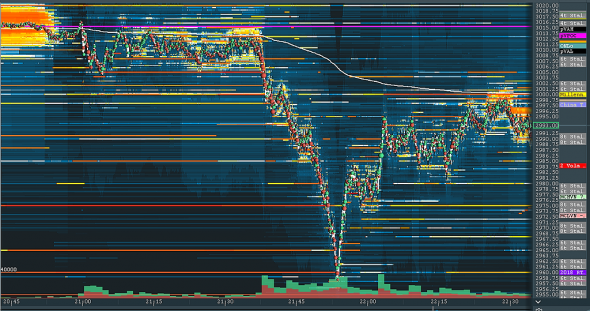

Рекомендую всем кто торгует ES обратить внимание на — www.linnsoft.com/videos/priceboxprojections-rtx

Рекомендую всем кто торгует ES обратить внимание на — www.linnsoft.com/videos/priceboxprojections-rtx — NYSE volume 389M shares, 20% below its three-month average; decliners lead advancers by 1.1:1.

— NYSE volume 389M shares, 20% below its three-month average; decliners lead advancers by 1.1:1.

— NASDAQ volume 1.67B shares, 7% below its three-month average; decliners lead advancers by 1.3:1. (US) Market Close Summary: Stocks end mixed as crude futures lift, while Boeing weighs on Dow

(US) Market Close Summary: Stocks end mixed as crude futures lift, while Boeing weighs on Dow

US Session

-(BR) Brazil Mar FGV Inflation IGP-DI M/M: 1.1% v 1.1%e; Y/Y: 8.3% v 8.3%e

-(SA) Saudi Aramco to sell USD-denominated 3-year, 5-year, 10-year, 20-year and 30-year bonds

-(CA) Canada Feb Building Permits M/M: -5.7% v +2.0%e

-(US) Feb Factory Orders -0.5% v -0.5%e

-(CA) Canada Democratic Institutions Min: govt may have to study regulating major social media firms ahead of Oct election; major platforms have not done enough to safeguard elections

-(US) New York Fed March Survey of Consumer Expectations: medium-term inflation outlook rises; expectations for earnings and income growth move higher

-Senate Democrats reportedly investigating e-cig maker Juul's marketing and partnership with Altria

-(BR) Brazil Central Bank Gov Campos Neto: Brazil's economic reforms are key for low CPI; Brazil is in a gradual economic recovery

-(US) Atlanta Fed raises Q1 GDP forecast to 2.3% v 2.1% prior

Europe

-(UK) PM May Spokesperson: PM wants the UK to have an independent trading policy and that both sides will need to compromise

-(EU) ECB committees said not to have discussed tiering options for banking sector — financial press

-(IL) ISRAEL CENTRAL BANK (BOI) LEAVES BASE RATE UNCHANGED AT 0.25%; AS EXPECTED

-(UK) Labour reportedly sees compromise on Brexit as still far off; UK Government Brexit offer said to not include a customs union — press

-(UK) Labour Leader Corbyn: govt does not seem to be moving from original red lines; so far we haven't had the undertakings we want on our demands

Corporate Headlines

-Boeing drops 4% on 737 Max production cut (suppliers ATI, SPR down)

-GE downgraded by JP Morgan

-MU downgraded

-WYNN reportedly made offer for Crown Resorts

-Third Point reportedly takes stake in Sony

-NBEV expands distribution agreement with Walmart

-AlphaOne's Niles mentions long position in Lions Gate in CNBC interview, taking positions in content producers

Summary:

US indices began the week ending on a mixed note. Boeing's production cut weighed on the Dow and several headline broker downgrades kept momentum under wraps as focus shifted to the upcoming earnings season. The energy complex was a bright spot, boosted by rising oil prices. WTI touched a fresh 5-mouth high propelled by Middle East tensions in Libya and Iran. Rates drifted up, with the 10-year yield finding some stability above 2.5%. The dollar lost ground and gold prices settled back above $1,300 for the first time in more than a week.

Markets:

— Dow Jones -0.3%

— S&P500 +0.1%

— Nasdaq +0.2%

— Russell 2000 -0.2%

-After Market Movers-

-PHAS Receives FDA Breakthrough Therapy Designation for PB2452 for the Reversal of the Antiplatelet Activity of Ticagrelor; +29% afterhours

-AVYA Said to be working with advisers to consider sale after unsolicited interest; potential bidders include Apollo, Searchlight and Permira — press; +4% afterhours

-ZGNX Receives Refusal to File Letter from U.S. FDA for FINTEPLA NDA; Will seek immediate guidance, including a Type A meeting with the FDA; -29% afterhours

Чат для тех кто торгует амер фьючи и любит поговорить об этом — discord.gg/Hcexewr

Чат для тех кто торгует амер фьючи и любит поговорить об этом — discord.gg/Hcexewr

Хороший, активный чат. Бесплатный и наверное самый крупный по количеству активных трейдеров на текущий момент.