комментарии QCAP на форуме

-

все рассудительно зашортили сипи, но на чем падаем никто не понял)

Dmitryy,

Падаем, потому что продают. что еще нужно понимать?

На чем хоть падаем?

Причины есть?

Чё говорят сми?

Тимофей Мартынов,

Комент одного из крупных трейдеров

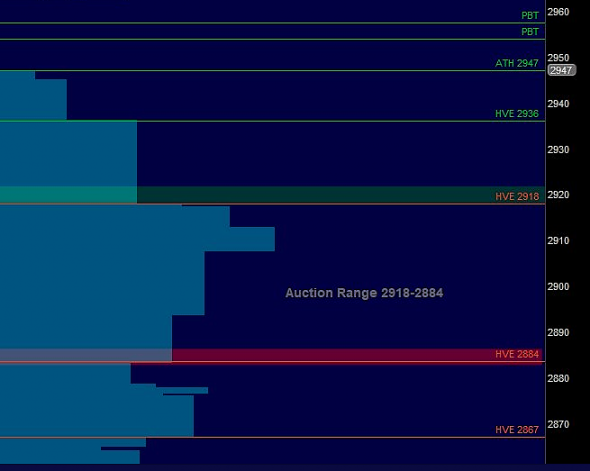

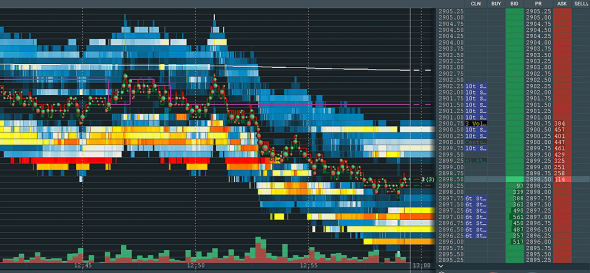

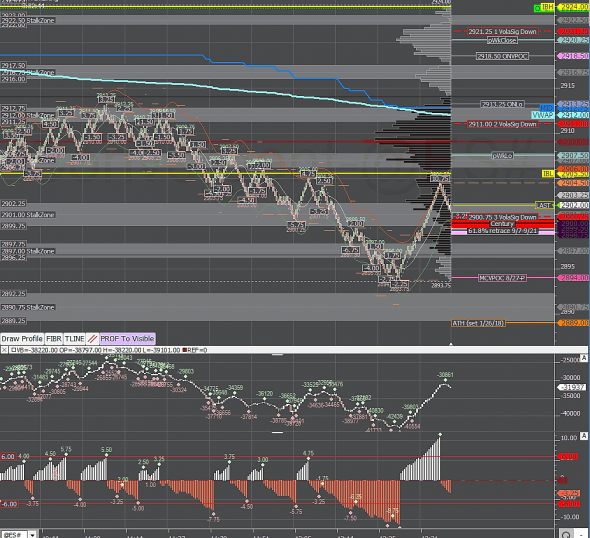

The move was abnormal, but so was the move yesterday in RTH and it was arguably much more material and yet it took equities a while to respond. IMO the correlations with treasuries seem weak in the short timeframe (ES was down overnight, bonds were down overnight… now ES down RTH, bonds balanced-to-up RTH). Not saying the markets aren't weak, just that an observational correlation does not indicate causation. The larger time frame trend is still intact. This move down is normal part of the auction IMHO. On the monthly, we dont even challenge the upward trend until we get down in the 2890 on the weekly and 2808.75 on the monthly. So could we see continuation lower absolutely. What we did today though is test the next major area of price acceptance at 2984 and found buyers and bounces, 2890/2888 becomes major support now. But even a break of that level wont get me thinking the top is in yet. This is actually healthy for the long side

The larger time frame trend is still intact. This move down is normal part of the auction IMHO. On the monthly, we dont even challenge the upward trend until we get down in the 2890 on the weekly and 2808.75 on the monthly. So could we see continuation lower absolutely. What we did today though is test the next major area of price acceptance at 2984 and found buyers and bounces, 2890/2888 becomes major support now. But even a break of that level wont get me thinking the top is in yet. This is actually healthy for the long side

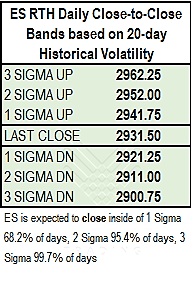

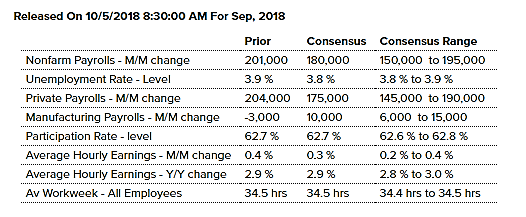

A large rise in U.S. Treasury yields is pulling global bond yields higher across the board and boosted the dollar, while stocks fell in response. The 10-year Treasury note is now at its highest level since mid-2011, up 7 bps to 3.23%, as recent comments from Federal officials signaled more rate hikes are on the horizon. Economic figures pointing to strength in the U.S. economy are also causing markets to reassess how far the Fed's tightening cycle will go.

A large rise in U.S. Treasury yields is pulling global bond yields higher across the board and boosted the dollar, while stocks fell in response. The 10-year Treasury note is now at its highest level since mid-2011, up 7 bps to 3.23%, as recent comments from Federal officials signaled more rate hikes are on the horizon. Economic figures pointing to strength in the U.S. economy are also causing markets to reassess how far the Fed's tightening cycle will go.

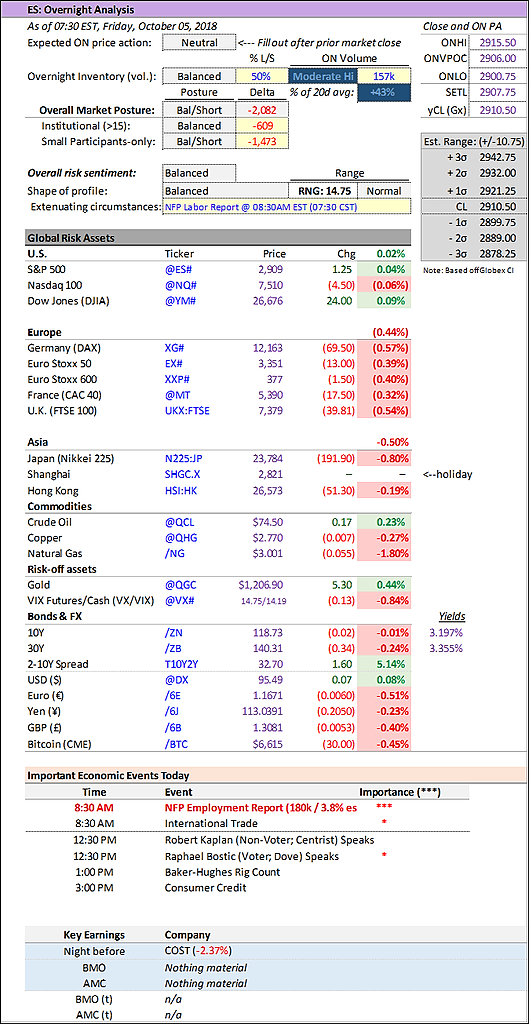

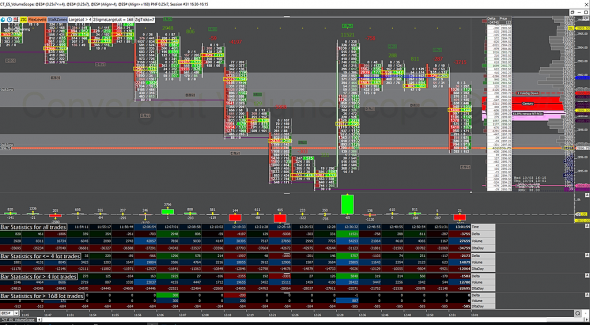

/ESZ8 Value: YVAH 2944 YPOC 2940 YVAL 2931

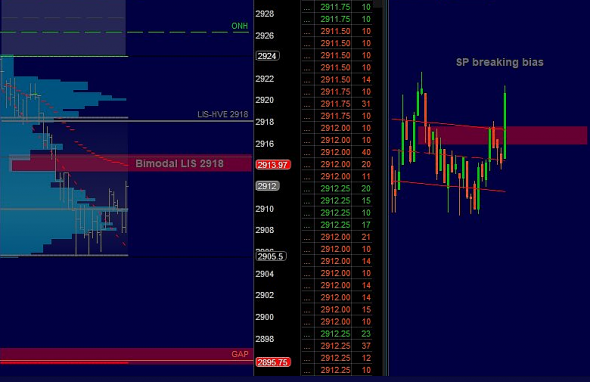

/ES Plan: Yesterday market closed bimodal (LIS 2936) but overnight looks more bearish (GBT 2911), moving below yesterday's range. We're moving into 2918-2936 auction range, so lower edge 2918 will be key, so we've these options:

A) If market remains above HVE 2918 with bullish internals, try to buy towards ONH 2926.25 GAP 2931.50 and HVE 2936.

B) If market starts to move below 2936 with bearish internals, sell towards ONL 2913.25 GAP 2911.75 and HVE 2908.

Today's Economic Calendar

10:00 Factory Orders

10:30 EIA Natural Gas Inventory This morning's Trader Bite at 16:00 MSK — *9:00 AM* Eastern US:

This morning's Trader Bite at 16:00 MSK — *9:00 AM* Eastern US:

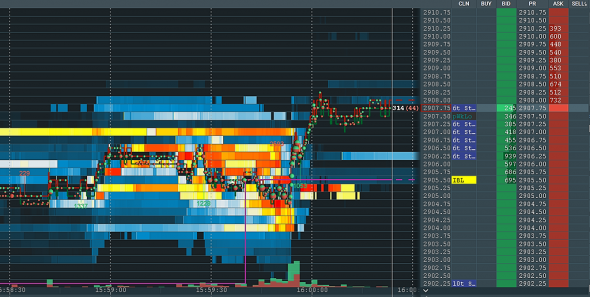

www.youtube.com/watch?v=7V6BlyjbZ1Q Yesterday we gapped higher; this morning it appears we will gap lower. All of this occurring near the all-time highs. Gap trading rules in play again this morning; acceptance below the overnight low targets 2907.50.I have recently labeled this is weak support.

Yesterday we gapped higher; this morning it appears we will gap lower. All of this occurring near the all-time highs. Gap trading rules in play again this morning; acceptance below the overnight low targets 2907.50.I have recently labeled this is weak support.