(US) Market Close Summary: Markets bounce in late-day rally amid volatile trading

Tue, 30 Oct 2018 17:07 PM EST

US Session

-(US) Goldman Economist Chain Store Sales w/e Oct 27th w/w: -2.9%; Y/Y: +0.8%

-(US) AUG S&P CASE SHILLER 20-CITY M/M: 0.09% V 0.10%E; Y/Y: 5.5% V 5.8%E; HOUSE PRICE INDEX (HPI): 213.72 V 213.77 PRIOR

-(US) OCT CONSUMER CONFIDENCE: 137.9 V 135.9E (18 year high)

-(MX) MEXICO Q3 PRELIMINARY GDP Q/Q: 0.9% V 0.5%E; Y/Y: 2.6% V 2.4%E

— (US) Treasury $45B 4-week bills draw 2.165%, BTC 2.85; $25B 8-week bills draw 2.205%, BTC 3.08

Europe

-(EU) EURO ZONE BUSINESS CLIMATE INDICATOR: 1.01 V 1.16E; CONSUMER CONFIDENCE: -2.7 V -2.7E

-(EU) EURO ZONE Q3 ADVANCE GDP Q/Q: 0.2% V 0.4%E; Y/Y: 1.7% V 1.8%E

-(IT) Italy Oct Consumer Confidence: 116.6 v 115.1e

-(IT) ITALY DEBT AGENCY (TESORO) SELLS TOTAL €4.5B VS. €3.5-4.5B INDICATED RANGE IN 5-YEAR AND 10-YEAR BTP BONDS

-(UK) Oct CBI Retailing Reported Sales: 5 v 20e

-(IT) Italy PM Conte: Reiterates that 2019 budget deficit to GDP of 2.4% is an upper limit and will NOT be changed when budget resubmitted

-(BE) Belgium Oct CPI M/M: 0.7% v 0.0% prior; Y/Y: 2.8% v 2.4% prior

-(IT) Italy Dep PM Salvini: Reiterates govt stance that Italy will continue as planned on the 2019 budget plan

-(DE) GERMANY OCT PRELIMINARY CPI M/M: 0.2% V 0.1%E; Y/Y: 2.5% V 2.4%E

— (UK) S&P analysis: risk of no-deal Brexit has increased enough to become a relevant sovereign rating consideration

— (IT) Italy Treasury: EU Commission has requested clarification on debt reduction plans; will respond by Nov 13th

Corporate Headlines:

-GE misses and cuts dividend to $0.01/shr; does not provide outlook

-ESIO reaches agreement to be acquired at $30/shr in $1B deal

-KLAC rallies after earnings and guidance

-UA lifts on EPS beat and raised outlook

-AKAM beats and raises outlook

-(US) Nevada reports Sept casino gaming Rev $991M, +1.3% y/y; Las Vegas strip Rev $546M, -3.7% y/y

-Volkswagen and Fiat report results

— Bunge reportedly near agreement with activists; to add four new Board members and form a strategic review committee to assess options

— IBM authorizes $4B stock repurchase (4% of market cap)

Summary:

US stocks endured another choppy trading session, ending the day higher with materials and energy leading the way. Despite Oct Consumer Confidence notching an 18-year high, investors remain anxious about the dramatic whipsawing market action seen of late. UST prices were lower despite the ongoing indigestion in equity markets, pushing the US benchmark yield back above 3.1%. The Greenback was up again, with the Dollar index trading to a new high for the year, as technicians are taking note of a potential breakout. Earnings season has carried on, with managements continuing to note strong growth in the US is largely being offset by pockets of weakness overseas concerns surrounding trade, input costs, and tariffs. Global growth concerns may be finally weighing on some commodities: After weaker-than-expected European GDP prints, crude and copper prices slipped lower.

Markets:

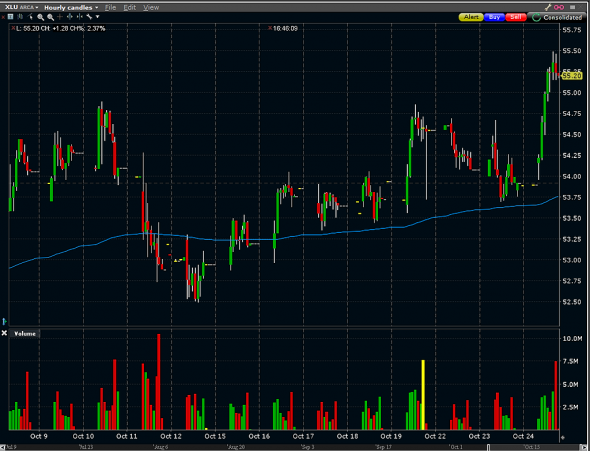

— Dow Jones +1.8%

— S&P500 +1.6%

— Nasdaq +1.6%

— Russell 2000 +2.0%

-After Market Movers-

— KMPH Enters into license agreement with KVK Tech for the commercialization of APADAZ®; +14.7% afterhours

-ARNC Reportedly Apollo Global in talks to acquire ARNC for over $11B — press; +7.1% afterhours

— FB Reports Q3 $1.76 v $1.46e, Rev $13.7B v $13.8Be; +1.7% afterhours

— ZEN Reports Q3 $0.09 v $0.04e, Rev $154.8M v $152Me; -5.1% afterhours

— EA Reports Q2 $0.83 v $0.58e, Rev $1.29B v $1.18Be; -6.1% afterhours

— PAYC Reports Q3 $0.52 v $0.52e, Rev $133.3M v $130Me; -8.3% afterhours

— BGFV Reports Q3 $0.15 v $0.28 y/y, Rev $266.4M v $270.5M y/y; -9.2% afterhours

— SFLY Reports Q3 -$2.20 v -$0.78 y/y, Rev $372.7M v $195.4M y/y; -12.3% afterhours

— TCS Reports Q2 $0.10 v $0.12 y/y, Rev $224.5M v $218.4M y/y; -15.4% afterhours

— DDD Reports Q3 $0.02 v $0.02e, Rev $164.5M v $170Me; -17.6% afterhours

— CLVS Reports Q3 -$1.71 v -$1.60e, Rev $22.8M v $30.1Me; -22.3% afterhours