комментарии QCAP на форуме

-

U.S. stock index futures look poised for a fifth day of declines, as traders gear up for $230B of Treasury auction today. Treasury yields resumed their upward march overnight ahead of more U.S. debt sales, putting a bit of pressure on U.S. stock index futures. We are at some sort of critical moment, a crossroads, for bond and equity markets. American producer and consumer price data is also due in the next two days, and may determine where yields go from here.

U.S. stock index futures look poised for a fifth day of declines, as traders gear up for $230B of Treasury auction today. Treasury yields resumed their upward march overnight ahead of more U.S. debt sales, putting a bit of pressure on U.S. stock index futures. We are at some sort of critical moment, a crossroads, for bond and equity markets. American producer and consumer price data is also due in the next two days, and may determine where yields go from here.

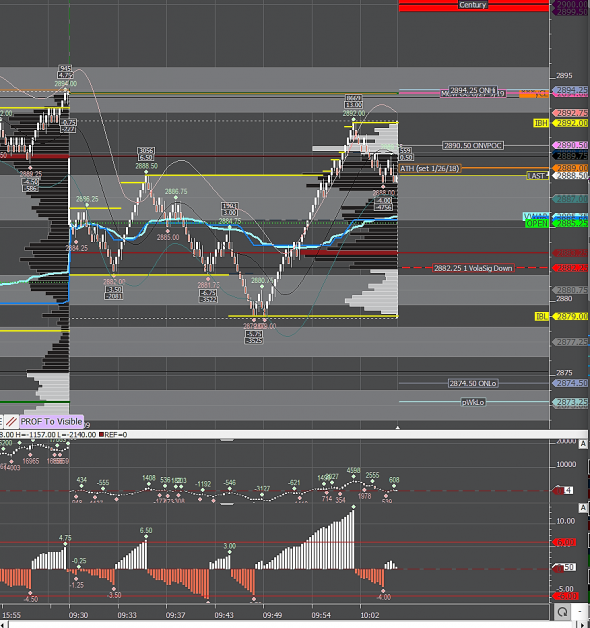

/ESZ18 Value: YVAH 2893 YPOC 2887.50 YVAL 2884

/ES Plan: Yesterday market closed balanced but overnight looks bimodal (LIS 2881), moving below yesterday's value. We're moving into 2884-2864 auction range, so we've these options:

A) If market remains below LIS 2881 with bearish internals, try to be a seller towards YLOD 2874.50 and LVN 2864.

B) If market starts to move above 2881 with bullish internals, buy towards YVAL 2884 GAP 2887.75 and YVAH 2893.

Tips: Double digit gap below yesterday's close. Gap rules are in play: Larger gaps may not fill on the first day or may do so only partially.

Today's Economic Calendar

10:00 Atlanta Fed's Business Inflation Expectations

10:00 Wholesale Trade

11:30 3-Year Note Auction

12:15 PM Fed's Evans speech

01:00 PM 10-Year Note Auction

Disclaimer: All information on this outlook is for educational purposes only and is not intended to provide financial advice.

Overnight inventory is very short and a small downward gap exists. Holding the gap, once again, targets the recent lows at the 2866 level and continues the intermediate-term auction to the downside.

Overnight inventory is very short and a small downward gap exists. Holding the gap, once again, targets the recent lows at the 2866 level and continues the intermediate-term auction to the downside. This morning's Trader Bite at 16:00 MSK — *9:00 AM* Eastern US:

This morning's Trader Bite at 16:00 MSK — *9:00 AM* Eastern US:

www.youtube.com/watch?v=2FWAGK_RbNQ

(US) Market Close Summary: Stocks end mixed as Treasury yields fall from 7-year high

(US) Market Close Summary: Stocks end mixed as Treasury yields fall from 7-year high

Tue, 09 Oct 2018 16:48 PM EST

US Session

-(US) National Hurricane Center (NHC): Hurricane Michael upgraded to category 2; maximum sustained winds at 100 mph v 90 mph prior

-(CA) CANADA SEPT ANNUALIZED HOUSING STARTS: 188.7K V 210.0KE

-(US) Fed's Kaplan (dove, non-voter): I am glad US trade agreements have been renegotiated

-(MX) MEXICO SEPT CPI M/M: 0.4% V 0.4%E; Y/Y: 5.0% V 5.0%E

-(ZA) Senior ruling ANC party source: Pres Ramaphosa to announce exit of Fin Min Nene

-(US) Pres Trump accepts resignation from US Ambassador to the UN Haley

-IEA director Birol: could see further tightening in oil markets in Q4

-(IR) Pres Trump: At some point Iran will want to make a 'real deal'; will be discussing ethanol policy at rally tonight in Iowa

— (BR) Brazil presidential candidate Bolsonaro: I believe in democracy; I will respect election results

— (US) White House Chief Economist Hassett: we've seen a lot of progress on trade with Europe; hopes for an endgame where we work everything out with China

— (MX) Mexico Sept ANTAD Same-Store-Sales Y/Y: 6.1% v 5.0% prior

— (KR) Sec of State Pompeo: made 'real progress' in North Korea talks; can now see path toward full denuclearization

Europe

-(IT) EU Commission: Italy 2019 budget plan to be assessed after Oct 15th

-(IT) Italy Fin Min Tria: Govt would act in case of unexpectedly rise in bond spreads

-(IT) Bank of Italy Representative in Parliament on Govt fiscal outline: Remains a threat of a vicious circle over Italy's debt costs and repercussions for the real economy

-(DE) German Fin Min Scholz said to aim for tax policy that treats Britain like an EU member until end of 2020 — German press

-(TR) Turkey Fin Min Albayrak announces program to counter inflation: Price will normalize with stability on currency front

-(UK) Government spokesperson Slack: To put forward new Irish border proposal 'in due course'

-(IT) Bank of Italy (BOI) Director General Signorini: There are spread levels above which some banks will need to ask the market for help

-(IE) Ireland Fin Min Donohoe: 2019 GDP growth seen at 4.2% vs. 7.5% expected this year; to raise betting tax

— (IE) Ireland Foreign Min Coveney: still see strong chance for a Brexit deal; hope to get more certainty in the next 6 weeks; A no deal Brexit would be 'carnage'

— (UK) Brexit Minister Raab: Brexit talks with EU have intensified; Will not accept anything that threatens the constitutional integrity of the UK

— (IT) EU banking regulators are reportedly monitoring Italy bank liquidity levels more intensely than usual due to market turbulence but have found no cause for alarm — press

— (US) Pres Trump: doesn't like what the Fed is doing; I think we don't have to go as fast on rates

Corporate Headlines:

-PZZA lifts on Trian report

-Kroger slumps on downgrade

-PPG slides after slashing forecast

-EBAY lifts on activist speculation

-Tata Motors falls on poor sales report

— Pershing's Ackman discloses $900M Starbucks position (about 15.2M shares or 1.1% stake, bought at an average cost of $51/shr)

— Zygna said to see some takeover interest

Summary:

US stocks ended mixed after a day of choppy trading as the selloff in Treasuries took a breather to send yields lower, while international trade concerns and the Italian budget process restrained sentiment. The Dow lagged as a FANG-led bounce lifted the NASDAQ to outperform for most of the day. Industrials and materials slumped while energy names lifted on higher crude prices. The Greenback came off early highs, led by weakness versus the South African Rand after President Ramaphosa named a new Finance Minister.

Markets:

— Dow Jones -0.2%

— S&P500 -0.1%

— Nasdaq +0.03%

— Russell 2000 -0.5%

Markets:

— Dow Jones -0.2%

— S&P500 -0.1%

— Nasdaq +0.03%

— Russell 2000 -0.5%

(US) Market Trading Hours Summary: Indices bounce after the open led by NASDAQ

(US) Market Trading Hours Summary: Indices bounce after the open led by NASDAQ

Tue, 09 Oct 2018 11:11 AM EST

Summary:

US stocks opened under modest pressure once again with rising Treasury yields, trade concerns, and the Italian budget process all cited as risk factors holding back sentiment. The Italian 10-year yield reversed off the highs along with US rates as equity buying picked up after the opening bell. The Dow lagged while a FANG-led bounce lifted the NASDAQ. Banks and materials slumped while most other sectors moved up within the S&P. The Greenback came off early highs, led by weakness versus the South African Rand after President Ramaphosa dismissed the finance minister.

Overnight

— Japan Aug Adjusted Current Account:: ¥1.43T v ¥1.52Te; Trade Balance: -¥219.3B v -¥208.0Be

— China PBoC set yuan reference rate: 6.9019 v 6.8957 prior (weakest fix since May 2017)

— S&P: China recent RRR cut was not enough to boost select lending, did not signal significant change in monetary policy

— IMF cut its global 2018 and 2019 GDP growth forecast by 0.2% to 3.7% (first cut since 2016); risk of balance had shifted to the downside due to escalating trade conflicts and tighter financial conditions

— Italy's EU Affairs Minister Savona was confident that if necessary ECB's Draghi would prevent another crisis in Europe

— EU Chief Brexit negotiator Barnier expected to delay publishing the union’s blueprint for a post-Brexit relationship with Britain after signals of new concessions from Downing Street

US Session

-(US) National Hurricane Center (NHC): Hurricane Michael upgraded to category 2; maximum sustained winds at 100 mph v 90 mph prior

-(CA) CANADA SEPT ANNUALIZED HOUSING STARTS: 188.7K V 210.0KE

-(US) Fed's Kaplan (dove, non-voter): I am glad US trade agreements have been renegotiated

-(MX) MEXICO SEPT CPI M/M: 0.4% V 0.4%E; Y/Y: 5.0% V 5.0%E

-(ZA) Senior ruling ANC party source: Pres Ramaphosa to announce exit of Fin Min Nene

-(US) Pres Trump reportedly accepts resignation from US Ambassador to the UN Haley — Axios

-IEA director Birol: could see further tightening in oil markets in Q4

-(IR) Pres Trump: At some point Iran will want to make a 'real deal'; will be discussing ethanol policy at rally tonight in Iowa

Europe

-(IT) EU Commission: Italy 2019 budget plan to be assessed after Oct 15th

-(IT) Italy Fin Min Tria: Govt would act in case of unexpectedly rise in bond spreads

-(IT) Bank of Italy Representative in Parliament on Govt fiscal outline: Remains a threat of a vicious circle over Italy's debt costs and repercussions for the real economy

-(DE) German Fin Min Scholz said to aim for tax policy that treats Britain like an EU member until end of 2020 — German press

-(TR) Turkey Fin Min Albayrak announces program to counter inflation: Price will normalize with stability on currency front

-(UK) Government spokesperson Slack: To put forward new Irish border proposal 'in due course'

-(IT) Bank of Italy (BOI) Director General Signorini: There are spread levels above which some banks will need to ask the market for help

-(IE) Ireland Fin Min Donohoe: 2019 GDP growth seen at 4.2% vs. 7.5% expected this year; to raise betting tax

Corporate Headlines:

-PZZA lifts on Trian report

-Kroger slumps on downgrade

-PPG slides after slashing forecast

-EBAY lifts on activist speculation

-Tata Motors falls on poor sales report

— Dow Jones -0.4%

— S&P500 -0.1%

— Nasdaq +0.3%

— Russell 2000 +0.1%

Treasuries:

— US 2-yr: -1bps at 2.881%

— 10-yr: -2bps at 3.212%

— 30-yr: -2bps at 3.382%

— 2-10 spread: -1bps at 0.33%

Commodities:

— Nov crude oil $74.94, +0.9%

— Dec Gold $1,191/oz, +0.2%

— Dec Silver $14.38/oz, +0.3%

— Dec Copper $2.781/oz, +0.5%