US Market Close Summary: Rebound in financials stabilizes slumping equities as investors contemplate rising rates.

US Session

-Bond market closed; stock volumes muted due to holiday

-(ZA) South Africa President office refutes earlier reports about Fin Min Nene asking to be relieved of duties

-(CL) Chile Sept CPI M/M: 0.3% v 0.4%e; Y/Y: 3.1% v 3.2%e

-(CN) China National Bureau of Stats (NBS) chief reiterates that could achieve its full year economic targets

-(US) Pres Trump: do not have any plan to fire Deputy AG Rosenstein — press

-(US) National Hurricane Center (NHC): Michael reaches category 1 hurricane and continued strengthening is expected

Europe

-(UK) May's Spokesman Slack: there remain big issues to be resolved with EU on Brexit

-(NL) ECB's Knot (Netherlands): Reiterates view that General Council comfortable with current guidance on interest rates

-(IL) ISRAEL CENTRAL BANK (BOI) LEAVES BASE RATE UNCHANGED AT 0.10%; AS EXPECTED

-(US) National Hurricane Center (NHC): Michael reaches category 1 hurricane and continued strengthening is expected

-(IT) Italian Chamber of Deputies Speaker Fico: Not concerned about market or dialogue with EU on budget

-(IT) Italy's Savona: Believes Italy GDP can grow 2% in 2019, 3% in 2020

— ECB's Villeroy: Italy mix of high debt and weak growth is unbalanced — press interview

Summary:

Weakness in Asian and European stocks led to softness at the US open. The The tech-laden NASDAQ underperformed again while consumer staples fared relatively well. Financials were weak in the morning, but rebounded in the afternoon helping erase most of the broader market losses. Safe haven flows pushed core European rates modestly lower as Italian Treasury yields continued to rise. US Treasury futures were higher while bond markets were closed due to the holiday. The Dollar index pushed back up towards the 96 level putting modest pressure on commodities prices. Brazil stocks rose sharply and the currency firmed after first round of elections showed right wing populist Presidential candidate Bolsonaro had captured nearly 47% of the vote.

Corporate Headlines:

— SBUX names new CFO

— PPG announces 10% global price increase for automotive OEM coatings due to «unprecedented cost pressures»

-AXTA steps down

-Rowan and Ensco merge in $3.9B deal

-SON Implementing 6-10% price increase for rigid plastic packaging

-RPC.UK Issues H1 trading update: H1 Rev £1.9B +3% y/y (organically); Margins and Op profit remain in line with expectations

-LTG.UK Places 31.3M shares at 130p/shr on behalf of holders

-Google: glitch exposed private data of at least hundreds of thousands of Google+ users over 3 years; Google chose not to disclose the issue, found no evidence of misuse — press

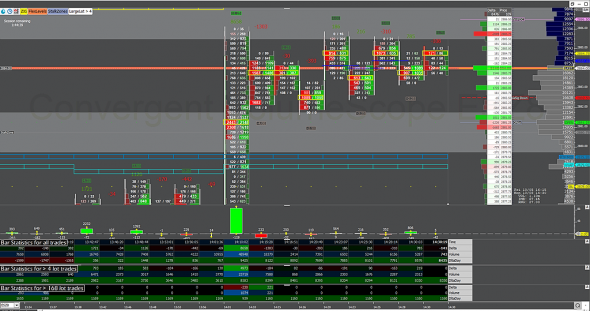

— Dow Jones +0.2%

— S&P500 -0.0%

— Nasdaq -0.7%

— Russell 2000 -0.0%

Treasuries:

— Markets closed for Columbus Day

Commodities:

— Nov crude oil $74.22, -0.2%

— Dec Gold $1,192/oz, -1.1%

— Dec Silver $14.41/oz, -1.6%

— Dec Copper $2.76/oz, +0.2%

-After Market Movers-

— BLKB Cuts guidance

— AFMD Places phase 1 program on clinical hold due to 3 adverse events including a death