SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Индекс производственной активности.

- 17 января 2017, 18:52

- |

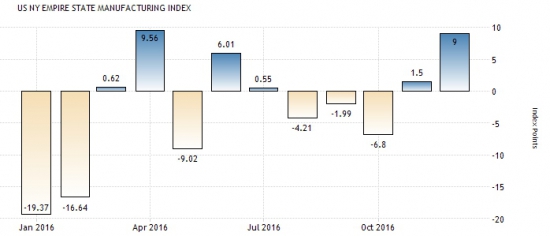

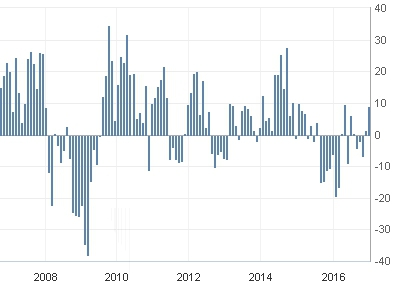

Экономическое здоровье производственного сектора находится на подъёме.

После уверенного роста в прошлом периоде, аналитики ожидают небольшое сокращение показателя до 8 пунктов. При этом на длительном отрезке индекс рассматривается позитивно и ожидается его дальнейший рост:

Все новости:

Данные: Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

European Bonds Rally

The stock market is poised for a lower open as the S&P 500 futures trade six points below fair value.

On the corporate front, Tiffany & Co (TIF 77.60, -4.32) has dropped 5.3% in pre-market trade after reporting lackluster holiday sales. Conversely, Walt Disney (DIS 109.00, +0.94) has climbed 0.9% after the company's stock was upgraded to 'Buy' from 'Neutral' at Goldman.

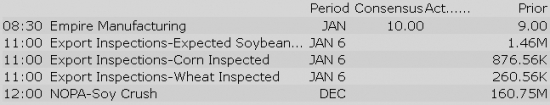

Just released, the Empire Manufacturing Survey for January fell to 6.5 from the prior month's reading of 9.0. The Briefing.com consensus estimate was pegged at 8.3.

Gapping up

In reaction to strong earnings/guidance: EDU +2.3%, UNH +0.5%, .

M&A news:

Select metals/mining stocks trading higher: KGC +4.8%, AU +4.7%, SBGL +4.5%, PAAS +3.7%, GG +3.4%, ABX +3.1%, NEM +3%, SLW +2.8%, GFI +1.7%

Other news:

Analyst comments:

The S&P 500 futures trade five points below fair value.

Equity indices across Asia-Pacific saw a modest pickup in activity last night, with traders returning to action in US following the MLK Holiday weekend. Unfortunately, the tone has been mostly negative with most of the major averages closing lower on Monday. There was only a few minor regional economic releases in Asia today with none having a profound impact upon release.

---Equity Markets---

Major European indices are on the defensive, but have cut their losses following a somewhat conciliatory Brexit speech from UK Prime Minister May, who confirmed Britain will leave the single market, but is aiming for a flexible and phased Brexit transition, which will be put to a parliamentary vote. The British pound has been really strong today, underpinned as well by a higher-than-expected CPI print for December.

---Equity Markets---

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance: EDU +2.3%, UNH +0.5%

M&A news:

Select metals/mining stocks trading higher: KGC +4.8%, AU +4.7%, SBGL +4.5%, PAAS +3.7%, GG +3.4%, ABX +3.1%, NEM +3%, SLW +2.8%, GFI +1.7%

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

M&A news:

Other news:

Analyst comments:

Filings:

Offerings:

Pricings:

Economic Data Summary:

Upcoming Economic Data:

Upcoming Fed/Treasury Events:

Other International Events of Interest

Highlights include:

The tech sector — XLK — trades modestly ahead of the broader market. Semiconductors, meanwhile, display relative weakness as the SOX index trades -0.79%. Within the SOX index, ADI (+0.67%) outperforms, while MKSI (-1.92%) lags. Among other major indices, the SPY is trading 0.20% lower, while the QQQ -0.24% and the NASDAQ -0.23% trade modestly lower on the session. Among tech bellwethers, TMUS (+0.93%) is showing relative strength, while AVGO (-1.01%) lags.

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

Scheduled to report earnings after the bell:

Scheduled to report earnings tomorrow morning:

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 0.74… VIX: (12.13, +0.90, +8.0%).

This Week is options expiration — Friday, January 20th is the last day to trade January equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

- Benitec Biopharma (BNTC +76.76%) BB-301 receives Orphan Drug Designation in EU

- Pulmatrix (PULM +63.26%) announces that its drug candidate for treating fungal infections in the lungs of CF patients, PUR1900, has been designated as a QIDP by the FDA

- Forward Pharma (FWP +50.9%) enters into settlement and license agreement with Biogen (BIIB), will receive $1.25 bln

Decliners on news:- Alcobra Pharma (ADHD -53.09%) reports that the Phase 3 clinical trial of MDX in adults with ADHD missed the primary endpoint

- Concert Pharma (CNCE -12.23%) provides further details on CTP-656 development in U.S. and Europe; FDA requiring adequate washout period

- Medigus (MDGS -9.68%) receives non-compliance notice from NASDAQ for inability to maintain minimum bid price

Decliners on earnings:- UnitedHealth (UNH -1.53%) beats by $0.04, reports revs in-line; reaffirms FY17 EPS guidance, revs guidance

Upgrades/Downgrades:Rumor Activity was active to start out the week.

While many rumors circulate during the day, and the validity of the source of these rumors can be questionable, the speculation may increase volatility in the near term.

The Industrials sector (XLI) is trading 0.6% lower today, lower than the broader market (SPY -0.3%). In the industrial sector, China Eastern Airlines (CEA +0.3%) reports December operating data, Taser (TASR -2.2%) announces that Australian and New Zealand Police Agencies will Deploy 2585 TASER Smart Weapons, and Tutor Perini (TPC +2.9%) receives a NOI to receive an approx. $1.377 bln contract from the Los Angeles County Metropolitan Transportation Authority for the Westside Purple Line Extension Section 2 Project.

News

Broker Research

Upgrades

Downgrades

Other

Stocks that traded to 52 week lows: ACUR, ADHD, AVGR, COSIQ, DRYS, ECYT, EVC, FENX, FTEK, GBSND, ICLD, IFON, KOF, KONA, MACK, PRGO, SMRT, TV, TWER, VLRS, VNCE

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week highs on High Volume: BNTC, CBFV, CLRO, CVV, DAIO, DAX, FEUZ, FWP, GGM, GSH, GULF, HFBL, KFS, MLVF, MPB, MVO, OFS, ONEQ, OTEL, OVLY, OXBR, PNTR, QCLN, RMCF, SAL, SBCP, SHI, TPL, TRK, WAYN

Thinly-Traded Stocks (ADV below 45k) that traded to 52 week lows on High Volume: AXSM, CGG, GSIH, SPI

ETFs that traded to 52 week highs: DBC, EWC, EWG, GULF

Notable earnings/guidance:

- Trading higher following earnings/guidance:

- EDU +2.9%

- TUES 0.9% (Tuesday Morning sees Q2 revenue just above consensus; COO Melissa Phillips resigns)

- Trading lower following earnings/guidance:

- CBK -33.3% (Christopher & Banks CEO LuAnn Via departs; names Joel Waller interim CEO; lowers Q4 guidance)

- TIF -1.2% (Tiffany & Co reports its sales results for the two months ended December 31 of $966 million vs. $961 million a year ago; worldwide comparable store sales declined 2%; expects FY16 EPS to decline by no more than a mid-single-digit percentage)

In the news:- Leaders: JCP 4.2% (announces new Nike shops in 600+ stores), WMT 3.1% (announced plans to create American jobs and invest in local communities across the country), GM 0.2% (General Motors confirms $1 bln US investment & will create 7000 jobs), LOW 1.4% (Lowe's CFO to retire; Marshall A. Croom, a 20-year Lowe's veteran, to take over), MAT 3.7% (Mattel appoints Margaret Georgiadis as CEO effective February 8), BURBY 0.6% (confirms that Marco Gobbetti to become Group CEO in July), DLPH 0.8% (Delphi Automotive expects to record pre-tax charge of $300 million in Q4 related to litigation against the former Delphi Corporation)

- Laggards: GTN -4.3% (Gray Television stations dropped by Dish Network),ANGI -2.9% (Angie's List reports membership increased over 50% in 2016 to over 5 mln members), CONN -2.1% (names Coleman Gaines as President and Chief Operating Officer of Retail)

- M&A related: VZ 0.3% CHTR 1% CMCSA -0.2% (NYPost report that says Verizon is looking to acquire a large cable company, possibly Charter or Comcast)

- Limited Stores, parent company of women's fashion apparel retailer The Limited, files voluntary petition for relief under chapter 11 of the United States Bankruptcy Code.

Analyst related:Looking ahead:

Biggest point losers: ANET 92.5(-7.77), ADS 230.76(-6.79), AYI 209.89(-5.29), IBB 275.47(-4.54), PRGS 27.74(-4.51), REGN 363.87(-4.29), GS 240.08(-4.22), PNC 114.66(-4.13), CMA 66.1(-3.82), AGN 212.38(-3.76), ETRM 10.11(-3.59), CELG 114.29(-3.19), ALNY 38.89(-2.71), INCY 115.06(-2.69), SHPG 167.57(-2.65), UNH 159.24(-2.56), CMG 408.41(-2.34), JPM 84.41(-2.29), ZEN 22.48(-2.28), CP 146.29(-2.19), IONS 46.11(-1.98), OZRK 51.5(-1.96), HOLI 17.23(-1.95), SPR 56.17(-1.94), TSLA 235.88(-1.87)

Today's top 20 % gainers

- Healthcare: XBIT (10.89 +8.57%), THC (19.52 +7.14%), CYH (7.33 +5.77%)

- Materials: FSM (6.89 +6.49%), KGC (3.55 +5.51%)

- Consumer Discretionary: PVH (96.05 +7.55%), SHLD (9.38 +7.28%), GIII (28.75 +6.11%), MIK (21.76 +6.04%), GES (13.16 +5.92%), ZUMZ (20.9 +5.29%), RH (30.84 +4.97%)

- Financials: SRG (42.38 +6.48%)

- Energy: CWEI (142.54 +37.09%), SN (12.85 +14.3%), PBF (25.06 +5.69%), NBL (39.28 +5.05%)

- Consumer Staples: AVP (5.84 +5.8%)

- Utilities: NRG (15.54 +6.44%), CIG (2.74 +5.19%)

Today's top 20 % losersToday's top 20 volume

- Healthcare: PFE (12.03 mln -1.81%)

- Materials: VALE (13.02 mln +0.68%), ABX (8.96 mln +2.85%)

- Industrials: GE (9.65 mln -0.1%), CSX (7.7 mln -1.89%)

- Consumer Discretionary: F (16.31 mln -0.2%), JCP (13.51 mln +4.29%)

- Information Technology: AMD (33.08 mln -5.53%), AAPL (12.68 mln +0.64%)

- Financials: BAC (62.52 mln -2.76%), JPM (12.51 mln -2.79%), RF (11.35 mln -4.73%), C (9.43 mln -1.81%), WFC (9.12 mln -1.99%), MS (7.75 mln -2.88%)

- Energy: CHK (10.34 mln +0.58%), NBL (9.06 mln +5.05%)

- Consumer Staples: RAI (30.03 mln +3.14%), RAD (8.43 mln -0.64%)

- Telecommunication Services: S (10.55 mln +2.73%)

Today's top relative volume (current volume to 1-month average daily volume)