SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Ставка, запасы нефти, индекс цен производителей и заявки на покупку домов по ипотеке.

- 01 февраля 2017, 17:32

- |

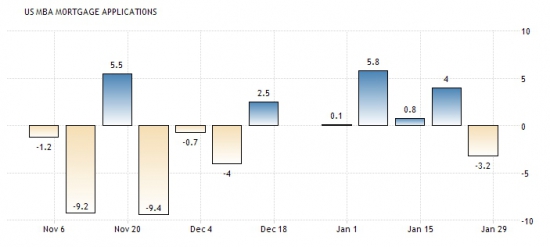

Первым показателем выходят данные по ипотеке. Рваный показатель заявок на покупку домов по ипотеке в этом месяце аналитики ожидают в положительной зоне несмотря на рост стоимости кредита:

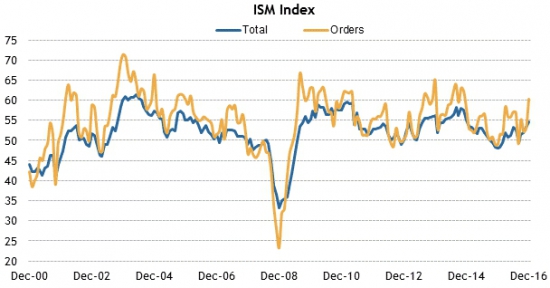

Индекс цен производителей отрисовал перевернутую голову-плечи и ожидается его дальнейшее укрепление на отметке 55.2:

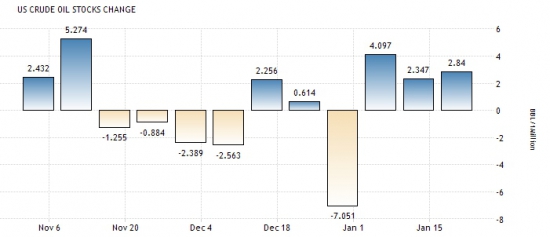

Также ожидается рост запасов сырой нефти, сюрпризом будет значение выше 4 млн. баррелей:

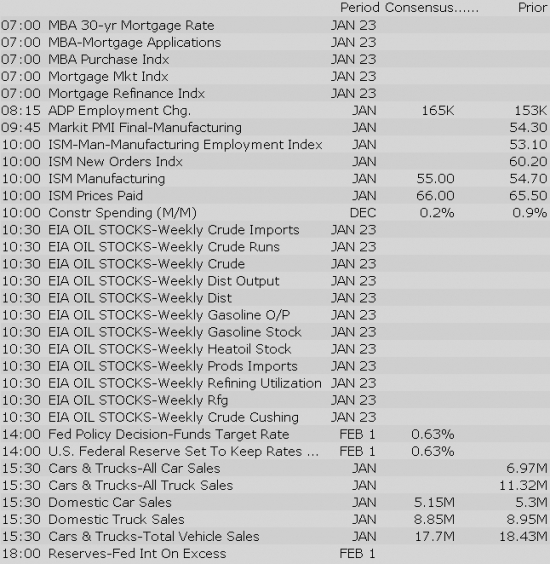

Наиболее важной новостью будет решение по ставке в 14:00 NY, ожидаемое без изменений на уровне 0.75 базисных пунктов :

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Upgrades:

Downgrades:

Miscellaneous:

Major European indices trade higher across the board with France's CAC (+1.2%) showing relative strength. The euro trades little changed against the dollar after climbing into the 1.0800 area yesterday. Meanwhile, the pound (1.2641) is up 0.5% against the greenback. Not long ago, British Prime Minister Theresa May said a white paper that contains the Brexit strategy will be published tomorrow. Participants received a full slate of PMI readings from the region, but the results were mixed.

---Equity Markets---

Treasuries Slip Ahead of Heavy News Flow

Upcoming IPOs:

Equity futures are pointing to a higher open this morning, after yesterday's afternoon rally helped the major averages finish at their best levels of the day. The S&P 500 futures currently trade three points (0.1%) above fair value.

U.S. Treasuries are under modest selling pressure this morning after posting solid gains on Tuesday. The benchmark 10-yr yield is one basis point higher at 2.47%.

Conversely, crude oil is pushing for its second consecutive win. The commodity is currently up 0.7% at $53.18/bbl.

The weekly MBA Mortgage Index, which was released earlier this morning, declined 3.2% to follow last week's 4.0% increase.

Other economic reports on Wednesday will include January ADP Employment Change (Briefing.com consensus 165k) at 8:15 am ET, January ISM Index (Briefing.com consensus 55.0) at 10:00 am ET, December Construction Spending (Briefing.com consensus 0.2%) at 10:00 am ET, and the FOMC Rate Decision (Briefing.com consensus 0.625%) at 2:00 pm ET.

January Auto & Truck Sales will be released throughout the day.

In U.S. corporate news:

Reviewing overnight developments:

Eurozone Yields Remain near Multi-Year Highs After Strong Factory Surveys

The stock market remains on track for a higher open as the S&P 500 futures trade five points above fair value.

The Fed (FOMC) will release its latest policy decision and statement this afternoon at 2:00 pm ET. However, this FOMC meeting isn't garnering much fanfare as the general expectation is that there won't be any change to monetary policy.

This meeting marks the first meeting with new voting members for 2017 — Chicago Fed President Evans, Philadelphia Fed President Harker, Dallas Fed President Kaplan, and Minneapolis Fed President Kashkari are the new voting members. Mr. Evans is the only one of that group who has voted before on the FOMC.

While no change in policy is expected, the wording of the directive could potentially accentuate the policy divergences between the Fed and other leading central banks, which could result in some market gyrations.

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select Apple suppliers/related names showing strength:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select Apple suppliers/related names showing strength:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

The S&P 500 futures trade five points (0.2%) above fair value.

Equity indices in the Asia-Pacific region ended Wednesday on a mixed note while China's Shanghai Composite remained close for Lunar New Year. In Japan, Koichi Hamada, who advises Prime Minister Shinzo Abe, said President Donald Trump's arguments on border tax and currencies are destructive to Japan and the world economy.

---Equity Markets---

Major European indices trade higher across the board. The euro (1.0770) is down 0.3% against the dollar after climbing into the 1.0800 area yesterday. Meanwhile, the pound (1.2641) is up 0.5% against the greenback. Earlier this morning, British Prime Minister Theresa May said a white paper that contains the Brexit strategy will be published tomorrow. Participants received a full slate of PMI readings from the region, but the results were mixed.

---Equity Markets---

Filings:

Offerings:

Pricings:

The stock market is poised to build on Tuesday's afternoon momentum as the S&P 500 futures trade four points (0.2%) above fair value.

Earnings season is alive and well with a host of large-cap names reporting between yesterday's close and this morning's open. No earnings report, however, was more influential than Apple's (AAPL 127.37, +6.02).

AAPL is up 5.0% in pre-market trade after the company beat top and bottom line estimates with the help of record iPhone sales that also topped expectations. As the most heavily-weighted stock in the S&P 500 and Nasdaq 100, Apple's pre-market gain has helped lift the futures markets this morning.

Earlier, the ADP National Employment Report showed an increase of 246,000 private-sector jobs in January (Briefing.com consensus 165,000) while the December reading was revised lower to 151,000 from 153,000. The ADP reading precedes Friday's more influential Employment Situation Report for January, which the Briefing.com consensus expects will show the addition of 170,000 nonfarm payrolls. Economists, though, may very well take up their estimates after the ADP number.

Separately, the weekly MBA Mortgage Index declined 3.2% following last week's 4.0% increase.

Wednesday morning will see a few more economic reports including the ISM Index for January (Briefing.com consensus 55.0) and the Construction Spending report for December (Briefing.com consensus 0.2%). Both reports will be released at 10:00 am ET.

The FOMC rate decision (Briefing.com consensus 0.625%) and policy directive will be announced at 2:00 p.m. ET and Auto & Truck Sales for January will be released throughout the day.

The major averages opened Wednesday's session higher, with the Nasdaq (+0.7%) showing relative strength. The S&P 500 currently sports a gain of 0.3%.

Cyclical spaces lead the advance with the heavily-weighted technology (+0.9%) and financial (+0.9%) sectors at the top of today's leaderboard. Countercyclical groups lag with consumer staples, utilities, and real estate posting losses between 0.1% and 1.1%.

Selling pressure persists in the Treasury market, pushing the 10-yr Note below its overnight low. The benchmark 10-yr yield is three basis points higher at 2.49%.