SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Данные по розничным продажам и инфляции.

- 15 февраля 2017, 16:58

- |

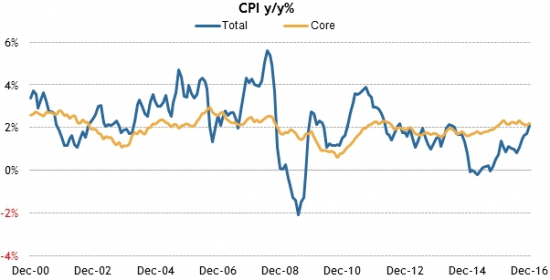

Сегодня выходит блок значительных новостей. За час до открытия рынка выходят данные по инфляции, согласно ожиданиям превысившей 2% в годовом измерении. Новый показатель ожидается на уровне 2.1%:

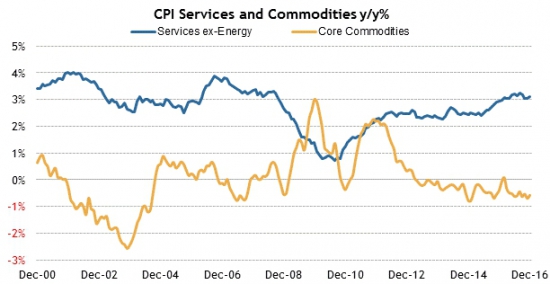

Наибольшая инфляция продолжает наблюдаться в сфере услуг, товарная инфляция снижается, но эти темпы замедляются:

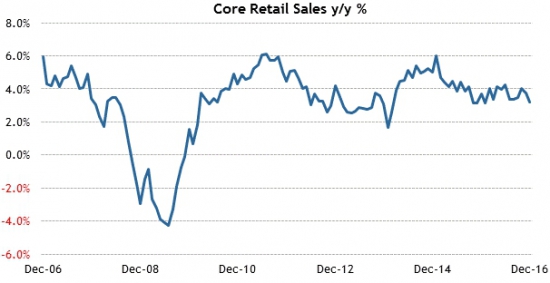

Вместе с инфляционными данными выходит показатель розничных продаж, который в годовом выражении ожидается на том же уровне:

Падение в годовом масштабе происходит из-за слабого прироста в месячных показателях этого года. Данные за январь ожидаются на уровне 0.3%:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Market updates

US Econ Data

Equity indices in the Asia-Pacific region ended the midweek session on a mixed note. Overall, regional markets appeared unperturbed by yesterday's testimony on monetary policy delivered by Federal Reserve Chair Janet Yellen. Economic data out of Australia showed that businesses and consumers are anticipating a rate hike from the Reserve Bank of Australia in the near term.

---Equity Markets---

---FX---

StoneRiver's product portfolio is comprised of a policy administration suite, rating, underwriting, illustrations, reinsurance, and finance & compliance solutions for all major insurance business lines, across both property and casualty and life and annuities.

Co will host a conference call and webcast February 15 at 12:00 p.m. ET

Stocks with favorable mention: NUE, ENB, CBG, AQN, AZO, AAP, AMZN, SNA, FLEX, V, TMUS

Stocks with unfavorable mention: NOK

Major European indices trade in the green, hovering near record highs from January. The Italian government is reportedly in talks with European officials about a precautionary recapitalization of Banca Popolare di Vincenza and Veneto Banca. Elsewhere, Greek Prime Minister Alexis Tsipras reiterated that discussing additional austerity measures for Greece would be destructive.

---Equity Markets---

Upgrades:

Downgrades:

Miscellaneous:

Gapping down: FOSL -18.8%, EARS -18.3%, ESNC -16.9%, TRUP -11.7%, NAII -11.4%, PLAB -10.2%, CALX -8.5%, UNXL -7.9%, LC -6.8%, HOLI -5.6%, TECK -5.5%, AIG -4.9%, SBCF -4.3%, GOGL -4.2%, SDRL -3.7%, UAA -3.3%, MASI -3.2%, OMI -3.1%, BP -2.5%, CZR -2.3%, RDS.A -2.2%, ASGN -2.1%, BXMT -1.6%, MRK -1.5%, ESRX -1.5%, SEV -1.4%, QGEN -1.3%, FCX -1.3%, BYD -1.3%, VDSI -1.3%, SHPG -1.2%, MT -1.2%, RPXC -1.2%, AA -1.1%, DE -1%, TSLA -1%, NVO -0.9%, NBIX -0.9%, MFS -0.9%, LXFT -0.7%, DNOW -0.7%

Shares of AIG are down approx 5% in reaction to bigger than expected reserve build.

Treasuries Edge Lower Ahead of Data Deluge

Investors have hit the pause button on Wednesday morning after pushing the major averages to fresh record highs on Tuesday and ahead of a heap of economic data today. The S&P 500 futures trade one point above fair value.

U.S. Treasuries remain under pressure this morning and are in danger of posting their fifth consecutive loss. The benchmark 10-yr yield is one basis point higher at 2.48%.

Crude oil also trades lower this morning, down 0.6% at $52.88/bbl. The energy component's downtick follows yesterday's American Petroleum Institute report which showed a build of 9.9 million barrels. The Energy Information Administrations's official supply report will cross the wires today at 10:30 ET.

The weekly MBA Mortgage Index, which was released earlier this morning, decreased 3.7% to follow last week's 2.3% uptick.

In addition to the MBA Mortgage Index, Wednesday's economic agenda is jam-packed with January CPI (Briefing.com consensus 0.3%), January Retail Sales (Briefing.com consensus 0.1%), and February Empire Manufacturing (Briefing.com consensus 7.0) at 8:30 ET, January Industrial Production (Briefing.com consensus 0.0%) and Capacity Utilization (Briefing.com consensus 75.5%) at 9:15 ET, December Business Inventories (Briefing.com consensus 0.4%) and February NAHB Housing Market Index (Briefing.com consensus 68) at 10:00 ET, and December Net Long-Term TIC Flows at 16:00 ET.

In U.S. corporate news:

Reviewing overnight developments:

Shares of SEDG are up approx 4% in reaction to earnings.

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select EU financial related names showing strength:

Select Airline related names showing strength:

Other news:

Analyst comments:

Greek Bonds Fall Again as Spanish Inflation Hits 4-Year High

Gapping down

In reaction to disappointing earnings/guidance:

Select oil/gas related names showing early weakness:

Other news:

Analyst comments:

The S&P 500 futures trade one point below fair value.

Just in, total CPI rose 0.6% (Briefing.com consensus +0.3%) in January while core CPI, which excludes food and energy, increased 0.3% (Briefing.com consensus +0.2%). On a year-over-year basis, total CPI is up 2.5% and core CPI has increased 2.3%.

Separately, January retail sales increased 0.4%, which compares to the Briefing.com consensus of 0.1%. The prior month's reading was revised higher to 1.0% from 0.6%. Excluding autos, retail sales rose 0.8% while the consensus expected an uptick of 0.4%. The prior month's reading was revised higher to 0.4% from 0.2%.

The Empire Manufacturing Survey for February rose to 18.7 from the prior month's reading of 6.5. The Briefing.com consensus estimate was pegged at 7.0.

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select EU financial related names showing strength:

Select Airline related names showing strength:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Select oil/gas related names showing early weakness:

Other news:

Analyst comments:

The S&P 500 futures trade two points below fair value.

Equity indices in the Asia-Pacific region ended the midweek session on a mixed note. Overall, regional markets appeared unperturbed by yesterday's testimony on monetary policy delivered by Federal Reserve Chair Janet Yellen. Economic data out of Australia showed that businesses and consumers are anticipating a rate hike from the Reserve Bank of Australia in the near term.

---Equity Markets---

Major European indices trade in the green, hovering near record highs from January. The Italian government is reportedly in talks with European officials about a precautionary recapitalization of Banca Popolare di Vincenza and Veneto Banca. Elsewhere, Greek Prime Minister Alexis Tsipras reiterated that discussing additional austerity measures for Greece would be destructive.

---Equity Markets---

Filings:

Offerings:

Pricings:

The stock market is poised for a lower open on Wednesday morning following a heavy dose of economic data. The S&P 500 futures trade three points below fair value.

Just released, January Industrial Production decreased 0.3% (Briefing.com consensus 0.0%) while Capacity Utilization declined to 75.3% (Briefing.com consensus 75.5%) from a revised reading of 75.6% (from 75.5%) in December.

In addition to Industrial Production and Capacity Utilization, a number of economic reports were released earlier this morning, including January CPI, January Retail Sales, February Empire Manufacturing, and the MBA Mortgage Index.

Total CPI rose 0.6% (Briefing.com consensus +0.3%) in January while core CPI, which excludes food and energy, increased 0.3% (Briefing.com consensus +0.2%). On a year-over-year basis, total CPI is up 2.5% and core CPI has increased 2.3%.

January retail sales increased 0.4%, which compares to the Briefing.com consensus of 0.1%. The prior month's reading was revised higher to 1.0% from 0.6%. Excluding autos, retail sales rose 0.8% while the consensus expected an uptick of 0.4%. The prior month's reading was revised higher to 0.4% from 0.2%.

The Empire Manufacturing Survey for February rose to 18.7 from the prior month's reading of 6.5. The Briefing.com consensus estimate was pegged at 7.0.

The weekly MBA Mortgage Index decreased 3.7% to follow last week's 2.3% uptick.

Treasuries fell to lows in reaction to the data. The 10-yr yield is up four basis points at 2.51% while the five year yield has spiked ten basis points to 2.01% in the wake of hotter than expected inflation figures.

Investors will also receive December Business Inventories (Briefing.com consensus 0.4%) and February NAHB Housing Market Index (Briefing.com consensus 68) at 10:00 ET and December Net Long-Term TIC Flows at 16:00 ET.

The major averages opened Wednesday's session mixed with the Dow (+0.1%) holding a modest gain while the S&P 500 (-0.1%) hovers below its flat line.

Nine of eleven sectors trade in the red with real estate (-1.0%) and utilities (-0.9%) leading the retreat. On the bright side, the two spaces to buck the bearish trend are the top-weighted financial (+0.2%) and technology (+0.1%) sectors.

Treasuries show losses following this morning's heavy dose of economic data. The 5-yr yield has spiked nine basis points to 2.00% while the benchmark 10-yr yield is up four basis points at 2.51%.

The tech sector — XLK — trades mostly in-line with the broader market. Semiconductors, meanwhile, display relative strength as the SOX index trades +0.26%. Within the SOX index, CY (+1.59%) outperforms, while INTC (-0.50%) lags. Among other major indices, the SPY is trading 0.01% higher, while the QQQ +0.05% and the NASDAQ -0.16% trade opposite on the session. Among tech bellwethers, QCOM (+0.79%) is showing relative strength, while SAP (-0.82%) lags.

Notable gainers following earnings:

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

Scheduled to report earnings after the bell:

Scheduled to report earnings tomorrow morning:

Economic Data Summary:

Upcoming Economic Data:

Upcoming Fed/Treasury Events:

Other International Events of Interest

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 1.03… VIX: (11.63, +0.89, +8.3%).

This Week is options expiration — Friday, February 17th is the last day to trade February equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

The EIA reports that for the week ending Feb 10:

Production: U.S. crude oil refinery inputs avgd about 15.5 mln barrels per day during the week ending February 10, 2017, 435,000 barrels per day less than the previous week's avg. Refineries operated at 85.4% of their operable capacity last week. Gasoline production decreased last week, averaging about 9.0 mln barrels per day. Distillate fuel production decreased last week, averaging over 4.5 mln barrels per day.

Imports: U.S. crude oil imports avgd 8.5 mln barrels per day last week, down by 881,000 barrels per day from the previous week. Over the last four weeks, crude oil imports avgd 8.5 mln barrels per day, 9.9% above the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week avgd 604,000 barrels per day. Distillate fuel imports avgd 216,000 barrels per day last week.

Inventory: U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 9.5 mln barrels from the previous week. At 518.1 mln barrels, U.S. crude oil inventories are above the upper limit of the avg range for this time of year. Total motor gasoline inventories increased by 2.8 mln barrels last week, and are above the upper limit of the avg range. Both finished gasoline inventories and blending components inventories increased last week. Distillate fuel inventories decreased by 0.7 mln barrels last week but are above the upper limit of the avg range for this time of year. Propane/propylene inventories fell 2.6 mln barrels last week but are in the middle of the avg range. Total commercial petroleum inventories increased by 11.1 mln barrels last week.

Demand: Total products supplied over the last four-week period avgd about 19.4 mln barrels per day, down by 2.0% from the same period last year. Over the last four weeks, motor gasoline product supplied avgd over 8.4 mln barrels per day, down by 5.3% from the same period last year. Distillate fuel product supplied avgd 3.8 mln barrels per day over the last four weeks, up by 7.4% from the same period last year. Jet fuel product supplied is down 3.3% compared to the same four-week period last year.

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers

Notable earnings/guidance:

- Trading higher following earnings/guidance: GRPN +20.4%, PBPB +7%, RH +4%, WYN +2.6%, HEINY +2.4%, HLT +1%

- Trading lower following earnings/guidance: FOSL -17.4%, HNNMY -2.1%

- Near unchanged mark following earnings/guidance: ANGI

In the news:Looking ahead: