SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Инфляция, розничные продажи и складские запасы.

- 15 марта 2017, 15:18

- |

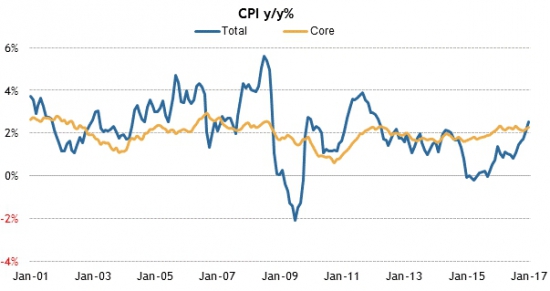

Инфляция в годовом базисе продолжает стремительно развиваться и вышла за пределы 2%. В этом месяце показатель ожидается аналитиками выше этой отметки:

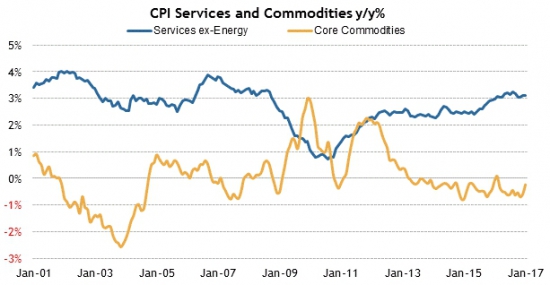

За инфляционными процессами в секторе услуг начала подтягиваться и товарная составляющая, которая в этом месяце в годовом базисе может выйти вверх за нулевую отметку:

Рост в розничных продажах замедлился и в годовом базисе начинает ход к отметке 2%:

Складские запасы тоже ожидают снижение к отметке 0.3%:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

Japan

Aus

Market Updates:

US Econ Data

Equity indices in the Asia-Pacific region ended the midweek session on a mixed note, but trading ranges were narrow once again, as investors awaited the latest rate decision and policy statement from the Federal Reserve. The Bank of Japan will follow, releasing its own policy update on Thursday. China's Premier Li Keqiang called for an improvement in Sino-US relations. Mr. Li added that China's 6.5% GDP growth target is ambitious given external risks.

---Equity Markets---

---FX---

Upgrades:

Downgrades:

Miscellaneous:

The Consumer Price Index for February will be released at 8:30 a.m. ET, providing the Federal Reserve with a final consumer inflation data point before the Federal Open Market Committee (FOMC) makes its interest rate decision.

According to the Briefing.com consensus estimates, total CPI is expected to be up 0.1% while core CPI, which excludes food and energy, is expected to increase 0.2%.

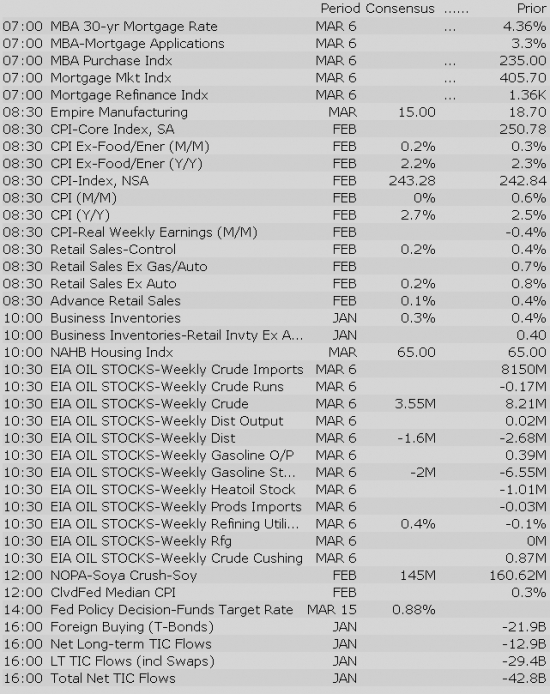

The Retail Sales Report for February will be released at 8:30 a.m. ET. It will be watched closely to see if high levels of consumer confidence are translating into actual spending activity.

According to the Briefing.com consensus estimates, total retail sales and retail sales, excluding autos, are both expected to be up 0.1%. That would be a marked slowdown from the 0.4% and 0.8% increases, respectively, registered in January.

Major European indices trade near their flat lines while Italy's MIB (+0.7%) and Spain's IBEX (+0.5%) outperform. Today's mostly range-bound action comes ahead of the latest FOMC rate decision and today's general election in the Netherlands. In Scotland, a YouGov Times survey showed that 57.0% of voters support remaining in the United Kingdom. Also of note, French presidential candidate Francois Fillon was placed under a formal investigation for diversion of public funds.

---Equity Markets---

Gapping down: RUBI -25.5%, DRWI -15.8%, NMM -14.4%, NPTN -13.4%, CXRX -8.2%, IMUC -8.1%, IMUC -8.1%, FTD -7.7%, OHAI -6.1%, CNXR -5.8%, INFI -5.1%, AKAO -5%, MU -2.1%, CEL -1.9%, ENDP -1.7%, KURA -1.6%, ERIC -1.2%, TWTR -1%, STM -1%, AZN -0.7%, INTC -0.7%, NVS -0.7%, TOT -0.6%, TWNK -0.5%

Treasuries Tick Higher Ahead of Retail Sales and CPI

NPTN -14% near $7/share premarket.

Crude oil has nudged equity futures higher this morning, but caution ahead of today's official rate decision from the Federal Open Market Committee has kept gains in check. The S&P 500 futures trade four points, or 0.2%, above fair value.

WTI crude trades 1.9% higher at $48.64/bbl this morning after the American Petroleum Institute (API) reported an unexpected draw of 0.531 million barrels on Tuesday evening. The bump puts the energy component on track to break its streak of six consecutive retreats, but that could change later this morning when the Energy Information Administration (EIA) releases its weekly inventory report. The report will cross the wires at 10:30 ET.

The two-day FOMC meeting in Washington will come to a close today with the official rate decision scheduled for 14:00 ET. It's pretty much a given that the U.S. central bank will increase the Fed funds target range by a quarter point, leaving investors more interested in the Fed's dot plot, which shows expectations for future rate changes.

U.S. Treasuries have seen an uptick in buying interest ahead of today's action with the benchmark 10-yr yield trading two basis points lower at 2.58%.

On the data front, the weekly MBA Mortgage Applications Index, which was released earlier this morning, increased 3.1% to follow last week's 3.3% uptick.

In addition, investors will receive February CPI (Briefing.com consensus 0.1%), February Retail Sales (Briefing.com consensus 0.1%), and March Empire Manufacturing (Briefing.com consensus 14.5) at 8:30 ET, with January Business Inventories (Briefing.com consensus 0.3%) and March NAHB Housing Market Index (Briefing.com consensus 65) following at 10:00 ET.

In U.S. corporate news:

Reviewing overnight developments:

European Bonds Rally with Treasuries Ahead of FOMC Decision

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select metals/mining stocks trading higher:

Select oil/gas related names showing strength:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

The S&P 500 futures trade five points above fair value.

Just in, total CPI rose 0.1% (Briefing.com consensus +0.1%) in February while core CPI, which excludes food and energy, increased 0.2% (Briefing.com consensus +0.2%). On a year-over-year basis, total CPI is up 2.7% and core CPI has increased 2.2%.

Separately, February retail sales increased 0.1%, which is in line with the Briefing.com consensus. The prior month's reading was revised higher to 0.6% from 0.4%. Excluding autos, retail sales rose 0.2% while the consensus expected an uptick of 0.1%. The prior month's reading was revised higher to 1.2% from 0.8%.

The Empire Manufacturing Survey for March rose to 16.4 from the prior month's reading of 18.7. The Briefing.com consensus estimate was pegged at 14.5.

Gapping up

In reaction to strong earnings/guidance:

M&A news:

Select metals/mining stocks trading higher:

Select oil/gas related names showing strength:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

Other commodities such as copper, oil and natural gas showed muted price action following

The S&P 500 futures trade five points (0.2%) above fair value.

Equity indices in the Asia-Pacific region ended the midweek session on a mixed note, but trading ranges were narrow once again, as investors awaited the latest rate decision and policy statement from the Federal Reserve. The Bank of Japan will follow, releasing its own policy update on Thursday. China's Premier Li Keqiang called for an improvement in Sino-US relations. Mr. Li added that China's 6.5% GDP growth target is ambitious given external risks.

---Equity Markets---

Major European indices trade near their flat lines while Italy's MIB (+0.7%) and Spain's IBEX (+0.7%) outperform. Today's mostly range-bound action comes ahead of the latest FOMC rate decision and today's general election in the Netherlands. In Scotland, a YouGov Times survey showed that 57.0% of voters support remaining in the United Kingdom. Also of note, French presidential candidate Francois Fillon was placed under a formal investigation for diversion of public funds.

---Equity Markets---

Filings:

Offerings:

Pricings:

A jump in the price of crude oil has nudged equity futures higher this morning, but caution ahead of the Federal Open Market Committee's rate decision has kept gains in check. The S&P 500 futures trade six points (0.3%) above fair value.

The two-day FOMC meeting will come to a conclusion this afternoon with the Fed announcing its rate decision at 14:00 ET. However, given that a rate hike is widely expected, investors will be more interested in the central bank's dot plot, which shows expectations for future rate changes.

Crude oil has reversed its bearish ways this morning following the API's latest crude oil inventory report, which showed an unexpected draw of 0.531 million barrels. If the EIA's inventory reading shows a similar figure later this morning at 10:30 ET, the energy component will be poised to break its streak of six consecutive retreats. WTI crude currently trades higher by 1.7% at $48.54/bbl.

In U.S. corporate news, airlines trade lower in pre-market action after Winter Storm Stella caused a mass of flight cancellations on Tuesday. United Continental (UAL 64.80, -1.75) leads the retreat with a loss of 2.6%.

Investors received several important economic reports earlier this morning, however, the response has been minimal as the data came in roughly as expected.

Total CPI rose 0.1% (Briefing.com consensus +0.1%) in February while core CPI, which excludes food and energy, increased 0.2% (Briefing.com consensus +0.2%). On a year-over-year basis, total CPI is up 2.7% and core CPI has increased 2.2%.

Separately, February retail sales increased 0.1%, which is in line with the Briefing.com consensus. The prior month's reading was revised higher to 0.6% from 0.4%. Excluding autos, retail sales rose 0.2% while the consensus expected an uptick of 0.1%. The prior month's reading was revised higher to 1.2% from 0.8%.

The Empire Manufacturing Survey for March rose to 16.4 from the prior month's reading of 18.7. The Briefing.com consensus estimate was pegged at 14.5.

Investors will also receive January Business Inventories (Briefing.com consensus 0.3%) and the March NAHB Housing Market Index (Briefing.com consensus 65) on Wednesday. Both reports will cross the wires at 10:00 ET.

Stocks with favorable mention: AAPL, CHKP, CSCO, CYBR, FB, NUE, PLD, SYY, TSLA

Stocks with unfavorable mention: JEC, SGEN

The S&P 500 opens Wednesday's session with a modest gain of 0.2%.

The materials (+0.6%) and energy (+0.6%) sectors lead with the latter space benefiting from crude oil's advance. The energy component trades 1.4% higher at $48.41/bbl after the API's latest inventory report showed an unexpected draw of 0.531 million barrels.

Meanwhile, the top-weighted technology group (unch) underperforms as chipmakers weigh; the PHLX Semiconductor Index trades lower by 0.2%.

The tech sector — XLK — trades behind the broader market. Semiconductors, meanwhile, display relative weakness as the SOX index trades -0.04%. Within the SOX index, TER (+1.30%) outperforms, while AMD (-2.77%) lags. Among other major indices, the SPY is trading 0.30% higher, while the QQQ +0.02% and the NASDAQ +0.44% trade modestly higher on the session. Among tech bellwethers, AMX (+1.02%) is showing relative strength, while NTES (-0.79%) lags.

Notable gainers following earnings:

Notable laggards following earnings:

Gainers on news:

Laggards on news:

Among notable analyst upgrades:

Among notable analyst downgrades:

Scheduled to report earnings after the bell:

Scheduled to report earnings tomorrow morning:

Taking an early look at the options market, we found the following names that may be worth watching throughout the day for further indication of investor expectations given their options volume and implied volatility movement.

Stocks seeing volatility buying (bullish call buying/bearish put buying):

Calls:

Puts:

Stocks seeing volatility selling:

Sentiment: The CBOE Put/Call ratio is currently: 0.93… VIX: (11.98, -0.32, -2.6%).

This Week is options expiration — Friday, March 17th is the last day to trade March equity options.

*Please use the Talk to Us link at the top of the page to provide feedback on this comment as well as the OPTNX comments.

The following are some of today's most notable movers of interest, categorized by market capitalization (large cap over $10 billion and mid cap between $2-10 billion) and ranked by % change (all stocks over 100K average daily volume).

Large Cap Gainers

Large Cap Losers

Mid Cap Gainers

Mid Cap Losers