Блог им. st-travich

СME Futures Analysis 05.06.2022

- 05 июня 2022, 17:14

- |

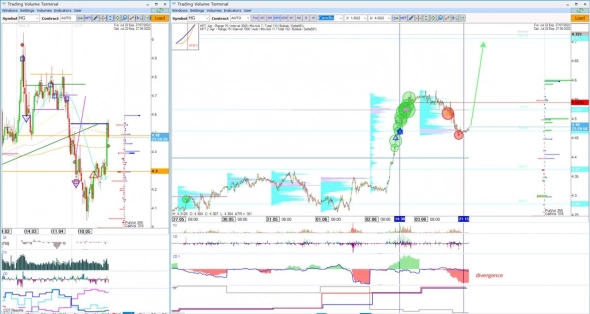

🔻 Let's discuss Gold (GC). I see here a few strategies entry point in one bottle.

Sell HFTs’ after green delta + limit buyer on top with OI increase on growth and then correction first of all to the direction of market sellers. I expect the movement to the limit buyer level on top and further. (See)

🔻 Also, note that the British pound (6B) is attending 1,25 — the strong support zone now. And if I see selling HFTs’ under this zone it will be interesting to buy this asset to surf another long wave. (See)

🔻 Copper (HG) shows us a good longing opportunity to target 4.7. That was unbelievable a month ago that the price ever go there, but it did. I even signed on the chart this direction at the beginning of May, but it was too early at that time. Now, this picture is clear enough for volume analysis buyers. (See)

🔻 Also, I see a beautiful picture in the New Zealand dollar (6N). Very often when we see sell HFTs and strongly buy Delta it is the real market signal for the pullback. So I expect the uptrend continuation up to the 0.66 price level. (See)

🔻 In the Platinum (PL) very strong effort of Bid Delta without result, it is the character of trend continuation (See)

As a result, my trading priorities are:

Gold (GC) buy

British pound (6B) breakdown, then buy

Copper (HG) buy

New Zealand dollar (6N) buy

Platinum (PL) buy

We need to know exactly what we are looking for in the market and are ready to wait!

See Volume Analysіs CME + video 05.06.2022

Have a nice upcoming week!

Sincerely, Taras Sviatun

теги блога Wilson Trade

- 6A

- 6B

- 6C

- 6E

- 6j

- 6N

- 6S

- analysis

- ask

- bid

- BR

- Brent Oil

- British pound

- CAD

- CC

- CL

- CME

- Cocoa

- corn

- COT

- CoT reports

- COT отчет

- COT отчеты

- Crude Oil

- DXY

- ES

- Euro

- futures

- GC

- Gold

- hft

- HG

- KC

- Larri Willams

- larry williams

- Market profile

- natural gas

- NG

- Oil

- PL

- Platinum

- S&P500

- SB

- SI

- Silver

- soybeans

- Sugar

- trade

- trader

- traders

- trading

- wheat

- YM

- ZC

- ZN

- ZS

- ZW

- автоуровни

- аналитическая статья

- бизнес

- биткоин

- газ

- Евро

- золото

- Иена

- Инвестиции

- канадский доллар

- китай

- корреляция

- Мазут

- медь

- на чем заработать

- нефть

- новая ниша бизнеса

- ОИ

- опционы

- открытый интерес

- оффтоп

- Палладий

- перспективы роста

- платина

- полезная информация

- серебро

- советы для начинающих

- СОТ

- СОТ отчеты

- стартапы

- сша

- торговые стратегии

- трейдер

- трейдинг

- трейдинг для начинающих

- уровни

- фонды

- форекс

- фрс

- Фунт

- фьючерс

- ФЬЮЧЕРСЫ