Сенатор Валерий Рязанский, который является автором законопроекта о регулировании электронных курительных устройств предложил разработанные поправки к законопроекту для второго чтения в Госдуме. Политик считает, что реализация некурительных продуктов должна быть полностью запрещена, если они не буду классифицироваться и регистрироваться как «медицинские изделия»

xn--c1abvl.xn--p1ai/short_news/85200/

| British American Tobacco Календарь Акционеров | |

| Прошедшие события Добавить событие | |

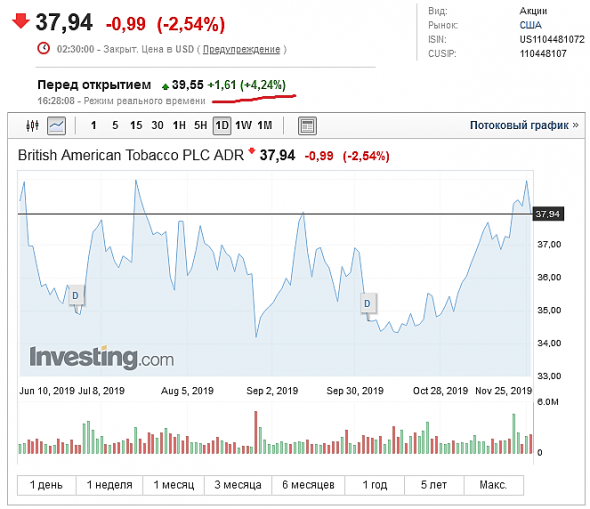

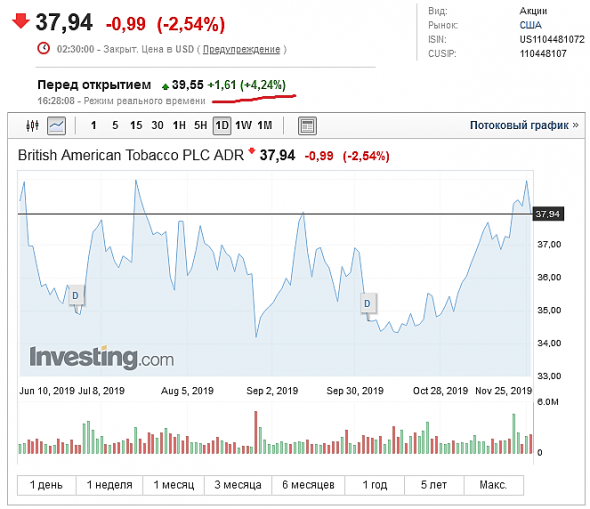

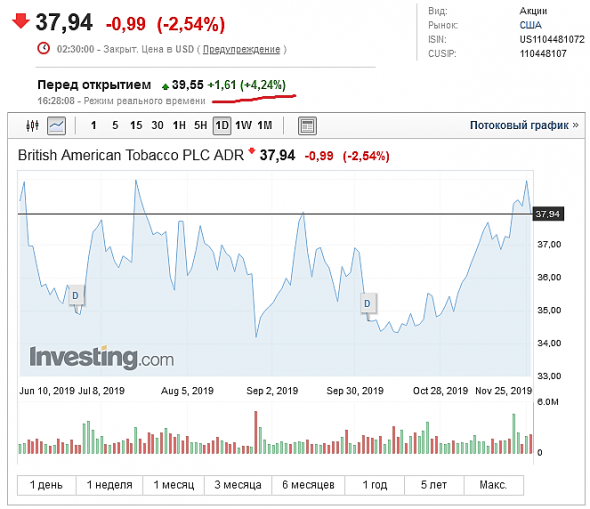

British American Tobacco акции

-

Кажется бумага взяла тренд на разворот

ZaPutinNet, дивы норм

Вадим Джог, да, дивы хорошие, и налог не берут, но всё равно вышел половиной, надоело в минусах сидеть. Подскажи к каким иностранным бумагам стоит приглядеться.

ZaPutinNet, я держу BMY,KMI,MSFT,PFE,CTL,T-присматриваюсь к XLNX,IVZ,CCL,NEE,BSX

Вадим Джог, CTL у меня тоже есть — 1 штука ))) Зато в плюсе

Кажется бумага взяла тренд на разворот

ZaPutinNet, дивы норм

Вадим Джог, да, дивы хорошие, и налог не берут, но всё равно вышел половиной, надоело в минусах сидеть. Подскажи к каким иностранным бумагам стоит приглядеться.

ZaPutinNet, я держу BMY,KMI,MSFT,PFE,CTL,T-присматриваюсь к XLNX,IVZ,CCL,NEE,BSX

Кажется бумага взяла тренд на разворот

ZaPutinNet, дивы норм

Вадим Джог, да, дивы хорошие, и налог не берут, но всё равно вышел половиной, надоело в минусах сидеть. Подскажи к каким иностранным бумагам стоит приглядеться.

Курсовой убыток 1,22%. Дивов где-то 5,5% получил — жить можно. Зато теперь хоть есть чем усредняться, а то по глупости все бабки в одну бумагу вбухал, да ещё и почти на самом максимуме.

Ну наконец-то хоть маленько подросли

Ну наконец-то хоть маленько подросли

Tobacco stocks rose Wednesday as the Food and Drug Administration delayed its plan to cut nicotine levels in cigarettes to minimally or non-addictive levels.

Federal agencies twice a year update the list of regulations they plan to work on within the next year. The FDA’s newly updated list does not include a regulation to reduce nicotine levels in cigarettes, a plan former FDA Commissioner Scott Gottlieb announced in July 2017.

Shares of Altria rose 3%, British American Tobacco shares rose 4%. Philip Morris International shares rose about 1%.

The agency included the proposed rule on its spring list of priorities. Bloomberg first reported the news of it being left off the newly updated fall list.

FDA spokesman Michael Felberbaum said the omission from the so-called unified agenda does not mean the FDA will stop working on it. He said the agency is reviewing comments it received in response to the proposal to cap nicotine levels in cigarettes.

“The agency has focused on regulations that reflect its most immediate priorities in this fall 2019 unified agenda,” Felberbaum said.

Also missing from the agency’s semiannual unified agenda is anything related to banning menthol cigarettes, a policy Gottlieb said the FDA would pursue last fall. One year later, that plan appears to have stalled.

“We continue to review all of the evidence related to flavored tobacco products, including menthol,” Felberbaum said in a statement.

Gottlieb announced the plan to cap the nicotine levels in cigarettes in July 2017 as part of a plan making sweeping changes to tobacco policy. The agency embraced the idea that nicotine products exist on a continuum of risk, where cigarettes are the most harmful way to consume nicotine and other products, such as e-cigarettes, may offer people a less harmful alternative.

Public health advocates welcomed Gottlieb’s plan to ban menthol cigarettes. Congress in 2009 prohibited all characterizing flavors from cigarettes, though it exempted menthol amid intense lobbying from the tobacco industry. Anti-tobacco groups have long pushed the FDA to reverse course and remove menthol cigarettes.

Gottlieb resigned in April before many of his policies were implemented. The entire framework he announced is now under threat. A surge in teen vaping has forced the FDA to try reining in the e-cigarette industry, though the efforts have reportedly faced pushback from President Donald Trump. 11/11/2019

11/11/2019

U.S. President Donald Trump said on Monday he will be meeting with vaping industry representatives as his administration considers tightening e-cigarette regulations amid a nationwide outbreak of vaping-related injuries and deaths.

«Will be meeting with representatives of the Vaping industry, together with medical professionals and individual state representatives, to come up with an acceptable solution to the Vaping and E-cigarette dilemma. Children’s health & safety, together with jobs, will be a focus!» he wrote on Twitter.

Trump did not give a time for the meeting or offer any other details. He said on Friday that his administration would come out with «an important position» on vaping this week.

On Thursday, the CDC reported there have been 2,051 confirmed and probable U.S. lung injury cases and 39 deaths associated with use of e-cigarettes, or vaping products. Nearly 85 percent of lung injury patients in the nationwide outbreak have reported using products containing THC, the component of marijuana that gets people high.

In the CDC analysis, THC was detected in 23 of 28 patient samples of lung cells, including from three patients who said they did not use THC products. Nicotine was detected in 16 of 26 patient samples.

U.S. public health officials have recommended that people avoid using e-cigarettes that contain THC or any products that come from illicit sources.

The Trump administration in September said the Food and Drug Administration was working on a «guidance document» that would lead to a ban of all e-cigarette flavors, aside from tobacco flavoring.

Health and Human Services Secretary Alex Azar told reporters that once the guidance was finalized, enforcement actions would begin to remove the products from store shelves.

In his remarks on Friday, Trump indicated that a flavor ban was still under consideration, but that other actions were as well, including raising the age limit for e-cigarette purchases.

Asked if Juul Labs Inc, which dominates the U.S. e-cigarette market, would participate in the discussions, a Juul spokesperson said the company was not lobbying on the issue.

«We are continuing to refrain from lobbying the administration on its draft flavor guidance while we take significant actions to combat underage use and convert adult smokers,» the spokesperson said. Выявлен компонент, виновный в заболеваниях вейперов

Выявлен компонент, виновный в заболеваниях вейперов

LIVE24, 10 ноября 2019

В последнее время люди стали чаще курить электронные сигареты. Американские ученые из Центров по контролю и профилактике заболеваний выяснили основную причину заболеваний пользователей данных устройств.

У 29 человек из легких взяли образцы жидкости. Специалисты обнаружили ацетат витамина Е во всех пробах. Это вещество используется при производстве продукции для вейпов и электронных сигарет в качестве добавки.

Отметим, 39 человек погибли от респираторных заболеваний, появившихся в результате курения электронных сигарет. С пагубной привычкой намерен бороться президент США Дональд Трамп. Политик хочет запретить продажу электронных сигарет с различными вкусовыми добавками.

И ещё много на английском

И ещё много на английском

Лучше смотреть в источнике, там более читабельно

www.bat-science.com/group/sites/UK__9D9KCY.nsf/vwPagesWebLive/DOBELLYE

Key performance indicators — summary

Total cigarette and THP volume declined in line with the industry*, down 3.5% to 336 billion sticks. In the key markets, value share1 increased 10 bps while volume share2 was in line with 2018;

Strategic Cigarette and THP increased volume share by 60 bps driven by the continued growth of Rothmans and success of Neo, with Strategic Cigarette and THP volume down only 0.5%;

Revenue increased 4.6% to £12,170 million, as good price/mix (totalling 7%) across the cigarette portfolio, as well as growth in revenue from New Categories and Traditional Oral, more than offset lower cigarette volume. The foreign exchange impact was a tailwind of 1.2% on our reported results. On a constant currency basis and excluding the impact of excise on bought in goods, adjusted revenue^ increased by 4.1%;

Revenue from the Strategic Portfolio (defined on page 80 of the full announcement) was up 8.7%, or 6.6% on an adjusted constant rate basis, with the growth driven (at constant rates) by:

5.2% growth in revenue from the strategic combustible brands;

27% increase in revenue from New Categories to £531 million, with volume growth across all categories:

THP revenue up 4% to £301 million, with consumable volume up 17% to 3.9 billion sticks, driven by Japan, South Korea and Russia;

Vapour revenue up 58% to £183 million, with consumables volume increasing 32% to 102 million units, with volume higher across ENA and Canada; and

Modern oral revenue up 284% to £47 million, with volume 179% higher (to 412 million pouches) driven by Scandinavia and Russia; and

10% increase in revenue from traditional oral to £463 million with volume in line with 2018;

Profit from operations was down 1.3%, as the strong operational performance, which included a translational foreign exchange tailwind of 2.2%, was more than offset by the £436 million charge recognised in Canada related to the Quebec Class Action. Consequently, operating margin declined 210 bps;

Adjusted profit from operations grew 5.9% at constant rates of exchange as the adjusted revenue growth and continued drive for efficiency gains (including the product rationalisation to remove complexity) more than offset the increased investment in New Categories that reflects the Group’s continued development of these categories;

Adjusted operating margin, at current rates, was 110 bps higher than the same period in 2018 at 42.9%, as the investment in the development and roll out of New Categories was more than offset by pricing and cost control;

Net cash generated from operating activities fell by 41% to £2,288 million, with cash conversion of 52% (compared to 87% in the same period last year) due to the timing of payments related to the master settlement agreement (MSA) in prior periods described on page 36, and working capital movements. Operating cash flow conversion of 66% (30 June 2018: 70% after normalising for the timing of the MSA payment). The decrease in conversion, on a normalised basis, was largely due to the working capital movements in the period;

Borrowings increased to £50,292 million (30 June 2018: £48,512 million, 31 December 2018: £47,509 million), driven by the timing of cash generation, working capital movements and the recognition of lease liabilities under IFRS 16 (£607 million);

Adjusted net debt3 increased to £45,532 million (30 June 2018: £44,739 million, 31 December 2018: £43,407 million). This was driven by the recognition of lease liabilities under IFRS 16 (£607 million) and free cash outflow (after dividends paid to shareholders) of £1,052 million (30 June 2018: £611 million inflow). The movement in free cash flow after dividends paid to shareholders against 2018 was due to the short-term timing impact of working capital movements and the payments related to the MSA. With the normal weighting of cash generation to the second half of the year, the Group continues to expect to generate free cash flow after dividends in excess of £1.5 billion for the full year. Adjusted net debt to adjusted EBITDA is expected to reduce by approximately 0.4x in 2019, excluding the translational foreign exchange impact;

Basic earnings per share increased 4.6%, with diluted earnings per share 4.6% higher, as a reduction in the effective tax rate from 30.1% to 25.1% and an improved performance from the Group’s main associate in India (ITC) more than offset the lower profit from operations explained above; and

Adjusted diluted earnings per share at constant rates of exchange rose 7.1%, as the Group’s growth in adjusted profit from operations, an improved performance from ITC and a decrease in the underlying effective tax rate from 26.9% to 26.6% more than offset a £55 million increase in adjusted net finance costs.

Вот интересные америкосы, против табака борются, якобы за здоровье нации, а то, что у них огнестрела выше крыши, и каждый год в школах и общественных местах стреляю и убивают — это похер

Вот интересные америкосы, против табака борются, якобы за здоровье нации, а то, что у них огнестрела выше крыши, и каждый год в школах и общественных местах стреляю и убивают — это похер

Почти 7% — поздравляю сам себя, т.к. на ветке я один )))

ZaPutinNet, Иногда заглядываю)

iceflash, опять падает сволочь, чувствую на долго я в ней застрял, если ещё и дивы снизят, то это будет фиаско

Почти 7% — поздравляю сам себя, т.к. на ветке я один )))

ZaPutinNet, Иногда заглядываю) Почти 7% — поздравляю сам себя, т.к. на ветке я один )))

Почти 7% — поздравляю сам себя, т.к. на ветке я один )))

A rival boosts optimism for British American

Shares of British American Tobacco climbed 7% after the global tobacco giant's investors responded favorably to good news from one of its biggest competitors. Philip Morris International reported its second-quarter financial results this morning, and although its overall revenue was slightly lower compared to year-earlier results, top-line growth amounted to 9% after accounting for various accounting-related shifts, and adjusted earnings were far better than expected. Investors in British American took its rival's results as a sign that the global tobacco market remains healthier than some had feared, and they'll have an opportunity to see if the company can confirm their hopes when i t report s half-year results later this month.

Ау, есть тут кто?

ZaPutinNet, есть)

Тимофей Мартынов, У тебя есть эти акции? Каково твоё мнение по перспективам компании, что-то я не очень удачно зашёл — по 40,17. Анти-табачная война в правительстве уже давно началась и вроде как акции уже отыграли практически весь негатив, а с другой стороны что-то очково. Кстати, отчёт за 1 квартал уже был? Я не могу найти

Акции компании участвуют в расчёте биржевого индекса FTSE 100. Рыночная капитализация BAT на LSE на февраль 2016 года — 73,5 млрд фунтов стерлингов. Группа входит в первую десятку компаний по капитализации на LSE.

Акции компании участвуют в расчёте биржевого индекса FTSE 100. Рыночная капитализация BAT на LSE на февраль 2016 года — 73,5 млрд фунтов стерлингов. Группа входит в первую десятку компаний по капитализации на LSE.

Председатель совета директоров компании — Ричард Барроуз (Richard Burrows), управляющий директор Группы — Никандро Дуранте (Nicandro Durante).

British American Tobacco - факторы роста и падения акций

⚠️ Если вы считаете, что какой-то фактор роста/падения больше не является актуальным, выделите его и нажмите CTRL+ENTER на клавиатуре, чтобы сообщить нам.

Финаме

Финаме БКС Мир Инвестиций

БКС Мир Инвестиций