SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

dr-mart

Загадка по акциям Яндекса = сколько акций и как посчитать капитализацию?

- 27 октября 2016, 20:28

- |

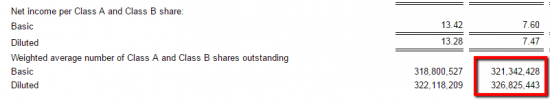

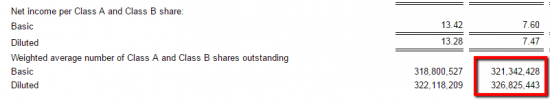

У яндекса очень мутная структура акций… Вот из сегодняшнего отчета выдержка:

Что понятно?

Кстати Яндекс сегодня +5,5% после отчета.

Квартальная выручка Яндекса:

Shareholders' equity:

Priority share: €1.00 par value; 1 share authorized, issued and outstanding — - -

Preference shares: €0.01 par value; 1,000,000,001 shares authorized, nil shares issued and outstanding — - -

Ordinary shares: par value (Class A €0.01, Class B €0.10 and Class C €0.09);

shares authorized (Class A: 1,000,000,000, Class B: 61,295,523 and 46,997,887 and Class C: 61,295,523 and 46,997,887);

shares issued (Class A: 282,161,148 and 284,506,784, Class B: 47,895,605 and 45,549,969, and Class C: 12,000,000 and 48,000, respectively);

shares outstanding (Class A: 271,356,566 and 276,248,540, Class B: 47,895,605 and 45,549,969, and Class C: nil)

Что понятно?

- Что у Яндекса есть объявленные но не выпущенные префы

- Что у Яндекса есть обыкновенные акции трех классов: A, B и C

- Акций Ц в обращении нет

- Что означают эти 2 цифры: Class A: 271,356,566 and 276,248,540? в чем между ними разница?

- Как учитывать акции B при подсчете капитализации?

- чем собственно отличаются эти числа? Что значит базовое и разводненное число?

Кстати Яндекс сегодня +5,5% после отчета.

Квартальная выручка Яндекса:

теги блога Тимофей Мартынов

- FAQ

- forex

- IMOEX

- IPO

- NYSE

- QE

- S&P500

- S&P500 фьючерс

- smart-lab

- smartlabonline

- tradingview

- акции

- антикризис

- банки

- бизнес

- брокеры

- вебинар

- видео

- вопрос

- встреча smart-lab

- ВТБ

- Газпром

- Греция

- дивиденды

- доллар рубль

- ЕЦБ

- золото

- инвестиции

- Индекс МБ

- Инфляция

- Китай

- книга

- Книги

- комментарий

- комментарий по рынку

- конференция смартлаба

- конференция трейдеров

- кризис

- криптовалюта

- Лукойл

- ЛЧИ

- Магнит

- Максим Орловский

- ММВБ

- мобильный пост

- мозговик

- Московская биржа

- недвижимость

- Нефть

- нищетрейдинг

- Новости

- обзор рынка

- облигации

- объявление

- опрос

- опционная конференция

- опционы

- отчетность

- отчеты МСФО

- Причины падения акций

- прогноз

- психология

- Путин

- работа над ошибками

- рассылка

- реакция рынка

- рецензия на книгу

- роснефть

- Россия

- рубль

- Русагро

- рынок

- санкции

- Сбербанк

- смартлаб

- смартлаб конкурс

- смартлаб премиум

- статистика

- стратегия

- страшилка

- Сургутнефтегаз

- сша

- технический анализ

- Тимофей Мартынов

- торговые роботы

- трейдинг

- Украина

- Уоррен Баффет

- уровень

- философия

- форекс

- ФРС

- фундаментальный анализ

- фьючерс mix

- фьючерс на индекс РТС

- фьючерс ртс

- экономика

- экономика США

- Яндекс

В бухг. балансе обычно первая цифра за последнюю отчетную дату, а вторая за конец последнего фискального года. Это для сравнения.

По-хорошему их надо вместе суммировать. Разница обычно бывает в количестве голосов, но претендуют на чистую прибыль они (обыкн. акции разного класса) в одинаковой степени, и дивы, опять-таки обычно, выплачиваются одинаковые.

"

The concentration of voting power with our principal shareholders, including our founders, directors and senior management, limits your ability to influence corporate matters.

Our Class B shares have ten votes per share and our Class A shares have one vote per share. As of March 17, 2016, our founders, directors, senior management (and their affiliates) and principal non-institutional shareholders together own 85.92% of our outstanding Class B shares and 5.22% of our outstanding Class A shares, representing in the aggregate 55.63% of the voting power of our outstanding shares. In particular, our founder, Mr. Volozh, directly or indirectly controls 76% of our outstanding Class B shares representing 47% of the voting power of our outstanding shares. For the foreseeable future, therefore, our founder, directors, senior management and their affiliates will have significant influence over the management and affairs of our company and over all matters requiring shareholder approval, including the election of directors, the amendment of our articles of association and significant corporate transactions, such as a sale of our company or its assets. Because of this multiple class structure, these persons will continue to exert significant influence over all matters submitted to our shareholders for approval even if they come to own fewer than 50% of our outstanding shares by number.

In addition, our principal shareholders are parties to a shareholders' agreement that, among other things, requires them to vote to elect those directors nominated by our Board of Directors for election or re-election, and limits their ability to vote in favor of amendments of the anti-takeover provisions of our articles of association. This concentrated control limits your ability to influence decisions on corporate matters. We may take actions that our public shareholders do not view as beneficial or as maximizing value for them. As a result, the market price of our Class A shares may be adversely affected. "

Разводненное — это с учетом еще тех акций, которые могут быть выпущены на основе, например, конвертируемых бондов, stock-based compensation (RSUs, stock options) и т.д. Чаще всего ориентируются на разводненные данные (на выходе отчетности при сравнении estimated vs actual adjusted EPS).

А вы кто?

Хорошо разбираетесь!

А цена ее балансовая была в том году 600-700 рублей… если не изменила память… остальное — наши с вами надежды…

в цене очень большие ожидания

+7 495 974 3538

askIR@yandex-team.ru

ez@yandex-team.ru