SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Новости рынков

Новости рынков | Японские инвест фонды владеют за рубежом активам на 196.6 млрд. $ (Рейтерс)

- 15 марта 2011, 22:57

- |

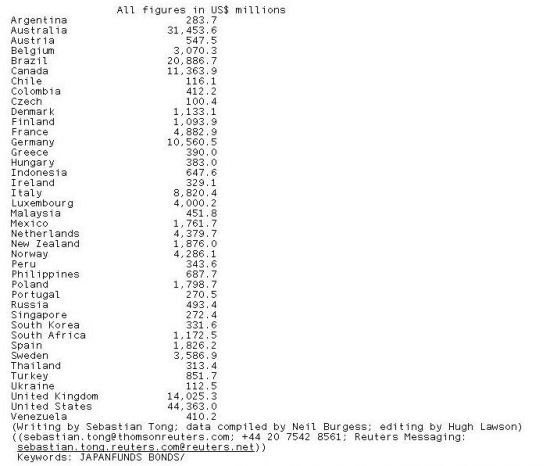

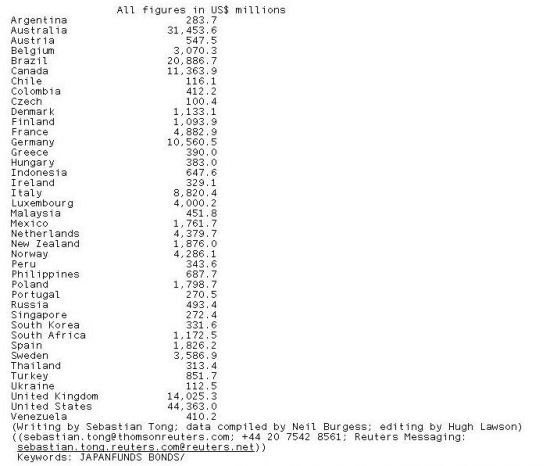

March 15 (Reuters) — Japanese-based investment funds hold about $196.6 billion in foreign bonds, data from Thomson Reuters shows. This includes bonds issued by governments, companies as well as supranational institutions. U.S.-domiciled borrowers, followed by those in Australia and Brazil, account for the bulk of issuance bought by the funds. These bonds top the list of vulnerable assets should Japanese investors start bringing overseas capital home in the wake of the triple disaster of earthquake, tsunami and nuclear breakdown.

The data is derived from holdings reported late last year, including debt held by global fund managers based in Japan. Japanese insurers — which are believed to hold huge amounts of foreign assets — are not included as they are not obliged to reveal their portfolio holdings. The following lists the countries alphabetically in which Japanese funds have the largest debt exposure:

На нашем рынке у них вложено относительно немного — менее 500 млн, что хорошо для нас.

The data is derived from holdings reported late last year, including debt held by global fund managers based in Japan. Japanese insurers — which are believed to hold huge amounts of foreign assets — are not included as they are not obliged to reveal their portfolio holdings. The following lists the countries alphabetically in which Japanese funds have the largest debt exposure:

На нашем рынке у них вложено относительно немного — менее 500 млн, что хорошо для нас.

теги блога asf-trade

- 2012

- API

- asf

- asf-trade

- brent

- chat

- CME

- earnings

- ES

- FED

- FOMC

- forex

- GDP USA

- hedge fund

- HFT

- micex

- Q&A

- QE3

- quik

- Ri 6.13

- RIM1

- RIM2

- RIM3

- riu

- RIZ3

- RTS

- RTS -9.13

- T+2

- tapering

- USA

- wheat

- WTI

- авто

- алготрейдинг

- Алжир

- Аптеки 36.6

- аукцион закрытия

- АЭС

- беспредел РФ

- брокерские услуги

- брокеры

- Вакансия

- видео

- война

- встреча smart-lab

- вулкан

- Газпром

- Девальвация рубля

- Доллар

- Египет

- ЕЦБ

- жулики

- инвест идеи

- индекс доллара

- Ирак

- Исландия

- Кипр

- Ливия

- лохотрон

- лчи 2012

- март

- Медведев

- митинг

- ММВБ

- Мои трейды

- моя позиция

- МТС

- МФЦ

- нефть

- НПФ

- образование

- опрос

- опционы

- опционы идеи

- отдых

- оффтоп

- портфель

- прогнозы

- программирование

- работа над ошибками

- рабочее место

- рефлексы

- роботы

- рынок

- сбербанк

- сбой на бирже

- смартлаб

- спред

- спрэд WTI Brent

- ставки

- толстые хвосты

- трейдинг

- украина 2014

- философия трейдинга

- ФР

- ФРС

- фьючерс на индекс РТС

- чат

- юмор

- япония

очень верное замечание!