Компания была основана в 1978 году. Это более 40 ка лет назад.

В это время еще не было России, а был СССР.

И был социализм, вместо капитализма..

ссылка на википедию

en.wikipedia.org/wiki/Interactive_Brokers

Поступило много сообщений и звонков от моих подписчиков. Все в непонимании.

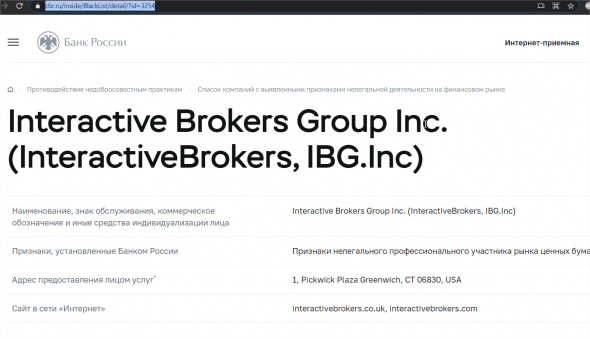

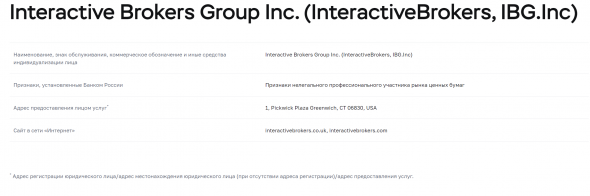

Стало известно о том, что ЦБ РФ внес в черный список (компании с признаками нелегальной деятельности) один из крупнейших американских брокеров Interactive Brokers. Учитывая, что данная компания имеет лицензию от комисси по ценным бумагам (SEC), страховое покрытие от SIPC, а так же постоянно входит 5-ку лучших брокеров США в различных номинациях, данный “жест” может вызывать лишь кривую улыбку от уровня непрофессионализма аналитиков ЦБ.

Однако, вполне возможно, это просто месть, за то, что недавно Interactive Brokers отказался предоставлять услуги российским брокерам, которые не захотели выдавать информацию о конечных бенефициарах ценных бумаг, в соответсвии с американским законодательством.

Авто-репост. Читать в блоге >>>

![IB в сером списке. Что это было ? [Версия] IB в сером списке. Что это было ? [Версия]](/uploads/images/00/88/99/2021/06/02/48a812.jpg)