Scorpio

Справедливый курс доллара (правило 40$ за нефть)

- 27 января 2017, 11:53

- |

Минфин заложил курс доллара в 67,5 руб. в проект бюджета на 2017 год

Ранее министр также заявлял, что в проекте бюджета на трехлетку учитывается цена на нефть $40 за баррель на все три года.

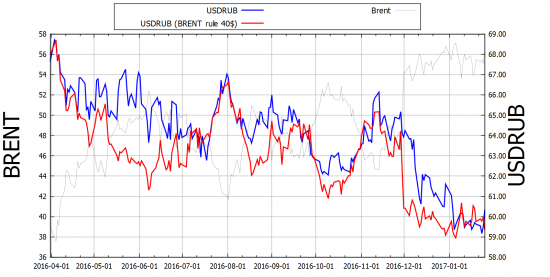

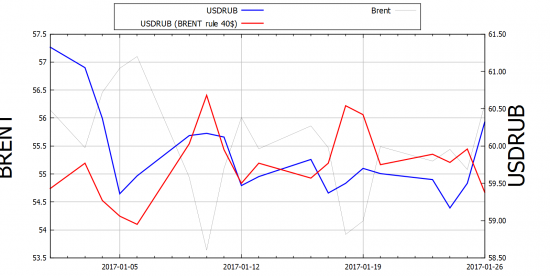

Я сделал графики от 1 апреля 2016 года по текущий момент и от 1 января 2017 года по текущий момент.

За справедливый курс доллара я взял формулу расчёта 67.5 — (BRENT — 40) / 2

Предлагаю посмотреть на то, что получилось.

от 1 апреля 2016 года по текущий момент

от 1 января 2017 года по текущий момент

( Читать дальше )

Трамп двигает энергетику

- 27 января 2017, 01:47

- |

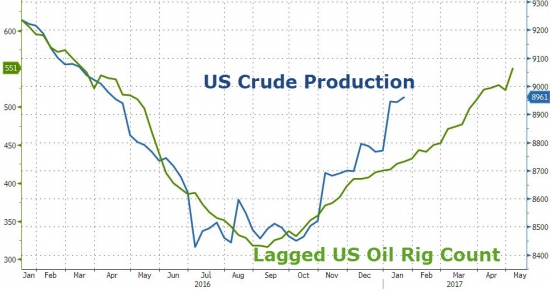

President Donald Trump signed several executive orders this week intended to juice the American energy sector, calling for expedited environmental reviews and the advancement of the Keystone XL and Dakota Access Pipelines.

It is not a coincidence then that North Dakota oil output has declined roughly 200,000 bpd from a peak of 1.22 mb/d at the end of 2014. The absence of adequate pipeline capacity has helped trim the growth of the Bakken, and it has also deepened its losses since the market downturn over two years ago.

The result could be a price premium of about 25 percent immediately for WTI relative to international benchmarks, according to Goldman Sachs, or $10 per barrel. Higher prices will attract global capital, which could boost oil production. Goldman Sachs estimates the border tax could lead to an increase in U.S. oil production by about 1.5 million barrels per day by 2018, twice as much as the investment bank’s forecast without the border tax.

While that seems great for U.S. oil producers, such a scenario would not play out in a vacuum. Higher U.S. output could push down global oil prices, just as the surge in shale caused a price meltdown in 2014, as Liam Denning of

( Читать дальше )

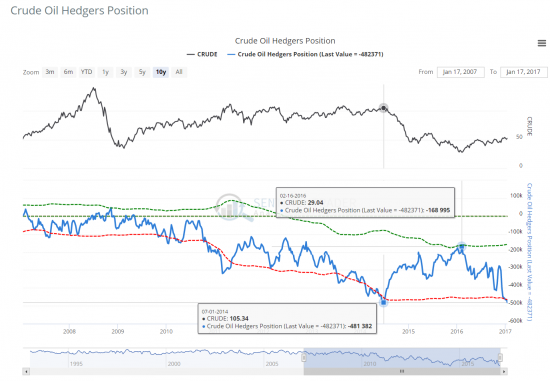

Сентимент Crude Oil Hedgers Position -482 371

- 26 января 2017, 10:02

- |

This chart shows the net number of contracts (longs minus shorts) held by large commercial hedgers. The green dotted line is 1 standard deviation above the 3-year average; the red dotted line is 1 standard deviation below the 3-year average.

Each week, the Commodity Futures Trading Commission (CFTC) releases information on the long and short positions of three groups of traders in a couple of dozen different futures markets in a report known as the Commitments of Traders.

The three groups are determined by the number of contracts they are currently holding, and are described as follows:

Commercial Hedgers — Commonly believed to be the «smart money», these traders are involved in the day-to-day operations of each commodity. They have an excellent handle on the underlying market, and it typically pays to follow their positions when they reach an extreme.

Large Speculators — This group mostly consists of large pooled funds, and almost always take the opposite side of commercial traders. The are primarily trend-followers, and will accumulate positions as a trend progresses. When their positions reach an extreme, watch for a price reversal in the opposite direction of the existing trend.

Non-Reportables (aka Small Speculators) — These are smaller traders, composed mostly of hedge funds and individual traders. Again, they are mostly trend-following in nature and we often see price reversals (in the opposite direction) when they hit an extreme.

By definition, commercial hedgers take the opposite side of the trades of large and small speculators. Therefore, when hedgers are net long, speculators are net short. Because hedgers tend to drive the market at extremes, we focus on them.

( Читать дальше )

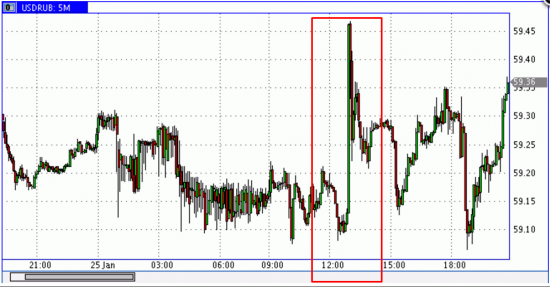

rbc.ru и finanz.ru делают вбросы ссылаясь на Bloomberg (часть 1)

- 25 января 2017, 21:13

- |

RBC: Bloomberg назвал сроки начала скупки валюты Центробанком

Ссылаясь на Bloomberg, rbc.ru не указывает ссылку на статью, указывает только на сайт!

( Читать дальше )

теги блога Scorpio

- 50

- 2017

- API

- Baker

- Baker Hughes

- Bitcoin

- Bloomberg

- brent

- CFTC

- Crude

- DOE

- Dow

- EIA

- GOLD

- Hughes

- light

- MICEX

- MOEX

- Oil

- RBOB

- Rigs

- S&P500

- USD

- usdrub

- VIX

- wti

- ZeroHedge

- Акции

- Бензин

- Буровые

- Вена

- волатильность

- вопрос

- Встреча

- Гусев

- Дистилляты

- Добыча

- доллар

- Евро

- ЕС

- Запасы

- Золото

- индекс доллара

- Ирак

- Италия

- Китай

- коррекция

- Кукл

- Курдистан

- Курс

- курс доллара

- Кушинг

- Ливия

- Лица

- ЛЧИ

- Маркидонова

- Минфин

- Михеев

- Москва

- Набиуллина

- нефть

- Новый год

- Обвал

- опек+

- опрос

- оффтоп

- Падение

- прогноз

- Путин

- Резервы

- референдум

- Роснефть

- Россия

- Рост

- рубль

- Русские

- РФ

- Санкции

- Саудовская Аравия

- Сделка

- Сенаторы

- сентимент

- Силуанов

- СмартЛаб

- Смешинка

- сокращение

- Ставка

- США

- Трамп

- Тренд

- Улюкаев

- Физические

- ФРС

- Фьючерс

- Хай

- Хакеры

- ЦБ

- Цена

- Шип

- Юридические