У Goldman Sachs на следующие аж 3 года очень низкая Dividend yield (%):

12/20 12/21E 12/22E 12/23E

8.6 3.2 5.7 6.5

То есть фактор низких дивофф, можно сказать, в цене.

Но при этом 12m Price Target: Rubl135.00.

Поэтому я бы сказал не совсем корректно ждать снижения цены на основании низких дивофф — это рынок знает, это в цене.

комментарии Vanger на форуме

-

VSMPO-AVISMA's sales, in line with its key aerospace market, will remain under pressure for the years to come. With

VSMPO-AVISMA's sales, in line with its key aerospace market, will remain under pressure for the years to come. With

75% of its revenue coming from sales to the aerospace industry, primarily aircraft and jet engines manufacturers,

VSMPO-AVISMA's sales will remain under pressure in the coming years as the aerospace industry slowly recovers

from severe decline in air travel globally, which led to collapse of demand for both aircraft and spare parts for them.

The group's sales will decline by a further 10% in 2021, after a 28% decline in 2020, as we expect aerospace demand to

remain depressed, despite some pick up in plane deliveries by key aircraft manufacturers. In our base case, volumes

will start to increase by up to 10% in 2022 and another 5% in 2023, but at a slower pace than the rebound in aircraft

deliveries because there is a large stock of both planes (particularly at Boeing, due to its high 737 MAX inventory) and

titanium at the manufacturers. We expect deliveries for narrow-body planes, which have significantly lower titanium

content, to rebound first with the rebound of deliveries for wide-body planes taking much longer. We also note that

most of the decline in VSMPO-AVISMA's sales is from export markets, while its domestic sales in Russia generally

remain stable. Подскажите плз, почему такая большая разница между префой и обычкой? Если решил входить, то в какую из них лучше?

Подскажите плз, почему такая большая разница между префой и обычкой? Если решил входить, то в какую из них лучше?

ну что, все как я писал :)

дивотсечка 11/05, дивы 39 р. итого 59 за год (я о 60 упоминал)

привет всем, кто пиарил дивы 78р

zzznth, дивиденды хуже прогноза!

Роман Ранний, ну я вот и активно не понимал, почему все топят за 78. почему решили дать 59 (итого за год), а не 60 — не очень понятно, но ошибочка тут небольшая.

zzznth, это называется как хочу так и плачу)

Роман Ранний, ну, будь я политологом, то рассуждая о знаках и намеках сказал бы, что это такой символический жест: мол возврата к стабильным 78р не будет, будет привязка именно к фин результату, в районе 20-50% ча мсфо.

но это именно что такие умственные спекуляции

zzznth, они просто выкуп не хотят по таким высоким ценам делать

Роман Ранний, имхо тогда бы заплатили ближе к 20% мсфо.

но конечно все это догадки на кофейной гуще

zzznth, сложно сказать, такой откровенный кидок, может на долгие годы отпугнуть серьёзных инвесторов.

Сейчас они просто скажут что был тяжёлый год

Роман Ранний, так наоборот для застроев год супер удачным. Если они сейчас лишь 59руб 7,2% грязными, то что будет если год не очень успешный?

по 1900-2000 апсайд все видели и меня за шорты высмеивали… а когда покупать надо --и Несис плох.и дивы маленькие, и золото рухнуло… Вывод--засадили в бумагу новых инвесторов и отбирают у слабых рук…

Арсений Нестеров, где откупать?

Fix Price — компания с очень сильными конкурентными позициями — Риком-Траст

Не стоит смешивать Ozon и Fix Price, потому что они работают в разных сегментах: Ozon – это электронная коммерция, Fix Price в сегменте офлайн-торговли, причем в определенном ценовом сегменте так называемых низкомаржинальных товаров повседневного спроса. Этот формат в отличие от, например, зарубежных рынков в России развит довольно слабо. В общем-то, если оценивать рынок и конкурентные позиции участников этого рынка, то мне в голову приходят два игрока. Это, собственно, Fix Price с долей рынка почти 90% и Home Market с долей рынка примерно 4,5%.

Все остальное – это сегмент хозтоваров у дома, либо формат дрогери крупных ритейлеров, например, «Магнита», «Ленты» или X5. Но это все-таки немножко другая философия ценовой политики. Именно поэтому мы выделяем Fix Price как компанию с очень сильными конкурентными позициями.

Когда ассортиментный ряд делится четко на ценовые категории с фиксированной ценой: условно 59 рублей, 109 рублей, 159 рублей, 199 рублей и так далее, то любому конкуренту крайне сложно по уровню маржи зайти в этот сегмент и в эту нишу. Даже тот же Home Market не является магазином фиксированной цены.

Понятно, что с Fix Price с Ozon сравнить абсолютно не стоит. Да, у Fix Price есть с 2018 года онлайн-направление. Я, кстати, считаю, что это особенно в эпоху пост-пандемийного развития может стать одним из конкурентных преимуществ компании. Но не надо думать, что это конкурент для Ozon.

Абелев Олег

ИК «Риком-Траст»

Это две абсолютно разные ниши. Скорее, конкурентом Fix Price может стать экспансия со стороны крупных ритейлеров, которые могут пытаться открывать в сегменте так называемых лоукостеров магазины товаров широкого потребления. В частности, насколько я помню, «Лента» открыла сеть «Чижик», которая является таковым.

Но с учетом того, что этот рынок в отличие от развивающихся стран в России крайне сжат и по прогнозам к 2027 году он должен вырасти чуть ли не втрое, здесь есть, где развернуться и куда выходить. Поэтому я оцениваю перспективы Fix Price достаточно позитивно.

Единственное, как обычно бывает с IPO в России, я не рекомендовал нашим клиентам участвовать в IPO, потому что понимал, что инвестиционные меморандумы эмитентов часто содержат немножко преувеличенную и приукрашенную информацию. Надо посмотреть, что происходит в первые дни после начала торгов.

Если говорить про то, что сейчас происходит с Ozon, то он стал жертвой панических продаж после обвала на рынке криптовалют, когда на прошлой неделе инвесторы по всему миру активно продавали бумаги ИТ-сегмента. Здесь под раздачу попал не только Ozon. Под раздачу попали все крупнейшие IT-компании, в числе которых «Яндекс», Qiwi, Mail.ru. За рубежом попала пятерка FAANG, то есть Facebook, Amazon, Apple, Netflix и Google. Попали телеком-компании типа AT&T и Verizon.

Как говорили раньше: «Говорим – партия, подразумеваем – Ленин», а сейчас: «Говорим – криптовалюта, подразумеваем – IT». Но на американских рынках уже начался отскок. Индекс Nasdaq вырос почти на 4%. Очевидно, что падение было связано с паническими продажами. Хотим мы этого или нет, цифровизация нашей жизни продолжает идти. Вот, например, новость, о том, что «Сбер» совместно с X5 запускают буквально c 1 апреля в магазинах X5 опцию оплаты товаров на кассе по сетчатке глаза. Вот цифровизация в чистом виде. Спрос на производителей ПО будет расти. Поэтому для Ozon который практически превратился в гиганта электронной коммерции, есть потенциал для роста.

Авто-репост. Читать в блоге >>>

stanislava, какой implied growth rate у FIXP по текущей цене?

А я ведь всех здесь предупреждал: не лезьте вы в эти вонючие IPO! Нравится вам компания — ну не спешите вы, подождите месяц-два, а может и полгода. Понаблюдайте за котировками, за развитием бизнеса. Не, никто меня не слушает, все хотят не просто разбогатеть, а разбогатеть БЫСТРО! Ну успехов тогда, смотрите на график.

Вася Баффет, так перед глазами кейс ОЗОНа, где +40% в первый же день, понятно что жадность берёт своё и стимулирует суваться даже вот в такие истории. Тут просто надо понимать, в какую игру кто играет, и если пошло не по плану, быстро не думаю крыцца. Перед IPO сообщалось о переподписке. Типа какие-то крупные фонды подали заявки на $500mln. Аллокация была 70%, т.е. ёмкость у всех есть. Но цена цена обвалилась — и никто не желает подбирать. То есть явно походит на очередной схематоз от ВТБ. В принципе -5% это ещё немного, чтоб лося зарезать сейчас.

Перед IPO сообщалось о переподписке. Типа какие-то крупные фонды подали заявки на $500mln. Аллокация была 70%, т.е. ёмкость у всех есть. Но цена цена обвалилась — и никто не желает подбирать. То есть явно походит на очередной схематоз от ВТБ. В принципе -5% это ещё немного, чтоб лося зарезать сейчас.

интересно, кто в здравом уме ее брал? в 10 раз переоценена и куда биржа смотрела? такой пузырь выпустили.

Алексей Мананников, я же ниже честно признался, что брал. Надеялся, что кол-во лохов будет ещё больше, чтобы им можно было скинуть с прибылью. А в итоге сам оказался среди лохов. ВТБ молодец, в который раз качественно обобрал лохов, знаю свою работу.

Надеялся на халяву по типу ОЗОНа, а в итоге ВТБ и FIX меня нагнули. Думаю, не я один такой застряли, т.е. навес тут будет давить. Вот и вопрос, сейчас ли сбрасывать это гавнецо или понадеяться, что откупят? Всё ж аллокация была заметно ниже 100%, мож и придут покупцы?

Vanger, График пока как у Озона. Рано паниковать. Озон неделю болтался около цены IPO, плюс минус 5-10 % и потом довольно резво пошёл вверх.

Илья Б, ОЗОН открылся гэпов вверх моментально. Здесь же никакого апсайда не случилось — то есть нету орды желающих купить. А вот желающих продать как раз много из тех, кто покупал ради апсайд (типа меня), и когда они поймут что надежд не осталось — начнётся залив. Поэтому думаю, что разумно сразу лося зафиксить, но рука пока не поднимается.

Nominal gold prices appear to have peaked this cycle.

Nominal gold prices appear to have peaked this cycle.

We cut the 2021E average price forecast 5% from $1,900/oz to $1,800/oz. For now, we hold our 2022E and 2023E outlook unchanged at $1,700/oz and $1,550/oz (forecasts were published in December 2020). In the very short-term, spot bullion holding support at $1,750-1,765 appears critical to avoid a sharper sell-off amid higher US yields. Notably, value buyers have consistently “bought the dip” in the mid-high $1,700s in recent months.

A rotational shift into Bitcoin and other crypto assets by some retail and institutional investors is probably exacerbating gold price weakness and the recent pace of outflows. Yet, for several months now we have been highlighting peak cycle risks for the bullion market.

Some key factors include:

Risk of Fed tapering asset purchases by end-2021 (Citi econ base case) and more aggressive STIRT pricing for policy rate lift-off in 2022/2023 which may in turn be US$ supportive. In addition, while real rates at the 5Y sector have been relatively pinned, 10Y TIPS yields have backed-up some 30-35 basis points this year and are a headwind for a long duration zero coupon asset like gold.

A risk asset and commodities reflation narrative amid a COVID-19 vaccine trade that favors inflows into oil, copper, and other markets versus gold. As we wrote in our 2021 Annual Outlook: “if 2020 was a long gold/short oil trade, then 2021 and a post-coronavirus market recovery should see some reversal of this trend.”

Reduced geopolitical bid for gold following the US elections and President Biden’s victory in early November (as reflected in XAU options markets).

Though not a primary driver for day-to-day gold trading, supply/demand balances for the yellow metal should be in hefty surplus this year. Hence, the absence of investor inflows can bolster the inventory overhang, capping gold market cheer.

Lackluster financial gold buying (e.g. historically weak futures/options net length and physical ETF products flipping from net buyers to net sellers) further emphasizes the importance of retail jewelry, bar/coin, and central bank consumption this year. Demand for all three should grow in 2021 versus 2020, but is likely to remain below 2018/2019 levels. This is as mine production is rebounding from COVID-19 shut-ins in 1H’20 and gold recycling activity has ticked-up, bolstering total supply.

Even as we believe bullion trading is unlikely to revisit $2,000-2,100/oz, market consensus remains deeply divided.

Our February client survey asked “Have nominal gold prices peaked this cycle?” and 42% responded ‘Yes’, 40% responded ‘No’, and 18% were ‘Unsure’. This is among the most deeply divided reader surveys we have conducted in recent years and also contrasts sharply to our outright bullish bias for gold since 2019. A Fed on perma-hold, further US$ devaluation, higher upside to inflation, and increased concerns about debt and deficits are all credible risks that should support higher gold prices. But that is not our base cas

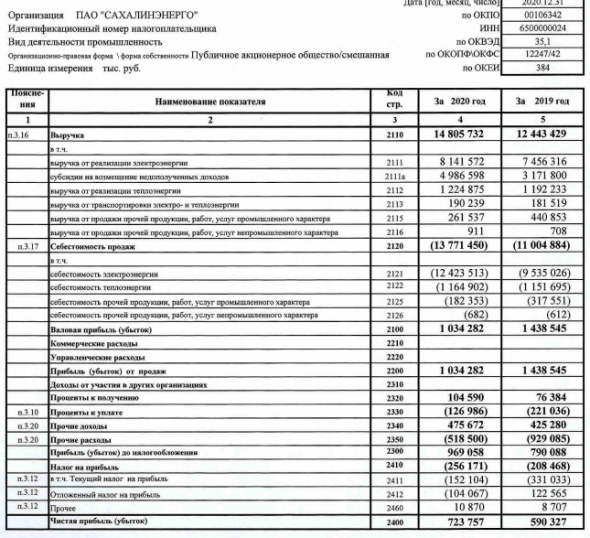

кто-то попутал РСБУ с МСФО…

Efan,

Прямо с языка снял!

Народ, вы понимаете, что вышел отчет по РСБУ? Дивы платятся по консолидированной МСФО, которой за 2020 пока не было.

Смотрим то, что есть.

Операционные результаты за 6 мес. 2020, в сравнении с 6 мес. 2019:

выручка +3%

операционная прибыль +16%

Хотя в 1 полугодии 2020 был вирус.

Смотрим консолидированную МСФО за 6 мес. 2020 (за год пока нет):

и выручка и операционная прибыль чуть выросли к 2019

Чего такого могло произойти во втором полугодии, чтобы так все рухнуло?

Подозреваю, что это чистое изменение в учете. ЭСКРОУ?

Андрей, Они не понимают! Они еще управляют крупными УК, пифами, компаниями, но ничего в отчетах и инвестициях не понимают. Это наша российская особенность. Поэтому никогда не давайте им в ДУ.

elber,

Смущает только одно. Прошел большой объем на падении. Хотя возможно глобальный стопосъем сработал. Если так, в понедельник прекрасная возможность…

Андрей, падало всё, весь наш рынок и американцы тоже.

elber,

Было время в субботу. Изучил все что есть в открытом доступе. Операционные результаты, ЕЖО, МСФО за полгода. Ни одного аргумента продавать не нашел. В понедельник увеличу позу.

Андрей, может кто на плечи набрал и поэтому решил скинуть? ну как-то странно действительно падение-то выглядит это… как объяснить-то?