SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

фрс

Экономика США: закладки новых домов +15%

- 19 октября 2011, 16:50

- |

16:30мск вышли свежие данные по экономике США:

Реакция рынка на данные была положительной. Закладки домов выросли больше, чем ждали аналитики.

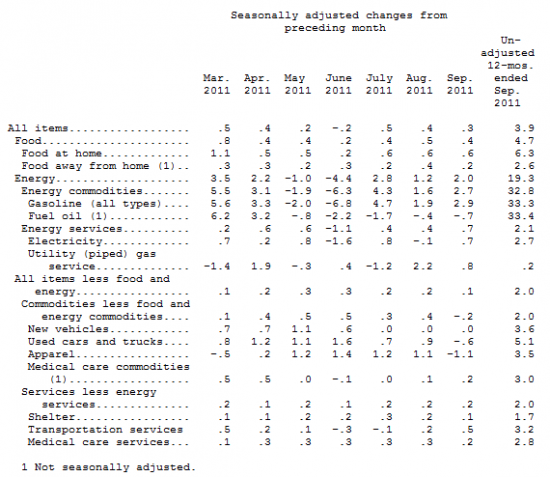

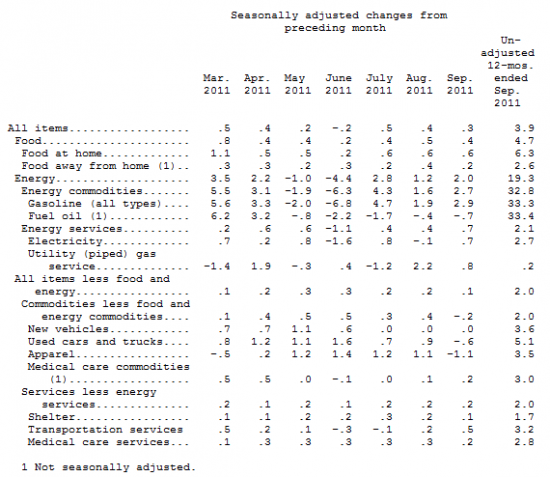

- Core CPI +0,1%м/м прогноз был +0,2%м/м...

- В годовом выражении стержень +2%.

- CPI +0.3% — как и ожидалось

- Цены на бензин +2,9%м/м за месяц.

- Закладки новых домов +15% — до 658 тыс.

- Разрешения на строительство -5% до 594 тыс.

- Официальные данные по инфляции показывают, что ускорения цен не происходит, что благоприятно для текущей стимулирующей политики ФРС. Давление на уровень базовой инфляции в сентябре оказало падение цен на поддержаные драндулеты (-0,6%м/м). Падение цен на товары для дома упали на 1,1% — макс падение с сентября 1998 года. (видимо это говорит о падении спроса)

Реакция рынка на данные была положительной. Закладки домов выросли больше, чем ждали аналитики.

- комментировать

- Комментарии ( 6 )

Ай да Гринспан! Ай да Сукин сын!

- 17 октября 2011, 15:20

- |

Оказывается, что Гринспан разделял полуавстрийские взгляды на экономику, в частности, выступал за настоящий золотой стандарт...

Единственная его ошибка — непризнание 100% резервирования вкладов до востребования.

Вот так большие деньги и нажива делают из честного австрийца вонючего пейнсо-монетариста...

наслаждайтесь его небольшой статьей

P.S. Кейнс — гей, википедия подтверждает)

Единственная его ошибка — непризнание 100% резервирования вкладов до востребования.

Вот так большие деньги и нажива делают из честного австрийца вонючего пейнсо-монетариста...

наслаждайтесь его небольшой статьей

P.S. Кейнс — гей, википедия подтверждает)

Центральные банки, ФРС и Ротшильды

- 12 октября 2011, 23:06

- |

Со времён греческой драхмы, завоевавшей себе место универсальной денежной единицы в древнем мире, разные страны в разные времена постоянно подвергались циклам материального благосостояния и экономического упадка. В периоды, когда страны пользовались надёжными денежными единицами (т.е., золотыми и/или серебряными монетами), экономика всегда расцветала. Но, как только такие деньги заменялись некими суррогатами, не имеющими ценности САМИ ПО СЕБЕ, неизбежно следовала инфляция, обнищание населения и экономический хаос.

Поразительной финасовой стабильности добилась Византия. По почину императора Константина начали чеканиться византийские золотые монеты „солиды", (solidius) и серебряные „милиарессии" (miliarense). В течение последующих 800 лет(!) эти монеты стали универсальной денежной единицей от Китая до Британии и от Балтийского моря до Эфиопии.

Необеспеченные бумажные деньги – инструмент ограбления и мошенничества.

Периоды экономического благополучия, обеспеченного наличием надёжной валюты, в течение всей истории неизбежно кончались из-за жадности политиканов-правителей: неизбежно наступал момент, когда политиканам незамедлительно требовались деньги. Не желая увеличивать налоги и, таким образом, терять свою популярность среди населения, они пытались раздобыть деньги другими способами, включая и прямое жульничество. Например, подмешивание неблагородных металлов в якобы золотые монеты; уменьшение веса золотых монет при чеканке или путём „бритья" монет, находящихся в обороте; и другие попытки СОЗДАТЬ деньги из ничего, не обеспечивая их никакими материальными ценностями.

( Читать дальше )

Поразительной финасовой стабильности добилась Византия. По почину императора Константина начали чеканиться византийские золотые монеты „солиды", (solidius) и серебряные „милиарессии" (miliarense). В течение последующих 800 лет(!) эти монеты стали универсальной денежной единицей от Китая до Британии и от Балтийского моря до Эфиопии.

Необеспеченные бумажные деньги – инструмент ограбления и мошенничества.

Периоды экономического благополучия, обеспеченного наличием надёжной валюты, в течение всей истории неизбежно кончались из-за жадности политиканов-правителей: неизбежно наступал момент, когда политиканам незамедлительно требовались деньги. Не желая увеличивать налоги и, таким образом, терять свою популярность среди населения, они пытались раздобыть деньги другими способами, включая и прямое жульничество. Например, подмешивание неблагородных металлов в якобы золотые монеты; уменьшение веса золотых монет при чеканке или путём „бритья" монет, находящихся в обороте; и другие попытки СОЗДАТЬ деньги из ничего, не обеспечивая их никакими материальными ценностями.

( Читать дальше )

Рынок заложник, политического противостояния в США.

- 10 октября 2011, 14:17

- |

Постараюсь объяснить происходящее то, как это вижу я. Историю надо начать с начала этого года.

Все знают об арабской весне и, наверное, помнят, американо-южно-корейские учения в ходе которых произошел обстрел южнокорейского острова. На мой взгляд, в Корее была провокация с американской стороны, я думаю, что определенные круги в США хотели спровоцировать вооруженный конфликт. Но видимо, в стане американских правящих кругов, сейчас существует раскол во взглядах и методах. Все помнят госпожу Сару Пэйлин (кандидат на пост вице президента, от республиканцев на прошлых выборах). Весной, она почти прямым текстом обвиняла Обаму в малодушии, в слабости, в трусости, в том, что он не может решиться отправить американских военных соколов в Ливию и навести там нужный Америке порядок. То есть, по моему мнению, республиканцем нужна война, они хотят провоцировать конфликты за пределами США. И с помощью этого поддерживать доллар. Совершенно очевидно, что основным выгодополучателем, в случае конфликта в Корее, был бы доллар США и казначейские облигации.

( Читать дальше )

Все знают об арабской весне и, наверное, помнят, американо-южно-корейские учения в ходе которых произошел обстрел южнокорейского острова. На мой взгляд, в Корее была провокация с американской стороны, я думаю, что определенные круги в США хотели спровоцировать вооруженный конфликт. Но видимо, в стане американских правящих кругов, сейчас существует раскол во взглядах и методах. Все помнят госпожу Сару Пэйлин (кандидат на пост вице президента, от республиканцев на прошлых выборах). Весной, она почти прямым текстом обвиняла Обаму в малодушии, в слабости, в трусости, в том, что он не может решиться отправить американских военных соколов в Ливию и навести там нужный Америке порядок. То есть, по моему мнению, республиканцем нужна война, они хотят провоцировать конфликты за пределами США. И с помощью этого поддерживать доллар. Совершенно очевидно, что основным выгодополучателем, в случае конфликта в Корее, был бы доллар США и казначейские облигации.

( Читать дальше )

Акции США снижаются вслед за бумагами банков

- 07 октября 2011, 19:51

- |

Деннис Локхарт из ФРБ Атланты заявил, что регулятры еще не придумали такую систему, при которой будет возможно упорядоченное банкротство финансовых институтов без участия налогоплательщиков.

Акции BAC и GS упали более чем на 3%.

Стата по индексу S&P500

Акции BAC и GS упали более чем на 3%.

Стата по индексу S&P500

- Индекс S&P500 поднялся в предыдщие 3 торговые сессии на 8%.

- Индекс S&P500 остается в диапазоне 1120-1220.

- С 1990 года американский рынок акций 14 раз находится в диапазонах с минимальной продолжительностью 3 мес и средней продолжительностью — 7 мес.

- В 75% случаев, рынок акций выходил из диапазона наверх в течение 3-6 мес.

- Сегодня вышел отчет по занятости лучше прогноза.

- Данные говорят о медленных темпах роста экономики.

- Но данные никак пока не соответствуют рецессии.

- Экономисты говорят, что с такими цифрами, в ближайшие 3-6 мес экномику США ждет слабый рост, если в Европе тем временем не произойдет ничего ужасного.

- Билл Гросс из PIMCO: прирост занятости недостаточен для устойчивого роста США. Экономике необходимо 250-300 тыс новых рабочих мест ежемесячно, чтобы расширяться.

- По итогам недели EuroStoxx600 вырос на 2,5%

- Причины: перепроданность и надежды на властей. Кроме того, рынки переоценивают вероятность рецессии в сторону понижения.

- Рынок на 20% ниже своих максимумов этого года

- P/E европейского рынка — 9,3 — минимальное с марта 2009

Время медведей заканчивается.

- 05 октября 2011, 11:53

- |

Федоров Михаил, аналитик ИК «РИК-Финанс»

Черный четверг, черный вторник. Паника. Страх. Падение. Все это привело сейчас к тому, что акции стали дешевыми. И на мой взгляд, привлекательными для покупки. Я с февраля являлся медведем, в данный же момент, я снимаю с себя данный статус и занимаю нейтральную позицию.

Дальнейшее падение рынка, возможно и будет. Возможно, дно еще впереди и рынок еще провалиться вниз, но это дно уже рядом.

Весной я писал, что рынок упадет и называл главную причину этого. Причина в отсутствии возможностей у властей США помочь экономике в будущем, с помощью новых программ стимулирования, ввиду инфляционных рисков. В виду слабости доллара, в виду необходимости привлекать капитал в казначейские облигации США. И как следствие, слабые экономические данные.

Америке нужно, иметь стабильный доллар, нужно чтобы был спрос на облигации казначейства, нужно чтобы экономика росла. В данный момент, доллар пользуется огромным спросом, так же как и облигации казначейства, цена на облигации взлетела в текущий момент, даже выше чем в 2008 году. Две цели выполнены, остается третья цель, это экономика.

( Читать дальше )

Черный четверг, черный вторник. Паника. Страх. Падение. Все это привело сейчас к тому, что акции стали дешевыми. И на мой взгляд, привлекательными для покупки. Я с февраля являлся медведем, в данный же момент, я снимаю с себя данный статус и занимаю нейтральную позицию.

Дальнейшее падение рынка, возможно и будет. Возможно, дно еще впереди и рынок еще провалиться вниз, но это дно уже рядом.

Весной я писал, что рынок упадет и называл главную причину этого. Причина в отсутствии возможностей у властей США помочь экономике в будущем, с помощью новых программ стимулирования, ввиду инфляционных рисков. В виду слабости доллара, в виду необходимости привлекать капитал в казначейские облигации США. И как следствие, слабые экономические данные.

Америке нужно, иметь стабильный доллар, нужно чтобы был спрос на облигации казначейства, нужно чтобы экономика росла. В данный момент, доллар пользуется огромным спросом, так же как и облигации казначейства, цена на облигации взлетела в текущий момент, даже выше чем в 2008 году. Две цели выполнены, остается третья цель, это экономика.

( Читать дальше )

ФРС США готовится начать новую широкую программу кредитования банков

- 05 октября 2011, 11:23

- |

Центральный банк США может начать новую широкую программу кредитования для удовлетворения потенциального спроса финансовой системы, если европейский кризис усилится. Об этом заявил председатель Федеральной резервной системы Бен Бернанке, выступая перед Объединенной экономической комиссией Конгресса.

«Мы должны быть уверены с своей готовности предоставить нашей банковской системе как можно больше ликвидности под залог в случае необходимости в качестве кредитора последней инстанции», — отметил Бернанке.

Полный текст: http://take-profit.org/newsreview.php?mid=3336

«Мы должны быть уверены с своей готовности предоставить нашей банковской системе как можно больше ликвидности под залог в случае необходимости в качестве кредитора последней инстанции», — отметил Бернанке.

Полный текст: http://take-profit.org/newsreview.php?mid=3336

Глава ФРС США выступил в Конгрессе и пообещал новые меры для поддержки экономики

- 04 октября 2011, 20:45

- |

Федеральная резервная система (ФРС США) готова предпринять новые шаги для поддержания роста экономики по мере необходимости. Как передает «Интерфакс» со ссылкой на Bloomberg, с таким заявлением выступил глава ведомства Бен Бернанке на заседании объединенного комитета по экономике обеих палат Конгресса США.

ФРС «продолжит пристально отслеживать изменения в макроэкономической ситуации и готова по мере необходимости предпринять дополнительные шаги, чтобы обеспечить более заметное восстановление экономики в контексте ценовой стабильности», говорится в заявлении Бернанке.

Говоря о ситуации в Европе, председатель ФРС отметил, что пока сложно оценить непосредственное влияние этих событий на деловую активность в США, хотя уже сейчас очевидно, что эти события ухудшили настроения как деловых кругов, так и рядовых граждан страны.

Еще одним фактором, негативно влияющим на настроения в США, Бернанке считает политику федерального правительства и властей отдельных штатов, которые вынужденно сокращают расходы и рабочие места.

( Читать дальше )

ФРС «продолжит пристально отслеживать изменения в макроэкономической ситуации и готова по мере необходимости предпринять дополнительные шаги, чтобы обеспечить более заметное восстановление экономики в контексте ценовой стабильности», говорится в заявлении Бернанке.

Говоря о ситуации в Европе, председатель ФРС отметил, что пока сложно оценить непосредственное влияние этих событий на деловую активность в США, хотя уже сейчас очевидно, что эти события ухудшили настроения как деловых кругов, так и рядовых граждан страны.

Еще одним фактором, негативно влияющим на настроения в США, Бернанке считает политику федерального правительства и властей отдельных штатов, которые вынужденно сокращают расходы и рабочие места.

( Читать дальше )

Среди Американских трейдеров ходят слухи.

- 04 октября 2011, 19:36

- |

Программа количественного смягчения №3, будет запущена в том случае, если индекс S&P500 опустится ниже 1000 пунктов, соответственно если хотят дополнительных денег, то будут тащить туда, а также возможна негативная реакция рынка на выход хороших данных по экономике в США, так как это будет не очень хорошо сказываться на ожиданиях, так Б.Бернанке в очередной раз дал понять — деньги будут в том случае, если ситуация ухудшится. Так что очередные сегодняшние заявления ФРС не надо воспринимать как краткосрочный позитив.

Бернанке не ожидает роста занятости в ближайшее время

- 04 октября 2011, 18:59

- |

Внимательное изучение последних экономических данных не дало вялому рынку труда в США никакого намека на улучшение ситуации. Об этом заявил председатель Федеральной резервной системы Бен Бернанке в докладе для Объединенного экономического комитета Конгресса.

«Последние индикаторы, включая новые заявки на пособия по безработице и опросы работодателей относительно планов найма, указывают на вероятность ухудшения темпов роста занятости в ближайшее время», — отметил он.

Полный текст: http://take-profit.org/newsreview.php?mid=3330

«Последние индикаторы, включая новые заявки на пособия по безработице и опросы работодателей относительно планов найма, указывают на вероятность ухудшения темпов роста занятости в ближайшее время», — отметил он.

Полный текст: http://take-profit.org/newsreview.php?mid=3330

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- алроса

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- золото

- инвестиции

- индекс мб

- инфляция

- китай

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- натуральный газ

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- юмор

- яндекс

Новости тг-канал

Новости тг-канал