NASDAQ

NASDAQ Cигналы (Интрадей)

- 17 февраля 2022, 12:41

- |

Profit — величина максимального изменения от рекомендованной цены

Сигналы на сессию 17.02.2022

NASDAQ signals to BUY

Symbol: ANGI

Recommended price: 6.77

Signal strength: 3 (BUY)

Prediction date: 16/02/2022

Issuer: Angi Inc. Class A Common Stock

SL: -1.4% TP: 4.1%

NASDAQ signals to SELL

Symbol: BXRX

Recommended price: 4.6

Signal strength: -21 (SELL)

Prediction date: 16/02/2022

Issuer: Baudax Bio, Inc. Common Stock

SL: -1.1% TP: 5%

Symbol: RESN

Recommended price: 4.4

Signal strength: -19 (SELL)

Prediction date: 16/02/2022

Issuer: Resonant Inc.

SL: -1% TP: 1.5%

Symbol: ATRC

Recommended price: 67.92

Signal strength: -15 (SELL)

Prediction date: 16/02/2022

Issuer: AtriCure, Inc.

SL: -1% TP: 5%

Symbol: ENOB

Recommended price: 7.94

Signal strength: -6 (SELL)

Prediction date: 16/02/2022

Issuer: Enochian Biosciences Inc. Common Shares

SL: -1.7% TP: 5%

Symbol: ESPR

Recommended price: 3.98

Signal strength: -5 (SELL)

Prediction date: 16/02/2022

Issuer: Esperion Therapeutics, Inc.

SL: -4.4% TP: 1.4%

Symbol: CPSI

Recommended price: 29.51

Signal strength: -4 (SELL)

Prediction date: 16/02/2022

Issuer: Computer Programs & Systems In

SL: -1.3% TP: 5%

Symbol: SDGR

Recommended price: 28.03

Signal strength: -4 (SELL)

Prediction date: 16/02/2022

Issuer: Schrodinger, Inc. Common Stock

SL: -1.3% TP: 5%

- комментировать

- Комментарии ( 1 )

Капитал из «убежища от риска» перераспределяются в «рисковые» активы.

- 16 февраля 2022, 16:18

- |

На фьючерсном рынке ясно видно, что основные фондовые индексы начнут сегодня торги с открытием Америки на явно оптимистичной ноте.

В настоящее время фьючерсы на S&P 500 выросли на 55 пунктов и торгуются на 1,4% выше справедливой стоимости, фьючерсы на Nasdaq 100 выросли на 242 пункта и торгуются на 1,8% выше справедливой стоимости; а фьючерсы на Dow Jones Industrial Average выросли на 348 пунктов и торгуются на 1,3% выше справедливой стоимости.

Импульс для оптимистичных настроений связан с сообщениями о том, что Россия начала отводить войска от границы с Украиной. Есть некоторые сомнения относительно того, является ли это серьезным отступлением, которое сводит на нет атакующие возможности России в краткосрочной перспективе, но на данный момент фьючерсный рынок рассматривает это как шаг в правильном направлении к деэскалации.

Это восприятие приводит к «ралли смягчения», которое усиливается деятельностью по закрытию коротких позиций.

( Читать дальше )

NASDAQ Cигналы (Интрадей)

- 16 февраля 2022, 01:20

- |

Profit — величина максимального изменения от рекомендованной цены

Сигналы на сессию 16.02.2022

NASDAQ signals to BUY

Symbol: SYNH

Recommended price: 82.17

Signal strength: 5 (BUY)

Prediction date: 15/02/2022

Issuer: Syneos Health, Inc. Class A Common Stock

SL: -1% TP: 4.9%

Symbol: DAVE

Recommended price: 5.73

Signal strength: 2 (BUY)

Prediction date: 15/02/2022

Issuer: Dave Inc. Class A Common Stock

SL: -1% TP: 5%

NASDAQ signals to SELL

Symbol: IPGP

Recommended price: 137.55

Signal strength: -1 (SELL)

Prediction date: 15/02/2022

Issuer: IPG Photonics Corporation

SL: -2.6% TP: 4.6%

Symbol: IPSC

Recommended price: 12.95

Signal strength: -1 (SELL)

Prediction date: 15/02/2022

Issuer: Century Therapeutics, Inc. Common Stock

SL: -2.6% TP: 4.6%

Symbol: LFST

Recommended price: 9.24

Signal strength: -1 (SELL)

Prediction date: 15/02/2022

Issuer: LifeStance Health Group, Inc. Common Stock

SL: -2.6% TP: 4.6%

NASDAQ Cигналы (Интрадей)

- 15 февраля 2022, 12:55

- |

Profit — величина максимального изменения от рекомендованной цены

Сигналы на сессию 15.02.2022

NASDAQ signals to BUY

Symbol: DYN

Recommended price: 6.66

Signal strength: 2 (BUY)

Prediction date: 14/02/2022

Issuer: Dyne Therapeutics, Inc. Common Stock

SL: -1% TP: 5%

Symbol: EVGN

Recommended price: 1.225

Signal strength: 2 (BUY)

Prediction date: 14/02/2022

Issuer: EVOGENE LTD.

SL: -1% TP: 5%

Symbol: ABOS

Recommended price: 5.105

Signal strength: 1 (BUY)

Prediction date: 14/02/2022

Issuer: Acumen Pharmaceuticals, Inc. Common Stock

SL: -1% TP: 5%

Symbol: AVAH

Recommended price: 4.92

Signal strength: 1 (BUY)

Prediction date: 14/02/2022

Issuer: Aveanna Healthcare Holdings Inc. Common Stock

SL: -1% TP: 5%

Symbol: DCFC

Recommended price: 9.3624

Signal strength: 1 (BUY)

Prediction date: 14/02/2022

Issuer: Tritium DCFC Limited Ordinary Shares

SL: -1% TP: 5%

Symbol: DLHC

Recommended price: 15.752

Signal strength: 1 (BUY)

Prediction date: 14/02/2022

Issuer: DLH Holdings Corp.

SL: -1% TP: 5%

Symbol: EWTX

Recommended price: 11.23

Signal strength: 1 (BUY)

Prediction date: 14/02/2022

Issuer: Edgewise Therapeutics, Inc. Common Stock

SL: -1% TP: 5%

Symbol: HIBB

Recommended price: 54.02

Signal strength: 1 (BUY)

Prediction date: 14/02/2022

Issuer: Hibbett, Inc. Common Stock

SL: -1% TP: 5%

( Читать дальше )

Как жителям СНГ купить акции компаний США?

- 15 февраля 2022, 11:21

- |

У некоторых читателей будет вопрос — зачем нам акции компаний США, ведь мы на пространстве СНГ (в бывшем СССР) живем, далеко от этих стран как экономически, так и географически?

Однако могу поспешить на это возразить- западные экономики отличаются высокой стабильностью, в то время как на просторах СНГ все очень переменчиво, и потому жителям СНГ также имеет смысл пробовать себя в инвестировании наравне с жителями запада (при наличии желания и денег конечно), к тому же русские олигархи тоже как бы жители СНГ и поверьте они только тем и занимаются что вкидывают в америанкские акции

И потому публикую небольшую инструкцию как жителю СНГ приобрести акции или другие ценные бумаги западных компаний, торгуемых на биржах, надеюсь будет полезным

1) Выбрать брокера в США, который:

— зарегистрирован в США (ни Панама, ни Россия, ни Кипр или оффшор Виргинских островов) и работает по законам США

( Читать дальше )

Новости финансовых рынков от 13.02.2022

- 13 февраля 2022, 20:45

- |

Новости финансовых рынков. Выпуск от 13.02.2022г

Взгляд трейдера на новостной фон и как он влияет на финансовые рынки. Обзор финансовых рынков за неделю, еженедельные выводы и грядущие события. В этом выпуске сделал акцент на информационный фон в западных СМИ вокруг конфликта Россия-НАТО, фон вокруг цен на нефть, а также заголовки СМИ на тему снижения фондового рынка США.

( Читать дальше )

NASDAQ Cигналы (Интрадей)

- 12 февраля 2022, 12:59

- |

Profit — величина максимального изменения от рекомендованной цены

Сигналы на сессию 14.02.2022

NASDAQ signals to BUY

Symbol: SMTI

Recommended price: 23.1433

Signal strength: 14 (BUY)

Prediction date: 11/02/2022

Issuer: Sanara MedTech Inc. Common Stock

SL: -1.4% TP: 5%

Symbol: TCRR

Recommended price: 3

Signal strength: 8 (BUY)

Prediction date: 11/02/2022

Issuer: TCR2 Therapeutics Inc. Common Stock

SL: -1% TP: 3.7%

Symbol: GREE

Recommended price: 11.55

Signal strength: 7 (BUY)

Prediction date: 11/02/2022

Issuer: Greenidge Generation Holdings Inc. Class A Common

SL: -1% TP: 5%

Symbol: NLTX

Recommended price: 2.84

Signal strength: 7 (BUY)

Prediction date: 11/02/2022

Issuer: Neoleukin Therapeutics, Inc. Common Stock

SL: -1% TP: 5%

Symbol: ADPT

Recommended price: 15.36

Signal strength: 5 (BUY)

Prediction date: 11/02/2022

Issuer: Adaptive Biotechnologies Corporation Common Stock

SL: -4.7% TP: 4.9%

Symbol: HIVE

Recommended price: 2.08

Signal strength: 3 (BUY)

Prediction date: 11/02/2022

Issuer: Hive Blockchain Technologies Ltd. Common Shares

SL: -1.4% TP: 4.1%

Symbol: GERN

Recommended price: 1.02

Signal strength: 2 (BUY)

Prediction date: 11/02/2022

Issuer: Geron Corp

SL: -1% TP: 5%

( Читать дальше )

Когда рухнут финтехи?

- 12 февраля 2022, 01:03

- |

Лопнувший пузырь утянет на дно все остальные рынки.

На поверхности останутся только вздутые синие трупы.

NASDAQ Cигналы (Интрадей)

- 11 февраля 2022, 10:34

- |

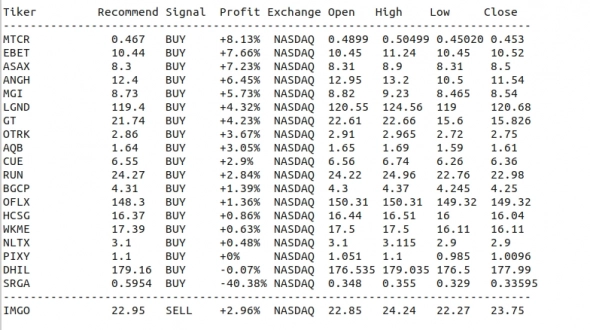

Profit — величина максимального изменения от рекомендованной цены

Сигналы на сессию 11.02.2022

NASDAQ signals to BUY

Symbol: SRGA

Recommended price: 0.5954

Signal strength: 11 (BUY)

Prediction date: 10/02/2022

Issuer: Surgalign Holdings, Inc. Common Stock

SL: -1% TP: 3.8%

Symbol: ASAX

Recommended price: 8.3

Signal strength: 10 (BUY)

Prediction date: 10/02/2022

Issuer: Astrea Acquisition Corp. Class A Common Stock

SL: -1.1% TP: 3.3%

Symbol: PIXY

Recommended price: 1.1

Signal strength: 8 (BUY)

Prediction date: 10/02/2022

Issuer: ShiftPixy, Inc. Common Stock

SL: -1% TP: 5%

Symbol: AQB

Recommended price: 1.64

Signal strength: 7 (BUY)

Prediction date: 10/02/2022

Issuer: AquaBounty Technologies, Inc.

SL: -1% TP: 5%

Symbol: OFLX

Recommended price: 148.3

Signal strength: 5 (BUY)

Prediction date: 10/02/2022

Issuer: Omega Flex, Inc.

SL: -4.7% TP: 4.9%

Symbol: BGCP

Recommended price: 4.31

Signal strength: 3 (BUY)

Prediction date: 10/02/2022

Issuer: BGC Partners, Inc.

SL: -2.4% TP: 4.1%

Symbol: GT

Recommended price: 21.74

Signal strength: 3 (BUY)

Prediction date: 10/02/2022

Issuer: Goodyear Tire & Rubber

SL: -2.4% TP: 4.1%

Symbol: WKME

Recommended price: 17.39

Signal strength: 3 (BUY)

Prediction date: 10/02/2022

Issuer: WalkMe Ltd. Ordinary Shares

SL: -2.4% TP: 4.1%

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- алроса

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- золото

- инвестиции

- индекс мб

- инфляция

- китай

- кризис

- криптовалюта

- лидеры роста и падения ммвб

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- си

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трейдер

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- юмор

- яндекс

Новости тг-канал

Новости тг-канал