SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог им. lekrus

Трейд по нефти.

- 10 июня 2014, 13:14

- |

В этом посте я разбирал сентимент на нефтяном фьючерсе, данный трейд является частью того анализа.

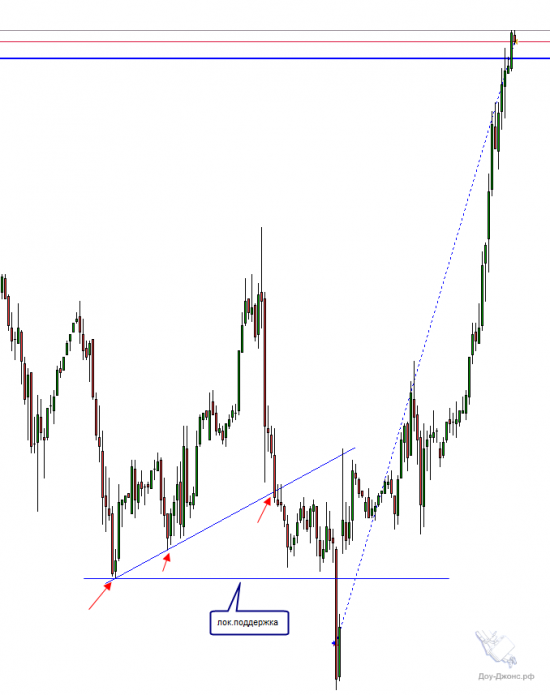

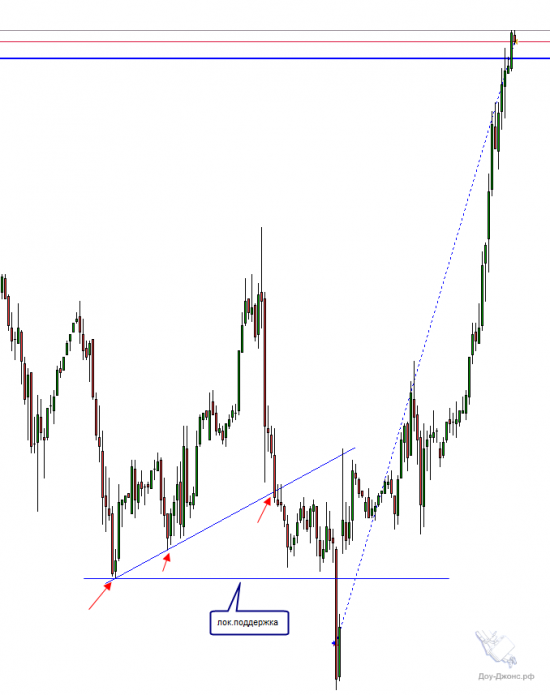

На дневном графике цена нефти ударилась в эти сильные уровни сопротивления и ушла вниз, т.к. на этом техническом анализе в рынок можно посадить много медвежьего объёма. Какой смысл улетать наверх и не замечать эти уровни, если на них кукловод может увеличить свою позу и заработать ещё больше денег? В таких ситуациях тех.анализ работает, но смысл этих линий не такой, как думает большинство трейдеров.

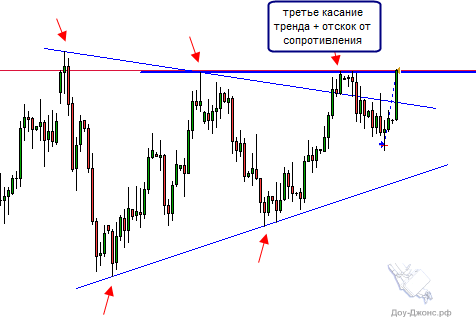

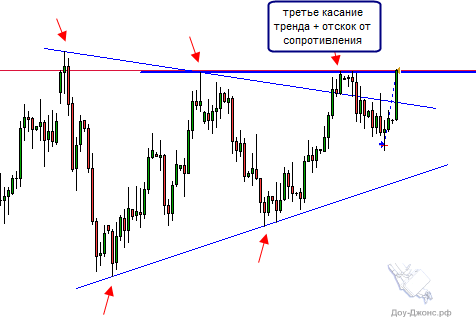

На часовом графике медведям продолжали рисовать линии и уровни, на пробой которых они продавали. Это ещё сильнее увеличивало перевес в сторону медведей, т.е. на рынке продолжал увеличиваться шортовый открытый интерес.

Читать дальше...

На дневном графике цена нефти ударилась в эти сильные уровни сопротивления и ушла вниз, т.к. на этом техническом анализе в рынок можно посадить много медвежьего объёма. Какой смысл улетать наверх и не замечать эти уровни, если на них кукловод может увеличить свою позу и заработать ещё больше денег? В таких ситуациях тех.анализ работает, но смысл этих линий не такой, как думает большинство трейдеров.

На часовом графике медведям продолжали рисовать линии и уровни, на пробой которых они продавали. Это ещё сильнее увеличивало перевес в сторону медведей, т.е. на рынке продолжал увеличиваться шортовый открытый интерес.

Читать дальше...

теги блога Lekrus

- Alpari

- apple

- Citigroup

- Coca-Cola

- DX

- ebay

- eur

- EUR USD

- eurusd

- Facebook Акции

- First Solar

- forex

- freestockcharts

- futures gold cme

- gold

- Goldman Sachs

- hsbc

- ibm

- NASDAQ

- nyse

- oil

- quik

- RTS

- S&P500

- TradingView

- usdx

- Wal-Mart Stores

- акция

- брокеры

- вопрос

- ДВМП

- Дмитрий Хотимский

- дц

- евро доллар

- евродоллар

- золото

- индекс sp500

- индекс доллара

- интервью

- Калиниченко

- Китай

- коронавирус

- кукл

- ловля ножей

- нефть

- НПФ

- опрос

- оффтоп

- полиметалл

- риск менеджмент

- Россия

- РТС

- сбербанк

- Сбербанк брокер

- сипи

- скрипты для QUIK

- совкомбанк

- сша

- технический анализ

- торговые сигналы

- трейдинг

- фьючерс на золото

- эмоции

- эмоции в трейдинге

- юмор

FYI.

North Sea

Market analysis: Activity picked up in

a hectic North Sea crude MOC process Monday, with

11 bids and offers shown. While Forties strengthened

further as more July dates came into the window, Ekofisk

plunged to take the place of the most competitive

BFOE grade across most of the 10-25 day range, with

a June 22-24 Ekofisk cargo offer published at Dated

Brent plus $0.85/barrel still finding no buying interest.

Oseberg was the most competitive grade over the

remaining four dates at the back end of the range,

July 1-4, after subtraction of the July Oseberg Quality

Premium (0.9131). The softer numbers seen on Oseberg

and Ekofisk were related to the higher volumes in July

programs compared to June, said traders, even if this

was only due to deferrals. “I see 300,000 b/d higher

overall [North Sea] production in July, but barrels are

also leaving the region,” said one trader. “The key

question is how much WAF arrives in Europe. Angola

[crude] doesn’t usually come into Europe, it is usually

Nigerian, but I think it has to come.” The pick-up in

Forties differentials for July dates seemed to be related

to the belief that two VLCCs-worth of Forties was set

to arbitrage out of the region in July. While no actual

July fixtures have been reported for this route yet, there

was a June-loading fixture Monday: the Grand Lady

VLCC was fixed to Vitol for a Hound Point-South Korea

voyage, according to several shipbrokers. The vessel,

owned by East Med Maritime, was reportedly fixed at a

$4.5 million lump sum for loading June 16, the first day

Hound Point’s VLCC berth is available after maintenance.

This was not generally seen as additional to the July

volumes of Forties said to be leaving the region however:

“You’ve probably heard of two July VLCCs to China,” said

a trader. “My feeling is this is one of them. It’s just for

pricing reasons, they preferred to load early.” Another

trader said: “The question is whether that [VLCC] is

an additional one. They could slow steam it, or sit in

Crude oil Marketwire june 9, 2014

Copyright © 2014, McGraw Hill Financial 5

water for a while.” The Forties June 15-17 cargo was

bought last week by Vitol at Dated Brent minus $0.95/b,

whereas the first three days of the July program were

bid for Monday at Dated Brent plus $0.60/b without

trading. Outside the MOC, activity was subdued Monday

with holidays across much of Europe, and none of

the Norwegian July programs had been offered yet,

said traders. “Statoil is not in today — no numbers

discussed yet on sweet grades,” said one trader. Value

on grades such as Statfjord and Gullfaks remained

opaque, said traders. “I haven’t seen July offers yet,”

said one. Meanwhile the one cargo for which Monday

was the last day of entry into the 25-day nomination

procedure, Forties F0704, was not nominated.

либо будет так, либо уйдёт вниз без меня…