Блог им. st-travich

⚡️ Today I want to justify about 3 interesting pictures on the futures market.

- 05 марта 2023, 22:02

- |

Good evening, traders! 👋

Today I want to justify about 3 interesting pictures on the futures market.

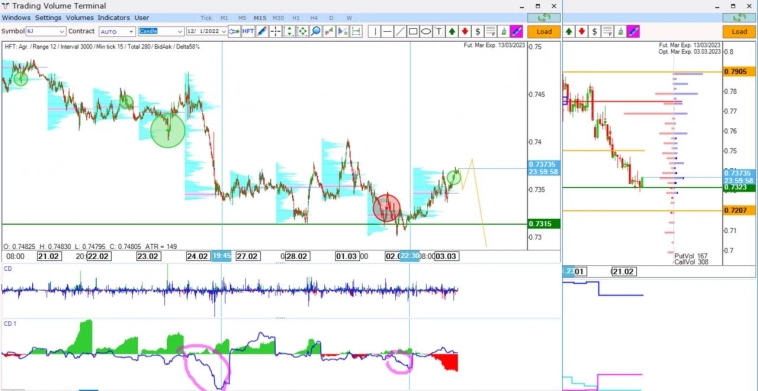

▪️ Japanese yen (6J) shows preparations to break the demand zone.

The quantitative cumulative delta was negative several times before the support. Bid HFTs were created near the level, and afterward, we can observe the involvement in buys. It is necessary to collect liquidity and then, break the demand level. If after the current Ask tick chain, the price stops growing it will be a good selling opportunity.

▪️ Brent Oil (BR) created a new uptrend line with the help of fast tick chains on it. Very often price return to such trendlines and break them.

The price can overcome the next supply zone 86.5 and then will go to the downside. Still, to my mind, the probability that the Daily range will continue to form is higher, than it will be broken.

▪️ Also, Corn (ZC), now it is obvious to everybody that it continues rising to the 655 price level.

And from the volumetric perspective, it is also beautiful.

There was enough enforcement of sellers before the market breakthrough important demand zones and after them. And it also triggered activity in put options block trades (we see on Daily).

But be careful, there are passengers in this game who traded false breakdown. That's why coiling is more probable in this case. ☝️

«It's big level» is not a good enough reason to put on a trade."

Brent Donnelly

But many traders really do this, and we need to read the chart, — wear it is worthless for MM to trade against and were NO fuel.

I wish you a good and profitable week! 👍

- 05 марта 2023, 22:10

- 09 марта 2023, 20:12

- 05 марта 2023, 23:46

- 09 марта 2023, 20:14

теги блога Wilson Trade

- 6A

- 6B

- 6C

- 6E

- 6j

- 6N

- 6S

- analysis

- ask

- bid

- BR

- Brent Oil

- British pound

- CAD

- CC

- CL

- CME

- Cocoa

- corn

- COT

- CoT reports

- COT отчет

- COT отчеты

- Crude Oil

- DXY

- ES

- Euro

- futures

- GC

- Gold

- hft

- HG

- KC

- Larri Willams

- larry williams

- Market profile

- natural gas

- NG

- Oil

- PL

- Platinum

- S&P500

- SB

- SI

- Silver

- soybeans

- Sugar

- trade

- trader

- traders

- trading

- wheat

- YM

- ZC

- ZN

- ZS

- ZW

- автоуровни

- аналитическая статья

- бизнес

- биткоин

- газ

- Евро

- золото

- Иена

- Инвестиции

- канадский доллар

- китай

- корреляция

- Мазут

- медь

- на чем заработать

- нефть

- новая ниша бизнеса

- ОИ

- опционы

- открытый интерес

- оффтоп

- Палладий

- перспективы роста

- платина

- полезная информация

- серебро

- советы для начинающих

- СОТ

- СОТ отчеты

- стартапы

- сша

- торговые стратегии

- трейдер

- трейдинг

- трейдинг для начинающих

- уровни

- фонды

- форекс

- фрс

- Фунт

- фьючерс

- ФЬЮЧЕРСЫ