SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

day0markets.ru

Отбор акций NYSE на 12/11/2012

- 12 ноября 2012, 17:05

- |

Продолжаю свой эксперимент, сегодня выкладываю всего 5 акций, которые отобрал и по которым есть четкие идеи. DVN GILD MNST PANL WLP. Сегодня новости выходили только по акции GILD — результаты тестов FDA по одному из препаратов, акция будет открываться хорошим гэпом вверх. Шортить я ее точно не буду, даже если будут формации. Еще не менее интересная бумага CELG — тоже фармацевтика и тоже новости FDA, Сегодня их на удивление много. Не могу не отметить, что сегодня в США День Ветеранов — банки и рынок облигаций не работают, поэтому ждать хорошей ликвидности не стоит. Вот собственно и мой отбор акций NYSE/NASDAQ.

( Читать дальше )

( Читать дальше )

- комментировать

- ★3

- Комментарии ( 5 )

Торговые идеи на 08/11/2012

- 08 ноября 2012, 17:14

- |

Снова небольшой отбор акций NYSE. Решил провести небольшой эксперимент — хочу посмотреть, как мои наблюдения отрабатываются на рынке. Для этого есть только один способ — записать свои мысли и посмотреть, что произошло после торговой сессии. Я отобрал на лист несколько бумаг, проанализировал графики с сделал кое-какие отметки, предположил возможный ход событий и сделал план по каждой акции. Посмотрим, что из этого получится.

( Читать дальше )

( Читать дальше )

Несколько мыслей по отбору акций.

- 07 ноября 2012, 14:39

- |

Сезон отчетов на NYSE начинает постепенно снижать обороты, можно время от времени присматриваться к уже отчитавшимся акциям. После сильного движения на отчете акция, как правило, консолидируется 2-3 дня и после этого пробивает намеченные уровни поддержки/сопротивления и начинается новый среднесрочный тренд. При отборе таких акций я обращаю внимание на несколько вещей:

1) Сильное движение акции на отчете. Гэп и внутридневное изменение должны давать в сумме минимум 5-7%. На отчете обязательно должен выйти хороший объем: раза в три больше, чем средний объем за последние пару месяцев.

2) После движения на отчете акция должна консолидироваться в относительно узком диапазоне.

3) Просматриваем движения акции в указанном диапазоне на 15 минутном графике ( меньше шума, чем на 5 минутке). Смотрим где были уровни поддержки и сопротивления, где выходил объем и где акция разворачивалась. Опускалась ли поддержка/сопротивление вниз или наоборот поднималась вверх?

4) Минимум/максимум диапазона: смотрим какие выходят тут объемы, значимы ли эти уровни. На них и выставляем алерты.

Сделки я открываю при выходе цены из диапазона, при это для меня важным условием является соотношение вышедшего объема до пробоя и после. Если до пробоя выходит больший объем, то скорее всего цена много и не пройдет и лучше закрыть сделки при первых признаках отката.

Вот что я отобрал сегодня себе на лист для торговли по этому алгоритму:

( Читать дальше )

1) Сильное движение акции на отчете. Гэп и внутридневное изменение должны давать в сумме минимум 5-7%. На отчете обязательно должен выйти хороший объем: раза в три больше, чем средний объем за последние пару месяцев.

2) После движения на отчете акция должна консолидироваться в относительно узком диапазоне.

3) Просматриваем движения акции в указанном диапазоне на 15 минутном графике ( меньше шума, чем на 5 минутке). Смотрим где были уровни поддержки и сопротивления, где выходил объем и где акция разворачивалась. Опускалась ли поддержка/сопротивление вниз или наоборот поднималась вверх?

4) Минимум/максимум диапазона: смотрим какие выходят тут объемы, значимы ли эти уровни. На них и выставляем алерты.

Сделки я открываю при выходе цены из диапазона, при это для меня важным условием является соотношение вышедшего объема до пробоя и после. Если до пробоя выходит больший объем, то скорее всего цена много и не пройдет и лучше закрыть сделки при первых признаках отката.

Вот что я отобрал сегодня себе на лист для торговли по этому алгоритму:

( Читать дальше )

Агрегированные ордера и торговля открытия.

- 01 ноября 2012, 12:43

- |

На открытии главная проблема состоит в том, что происходит все очень быстро. Просле входа в позицию можно просто не успеть поставить стоп и получить убыток больше, чем хотелось бы. Открытие — это не только быстрые деньги, но и быстрые потери. Я торгую на платформе Takion и платформа позволяет настраивать связанные ордера — т.е. я отправляю ордер на вход в позицию и автоматически ставится стоп.

В первые полчаса торгов я пользуюсь связками ордеров — агрессивный лимитный ордер на вход в позицию (bid+1) и стоп ордером только на закрытие позиции (close only). Время жизни моего лимитного ордера на вход стоит очень короткое, что означает что если я почти сразу не получаю сделку, то ордер просто отменяется. Поскольку стоп установлен только на закрытие, то обратная позиция открыта не будет. У меня настроено несколько ордеров со стопом в 5 и 10 центов и разным временем жизни самих ордеров. Как настроить ордер и привязать к нему хоткей я показал в видео. Возможно, кому-нибудь пригодиться.

В первые полчаса торгов я пользуюсь связками ордеров — агрессивный лимитный ордер на вход в позицию (bid+1) и стоп ордером только на закрытие позиции (close only). Время жизни моего лимитного ордера на вход стоит очень короткое, что означает что если я почти сразу не получаю сделку, то ордер просто отменяется. Поскольку стоп установлен только на закрытие, то обратная позиция открыта не будет. У меня настроено несколько ордеров со стопом в 5 и 10 центов и разным временем жизни самих ордеров. Как настроить ордер и привязать к нему хоткей я показал в видео. Возможно, кому-нибудь пригодиться.

Пара мыслей по торговле отчетов.

- 29 октября 2012, 21:21

- |

Оригинал тут.

Пока в США бушует ураган решил изложить пару мыслей по движению бумаг на NYSE в сезон отчетов, систематизировать немного свое понимание рынка. Привело это к формированию нескольких простых моделей, которыми и решил поделиться.

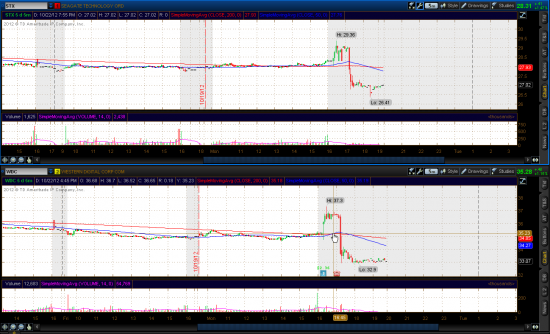

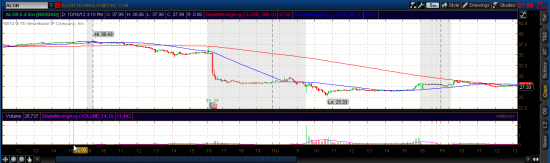

1. Акция находится около многомесячных максимумов, цена сейчас выше, чем на предыдущем отчете. Допустим, что компания выпускает хороший отчет, ничего особенного — просто хороший отчет. Наиболее вероятное движение здесь — гэп ап с последующим рэйнджем, либо дальнейшем снижением на фоне фиксации прибыли. Неплохой пример этому — движение в акции AKAM. Открытие с гэпом вверх, обновление максимума на премаркете и разворот вниз. Отчет лучше ожиданий по выручке и по EPS.

( Читать дальше )

Пока в США бушует ураган решил изложить пару мыслей по движению бумаг на NYSE в сезон отчетов, систематизировать немного свое понимание рынка. Привело это к формированию нескольких простых моделей, которыми и решил поделиться.

1. Акция находится около многомесячных максимумов, цена сейчас выше, чем на предыдущем отчете. Допустим, что компания выпускает хороший отчет, ничего особенного — просто хороший отчет. Наиболее вероятное движение здесь — гэп ап с последующим рэйнджем, либо дальнейшем снижением на фоне фиксации прибыли. Неплохой пример этому — движение в акции AKAM. Открытие с гэпом вверх, обновление максимума на премаркете и разворот вниз. Отчет лучше ожиданий по выручке и по EPS.

( Читать дальше )

Сезон отчетов - коррелирующие акции.

- 23 октября 2012, 11:04

- |

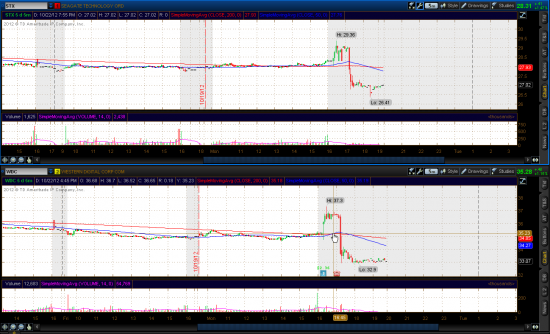

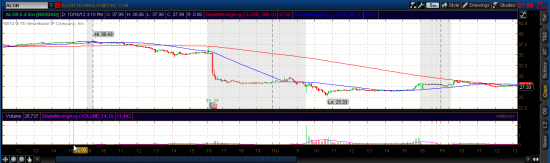

Яркий пример двух сильно скоррелированных акций: WDC и STX. Вчера после закрытия рынка Western Digital (производитель съемных жестких дисков) опубликовал отчет. Отчет лучше ожиданий по прибыли и по выручке, но акции тем не менее провалились на премаркете. Аналогочная ситуация произошла и с акциями Seagate Technology, которая будет отчитываться позже в этом месяцце. Сегодня можно ожидать дальнейшего совместного движения двух бумаг. К слову, STX — бумага менее волатильная и сегодня будет повторять движения WDC. Премаркет обоих акций на картинке.

Похожая ситуация на постмаркете была недавно в акциях ALGN, закончилось все это продолжением падения.

( Читать дальше )

Похожая ситуация на постмаркете была недавно в акциях ALGN, закончилось все это продолжением падения.

( Читать дальше )

Историческое изменение цены акций на NYSE.

- 19 октября 2012, 00:36

- |

Возникла потребность в исторических данных по процентному изменению цены конкретной акции, интересен промежуток за два года. Т.е. нужно примерно следующее: дата-%изменение. Может кто знает где раздобыть? Акции NYSE и NASDAQ. Данные нужны по всем акциям. Плюс в профиль тем, кто поможет))

Отчет Morgan Stanley

- 18 октября 2012, 15:38

- |

Лучше ожиданий по EPS, но хуже по выручке.

Morgan Stanley beats by $0.03, misses on revs Price: 18.49 Change:

Reports Q3 (Sep) earnings of $0.28 per share (excluding DVA), $0.03 better than the Capital IQ Consensus Estimate of $0.25; revenues fell 46.1% year/year to $5.29 bln (including DVA) which may not be comaprable to the $6.27 bln consensus. Net Revenues included the negative impact of $2.3 bln from the tightening of Morgan Stanley's Debt-Related Credit Spreads (DVA); Including the DVA adjustment the loss from Continuing Operations was $0.55 per share, which may not compared to the Capital IQ GAAP consensus of -$0.36.

Morgan Stanley reported net revenues of $5.3 bln for Q3 compared with $9.8 bln a year ago. For the current quarter, the loss from continuing operations applicable to Morgan Stanley was $1.0 billion, or a loss of $0.55 per diluted share, compared with income of $2.2 billion, or $1.14 per diluted share, for the same period a year ago. Excluding DVA, net revenues for the current quarter were $7.6 bln compared with $6.4 bln a year ago and income from continuing operations applicable to Morgan Stanley was $561 million, or $0.28 per diluted share, compared with income of $64 million, or $0.02 a year ago.

Compensation expense of $3.9 billion increased from $3.6 billion a year ago. Non-compensation expenses of $2.8 billion increased from $2.5 billion a year ago primarily due to litigation costs reported in Institutional Securities and non-recurring expenses associated with the Morgan Stanley Wealth Management integration.

Institutional Securities

Institutional Securities reported a pre-tax loss from continuing operations of $1.9 billion compared with pre-tax income of $3.4 billion in the third quarter of last year. Net revenues for the current quarter were $1.4 billion compared with $6.4 billion a year ago. DVA resulted in negative revenue of $2.3 billion in the current quarter compared with positive revenue of $3.4 billion a year ago. Excluding DVA, net revenues for the current quarter were $3.6 billion compared with $3.0 billion a year ago. Advisory revenues were $339 million compared with $413 million a year ago reflecting lower completed market volumes.

( Читать дальше )

Morgan Stanley beats by $0.03, misses on revs Price: 18.49 Change:

Reports Q3 (Sep) earnings of $0.28 per share (excluding DVA), $0.03 better than the Capital IQ Consensus Estimate of $0.25; revenues fell 46.1% year/year to $5.29 bln (including DVA) which may not be comaprable to the $6.27 bln consensus. Net Revenues included the negative impact of $2.3 bln from the tightening of Morgan Stanley's Debt-Related Credit Spreads (DVA); Including the DVA adjustment the loss from Continuing Operations was $0.55 per share, which may not compared to the Capital IQ GAAP consensus of -$0.36.

Morgan Stanley reported net revenues of $5.3 bln for Q3 compared with $9.8 bln a year ago. For the current quarter, the loss from continuing operations applicable to Morgan Stanley was $1.0 billion, or a loss of $0.55 per diluted share, compared with income of $2.2 billion, or $1.14 per diluted share, for the same period a year ago. Excluding DVA, net revenues for the current quarter were $7.6 bln compared with $6.4 bln a year ago and income from continuing operations applicable to Morgan Stanley was $561 million, or $0.28 per diluted share, compared with income of $64 million, or $0.02 a year ago.

Compensation expense of $3.9 billion increased from $3.6 billion a year ago. Non-compensation expenses of $2.8 billion increased from $2.5 billion a year ago primarily due to litigation costs reported in Institutional Securities and non-recurring expenses associated with the Morgan Stanley Wealth Management integration.

Institutional Securities

Institutional Securities reported a pre-tax loss from continuing operations of $1.9 billion compared with pre-tax income of $3.4 billion in the third quarter of last year. Net revenues for the current quarter were $1.4 billion compared with $6.4 billion a year ago. DVA resulted in negative revenue of $2.3 billion in the current quarter compared with positive revenue of $3.4 billion a year ago. Excluding DVA, net revenues for the current quarter were $3.6 billion compared with $3.0 billion a year ago. Advisory revenues were $339 million compared with $413 million a year ago reflecting lower completed market volumes.

( Читать дальше )

Отчет Bank of America

- 17 октября 2012, 15:18

- |

Отчитался лучше ожиданий по EPS.

Английская версия:

Bank of America beats by $0.06 Price: 9.46 Change:

Reports Q3 (Sep) net of breakeven, $0.06 better than the Capital IQ Consensus Estimate of ($0.06); As previously reported, the third quarter of 2012 was negatively impacted by $1.9 billion of debit valuation adjustments (DVA) and fair value option (FVO) adjustments related to the improvement in the company's credit spreads, $1.6 billion for total litigation expense, including a charge for the previously announced settlement of the Merrill Lynch class action litigation, and a charge of $0.8 billion related to the repricing of certain deferred tax assets due to a reduction in the U.K. corporate tax rate. Together, these three items totaled a negative $0.28 per share

Revenues were $20.65 bln down 28.0% year/year; Revenues excluding DVA and FVO were $22.52 bln.

Capital & Valuations

Regulatory capital ratios increased with the Tier 1 common capital ratio under Basel 1 increasing to 11.41% in the third quarter of 2012, up 17 bps from the second quarter of 2012 and 276 bps higher than the third quarter of 2011. The Tier 1 common capital ratio under Basel 3 on a fully phased-in basis was estimated at 8.97% as of September 30, 2012, up from 7.95% at June 30, 2012. Tangible book value per share increased to $13.48 at September 30, 2012, compared to $13.22 at both June 30, 2012 and September 30, 2011. Book value per share was $20.40 at September 30, 2012, compared to $20.16 at June 30, 2012 and $20.80 at September 30, 2011.

Credit

( Читать дальше )

Английская версия:

Bank of America beats by $0.06 Price: 9.46 Change:

Reports Q3 (Sep) net of breakeven, $0.06 better than the Capital IQ Consensus Estimate of ($0.06); As previously reported, the third quarter of 2012 was negatively impacted by $1.9 billion of debit valuation adjustments (DVA) and fair value option (FVO) adjustments related to the improvement in the company's credit spreads, $1.6 billion for total litigation expense, including a charge for the previously announced settlement of the Merrill Lynch class action litigation, and a charge of $0.8 billion related to the repricing of certain deferred tax assets due to a reduction in the U.K. corporate tax rate. Together, these three items totaled a negative $0.28 per share

Revenues were $20.65 bln down 28.0% year/year; Revenues excluding DVA and FVO were $22.52 bln.

Capital & Valuations

Regulatory capital ratios increased with the Tier 1 common capital ratio under Basel 1 increasing to 11.41% in the third quarter of 2012, up 17 bps from the second quarter of 2012 and 276 bps higher than the third quarter of 2011. The Tier 1 common capital ratio under Basel 3 on a fully phased-in basis was estimated at 8.97% as of September 30, 2012, up from 7.95% at June 30, 2012. Tangible book value per share increased to $13.48 at September 30, 2012, compared to $13.22 at both June 30, 2012 and September 30, 2011. Book value per share was $20.40 at September 30, 2012, compared to $20.16 at June 30, 2012 and $20.80 at September 30, 2011.

Credit

( Читать дальше )

Отбор акций NYSE в сезон отчетов

- 17 октября 2012, 14:22

- |

Сезон отчетов должен любить каждый трейдер. Это месяцы основного заработка на NYSE/NASDAQ. Преимущества внутридневного спекулянта в сезон отчетов многократно увеличиваются. Крупные инвестиционные фонды начинают перетряхивать свои портфели, фиксировать прибыли на ожидаемо хороших отчетах, скупать подешевевшие акции упавшие на плохом отчете, сбрасывать акции не оправдавших надежды компаний; неопытные инвесторы именно в этот период склонны к панике и эйфории: изменение цены акции на 5-6% на отчете — нормальное явление. Именно это и позволяет нам заработать, в большинстве отчетных акций всегда есть волатильность, повышенный интерес (тут главное определить с какой стороны) и что самое главное там нет надоедливых HFT, лента становится на порядок понятней, но из-за возросших объемов она значительно ускоряется. Очень часто на отчетах акции легко пробивают уровни, которые держались месяцами.

( Читать дальше )

( Читать дальше )

теги блога day0markets.ru

- AMEX

- BAC

- Basic Materials

- BOVESPA

- charts

- CME

- Earning season

- earnings

- earnings season

- ECN

- ETF

- EWZ

- FDA

- floored

- Fusion

- halt

- HFT

- HLF

- Hotkeys

- ICE

- Imbalance trading

- inplay

- IQFeed

- machine learning

- Morgan Stanley

- multicharts

- NASDAQ

- NASDQ

- nflx

- NYSE

- python

- Sec fillings

- short float

- spin off

- SPY

- stocks in play

- stocks inplay

- STX

- takion

- thinkorswim

- trading floor

- UVXY

- VPS

- VRTX

- WDC

- азия

- акции

- алгоритмы

- алготрейдинг

- аналитика

- Бразилия

- Бразильская биржа

- брокеры

- бэктестинг

- волатильность

- выборы

- Гербалайф

- дауншифтинг

- дауншифтинг трейдера

- дивиденды в США

- заграница

- Индия

- инсайдеры

- исторические данные

- история котировок

- итоги года

- календарь отчетов

- Карл Айкон

- комиссии брокера

- корпоративные новости

- корреляция

- котировки NYSE

- криптовалюта

- лось

- Миграция

- ММВБ

- мысли о трейдинге

- новостной трейдинг

- опционы

- отбор акций

- офф топ

- оффтоп

- премаркет

- проп трейдинг

- раб место трейдера

- риск менеджмент

- Россия

- сезон отчетов

- сервер для робота

- серфинг

- статистика для трейдера

- такион

- торговая платформа

- торговые роботы

- трейдинг

- философия трейдинга

- фильм

- фьючерсы

- эмиграция

- юмор