SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог им. renat_vv |p.s. опрос про EURUSD

- 08 сентября 2014, 17:43

- |

Итак, тут (http://smart-lab.ru/blog/202852.php) я спросил, что делать на данном графике:

21 % проголосвало за лонг. Конечно же, если открывать здесь позицию на несколько дней, то нужно открывать шорт.

Всё довольно просто. Движение вниз 4 сентября — это сильнейший импульс, после которого цена, обычно, продолжает двигаться в том же направлении. EURUSD упал на две фигуры (!). Это как бы сильный тяжелый удар, после которого развернуться цене крайне сложно. Рынок инертен. На мой взгляд, продолжение движения после импульса — одна из вещей, на которой можно делать деньги на рынке.

21 % проголосвало за лонг. Конечно же, если открывать здесь позицию на несколько дней, то нужно открывать шорт.

Всё довольно просто. Движение вниз 4 сентября — это сильнейший импульс, после которого цена, обычно, продолжает двигаться в том же направлении. EURUSD упал на две фигуры (!). Это как бы сильный тяжелый удар, после которого развернуться цене крайне сложно. Рынок инертен. На мой взгляд, продолжение движения после импульса — одна из вещей, на которой можно делать деньги на рынке.

Блог им. renat_vv |Опрос - что бы вы сделали на данном графике (EURUSD)?

- 08 сентября 2014, 10:23

- |

Опрос - что бы вы сделали на данном графике (EURUSD)?

Какую бы позицию вы открыли, глядя на этот график (временной горизонт — несколько дней)?

www.tradingview.com/x/mz3mmDXQ/

Это пара EURUSD, график часовой. Свои комментарии дам по результату опроса.

Блог им. renat_vv |eur short (09.07.14)

- 09 июля 2014, 11:20

- |

На графике, пожалуй, мой любимый паттерн — импульс, последующая коррекция и свеча с длинной тенью, возникающая часто в завершение коррекции. Let's see!

4-х часовой график

4-х часовой график

Блог им. renat_vv |EURUSD: time to go short?

- 17 апреля 2014, 19:04

- |

EURUSD: time to go short?

Eurozone is probably facing risk of deflation.

It seems like disinflation trend is not going to stop.Europehas a lot of spare capacity (according to Mr. Draghi), output gap is about 2.1% (according to Goldman Sachs) and about 4% (according to OECD). Sudden inflation print below 0% can cause broad sell-off.

( Читать дальше )

Eurozone is probably facing risk of deflation.

It seems like disinflation trend is not going to stop.Europehas a lot of spare capacity (according to Mr. Draghi), output gap is about 2.1% (according to Goldman Sachs) and about 4% (according to OECD). Sudden inflation print below 0% can cause broad sell-off.

( Читать дальше )

Блог им. renat_vv |Перед ЕЦБ

- 06 февраля 2014, 14:23

- |

Итак, грамотный pre-view от одного чела:

What could the ECB do today? Last month, ECB President Draghi set out the two conditions that could induce the ECB to act: a worsening of the medium-term outlook for inflation and an unwarranted tightening of the short-term money markets. Since then, Eurozone inflation has indeed fallen and money market rates have indeed risen, with EONIA rising above the main refinancing rate in mid-January.

* I don't think either has gone far enough to get them to take any action yet. The fall in inflation is mostly accounted for by falling energy prices, which won't be affected by EU monetary policy. Furthermore, the improvement in the Eurozone PMIs suggest that the ECB's scenario of a gradually improving economy and rising inflation is still possible. Moreover, Draghi didn't say they would take action if inflation fell further, he said they would take action if the medium-term outlook for inflation worsened. That suggests they are likely to wait at least until after the results of the ECB's survey of professional forecasters is published on Feb. 13th to see whether inflation expectations are falling, and more likely until next month, when the new staff projections will be announced. As for the rise in money market rates, that probably hasn't been severe enough to warrant action, in my view.

( Читать дальше )

What could the ECB do today? Last month, ECB President Draghi set out the two conditions that could induce the ECB to act: a worsening of the medium-term outlook for inflation and an unwarranted tightening of the short-term money markets. Since then, Eurozone inflation has indeed fallen and money market rates have indeed risen, with EONIA rising above the main refinancing rate in mid-January.

* I don't think either has gone far enough to get them to take any action yet. The fall in inflation is mostly accounted for by falling energy prices, which won't be affected by EU monetary policy. Furthermore, the improvement in the Eurozone PMIs suggest that the ECB's scenario of a gradually improving economy and rising inflation is still possible. Moreover, Draghi didn't say they would take action if inflation fell further, he said they would take action if the medium-term outlook for inflation worsened. That suggests they are likely to wait at least until after the results of the ECB's survey of professional forecasters is published on Feb. 13th to see whether inflation expectations are falling, and more likely until next month, when the new staff projections will be announced. As for the rise in money market rates, that probably hasn't been severe enough to warrant action, in my view.

( Читать дальше )

Блог им. renat_vv |Тех. анализ. (евро, австралия, фунт) - результат и дальнейший взгляд.

- 05 декабря 2013, 11:25

- |

Какое-то время назад писал пост про евро, автралию и фунт (http://smart-lab.ru/blog/151780.php).

Там рекомендовал открывать шорт по евро, шорт по австралийскому доллару и лонг по фунту.

Если бы были открыты позиции, то были бы примерно след. результаты:

1. EURUSD -100 п.

2. AUDUSD +350 п.

3. GBPUSD +280 п.

Итак, что мы имеем сегодня.

1. EURUSD — шорт все еще остается актуален.

( Читать дальше )

Там рекомендовал открывать шорт по евро, шорт по австралийскому доллару и лонг по фунту.

Если бы были открыты позиции, то были бы примерно след. результаты:

1. EURUSD -100 п.

2. AUDUSD +350 п.

3. GBPUSD +280 п.

Итак, что мы имеем сегодня.

1. EURUSD — шорт все еще остается актуален.

- Евро показывает сильную устойчивость последнее время, это немного удивляет и настораживает. Однако я всё еще придерживаюсь взгляда, что в Европе нихера в целом не изменилось. Безработица растёт, долговая нагрузка на уровнях еще более высоких, чем до кризиса. Это вкратце. Говорят, в Европу всё еще идут сильные потоки из штатов. Тут еще заявления Китая, что они будут скупать европейские гос. облигации...

- Впереди, однако, нас ждёт tapering в штатах, и эту идею нужно отыгрывать уже сейчас.

- ЕЦБ всё еще имеет easing bias (новое LTRO, обсуждение негативной ставки и т.п.)

( Читать дальше )

Блог им. renat_vv |Простой тех.анализ по текущей ситуации (евро, австралия, фунт).

- 20 ноября 2013, 10:51

- |

1. EURUSD — entering short

Думаю, текущий уровень очень неплох для шорта. Этого уровня ждал больше недели.

Думаю также, что с текущих уровней можно вообще формировать долгосрочный шорт на идею таперинга и возобновления проблем в европе.

2. AUDUSD — little short

Скорее, шорт, чем лонг, хотя большой убежденности нет.

( Читать дальше )

Думаю, текущий уровень очень неплох для шорта. Этого уровня ждал больше недели.

- Логично вернулись к прорванному ранее каналу

- Есть наконец признаки, что стопы вынесли (pin-bar)

- Находимся на уровне выше, который был до снижения ставки ЕЦБ, хотя на рынке за это время толком ничего не произошло.

Думаю также, что с текущих уровней можно вообще формировать долгосрочный шорт на идею таперинга и возобновления проблем в европе.

2. AUDUSD — little short

Скорее, шорт, чем лонг, хотя большой убежденности нет.

- Похожа формируется всем известная фигура голова и плечи

- RBA (Банк Австралии) постоянно заявляет, что текущий уровень курса «uncomfortably high»

( Читать дальше )

Блог им. renat_vv |Технический обзор 13.06.13

- 13 июня 2013, 13:53

- |

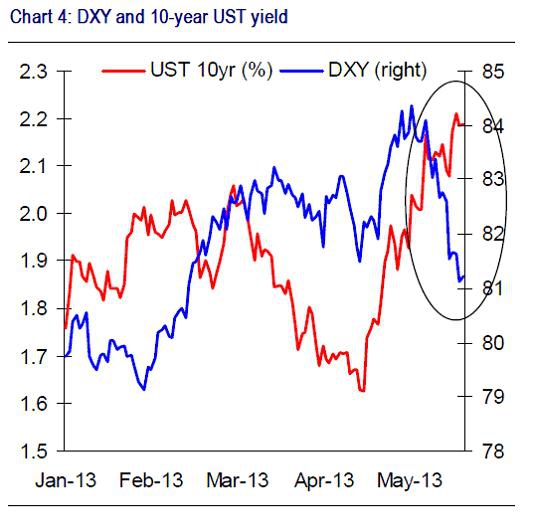

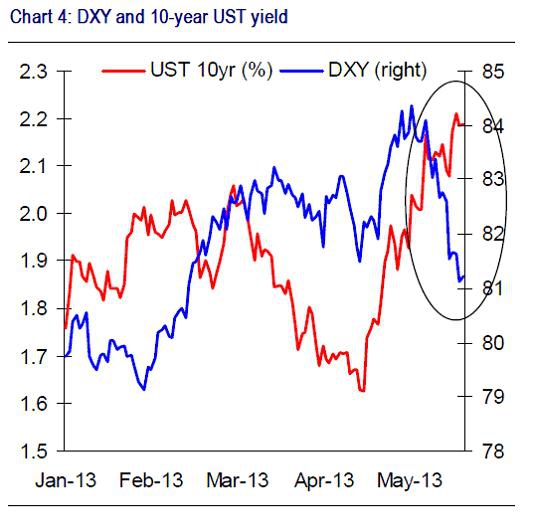

1. Dollar index

( Читать дальше )

- Думаю, с текущих уровней можно начинать присматриваться к покупкам доллара.

- Наблюдается расхождение между ростом 10-летних ставок и долларом, что заставляет задуматься:

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- алроса

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- золото

- инвестиции

- индекс мб

- инфляция

- китай

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдер

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- юмор

- яндекс