Блог им. st-travich |So brave Bears 🐻 started in S&P 500 and lost everything by the end of the week

- 28 мая 2023, 16:59

- |

Hello dear traders!

● So brave Bears 🐻 started in S&P 500 and lost everything by the end of the week

● What will be next? now it is difficult to predict.

Nasdaq made an impudent bullish workout of the support 👏

( Читать дальше )

- комментировать

- Комментарии ( 1 )

Блог им. st-travich |Today I want to show you some interesting situations in the commodities market

- 16 апреля 2023, 18:38

- |

Good evening, dear traders!

Today I want to show you some interesting situations in the commodities market.

▪️ The previous week I spoke about Natural gas (NG) and we really saw a pullback after the HFT volumes. Such a picture was repeated on Friday after 2 days divergence of deltas, and for now, the potential of the uprising movement is even stronger.

We had stop-loss hunting and involvement cocktail which is the fuel for MM, hedge funds shorted 2 weeks in a row. Earlier everybody tried to buy this cheap asset, but the price couldn't go to the upside till this Bid imbalances. (Watch)

▪️ In Crude oil (CL) the market made several Ask imbalances, and for now, is ready to make a correction to the 80.5 price level. (Watch)

( Читать дальше )

Рецензии на книги |“Unknown Market Wizards” Jack Shwager review about ***Peter Brandt***

- 28 марта 2023, 12:49

- |

Hello traders 👋

Today I want to share with you a review of the first trader from the last book of Jack Schwager “Unknown Market Wizards”

His name is ***Peter Brandt***

27 years of trading experience till 2020 (when the book was published for the first time)

14 and 13 years in a row with 11 years of pause between 😱

Settled in this business as a trainee for a commodity broker in the year 1972. Started his own trading around 1976, and from 1981 had a track record.

His average annual return is 58% 🏋️

Sharp ratio = 1.11, Sortino ratio = 3.00 Gain to pain ratio = 2.81

Succeeds nonetheless because his average gain is much larger than his average loss.

He is a breakout trader.

Bad years 1988 🆘 (After nine good years I got sloppy. I would enter chart patterns too early. I would chase markets. I didn’t have orders where I should have.)

And in 2013 🆘 when he decided to accept other people's money (That messed up his trading. I was out of sync with my approach. I am not being disciplined. I am not being patient. I’m jumping the gun on trades. I am taking positions before the market confirms them. I am taking trades on inferior patterns.)

( Читать дальше )

Блог им. st-travich |According to the latest news, next week will be hot for sure. 🔥

- 12 марта 2023, 17:27

- |

Hello, traders!

According to the latest news, next week will be hot for sure. 🔥

On Thursday we received on Euro (6E) the incredible uprising of open interest (+18K contracts) in “Put” options strike 1.04 (Watch prnt.sc/n_GEI456fpjG)

Amazing, before the technical support! 🤪

That was a big hedge before the bankruptcy of Silicon Valley Bank, someone understood that the time would come to withdraw dollar liquidity from the market.

All currencies, except the dollar DXY, will feel strong pressure from sellers and Indices of course next week.

Stronger, to my mind, will be the Grain market.

In continuation of the previous downside forecast for Сorn (ZC) (Watch prnt.sc/HHsH8uCit3sm)

( Читать дальше )

Торговые сигналы! |⚡️ Interesting forecasts were that week, and I am also shocked that the market shows everything according to plan. Is it chaotic⁉️

- 09 марта 2023, 12:44

- |

Блог им. st-travich |⚡️ Today I want to justify about 3 interesting pictures on the futures market.

- 05 марта 2023, 22:02

- |

Good evening, traders! 👋

Today I want to justify about 3 interesting pictures on the futures market.

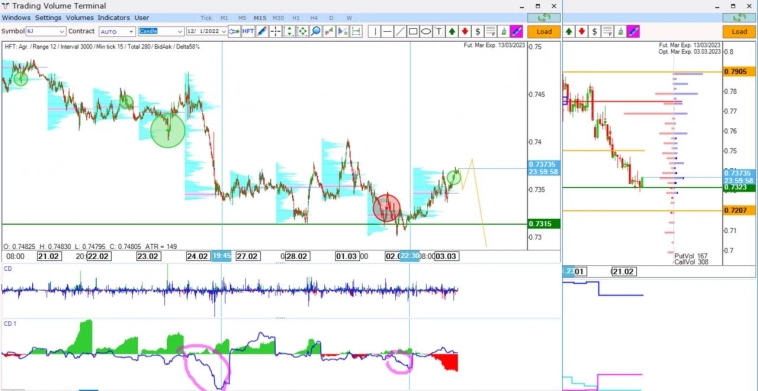

▪️ Japanese yen (6J) shows preparations to break the demand zone.

The quantitative cumulative delta was negative several times before the support. Bid HFTs were created near the level, and afterward, we can observe the involvement in buys. It is necessary to collect liquidity and then, break the demand level. If after the current Ask tick chain, the price stops growing it will be a good selling opportunity.

▪️ Brent Oil (BR) created a new uptrend line with the help of fast tick chains on it. Very often price return to such trendlines and break them.

( Читать дальше )

Блог им. st-travich |Flash in the pan 😕

- 18 сентября 2022, 17:07

- |

Flash in the pan 😕

Hello, traders

That week was really difficult and some of the forecasts were wrong. So today we will focus on analyzing mistakes and making conclusions.

This video is only 9 minutes, but still, I tried to make it informative and useful for you, please watch

( Читать дальше )

Блог им. st-travich |Next DXY reversal point and peculiar workout in Soybeans 🔥

- 07 августа 2022, 23:50

- |

Good evening, Traders!

That week was very interesting, and we will observe it and make predictions for the next one.

NEW 11-minute video for you about :

DXY, Euro, S&P 500, Oil, Japanese yen, Natural Gas, Soybeans

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- алроса

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- золото

- инвестиции

- индекс мб

- инфляция

- китай

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдер

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- юмор

- яндекс