SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

wannatradelikePTJ

DAX brief update

- 24 мая 2013, 20:02

- |

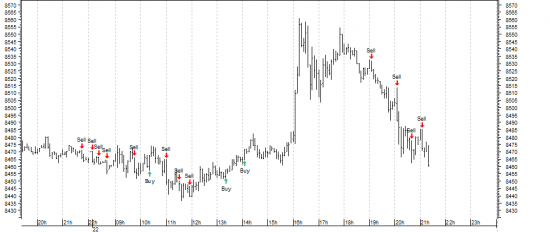

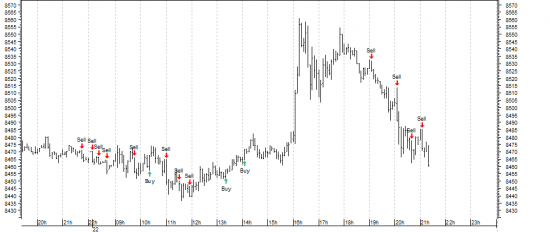

Dax June 13 traded through a pretty choppy session today, with downward bias. Still there is a fair chance for a terminal swing higher to ~8450 in order to complete the upward correction. Indicators on higher TFs (H1 & D1) remain firmly in the «sell» mode, though.

- комментировать

- Комментарии ( 2 )

DAX brief update

- 24 мая 2013, 14:55

- |

Dax June 13 had a 300 points dynamic sell-off after reaching my stipulated targets above 8500. Taking into account the dynamics of the downmove, I am switching to the alternative wave count I've shown the other day — that is, the Dax has topped on 22 May. This implies much more downside outright, with targets below 7400. Short term, a residual upswing to ~8450 is possible, but any such upside should be retraced down thereafter, immediately. Stay tuned

DAX update

- 22 мая 2013, 23:24

- |

Market has sold-off after reaching stipulated technical targets, this could imply some downside for days to come. Yet it's too early to consider market ultimate top.

Stay tuned.

( Читать дальше )

Stay tuned.

( Читать дальше )

DAX update

- 22 мая 2013, 21:18

- |

On 8 May I said that the probable target for the advance is about 8500. Today Dax June 13 traded at 8561 — high for the day so far. So that technical targets has been met today. Yet there is no indication for trend change, and we should assume that the trend is still up. Market could grind higher in coming weeks. I expect the rally to terminate by early June. The pending reversal should bring a tremendous downside potential.

DAX update

- 08 мая 2013, 15:38

- |

I think Dax June 13 is due for correction and that it's good level to take profit on longs. On larger timeframes, there likely will be at least one down-up sequence, in order to complete rally from 19th April's low. Targets for upside are around 8500. The less probable, but still possible option is for market to top out here and turn down decisively.

DAX brief update

- 03 мая 2013, 17:27

- |

On April 23th I wrote: «Dax June 13 has rallied smartly, momentum has shifted decisively to the upside. Market is open for more upside in coming days/weeks, targets are above 8100»

Today, Dax June 13 has hit the first stipulated target — 8100, a wooping 600+ points gain in just eight days. Rally doesn't look finished, but quite over-extended in the short-term, so I think it worths to take 1/2 chips out of the table.

Stay tuned.

Today, Dax June 13 has hit the first stipulated target — 8100, a wooping 600+ points gain in just eight days. Rally doesn't look finished, but quite over-extended in the short-term, so I think it worths to take 1/2 chips out of the table.

Stay tuned.

DAX brief update

- 23 апреля 2013, 21:20

- |

On April 17th I wrote: «I expect market to rally for several handreds points from here, but I still have no reliable evidence that the turn has occured already». Market continued trading in choppy sideways manner for next several days.

And today Dax June 13 has rallied smartly, momentum has shifted decisively to the upside. I think that the market is open for more upside in coming days/weeks, targets are above 8100.

And today Dax June 13 has rallied smartly, momentum has shifted decisively to the upside. I think that the market is open for more upside in coming days/weeks, targets are above 8100.

DAX brief update

- 17 апреля 2013, 15:40

- |

There is little to update regarding DAX June 13 — technicals are muted and my prop indicators remain in «sell». Nevertheless, I am of the opinion that market has bottomed today @7492, or maybe will sink marginally lower. While I expect market to rally for several handreds points from here, I still have no reliable evidence that the turn has occured already.

DAX brief update

- 12 апреля 2013, 19:16

- |

Technical picure in Dax June 13 remains somewhat muted, but the basement for bullish case has been laid with the strong momentum shift happened yesterday. Trading above 7800 would confirm odds for extended rally next week. My prop indicators remain «sell» from late yesterday, I will turn long as soon as I have them flipped up.

DAX brief update

- 12 апреля 2013, 13:33

- |

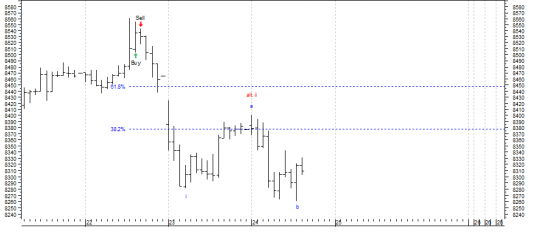

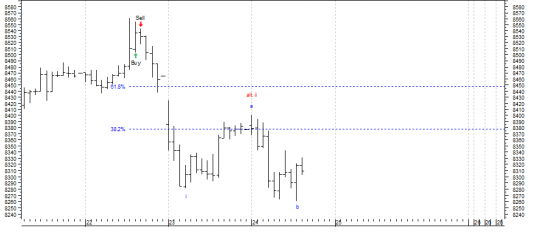

I must admit I am lost pattern-wise, having no credible forecast for immediate future.

But that's what I have on my trading algo — that's what I base my trading decisions on:

( Читать дальше )

But that's what I have on my trading algo — that's what I base my trading decisions on:

( Читать дальше )

теги блога wannatradelikePTJ

- AAPL

- Australia

- bitcoin

- Bonds

- Brent

- copper

- DAX

- DJIA

- Dow Jones Industrial

- e-mini S&P 500

- EURO STOXX 50

- eurostoxx

- eurusd

- FCX

- Merval

- natural gas

- NYSE

- RUB

- stoxx50

- usdjpy

- USDRUB

- WTI

- WTI и BRENT

- торговые сигналы