SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

офз

Моя текущая опционная стратегия

- 07 апреля 2016, 19:33

- |

Итак, внес корректировку в свою апрельскую стратегию - http://smart-lab.ru/blog/317620.php

а именно:

1) продал все облигации ОФЗ серии 29006 (на фоне заявлений Набиуллиной о продолжении цикла снижения ставок это была не самая выгодная покупка);

2) Сформировал кошку на SIM6 на майскую экспирацию:

Таким образом, моя стратегия на апрель/май теперь выглядит таким образом:

( Читать дальше )

а именно:

1) продал все облигации ОФЗ серии 29006 (на фоне заявлений Набиуллиной о продолжении цикла снижения ставок это была не самая выгодная покупка);

2) Сформировал кошку на SIM6 на майскую экспирацию:

Таким образом, моя стратегия на апрель/май теперь выглядит таким образом:

( Читать дальше )

- комментировать

- ★2

- Комментарии ( 5 )

ОФЗ возможен разворот

- 05 апреля 2016, 19:26

- |

Ребята будте аккуратны возможен разворот на Российских ОФЗ. Особенно после всех скандалов с правительством инвесторы очень нервничают.

Минфин по-прежнему делает ставку на Резервный фонд

- 28 марта 2016, 13:07

- |

Минфин по-прежнему делает ставку на Резервный фонд

В пятницу Минфин провел очередную встречу с участниками рынка, из которой интересными мы считаем следующие моменты:

( Читать дальше )

To Фыва график ОФЗ и 3 месячного форварда

- 22 марта 2016, 10:43

- |

я ей богу не знаю что тов. Левченко на этих графиках видит, но если ему это помогает торговать — только в помощь :)

не знаю какие ОФЗ он берет в расчет, я взял 3 и 10 летние

более короткие это чисто казначейский продукт для банков и НПФов, более длинные это «чисто» спекулянты

видно, что «горбик» превышения доходности ОФЗ над ставкой форварда был только в момент, когда сбили боинг и народ пофиксил ОФЗ

потом кривая форварда опять ушла выше доходности ОФЗ, и там остается

Это 3 месячные форвард на рубль и 3 летние ОФЗ

Это 3 месячные форвард на рубль и 10 летние ОФЗ

( Читать дальше )

не знаю какие ОФЗ он берет в расчет, я взял 3 и 10 летние

более короткие это чисто казначейский продукт для банков и НПФов, более длинные это «чисто» спекулянты

видно, что «горбик» превышения доходности ОФЗ над ставкой форварда был только в момент, когда сбили боинг и народ пофиксил ОФЗ

потом кривая форварда опять ушла выше доходности ОФЗ, и там остается

Это 3 месячные форвард на рубль и 3 летние ОФЗ

Это 3 месячные форвард на рубль и 10 летние ОФЗ

( Читать дальше )

Куда вложиться на краткосрок с мин.риском?

- 14 марта 2016, 11:04

- |

На депо скопилась часть неиспользованных средств.

Не хотелось бы, чтобы они лежали в кэше мертвым грузом (= кредитовать брокера).

Подскажите, что во что можно вложиться с горизонтом 2-3 мес. с минимальным риском?

Пока что вижу только два варианта.

1) краткосрочные ОФЗ. Но вкусные ОФЗ сейчас стоят дорого и за 2-3 мес можно банально потерять на спреде.

2) еще, я так понял, можно купить своп USD_TODTOM. Но как работает этот инструмент и как подсчитать его доходность понять не могу. Также не понимаю, что происходит со купленным свопом при снижении курса USD.

Как использовать наиболее эффективно свободные рублевые средства?

- 09 марта 2016, 11:59

- |

Коллеги, просьба дать совет, как наиболее эффективно и безопасно использовать свободные рублевые средства, после продажи $.

Как я делаю это сейчас -

30% лежит на карте под 8% на остаток.

10% в вкладе до востребования 5% годовых.

30% куплены, по рекомендации Олейника FXMM ETF (около 11% годовых).

20% куплены ОФЗ

Задача продержать полмесяца — месяц — два месяца рубли до появления возможности зайти в бакс от 65 — 70 и держать бакс.

Скорее всего более эффективных инструментов я не знаю, порекомендуете?

Как я делаю это сейчас -

30% лежит на карте под 8% на остаток.

10% в вкладе до востребования 5% годовых.

30% куплены, по рекомендации Олейника FXMM ETF (около 11% годовых).

20% куплены ОФЗ

Задача продержать полмесяца — месяц — два месяца рубли до появления возможности зайти в бакс от 65 — 70 и держать бакс.

Скорее всего более эффективных инструментов я не знаю, порекомендуете?

С праздником милые дамы !

- 08 марта 2016, 16:07

- |

Чтобы заработать благ для любимых дам, мужчине стоит очень стараться в своих инвестициях и долго медитировать над своим портфелем, что я в очередной раз и делаю )

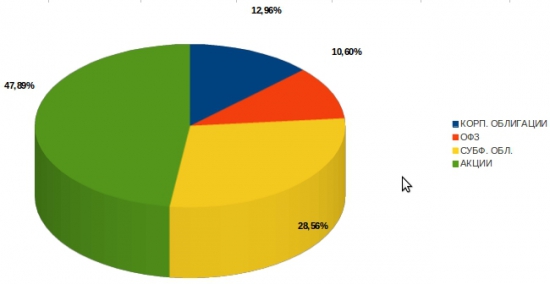

Похоже сейчас открывается замечательная возможность «перетряхнуть» содержимое инвестиционных портфелей: Скорее всего рынок акций продолжит рост в краткосрочной перспективе и это позволит продать неинтересные акции по интересным ценам. Освободившиеся средства можно разместить в инструменты с фиксированной доходностью. Пока смотрю на суб.федеральные облигации, которые сейчас предлагают доходность 10-12% и и накопительные счета в надежных банках под 5-7% годовых. После коррекции рынка, можно опять войти в акции, но другие — с более привлекательными дивидендными перспективами. Это позволит сохранить достойную среднесрочную доходность по портфелю, т.к. заработав десятки процентов на росте акций, можно и зафиксировать доход на невысоком уровне до ближайшей коррекции ММВБ ниже 200-дневной скользящей средней. А потом опять войти в акции. И так повторять много раз. Такая тактика.

Фиксирую распределение между ценными бумагами в портфеле на 07.03.2016 :

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- алроса

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- золото

- инвестиции

- индекс мб

- инфляция

- китай

- кризис

- криптовалюта

- лидеры роста и падения ммвб

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- си

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трейдер

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- юмор

- яндекс

Новости тг-канал

Новости тг-канал