рынок США

S&P500 пробил ВАЖНЫЙ уровень! Все становится хуже

- 04 мая 2021, 19:01

- |

- комментировать

- Комментарии ( 0 )

sunnytrueman: 700% годовых - лонгую волатильность через опционы

- 26 апреля 2021, 19:50

- |

Кратко для разбирающихся в опционах:

Sell VXX 40 put (premium 3.70, 25 days to expire) & 60 call (premium 2.56, 53 days to expire).

Я покупаю волатильность продавая волатильность через стренгл опционов на ETN фьючерсов вмененной волатильности опционов на фьючерс индекса широкого рынка акций 500 крупнейших компаний США.

Подробно:

Идея:

Волатильность на рынке США упала.

Чтобы она упала еще сильнее рынку США нужно и дальше продолжать расти или стоять на месте или расти без коррекций.

Я считаю такой сценарий маловероятным. Я считаю, что на рынке США будет как минимум коррекция (даже если будет рост) и хочу заработать на росте или стоянии на месте волатильности, когда это произойдет. В общем-то мне неважно будет рынок США расти, падать или стоять на месте, главное, чтоб он иногда падал, поддерживая волатильность на текущих или чуть выше уровнях.

( Читать дальше )

Управляющие в США находятся в состоянии самоуспокоенности

- 20 апреля 2021, 08:58

- |

Вчера отечественные индексы показали отрицательную динамику. США могут запретить своим компаниям покупать российские долговые обязательства и на вторничном рынке. Это обстоятельство на время снизило у инвесторов аппетит к риску. Отдельные пакеты санкций не несут России большого экономического ущерба, но когда санкций много создается некая токсичная экономическая среда, которая мешает развитию экономики. Например, иностранные поставщики оборудования бояться попасть под санкции и перестают его обслуживать и поставлять запасные части. Вопрос довольно острый так как многие отечественные предприятия нуждаются в модернизации. К примеру, статистика показывает большой износ основных производственных фондов в Уральском федеральном округе. С точки же зрения спекуляций, постоянная угроза новых санкций это благо. Фондовый рынок все время меняет направление движения. Спекулянтам главное чтобы он не стоял на месте. Индекс РТС и его фьючерс 13 апреля пробили наверх локальный мартовский нисходящий тренд после чего фьючерс на индекс РТС вырос, но не смог преодолеть локальное сопротивление 146970.

( Читать дальше )

Чем больше горизонт инвестирования, тем меньше вероятность потерять деньги

- 31 марта 2021, 11:09

- |

Наткнулся на исследование американского рынка акции за длительный период в 147 лет, которое наглядно показывает положительный эффект долгосрочных инвестиций.

Аналитики сделали обзор рынка акций с 1872 по 2018 год и подсчитали какая была бы реальная доходность инвестиций в акции на разных периодах вложений: 1 год, 5, 10 и 20 лет. С учетом реинвестирования и поправки на инфляцию.

Общие выводы:

👉 Чем меньше период инвестирования тем выше шанс словить как большую доходность, так и большую просадку.

👉 С увеличением срока инвестирования уменьшается количество периодов с отрицательной доходностью, то есть вероятность уйти в минус становится меньше.

👉 Например, при инвестирования на срок в 1 год можно было как заработать 53%, так и потерять 37%.

👉 При инвестировании на срок в 20 лет не было ни одного периода с отрицательной среднегодовой доходностью. Минимальный результат для одного из 20-летних периодов 0,5% годовых.

( Читать дальше )

Выбор иностранного брокера для торгов на рынке США.

- 31 марта 2021, 10:41

- |

Экспресс разбор компаний США: Abbvie (ABBV)

- 30 марта 2021, 19:38

- |

Продолжаем наше исследование американского рынка. И на этот раз у нас представитель биофармацевтического сектора - Abbvie.

Одна из крупнейших американских биофармацевтических компаний. По капитализации входит в топ-5 компаний сектора, торгующихся в США. К слову, сейчас торгуется и на Московской бирже. Компания Abbvieдолгие годы входила в состав Abbott Laboratories. С 2013 является отдельной компанией. Руководство решило разделить бизнесы в сфере медицинского оборудования и специализированных устройств и фарму. Как раз последний сегмент отошел Abbvie и успешно продолжает развиваться.

Львиная доля выручки компании приходится на препарат Humira, который применяется для лечения ревматоидного артрита и других болезней. Остальная доля приходится на препараты в областях: иммунология, нейробиология, онкология, вирусология и даже уход за глазами. Компания также имеет портфель перспективных разработок, которые находятся на разных этапах утверждения и дистрибуции. Abbvie широко представлена в более чем 200 странах и продолжает расширяться. В первую очередь это происходит за счет покупки других фармацевтических компаний.

( Читать дальше )

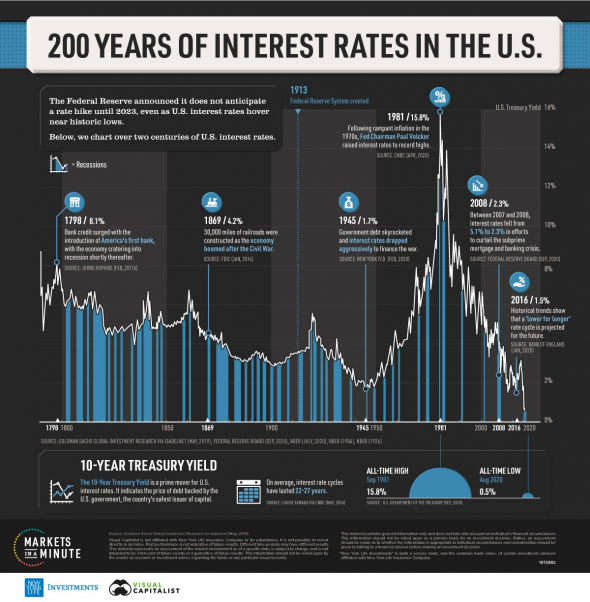

Какая процентная ставка вызовет следующий кризис?

- 19 марта 2021, 04:58

- |

Доходность 10-летних казначейских облигаций США составляет 1,61%.

Доходность 10-летних корпоративных облигаций 2,09%.

Ставка по 30-летней ипотеке — 3,05%.

Несмотря на недавнее повышение, процентные ставки колеблются около исторических минимумов. Давайте не будем относится к слову «исторический» легкомысленно. Под «историческим» подразумевается самый низкий уровень с 1776 года.

Любезно предоставленный график Visual Capitalist подчёркивает эту точку зрения.

Несмотря на 300-летние минимумы процентных ставок, инвесторы начинают беспокоиться, потому что ставки растут. Как показывает история, волноваться действительно есть о чём. Данные за последние 40 лет показывает, что внезапные всплески процентных ставок и финансовые проблемы идут рука об руку.

Вопрос для всех инвесторов: насколько большим должен быть скачок, чтобы история снова повторилась?

( Читать дальше )

В какие акции будут заходить те самые 40% от суммы чеков полученных американцами. Мнение и дискуссия. ???

- 12 марта 2021, 11:06

- |

Смотрим индикатор перекупленности. Есть один сектор недооцененных акций. Угадайте какой?

- 19 февраля 2021, 11:30

- |

Попался на глаза интересный индикатор от аналитической компании Morningstar. Называется Справедливая рыночная стоимость (Market Fair Value). Есть информация как по всему рынку акций, так и по секторам.

Можно посмотреть в какие периоды рыночной истории цены на акции были привлекательными. Как правило, это периоды сильных потрясений на рынках вроде Мирового финансового кризиса в 2008 году или прошлогодний обвал на коронавирусных опасениях.

Давайте посмотрим подробнее.

Если график в зеленой зоне, то акции в настоящий момент недооценены. Если в красной — переоценены.

Увы, почти по всем секторам индикатор в красной зоне. Можно сказать, на рекордно высоких значениях.

График оценки всего рынка

В начале года индикатор зашкалил на рекордную отметку.

Во время обвала весной прошлого года, наоборот, акции были существенно недооценены.

( Читать дальше )

Рынок США: цены на нефть достигли пика пандемии

- 18 февраля 2021, 14:59

- |

Морозная погода в некоторых регионах США спровоцировала очередное ралли цен на энергоносители и помогла нефти марки WTI подняться выше $60 за баррель впервые с первых дней пандемии коронавируса.

Нефть марки Brent, международный эталонный показатель поднялась на 1,23% до $65,13 за баррель. Согласно данным Американского института нефти, запасы сырой нефти в США снизились на 5,8 млн баррелей за неделю, хотя участники рынка ожидали снижения на 2,4 млн баррелей.

Последний всплеск на энергетическом рынке произошел, когда холодная погода ударила по некоторым частям США и стимулировала спрос на электроэнергию и топливо, одновременно угрожая сокращением добычи в штате Техас.

«Снежный шторм и рекордно низкие температуры, которые продвигаются на юг, в Хьюстон, могут иметь серьезные последствия для нефтяной промышленности», – сообщил нефтяной аналитик Энди Липоу.

«Холодная погода означает, что многие нефтяные скважины могут быть закрыты. Вода добывается вместе с нефтью, и эта вода может заморозить оборудование, – добавил он. –Холодный воздух влияет на добычу нефти в Канаде, Северной Дакоте, Оклахоме, Техасе и других местах».

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- алроса

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- золото

- инвестиции

- индекс мб

- инфляция

- китай

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- натуральный газ

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- юмор

- яндекс

Новости тг-канал

Новости тг-канал