ES

Опционный анализ 17 апреля 2023

- 17 апреля 2023, 11:54

- |

Анализ приоритетов движения рынков на основании опционного анализа ➡️ понедельник, 17 апреля 2023

- комментировать

- Комментарии ( 0 )

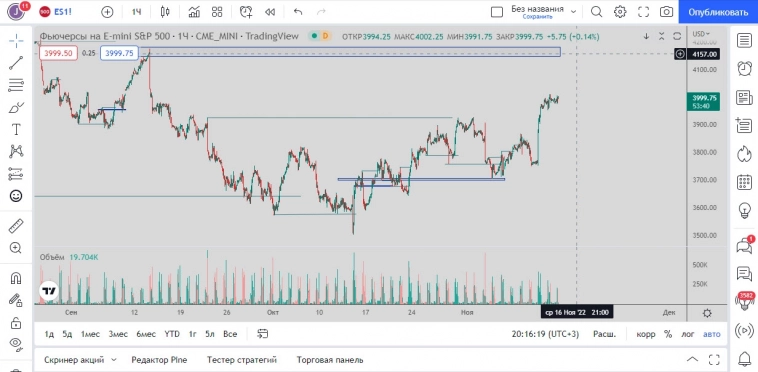

SP500. Ограниченные покупки.

- 03 марта 2023, 16:23

- |

Ниже приведу зоны покупок и ситуацию на всех таймфреймах, для торговли внутри дня.

SP500. Биржа CME (контракт 03-23)

тот же график в полном размере i.ibb.co/fNKYwD7/2023-03-03-160941.png

Сквозной анализ всех таймфреймов:

D1. Находятся в боковике, вчера приблизились к объемной зоне 3916 — 3895,25 откуда дали реакцию. Для этого тф приоритет продаж сохраняется. Сверху есть объем продавца 4018,5 — 4022,75, с которого вероятнее продолжат нисходящее движение.

Н1. Приостановили продажи и ушли на коррекцию, приоритет продаж сохраняется пока стоят под зоной продавцов 4022,75, вероятнее добьют зону, где увидим реакцию по защите, затем начнут двигать вниз ко вчерашним объемам 3937 — 3931.

М5. Сломали боковик, совершают попытку ухода в BUY тренд, на текущий момент приоритет покупок, но они ограничены зоной с Н1. Если достигнут нижней границы 3976,75, вероятность BUY приоритета ослабеет, там уже скорее будут пытаться продавить с ретестом зоны снизу и зайти на вчерашние объемы.

( Читать дальше )

We still don’t have CFTC report because of the impact of the cyber-related incident at ION is being mitigated

- 12 февраля 2023, 22:47

- |

Good day traders, we still don’t have CFTC report because of the impact of the cyber-related incident at ION is being mitigated.

Multiple reporting firms continue to experience technical issues that prevent submission of timely and accurate data to the CFTC. As a result, the weekly CFTC Commitments of Traders report will continue to be delayed until the receipt and validation of all reportable data is completed.

I already started to miss this data, as it really gives a better market understanding.

Nevertheless, I want to share with you with few engaging scenarios which may realize in the next week.

Natural Gas (NG) has a chance to reach 3$ target per MMBtu (watch)

We see that all the cumulative delta is negative, but the price grows and fixed above 2.5 technical and round number structure.

But to my mind everything is too sweet, that's why I think that the market will activate the liquidity under the level and only then will go to fair value. (watch)

Such enforcement of QD on Friday is not an empty sound.

( Читать дальше )

Today I have no possibility to make a video forecast, but I want to measure some ideas for you.

- 29 января 2023, 20:30

- |

Good afternoon, traders!

The price closed below the huge Ask tick chain near 4100, not achieved to the supply zone, and made a fast pullback. I see shorting opportunity, that the price will reach the 4020 price level.

Silver (SI)

On Silver vice-versa we see a Bid tick imbalance and some accurate algorithmic purchases on Friday according to the cumulative delta quantitative (CDQ) which diverges with the volume delta (CD). The price is coiling in the long-range during last 2 months and has a high probability to move toward the upper boundary and break it.

Copper (HG)

Copper made a peculiar squeeze of buyers, created a Bid tick imbalance, and bounced back from a commercial level into the range. Hedge funds continue aggressively buying the asset, increasing their longs by 18% with the OI increase by 6%.

We see a very strong divergence between CDQ and CD, clear absorption of stoploss liquidity with algorithms.

( Читать дальше )

⚡️ Fresh volume view on Coffee, Corn, Oil, SP500, Gas, Pound

- 11 декабря 2022, 01:50

- |

Today I finally made a short but very intense review of the most interesting current imbalances on the most liquid instruments of commodities, currencies and indices. 🤩

A fresh view on Coffee (KC), Corn (ZW), Crude Oil (CL), Brent (BR), S&P500 (ES), Natural Gas (NG), British Pound (6B), Euro (6E), Mexican peso (6M).

Really a lot of peculiar market pictures to workout the following week 💪

This 10 minutes video is ready for your attention! 👇

( Читать дальше )

ES 26.10

- 26 октября 2022, 20:43

- |

День.

Цена практически дошла до уровня. Верхней тенью. Идет уменьшение объемов. Движение можно считать отработанным. Но может и дальше пойти.

Robbins World Cup 2022 participation

- 02 октября 2022, 15:05

- |

Hello friends, finally I entered the list of the world 🌎 best traders according to famous world cup trading championship in which Larry Williams participated. This is the futures and forex section combined.

www.worldcupchampionships.com/world-cup-trading-championship-standings

This year I started this competition which began on June 1, and honestly, I am very happy to see my result on this list today. 🥳

During this competition of course I use the same methods and tools of volume analysis and order flow analysis that I give you in my market reviews and forecasts.

And today I also want to present you with such a forecast. That week was very volatile, very liquid, with a lot of strong movements, and I want to discuss with you some imbalances on the futures market which happened by the end of the week.

We will measure the Canadian dollar (6C), Japanese yen (6J), S&P 500 (ES), US Treasuries (UB) .

This 8-minute video is for you today

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- алроса

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- золото

- инвестиции

- индекс мб

- инфляция

- китай

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- натуральный газ

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- юмор

- яндекс

Новости тг-канал

Новости тг-канал