SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Fx-Specialist

Эксклюзивно для смартлаб EurUsd OTC FWD AVG-Ex (Reuters)

- 03 августа 2017, 02:08

- |

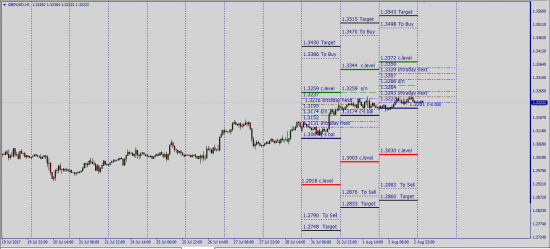

Ценовое значение FWD AVG ----- как средний ценник желающих купить-продать актив

Попробуем использовать его в торговле на Fx

Оценим риск по паре и попробуем совершить сделку к уровню 1.1881

Откроем серию ордеров Buy с целью 1.1881 stoploss 1.1790

( Читать дальше )

EurUsd....... Индикация Insider-Fx EurUsd

- 03 августа 2017, 00:34

- |

Пробитие и закрепление выше 1.1900 ------ реализация спот позиций с целью 1.2005

http://dropmefiles.com/z55GB

EurUsd справляется с таргетированием (Лонг - опасная игра )

- 02 августа 2017, 20:20

- |

Дальнейший лонг по паре только по причине явных факторов......

https://smart-lab.ru/blog/tradesignals/411868.php

DJ Switzerland"s First-World Problem : What to Do With 750$ Billion

- 02 августа 2017, 18:36

- |

Thanks to its efforts to weaken the franc, the Swiss central bank has amassed $750 billion in stocks, bonds and

cash.

That has provoked a lively debate in Switzerland: What should the country do with all of that? And whose money is

it, anyway?

For now, the Swiss National Bank holds on to it, and invests it around the world--but not in Switzerland. It held

$2.7 billion in Apple Inc. stock, for instance, at the end of March. Some lawmakers and many economists think a

sovereign-wealth fund created outside the SNB should invest a chunk at home.

The SNB's profit last year was 24.5 billion francs ($25.4 billion), or about $3,000 per Swiss resident.

Switzerland's central bank isn't the only one making profits. The Federal Reserve earned nearly $100 billion last

year from its bond portfolio. Eurozone central banks also make profits. But these central banks pass a big chunk of them

to their treasuries.

The SNB's current agreement with the government, which runs through 2020, allows for profit distribution of up to 2

billion francs a year. The SNB has put most of its profits into buffers to guard against large paper losses, which

occurred two years ago when the franc soared.

Two dozen Swiss parliamentarians want the arrangement to change and in June backed legislation introduced by

Socialist lawmaker Susanne Leutenegger Oberholzer to use some reserves and their profits for a sovereign-wealth fund.

Unlike the SNB, which invests the reserves only in non-Swiss assets, a fund could put the money to work inside

Switzerland, boosting long-term growth, backers say. The SNB takes passive positions in foreign stocks to mirror broad

( Читать дальше )

cash.

That has provoked a lively debate in Switzerland: What should the country do with all of that? And whose money is

it, anyway?

For now, the Swiss National Bank holds on to it, and invests it around the world--but not in Switzerland. It held

$2.7 billion in Apple Inc. stock, for instance, at the end of March. Some lawmakers and many economists think a

sovereign-wealth fund created outside the SNB should invest a chunk at home.

The SNB's profit last year was 24.5 billion francs ($25.4 billion), or about $3,000 per Swiss resident.

Switzerland's central bank isn't the only one making profits. The Federal Reserve earned nearly $100 billion last

year from its bond portfolio. Eurozone central banks also make profits. But these central banks pass a big chunk of them

to their treasuries.

The SNB's current agreement with the government, which runs through 2020, allows for profit distribution of up to 2

billion francs a year. The SNB has put most of its profits into buffers to guard against large paper losses, which

occurred two years ago when the franc soared.

Two dozen Swiss parliamentarians want the arrangement to change and in June backed legislation introduced by

Socialist lawmaker Susanne Leutenegger Oberholzer to use some reserves and their profits for a sovereign-wealth fund.

Unlike the SNB, which invests the reserves only in non-Swiss assets, a fund could put the money to work inside

Switzerland, boosting long-term growth, backers say. The SNB takes passive positions in foreign stocks to mirror broad

( Читать дальше )

Проект '' Smart Trade By Forex'' корректирока tp . Открытие новой позиции по GbpUsd

- 24 июля 2017, 17:42

- |

Корректировка tp по среднесрочным позициям

EurUsd ----- 1.2230

UsdChf ----- 0.8745

Открыта новая позиция по паре GbpUsd (Long) tp 1.3390

https://smart-lab.ru/blog/410190.php

EurUsd ----- 1.2230

UsdChf ----- 0.8745

Открыта новая позиция по паре GbpUsd (Long) tp 1.3390

https://smart-lab.ru/blog/410190.php

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- алроса

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- золото

- инвестиции

- индекс мб

- инфляция

- китай

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- си

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- юмор

- яндекс

Новости тг-канал

Новости тг-канал