xiv

Результаты трейдинга - US stock portfolio (YTD) и пару интересных графиков

- 13 февраля 2018, 22:44

- |

Давно хотел написать апдейт, но со временем совсем напряженно, так что вот только сейчас наконец дошли руки...

Результат портфеля (01.01-13.02): -2.1% (underperformance -1.43% vs S&P-500 )

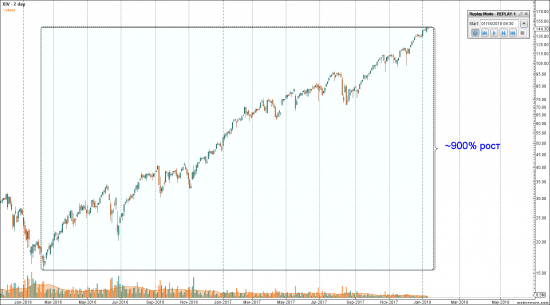

Несмотря на довольно скучные (грустные) цифры как по портфелю, так и по S&P-500 с начала года, время, конечно, было очень веселое. Особенно порадовались те, кто продолжал шортить волатильность, через inverse ETF — довольно популярный трейд на западе.

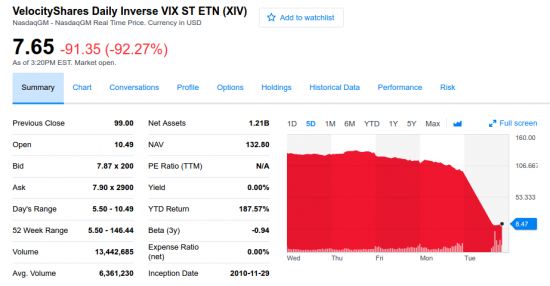

Грустная история XIV

График XIV (самого большого ETN на эту тему) до некоторых пор был практически идентичен тому, что рисовали ведущие американские индексы, вот только если S&P-500 с начала 2016 года до пика вырос чуть больше чем на 50%, то XIV вырос на все 900%. Как можно догадаться, для тех кто хочет «много и сразу», это прямо был очень заманчивый инструмент. В итоге на хаях, капитализация данного ETN составила примерно 3 млрд, и здесь мы говорим не о институционалах, а о ритейл инвесторах, то есть 3 млрд поэтому совсем немало. Но в феврале вдруг что-то пошло не так, и в одно прекрасное утро XIV открылся гапом на 90% вниз:

( Читать дальше )

- комментировать

- ★3

- Комментарии ( 5 )

Как Credit Suisse обманывали рынок, а обманули себя. (ETF, XIV). Банкротсво Credit Suisse?

- 09 февраля 2018, 18:31

- |

Как Credit Suisse обманывали рынок, а обманули себя.

Credit Suisse (CS) выпускали ETF под названием XIV, который реализовывал обратную волатильность, то есть это такая бумага, которая растет, когда волатильность S&P500 падает. Точнее, рос, потому что за последние несколько дней он обвалился. Обвал был до 20 раз.

( Читать дальше )

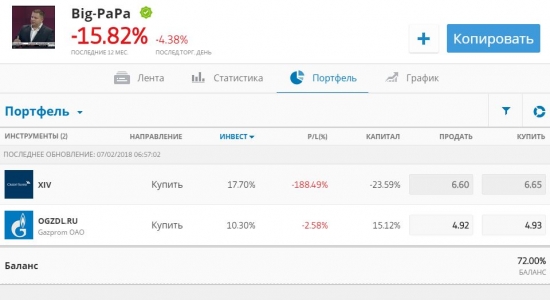

Сделки Гуру. Никогда не покупайте Индекс XIV на падениях рынка в 10%. Зеркальный сигнал.

- 07 февраля 2018, 18:07

- |

попробуем играть зеркально.

вороятно эта хрень наоборот падает, когда идут большие скачки в изменениях цен.

нужно делать всё наоборот?

История трейдера который потерял $4 млн. в понедельник на XIV.

- 07 февраля 2018, 14:46

- |

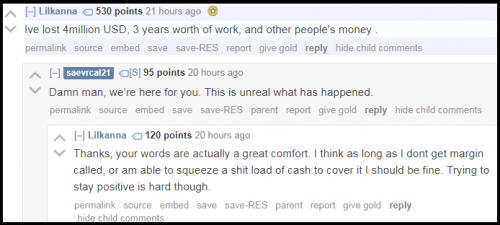

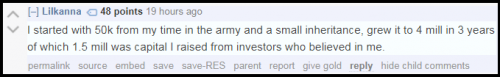

www.reddit.com/r/tradeXIV/?count=75&after=t3_7vi2jm

“1,5 миллиона — это капитал, который я привлек от инвесторов, поверивших в меня”, — пишет Lilkanna. “У меня была позиция с плечом. Я использовал “Day Trade Buying Power” (DTBP), чтобы совершать покупки, и мой счет сократился примерно до 1%, и я подумал, что смогу удержать позицию, зная, что дедлайн по пересмотру условий маржинального кредитования брокером наступит через 2 дня”.

( Читать дальше )

А вы говорите рынки эффективны... (про XIV termination)

- 06 февраля 2018, 23:31

- |

Сегодня, после 80+%-ного спайка VIX'а ночью, Credit Suisse терминейтнул XIV (если вы не понимаете, что это значит — ни в коем случае не суйтесь покупать). 21-го февраля владельцам одного контракта (которые вероятно покупали его за $100+) выплатят $4.22.

Какого рожна происходит в стакане — кто и с какой целью покупает его по ~$8???

XIV Торговля приостановлена

- 06 февраля 2018, 12:22

- |

WOW. The XIV, the VIX inverse ETF is totally BROKEN, down 80-90%. Termination/acceleration likelн

XIV is supposed to be the inverse of the VIX, the volatility index. However, the XIV is now down 90% after-hours. This is the first time an ETF will have triggered the termination, or “acceleration” clause in history. Insane. Something is clearly broken…

People buy this ETF when the market isn’t producing any volatility, which means a lot of people were in it for a long time because it was the smart trade, now you have to go back to a 8-ear chart just to see where the new low will be. Wow…never happened before, not even during the 2008 meltdown. A lot of people (aka hedge funds) will take a massive hit from this. Something is not right, there’s some kind of imbalance that is causing this. I’m sure a lot of folks are calling the SEC right now wondering what’s happening.

https://www.zerohedge.com/news/2018-02-05/it-traders-panic-xiv-disintegrates-after-close

( Читать дальше )

Live trading. Update. S&P500. У Трампа выбивают козыря.

- 30 января 2018, 21:49

- |

Ясно, что Трампа подставили и хотят закрыть DowJones -400. А может и -500 перед Tonight's speech State of The Union. 9pm ET

Outperformance Russell2000 тоже не заметно, тем не менее я продал IWM все по 158.07 (BOT 157.40 avg) и отобрался половину по 157.53 (этот лот уже в минусе) но ничего… беру еще по 156.45 (сегодня или завтра)

Update- 1.57 рм пока писал пост рынок пошел выше- свой лот скинул по 157.53 безубыток) За день в ++. На сегодня все.

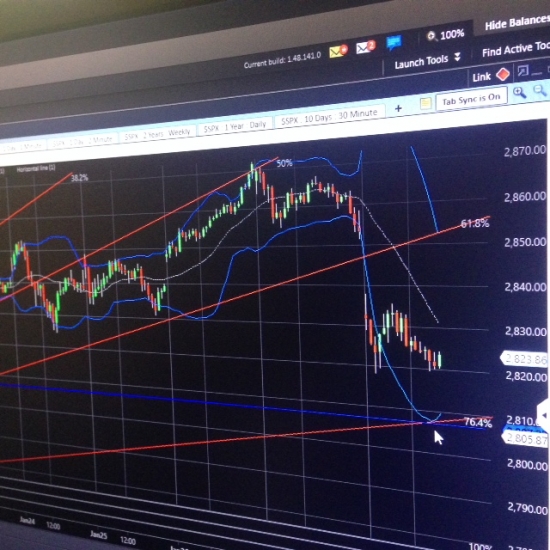

XIV 30min волатильность (short ETF )

S&P500 похоже идет на встречу Фибо 76.4% и нижней ленте Боллинжера. = 2810-2805

s&p 15min

( Читать дальше )

XIV

- 17 октября 2017, 10:13

- |

я удивляюсь как человек умеет находить такие инструменты, которые именно растут и самому становиться в другую сторону.

Такое впечатление он находит третьи волны и контртрендит их. Каааак?

Вопрос почему третьи? Да потому что находится в информационном поле и как предупреждал Демура (в руках с бокалом вискаря ) логистическая кривая это не хухры мухры.

Черпая информацию из интернета вы всегда будете в третьей .

Когда было видео про Норильск мне показалось что до человека НАКОНЕЦ!!! дошло и он поехал за инсайдерскими новоястями по ГМК чтоб быть в начале первой волны. Там все разведать и разнюхать

Как говорят «быть поближе к кухне» — ан нет.

Вот как это ?

Я например и думать не знал что существует xiv.

Симметрия рынка расскрывает стратегию Big Money. S&P500, XIV

- 16 октября 2017, 17:16

- |

Fibonacci numbers.

Masters of Money готовят психологически инвесторов к неминуемому.

Нет, не к краху, а к эйфории и желанию переводить средства из защитных активов в акции и прежде всего в NASDAQ.

Мне кажется, это очевидно для многих.

Но порой складывается впечатление, что работать мозгами ради достижения этих целей они уже не хотят. Победы расслабляют.

Все идет замечательно. Master Plan- гениален и работает сам собой.

Накануне я писал в своем блоге, что замечена удивительная симметрия в поведении XIV (short VIX ETF) в Июле и в Сентябре-Октябре.

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- алроса

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- золото

- инвестиции

- индекс мб

- инфляция

- китай

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- натуральный газ

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- юмор

- яндекс

Новости тг-канал

Новости тг-канал