SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Павел Дерябин

Мой Портфель для долгосрочных инвесторов, update

- 27 февраля 2018, 14:37

- |

Не прошло и 2х месяцев, а портфель для долгосрочных и пассивных инвесторов продолжает прибавлять!

Специально составленный для тех, кто ненавидит просадки в 5-10-20%, он избавляет от головной боли за сохранность средств и заставляет забыть о вложенных средствах, все будет в порядке

Yandex-Автоваз уже показали рост на 30%!

smart-lab.ru/q/watchlist/PavelDeryabin/2342/

Доходность уже больше 6%, максимальная просадка была 3% (с 5% доходности до 2%) в начале февраля на американской коррекции

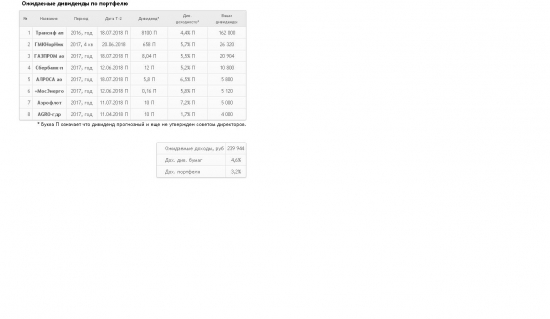

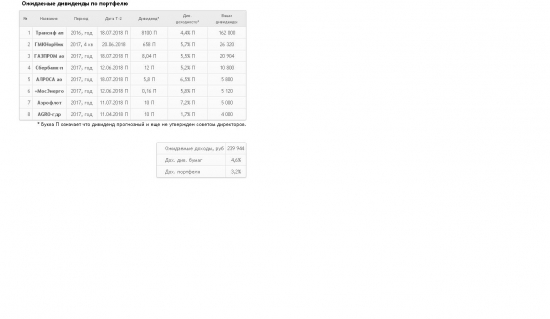

Ожидаются еще дивиденды летом:

( Читать дальше )

Специально составленный для тех, кто ненавидит просадки в 5-10-20%, он избавляет от головной боли за сохранность средств и заставляет забыть о вложенных средствах, все будет в порядке

Yandex-Автоваз уже показали рост на 30%!

smart-lab.ru/q/watchlist/PavelDeryabin/2342/

Доходность уже больше 6%, максимальная просадка была 3% (с 5% доходности до 2%) в начале февраля на американской коррекции

Ожидаются еще дивиденды летом:

( Читать дальше )

- комментировать

- Комментарии ( 6 )

Con-federation. Будьте осторожны, я проверил

- 21 февраля 2018, 16:24

- |

Утром был разбужен звонками из консалтинговой конторы Con-federation, посетил соответствующий сайт, задал вопросы.

Получается, что мой телефон кто то им слил. Есть подозрение, что кто то хакнул базу Атона и всего тамошнего Атона спейса.

Звонарь пожаловался на собственную малограмотность и честно сказал, что только начал работать.

Но уже успел предложить мне 15% гарантированной доходности в долларах и, в качестве подтверждения, заговорил об огромном недавном наваре на дивидендах СТарбакСа, который, по его инфо, заплатил сразу 5% дивидендов (хотя доходность у него 2,2% годовых)

Убедившись, что я профессионал, звонарь попросил меня закончить разговор

«Ну вы я вижу знаток… Я не могу с вами общаться...-Так а Вы только с незнайками общаетесь?-Ну не совсем...»

Вобщем, тут все ясно. Несите свои денежки в эту контору, их аналитики (один из них некто Михеев, выступал на РБК ТВ) все прямо таки правильно вам предложат.

Торгуют они вне юрисдикции РФ, вне законов РФ, куда смотрит прокуратора-не знаю. Я этих всех жуликов за версту чую. Нет лицензий, нет надзора от ЦБ РФ и просят денег… тут все ясно.

Будьте бдительны-империалистические хищники не дремлют. И ждут ваших денежек.

И да, забыл еще сказать, какой же ты урод и придурок, ты, который слил базу Атона. Дебил

Получается, что мой телефон кто то им слил. Есть подозрение, что кто то хакнул базу Атона и всего тамошнего Атона спейса.

Звонарь пожаловался на собственную малограмотность и честно сказал, что только начал работать.

Но уже успел предложить мне 15% гарантированной доходности в долларах и, в качестве подтверждения, заговорил об огромном недавном наваре на дивидендах СТарбакСа, который, по его инфо, заплатил сразу 5% дивидендов (хотя доходность у него 2,2% годовых)

Убедившись, что я профессионал, звонарь попросил меня закончить разговор

«Ну вы я вижу знаток… Я не могу с вами общаться...-Так а Вы только с незнайками общаетесь?-Ну не совсем...»

Вобщем, тут все ясно. Несите свои денежки в эту контору, их аналитики (один из них некто Михеев, выступал на РБК ТВ) все прямо таки правильно вам предложат.

Торгуют они вне юрисдикции РФ, вне законов РФ, куда смотрит прокуратора-не знаю. Я этих всех жуликов за версту чую. Нет лицензий, нет надзора от ЦБ РФ и просят денег… тут все ясно.

Будьте бдительны-империалистические хищники не дремлют. И ждут ваших денежек.

И да, забыл еще сказать, какой же ты урод и придурок, ты, который слил базу Атона. Дебил

Смартлаб может стать крутым

- 15 февраля 2018, 17:21

- |

И все мы можем в этом ему помочь.

Для чего это нужно? будет много новых лиц, новых опусов, а главное информации.

По рынку, по торговым идеям, по новым продуктам на рынке

Что для этого нужно?

Всего то в публичном пространстве упоминать, что вы пишите на Смартлабе.

Пошел на РБК ТВ? вскользь упомянул о смартлабе.

Постишь котиков на ФБ, в инстраграмме, в контакте? намекни на смартлаб

Решаешь проблемы на сайте знакомств? Укажи место работы Смартлаб

Через 3-4 года мы не узнаем ресурс.

Потеряли работу-ее можно будет найти через Смартлаб, не хватает денег на запись на семинары Ванюты-займи на смартлабе!

И самое главное. Среди посетителей ресурса много неудачников и нереализовавшихся личностей. Кто знает, может «клеймо смартлаба» поможет им решить свои проблемы

Для чего это нужно? будет много новых лиц, новых опусов, а главное информации.

По рынку, по торговым идеям, по новым продуктам на рынке

Что для этого нужно?

Всего то в публичном пространстве упоминать, что вы пишите на Смартлабе.

Пошел на РБК ТВ? вскользь упомянул о смартлабе.

Постишь котиков на ФБ, в инстраграмме, в контакте? намекни на смартлаб

Решаешь проблемы на сайте знакомств? Укажи место работы Смартлаб

Через 3-4 года мы не узнаем ресурс.

Потеряли работу-ее можно будет найти через Смартлаб, не хватает денег на запись на семинары Ванюты-займи на смартлабе!

И самое главное. Среди посетителей ресурса много неудачников и нереализовавшихся личностей. Кто знает, может «клеймо смартлаба» поможет им решить свои проблемы

ГМК Норникель. Срочно покупать

- 15 февраля 2018, 11:57

- |

Цены на металл никель резко выросли. Пробили 14000 долл за тонну.

Это шорты Ванюты загибаются, а не смартлаб

- 14 февраля 2018, 12:34

- |

Прочел опус Ванюты про загибание смартлаба. Толи было раньше! С его слов, в 2013г Смартлаб был крут. Скорее всего, на новом ресурсе было много молодежи, много раскрытых ртов, слушающих таких как Вася и Ванюта. Но, в отличие от этих персонажей, толпа не деградирует со временем. Она эволюционирует.

Сегодня ее уже не устраивают объяснения «я зарабатываю на растущем сбере в шорте...», «ну и что? 50% минус это просто неудачная ставка, я таких делаю миллион...» и т.п.

Толпе нужны всегда 2 вещи: хлеба (бесплатных халявных советов, где срубить бабла) и зрелищ (лоси со счетов Васи и Ванюты или взрыв волы).

К сожалению, клоуны тоже надоедают. Деградация налицо-никто не будет слушать человека, у которого нет эволюции знаний, мыслей, жизни. А все только один бубнеж про то, что он гуру и его измучили тролли.

Бубубубубубу

Смартлаб меняется в сторону качества, это тоже эволюция. Теперь количество постов от гуру уже не имеет значения, как раньше.

На финаме в свое время эту проблему клоуны решали так в свое время. Меняли ники.

( Читать дальше )

Сегодня ее уже не устраивают объяснения «я зарабатываю на растущем сбере в шорте...», «ну и что? 50% минус это просто неудачная ставка, я таких делаю миллион...» и т.п.

Толпе нужны всегда 2 вещи: хлеба (бесплатных халявных советов, где срубить бабла) и зрелищ (лоси со счетов Васи и Ванюты или взрыв волы).

К сожалению, клоуны тоже надоедают. Деградация налицо-никто не будет слушать человека, у которого нет эволюции знаний, мыслей, жизни. А все только один бубнеж про то, что он гуру и его измучили тролли.

Бубубубубубу

Смартлаб меняется в сторону качества, это тоже эволюция. Теперь количество постов от гуру уже не имеет значения, как раньше.

На финаме в свое время эту проблему клоуны решали так в свое время. Меняли ники.

( Читать дальше )

23ий и 24ый год на пути к 1 млрд долл

- 09 февраля 2018, 15:24

- |

Всем привет. Это столетие началось неплохо… не то как бабушка с прабабушкой миллионы закалачивали, но мне

хватит.

На инвестиционный счет феврале забросил еще 1 тыс.руб.

В рейтингах я почти везде отсутствую, потому что статистику на десятки лет никто не ведет-порталы разоряются быстрее, чем я успеваю заработать лишний доллар.

Иду медленно как черепаха к своей цели, соблюдаю меры предосторожности, чтобы кто то не узнал о моей цели и не украл последние 999 миллионов. Мне без разницы, вообще без разницы, как рынок живет и куда он идет. Моя цель меня согревает.

Да и капитализация Газпрома 1 трлн долл не за горами.

хватит.

На инвестиционный счет феврале забросил еще 1 тыс.руб.

В рейтингах я почти везде отсутствую, потому что статистику на десятки лет никто не ведет-порталы разоряются быстрее, чем я успеваю заработать лишний доллар.

Иду медленно как черепаха к своей цели, соблюдаю меры предосторожности, чтобы кто то не узнал о моей цели и не украл последние 999 миллионов. Мне без разницы, вообще без разницы, как рынок живет и куда он идет. Моя цель меня согревает.

Да и капитализация Газпрома 1 трлн долл не за горами.

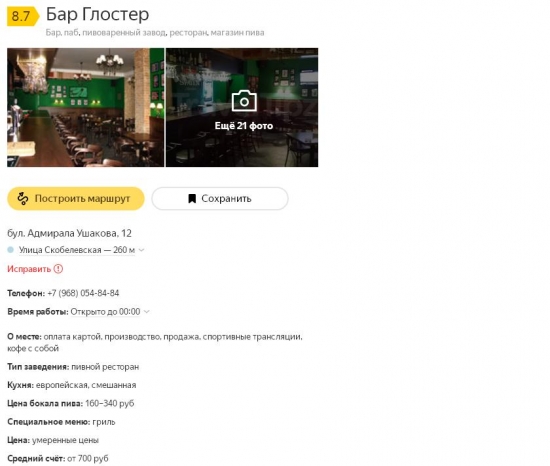

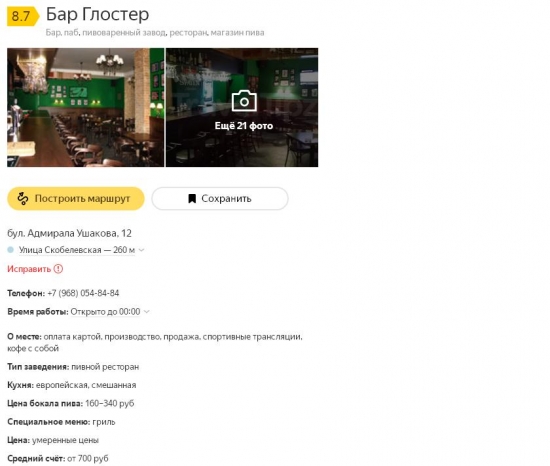

Туса на Южном Бутове. Всего 100 мест, торопитесь

- 07 февраля 2018, 17:03

- |

Серега Расточник тут придумал замутить тусню для удачливых трейдеров в Южном Бутове (всего в 35 км от центра Москвы) 25 февраля-1 марта. По слухам, билет в районе 100 руб + оплата лежака в подсобке бара. Не забудьте дезодоранты от блох.

Фейсконтроль. Вход по предъявлении рейтинга от 200 на смарт лабе.

Приехавшим на личном авто скидки, если согласятся отвезти тусовщиков по домам

Программа:

активное распитие пива.

активное поедание еды и инвестидей, как не слить счет

игра в снежки

торгующим опционами во время конференции специальный приз

Связаться с Серегой Расточником нельзя. Он шортит SP500 с 1994г

Фейсконтроль. Вход по предъявлении рейтинга от 200 на смарт лабе.

Приехавшим на личном авто скидки, если согласятся отвезти тусовщиков по домам

Программа:

активное распитие пива.

активное поедание еды и инвестидей, как не слить счет

игра в снежки

торгующим опционами во время конференции специальный приз

Связаться с Серегой Расточником нельзя. Он шортит SP500 с 1994г

Почему тебе никогда не звонил пьяный Василий по мобиле?

- 06 февраля 2018, 18:52

- |

Наверное, ты еще не дорос до его уровня, сынок. Вот когда сможешь объяснять, что при минусе 90% с деньгами расставаться легко-твой телефон обязательно зазвонит и на другом конце будет Василий.

Пока же сиди и не плачь над своими 3% минуса. Ты еще кроха… у тебя все впереди.

Не надо боятся рынка-из минус 90 он сделает вам как фокусник плюс 190… надо просто на правильное поле чудес ходить и жадничать свои сольдо

Пока же сиди и не плачь над своими 3% минуса. Ты еще кроха… у тебя все впереди.

Не надо боятся рынка-из минус 90 он сделает вам как фокусник плюс 190… надо просто на правильное поле чудес ходить и жадничать свои сольдо

теги блога Павел Дерябин

- AMZN

- Apple

- Brent

- DXY

- GTL

- herbalife

- IT Invest

- NASDAQ

- S&P500

- tesla

- tesla motors

- USA

- WTI

- акции

- американский рынок

- атон

- АФК Система

- баффет

- биотехнлогии

- Биотехнологии США

- биржа

- биткоин

- биток

- богатство

- брокеры

- бррррр

- Будушее

- будущее

- буль буль

- бум

- Ванюта

- Вася

- Вебенар

- вебинар

- война

- вопрос

- ВТБ

- Газпром

- ГМК НорНикель

- дивиденды

- Дно

- доллар

- Дональд Трамп

- Доу

- евро

- еда

- ЕЦБ

- загадка

- золото

- Иволга Капитал

- индекс доллара

- КАМАЗ

- Китай

- Кризиз

- кризис

- криптобиржа

- криптовалюта

- Лукойл

- медведев д.а

- Миллардеры

- нефть

- облигации

- опек+

- оффтоп

- прогноз

- Путин

- работа

- ралли

- РБК эфир

- РЖД

- Риски

- Роснефть

- рост

- РТС

- Рубль

- РУСАЛ

- РФ

- санкции

- сбербанк

- система

- смартлаб

- сургут преф

- Сургутнефтегаз

- сша

- торговые сигналы

- Трамп

- Транснефть

- трейдинг

- ужас

- УжасоПортфель

- Украина

- Уоррен Баффет

- уфа

- Финам

- форекс

- Фосагро

- ФСК Россети

- шорт

- Яндекс