Gold

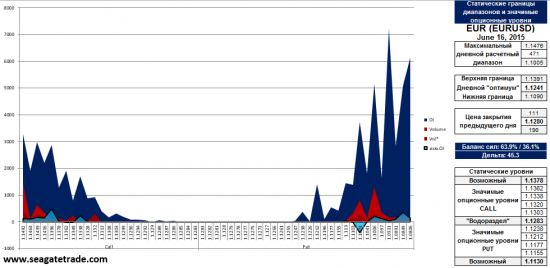

EURUSD... плачь, Европа...

- 16 июня 2015, 08:04

- |

:)))

Ожидание исполнения хотелок вниз, подкрепленнное даннными с рынка опционами на СМЕ

- комментировать

- Комментарии ( 4 )

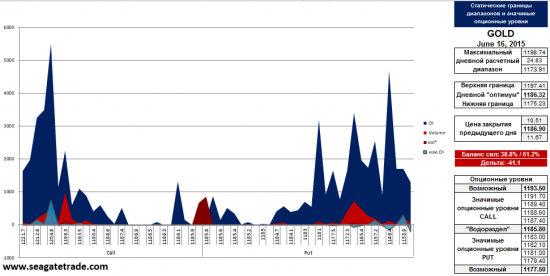

Золото. Рост неизбежен

- 16 июня 2015, 07:56

- |

но время резкого и стремительного роста ещё не пришло.

Золото продолжает свой расширенный флет в районе 1190,00

Золото. Стопы шорта ставим близко.

- 16 июня 2015, 07:17

- |

Буду искать (на откате) точку входа в лонг.

Появилась ли определенность в движении котировок золота? Я думаю -нет. Все тот же коридор шириной в «хороший слив депо», если неправильно «включить» манименеджмент.

Широкая пила, что хуже может быть для любых поз?

Картина на утро такова:

Как видно, четко «рисуются» поддержка на 1180 и два сопротивления на 1190 и 1200.

Сессия «богата» на новости как в первой так и во второй половине дня. Так что лучше воздержаться от каких либо предсказаний))).

Буду искать лонг если выбьет стоп, а не найдку (отката не будет) буду торговать контртренд краткосрочно и искать позу по тренду… если таковой все же «нарисуется».

А как дела у Вас?

P.S. Очень жаль что смарт лаб покинул пользователь Тихая Гавань. У него был довольно интересный стиль торговли, как по тактике, так и по количеству прибыльных сделок.

Дей Трейдерам 150615

- 15 июня 2015, 11:34

- |

Тот, кто указывает на твои недостатки, не всегда твой враг; тот, кто говорит о твоих достоинствах, не всегда твой друг.

...

..

Золото . И даже "проблемы Греции" не могут заставить расти....

- 15 июня 2015, 07:14

- |

Сегодня тоже стоит поторговать от шорта.

Ожидаемый всплеск на открытии -всего лишь отыгрыш проблем переговоров по гречесским долгам, нивелирован практически сразу.

Картина с утра такова:

Думаю, что мы останемся сегодня во флэте. Потому что новостей особо нет сегодня.

Скорей бы уже греков выгнали что ли? Порядком надоела эта тема.

А что думаете Вы?

Еженедельный видеообзор фин.рынков "Простая техника". EurUsd, GbpUsd, UsdRur, Gold, Oil, S&P500, RTS

- 15 июня 2015, 04:01

- |

Торговый план по фьючерсу на золото

- 12 июня 2015, 10:30

- |

Инструмент: GOLDU-6.15

Дата экспирации: 15.06.2015

Для удобства анализа взят график спотового золота.

В торговом плане от 9 июня 2015 года мы озвучили мнение, что золото начинает восстановление после затяжного четырёхлетнего падения и рекомендовали покупать его при пробое вверх уровня 1177,6$. Подъём выше этой отметки состоялся, и наш торговый план сейчас в действии. Он уже дал небольшую прибыль.

Добавим ещё несколько факторов, которые говорят в пользу начала большого роста.

На этом рисунке видно, что от исторического максимума 1921$ до дна первой медвежьей атаки рынок прошел столько же, сколько и впоследствии, когда падал до уровня 1132$. Следовательно, по теории уровней Фибоначчи мы имеем сильную поддержку на 1132$.

( Читать дальше )

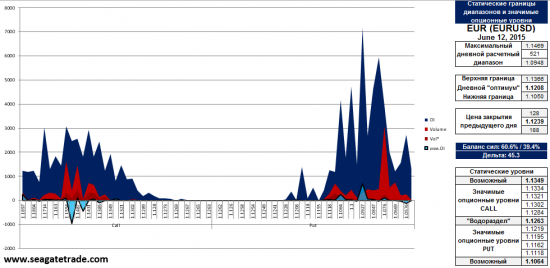

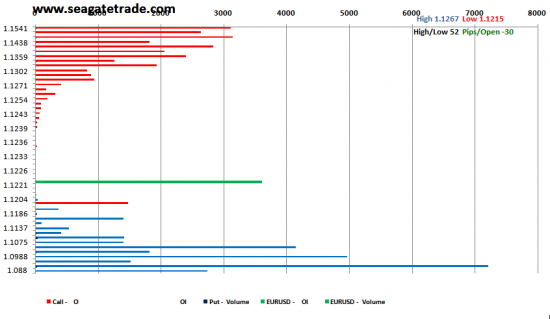

EURUSD ...

- 12 июня 2015, 09:45

- |

:)))

Динамические опционные уровни на текущий момент — обработка текущего состяния на торгах СМЕ

Июльские опционы (экспирация 02.07.2015)

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- алроса

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- золото

- инвестиции

- индекс мб

- инфляция

- китай

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- си

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- юмор

- яндекс

Новости тг-канал

Новости тг-канал