SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

cot отчеты

ПОВЕДЕНИЕ ЮРЛИЦ В ОСНОВНЫХ ВАЛЮТАХ

- 13 июня 2024, 12:05

- |

На фоне последних санкций возможна высокая волатильность валют. Сегоня рассмотрим, как Юридические лица встретили новости о запрете торговать USD/RUB, EUR/RUB и сказалось ли это на CNY/RUB.

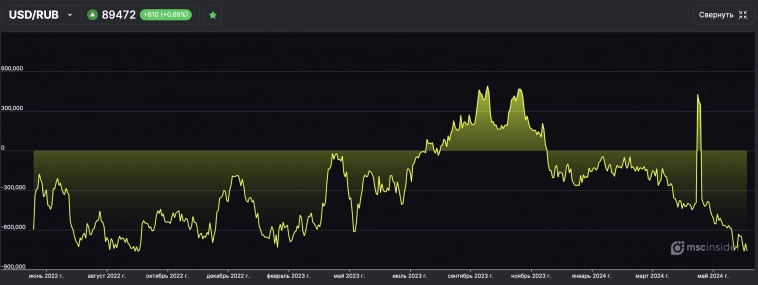

USD/RUB

С начала года Юридические лица активно наращивали шорт-позиции — нетто-покупки (чистые позиции, лонг — шорт) достигли минимальных значений за последние два года. (нетто-покупки usd)

EUR/RUB

Юрлица с начала года были склонны наращивать лонг позиции, нетто-покупки постепенно увеличивались, но глобально всё так же оставались в шорт-позициях.(eur)

( Читать дальше )

- комментировать

- ★3

- Комментарии ( 4 )

Юридические лица продолжают продавать Индекс Мосбиржи ! Отрицательный Рекорд !

- 03 июня 2024, 15:50

- |

Друзья, для начала хочу вам показать график чистых позиций юридических лиц фьючерса Индекса Мосбиржи. Чистые позиции — это разница покупок и продаж. На данный момент они на своем историческом минимуме, что означает что юрлица рекордно много продают и рекордно мало покупают Индекс ММВБ.

1) Чистые позиции юридических лиц по фьючерсу Индекса ММВБ с 2013 года

Юридические лица стали продавать индекс больше, чем покупать. Большие объемы покупки индекса 2023 года сошли на нет.

Можем ли мы визуализировать это как-то на цене? Давайте попробуем.

Зеленый цвет на цене — сильные покупки юрлиц

Красный цвет на цене — сильные продажи юрлиц

3) График цены с сигналами движения средств юрлиц

( Читать дальше )

1) Чистые позиции юридических лиц по фьючерсу Индекса ММВБ с 2013 года

Юридические лица стали продавать индекс больше, чем покупать. Большие объемы покупки индекса 2023 года сошли на нет.

Можем ли мы визуализировать это как-то на цене? Давайте попробуем.

Зеленый цвет на цене — сильные покупки юрлиц

Красный цвет на цене — сильные продажи юрлиц

3) График цены с сигналами движения средств юрлиц

( Читать дальше )

Юридические лица рекордно продают доллар ! Разбор

- 25 мая 2024, 14:10

- |

Друзья, давайте посмотрим на график продаж юридических лиц фьючерса доллара. На нем мы можем что юридические лица рекордно продают пару доллар/рубль на Мосбирже.

1) Продажи юридических лиц по фьючерсу доллара за год

График интересный, не так ли? Но давайте еще посмотрим на график чистых позиций. Чистые позиции или как их еще называют «нетто позиции», — это просто разница между покупками и продажами.

2)Чистые позиции юридических лиц по фьючерсу доллара за год

( Читать дальше )

1) Продажи юридических лиц по фьючерсу доллара за год

График интересный, не так ли? Но давайте еще посмотрим на график чистых позиций. Чистые позиции или как их еще называют «нетто позиции», — это просто разница между покупками и продажами.

2)Чистые позиции юридических лиц по фьючерсу доллара за год

( Читать дальше )

Юридические лица продают золото ! Разбор

- 24 мая 2024, 19:41

- |

Друзья, для начала хочу вам показать график покупок и продаж юридических лиц фьючерса золота. На нем мы можем заметить несколько вещей важных для нас.

1) Последние полгода покупок было больше чем продаж.

2) В последних неделях продаж стало больше чем покупок.

1) Покупки и продажи юридических лиц по фьючерсу золота за год

График выше недостаточно информативен. Лучше будет изменить график на разницу покупок и продаж (чистые позиции). Давайте посмотрим что получилось для наглядности.

2) Чистые позиции юридических лиц по фьючерсу золота за год

( Читать дальше )

1) Последние полгода покупок было больше чем продаж.

2) В последних неделях продаж стало больше чем покупок.

1) Покупки и продажи юридических лиц по фьючерсу золота за год

График выше недостаточно информативен. Лучше будет изменить график на разницу покупок и продаж (чистые позиции). Давайте посмотрим что получилось для наглядности.

2) Чистые позиции юридических лиц по фьючерсу золота за год

( Читать дальше )

Юридические лица встали в шорт в Индексе Мосбиржи ! Разбор

- 22 мая 2024, 11:47

- |

Друзья, для начала хочу вам показать график покупок и продаж юридических лиц фьючерса Индекса Мосбиржи. На нем мы можем заметить несколько вещей важных для нас.

1) Происходит беспрецедентная историческая активность в этом активе.

2) Покупок индекса было больше чем продаж с апреля 2023 года.

1) Покупки и продажи юридических лиц по фьючерсу Индекса ММВБ с 2020 года

С апреля 2023 года цена индекса Мосбиржи росла, весь рынок рос. Тем не менее, график выше недостаточно информативен. Лучше будет сделать и изменить график на разницу покупок и продаж (чистые позиции). Давайте посмотрим что получилось.

2) Чистые позиции юридических лиц по фьючерсу индекса ММВБ с 2020 года

( Читать дальше )

1) Происходит беспрецедентная историческая активность в этом активе.

2) Покупок индекса было больше чем продаж с апреля 2023 года.

1) Покупки и продажи юридических лиц по фьючерсу Индекса ММВБ с 2020 года

С апреля 2023 года цена индекса Мосбиржи росла, весь рынок рос. Тем не менее, график выше недостаточно информативен. Лучше будет сделать и изменить график на разницу покупок и продаж (чистые позиции). Давайте посмотрим что получилось.

2) Чистые позиции юридических лиц по фьючерсу индекса ММВБ с 2020 года

( Читать дальше )

Стратегия меньшинства ! Что будет если торговать как физики, но как меньшинство из них?

- 21 мая 2024, 00:07

- |

На бирже есть данные по покупкам и продажам физиков и юриков во фьючерсах. Появилась сегодня идея визуализировать что было бы, если бы мы торговали как физические лица, но как меньшинство из них? Если большинство физиков покупает, то мы продаем. Если большинство продает, то мы покупаем. Посмотрим на примере нефти.

Какие выводы мы можем сделать, глядя на этот график? Мы выделили на нем цветом когда меньшинство продавали, а когда покупали.

1) Меньшинство физиков в основном продают нефть, а большинство физиков покупают.

2) В целом стратегия ужасна, но есть пара интересных моментов в которых мы видим как меньшинство верно угадывает разворот и направление тренда.

Получилось интересно, но не думаю что из этого можно что-то построить.

Платформа использованная для анализа ,- mscinsider.com/

Ссылка на телеграмм канал, — t.me/MSCinsider

С уважением,

mscinsider

Какие выводы мы можем сделать, глядя на этот график? Мы выделили на нем цветом когда меньшинство продавали, а когда покупали.

1) Меньшинство физиков в основном продают нефть, а большинство физиков покупают.

2) В целом стратегия ужасна, но есть пара интересных моментов в которых мы видим как меньшинство верно угадывает разворот и направление тренда.

Получилось интересно, но не думаю что из этого можно что-то построить.

Платформа использованная для анализа ,- mscinsider.com/

Ссылка на телеграмм канал, — t.me/MSCinsider

С уважением,

mscinsider

Поведенческий анализ: Пример ПАО Русгидро

- 19 мая 2024, 19:52

- |

Я анализирую данные открытого интереса МосБиржи. По фьючерсам есть информация по продажам и покупкам юридических и физических лиц. Мы выяснили в недавних постах с помощью бэктеста, то что физические лица ошибаются чаще.

В качесте примера сегодня возьмем ПАО Русгидро. Смотреть позиции и получать анализ можно на платформе mscinsider.com

Зеленый цвет на цене — это сильное сокращение продаж или увеличение покупок. Покупаем актив.

Красный цвет на цене — это сильное сокращение покупок или увеличение продаж. Продаем актив.

Серый цвет на цене — нейтральное настроение юридических лиц. Выходим из актива.

1) Цена с сигналами юридических лиц по активу

2) Покупки и продажи юридических лиц по актвиу

( Читать дальше )

В качесте примера сегодня возьмем ПАО Русгидро. Смотреть позиции и получать анализ можно на платформе mscinsider.com

Зеленый цвет на цене — это сильное сокращение продаж или увеличение покупок. Покупаем актив.

Красный цвет на цене — это сильное сокращение покупок или увеличение продаж. Продаем актив.

Серый цвет на цене — нейтральное настроение юридических лиц. Выходим из актива.

1) Цена с сигналами юридических лиц по активу

2) Покупки и продажи юридических лиц по актвиу

( Читать дальше )

Поведенческий анализ: Есть ли польза для инвесторов ?

- 19 мая 2024, 19:37

- |

Я анализирую данные открытого интереса МосБиржи. По фьючерсам есть информация по продажам и покупкам юридических и физических лиц. Мы выяснили в недавних постах с помощью бэктеста, то что физические лица ошибаются чаще.

В качесте примера сегодня возьмем открытые позиции юридических лиц по фьючерсу акций РДР РУСАЛ. Ниже красным и зеленым цветом показаны продажи и покупки юридических лиц за последний год. Смотреть позиции и получать анализ можно на платформе mscinsider.com

1) Позиции юридических лиц во фьючерсе РДР РУСАЛ

Мы можем заметить, то что произошли сильные перемены под конец года. Резко увеличились покупки, а продажи сократились. Как это выглядит на цене ?

Зеленый цвет на цене — это сильное сокращение продаж или увеличение покупок. Покупаем актив.

Красный цвет на цене — это сильное сокращение покупок или увеличение продаж. Продаем актив.

Серый цвет на цене — нейтральное настроение юридических лиц. Выходим из актива.

2) Цена и сигналы юридических лиц во фьючерсе РДР РУСАЛ

( Читать дальше )

В качесте примера сегодня возьмем открытые позиции юридических лиц по фьючерсу акций РДР РУСАЛ. Ниже красным и зеленым цветом показаны продажи и покупки юридических лиц за последний год. Смотреть позиции и получать анализ можно на платформе mscinsider.com

1) Позиции юридических лиц во фьючерсе РДР РУСАЛ

Мы можем заметить, то что произошли сильные перемены под конец года. Резко увеличились покупки, а продажи сократились. Как это выглядит на цене ?

Зеленый цвет на цене — это сильное сокращение продаж или увеличение покупок. Покупаем актив.

Красный цвет на цене — это сильное сокращение покупок или увеличение продаж. Продаем актив.

Серый цвет на цене — нейтральное настроение юридических лиц. Выходим из актива.

2) Цена и сигналы юридических лиц во фьючерсе РДР РУСАЛ

( Читать дальше )

Что будет если торговать по открытому интересу Юридических или Физических лиц во фьючерсе НЕФТИ? Сравнение

- 28 апреля 2024, 11:45

- |

Есть открытые позиции юридических и физических лиц на МосБирже. Я решил что мало кто их глубоко анализировал,- они подаются в качестве ежедневного формата, они неудобные, непонятно что означают если не видишь всю историю их изменения. Сделаем анализ и проведем бэктест стратегии,- будем следовать большим позициям «лонг» и большим позициям «шорт» по очереди,- сначала юридических лиц, потом физических лиц.

Если собрать всю всю историю открытых позиций, сделать разницу лонг и шорт между друг-другом, то мы получим «чистые позиции». Это разница лонг и шорт позиций.

1) Чистые позиции юридических лиц по фьючерсу нефти

Чтобы уловить сильные изменения, — используем индикатор RSI на эти чистые позиции.

2) RSI на чистые позиции юридических лиц по фьючерсу нефти

( Читать дальше )

Если собрать всю всю историю открытых позиций, сделать разницу лонг и шорт между друг-другом, то мы получим «чистые позиции». Это разница лонг и шорт позиций.

1) Чистые позиции юридических лиц по фьючерсу нефти

Чтобы уловить сильные изменения, — используем индикатор RSI на эти чистые позиции.

2) RSI на чистые позиции юридических лиц по фьючерсу нефти

( Читать дальше )

Что будет если торговать по открытому интересу Юридических или Физических лиц во фьючерсе ЗОЛОТА? Сравнение

- 22 апреля 2024, 20:48

- |

Есть открытые позиции юридических и физических лиц на МосБирже. Я решил что мало кто их глубоко анализировал,- они подаются в качестве ежедневного формата, они неудобные, непонятно что означают если не видишь всю историю их изменения. Сделаем анализ и проведем бэктест стратегии,- будем следовать большим позициям «лонг» и большим позициям «шорт» по очереди,- сначала юридических лиц, потом физических лиц.

Если собрать всю всю историю открытых позиций, сделать разницу лонг и шорт между друг-другом, то мы получим «чистые позиции». Это разница лонг и шорт позиций.

1) Чистые позиции юридических лиц по фьючерсу золота

Чтобы уловить сильные изменения, — используем индикатор RSI на эти чистые позиции.

2) RSI на чистые позиции юридических лиц по фьючерсу золота

( Читать дальше )

Если собрать всю всю историю открытых позиций, сделать разницу лонг и шорт между друг-другом, то мы получим «чистые позиции». Это разница лонг и шорт позиций.

1) Чистые позиции юридических лиц по фьючерсу золота

Чтобы уловить сильные изменения, — используем индикатор RSI на эти чистые позиции.

2) RSI на чистые позиции юридических лиц по фьючерсу золота

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- алроса

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- золото

- инвестиции

- индекс мб

- инфляция

- китай

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- натуральный газ

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- юмор

- яндекс

Новости тг-канал

Новости тг-канал