Блог им. st-travich |⚡️ After a difficult week in Wheat (ZW), my attention is attracted to Corn (ZC)

- 17 сентября 2023, 22:17

- |

We have the ultimate bearish sentiment here. Just look at the imbalance in the volume of put options, which is twice as much as in calls. On Tuesday we got big trades in options block trades, Bid imbalance of order flow and so rejection. But on Friday the pressure of sellers continued to increase and we closed before the the last frontier.

As you remember, bid HFTs’ on the level of support means that with a high probability, it will be broken, as smart money and market makers more often sell in levels of support, than buy from them as we used to.

I assume that we will reach the 467,75 price level and touch all the liquidity that is concentrated under the demand zone. And I put my alert there. (Watch)

And only then the price will go to the upside, as hedgers are very active in buying wheat from trend-following hedge funds for such a cheap opportunity.

I am sure that we are on the verge of a big upside movement in grains, but it is impossible to provide it without the kicking of the passengers.

( Читать дальше )

- комментировать

- Комментарии ( 3 )

Блог им. st-travich |☝🏻 Today I want to highlight a Canadian dollar (6C)

- 27 августа 2023, 12:00

- |

Good day, traders!

Today I want to highlight a Canadian dollar (6C). On Friday, it closed above the strong volumetric and technical support according to the Daily chart. But hedge funds continue to accumulate their shorts. (Watch)

A large quantity of buyers are going to buy cheap. We see that call volumes are also more preferred. Moreover ask HFTt’s imbalance was created, but met a limit seller. (Watch)

I assume that despite the strong level of support we have more chances to break the level 0,7350 than to bounce from it. The target of the downside movement is at a 0,73 price level.

Have a nice week and a pleasant Sunday!

Блог им. st-travich |⚡️ ASK imbalances on currencies

- 09 июля 2023, 15:33

- |

Good evening traders ☀️

One week passed and today I see interesting ASK imbalances in such currencies as British Pound (6B), Canadian Dollar (6C), Mexican Peso (6M), and they can be realized as shorting opportunities during the next week. Also, I see BID imbalance and potential buying opportunity in Natural Gas (NG) if the price will fix above HFTs’.

I won’t take much time, I managed to talk about everything in 5 minutes

Блог им. st-travich |Sugar, Mexican peso and RWC final

- 04 июня 2023, 17:26

- |

Hello traders, hope you are doing well 👍

Today I see two opportunities in Sugar (SB) and the Mexican Peso (6M). Let's start with the second one.

● The last strong involvement of sellers in this asset was on level 0,05546$. It matches with the commercial level also, where hedgers added more than 20% of short contracts in the past.

Market maker absorbed this position and apparently unloaded it along the way to break out of market highs. (Watch)

Now all the passengers are liquidated and we are ready to take bearish 🐻 movement when the ice line will be broken.

● According to Sugar (SB) vice-versa I see the buying opportunity. 🦬

After the involvement of sellers created by bid HFT volumes on the market bottom and after the divergence of Deltas. If the bearish parabola will be broken on Monday, hope to see the movement to the 26$ price zone. (Watch)

( Читать дальше )

Блог им. st-travich |⚡️ Today observed all the assets, but exceptionally don’t see potential understandable scenarios 🤷♂️ Everything went on Thursday and Friday.

- 14 мая 2023, 20:13

- |

Good evening, traders!

Today observed all the assets, but exceptionally don’t see potential understandable scenarios 🤷♂️ Everything went on Thursday and Friday.

🔹 British pound this week showed us how amazing involvement in buys looks like. (Watch)

How long does it take for the pattern to be created and how quickly should a decision be made on it, — only 15 minutes after the formation of HFT volumes. So fast reaction from the market makers limit orders.

Our mind is rather inert and in good situations, he especially begins to hesitate “Can we wait a little more, maybe a little more to see what will be around the corner?” As a result, the next 15-minute candle already changes the risk-reward ratio by 2 times! Not in our favor...

An excellent quote by Linda Raschke fits here: “In trading, as in fencing, there are either quick or dead.”

Markets operations are based more on psychology than on fundamentals, says El Weiss in Jack Schwager's book “The New Market Wizards”. “Markets are completely based on human psychology, and by charting markets, you are only converting human psychology into graphical form.”

( Читать дальше )

Блог им. st-travich |Today I want to show you some interesting situations in the commodities market

- 16 апреля 2023, 18:38

- |

Good evening, dear traders!

Today I want to show you some interesting situations in the commodities market.

▪️ The previous week I spoke about Natural gas (NG) and we really saw a pullback after the HFT volumes. Such a picture was repeated on Friday after 2 days divergence of deltas, and for now, the potential of the uprising movement is even stronger.

We had stop-loss hunting and involvement cocktail which is the fuel for MM, hedge funds shorted 2 weeks in a row. Earlier everybody tried to buy this cheap asset, but the price couldn't go to the upside till this Bid imbalances. (Watch)

▪️ In Crude oil (CL) the market made several Ask imbalances, and for now, is ready to make a correction to the 80.5 price level. (Watch)

( Читать дальше )

Блог им. st-travich |⚡️ Today I want to justify about 3 interesting pictures on the futures market.

- 05 марта 2023, 22:02

- |

Good evening, traders! 👋

Today I want to justify about 3 interesting pictures on the futures market.

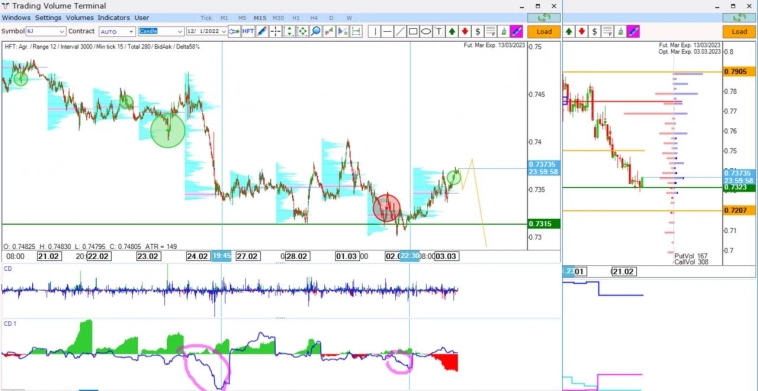

▪️ Japanese yen (6J) shows preparations to break the demand zone.

The quantitative cumulative delta was negative several times before the support. Bid HFTs were created near the level, and afterward, we can observe the involvement in buys. It is necessary to collect liquidity and then, break the demand level. If after the current Ask tick chain, the price stops growing it will be a good selling opportunity.

▪️ Brent Oil (BR) created a new uptrend line with the help of fast tick chains on it. Very often price return to such trendlines and break them.

( Читать дальше )

Блог им. st-travich |DXY is tired to rise + video

- 18 июля 2022, 03:25

- |

Good evening, Traders!

🔻 Let's start from the leader of markets — DXY. From the previous analysis, we have designated a key level 106.72 and the price did not brokedown this level even by 1 tick. It became a real growing point from the start of the week. On Friday the price closed on the uptrend line and after its breakdown, I expect to see correctional movement to this magnet. (See)

🔻 What about Gold (GC), I really expected that the price will go up from Tuesday's bottom, but the unbelievable record inflation in the USA created high volatility. Funds opened a record short position, and OI rose by 8% during the reported week. Now according to the big amount of ask HFTs here reversal is also rather possible. (See)

( Читать дальше )

Блог им. st-travich |СME Futures Analysis 26.06.2022 + video

- 26 июня 2022, 15:13

- |

🔻 In the previous analysis, we made a bet to follow shorts in Gold (GC), but for now, I see local buying opportunities according to the last HFTs’ bid imbalances. Ask delta on bid HFTs’ and close below this descending triangle is comfortable for bears but can be used by market makers to accumulate a bigger long position. For me the key level is volume level Feb21, if the price will break this level, it will be a bukkish signal for buyers. (See)

🔻 While if we look at Swiss frank (6S) it can still bounce back. As you remember I said if the price break this HFTs’ level, it will go down. It did not, but now the magnet zone is on the 1.025 price level. (See)

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- алроса

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- золото

- инвестиции

- индекс мб

- инфляция

- китай

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- си

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- юмор

- яндекс