SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

опционы

Здесь вы найдете самую полную в российском интернете коллекцию актуальных записей по торговле опционными контрактами, опционных стратегиях, вопросах по опционам.

Портфель разумного инвестора. Концепция долгосрочных инвестиций. Часть 3

- 03 ноября 2012, 15:41

- |

Начало тут

http://smart-lab.ru/blog/ideas/85545.php

http://smart-lab.ru/blog/ideas/85547.php

СИСТЕМА А.

Суммируя всю информацию — получаем следующий алгоритм:

( Читать дальше )

http://smart-lab.ru/blog/ideas/85545.php

http://smart-lab.ru/blog/ideas/85547.php

СИСТЕМА А.

Суммируя всю информацию — получаем следующий алгоритм:

- Производим отбор и составляем список акций пригодных для инвестиций, определяем «справедливую» стоимость, покупки возможны при «запасе прочности» равным 2 = стоимость/цена. Это самая сложная часть, но от нее будет зависеть – Ваш портфель будет лучше рынка или хуже. Пример Баффетта показывает, что «правильный» выбор компаний может значительно улучшить Ваши результаты в сравнении с рынком, и даже без использования «попутного ветра».

- Раз в месяц определяем «Индекс А». Если он ниже 85, то ждем. Ежемесячные сбережения направляем в депозиты. Кстати, вопрос СБЕРЕЖЕНИЙ очень важен, в этой статье никак не затронут. Но я факт сбережений опустил по умолчанию, так как, если Вам не оставили большого наследства, то сбережения делать нужно. Без сбережений нельзя будет делать инвестиции.

( Читать дальше )

- комментировать

- ★33

- Комментарии ( 0 )

Портфель разумного инвестора. Концепция долгосрочных инвестиций. Часть 2

- 03 ноября 2012, 15:38

- |

ЧТО ПОКУПАТЬ?

Выбор акций производится по методике определения справедливой стоимости (фундаментальный анализ) основанной на трудах Уоррена Баффетта и Бенджамена Грэхема (их книги «Эссе …» и «Разумный инвестор»).

Основные критерии при отборе компаний для начала оценки компаний:

— Лидерские позиции в своей отрасли, граничащие с монополизмом («незаменимый продукт»);

— Наличие широко известного бренда;

— Отличное руководство;

— Поступательное развитие компании – рост выручки, чистой прибыли и собственного капитала за последние 5 лет (отсутствие убытков);

— Капитализация компании не менее 200 млн. долл.

( Читать дальше )

Выпустят ли парня кто натарил 155 колов до экспиры?

- 01 ноября 2012, 17:49

- |

Выпустят ли парня кто натарил 155 колов до экспиры?

Trade idea: Sell WMB dec strangle P33 (1.025), C36(0.97), delta hedged (364 stocks)

- 31 октября 2012, 19:53

- |

Март-стратегический взгляд на маркет

- 31 октября 2012, 18:36

- |

безотносительно новостей и информации, за исключением ценовой:

аптренда больше нет

очень, вероятно, стоим в начале даунтренда

волатильность по индексу минимальная

сдается мне, волатильность сильно недооценена

волатильность сейчас в 2 раза ниже, чем 1 года назад

(использовал график индекса волатильности — вопрос опционщикам — а какая волатильность на самом деле??? И где ее посмотреть)

рынок наш подливают аккуратно, без шума и пыли

сдается мне мы близко от области, в которой плавное сползание может превратиться в довольно быстрый нырок со 140 на 130 (1-2 дня).

Такова сейчас рабочая гипотеза по рынку.

p.s. удобные графики на смартлабе: http://smart-lab.ru/g/

аптренда больше нет

очень, вероятно, стоим в начале даунтренда

волатильность по индексу минимальная

сдается мне, волатильность сильно недооценена

волатильность сейчас в 2 раза ниже, чем 1 года назад

(использовал график индекса волатильности — вопрос опционщикам — а какая волатильность на самом деле??? И где ее посмотреть)

рынок наш подливают аккуратно, без шума и пыли

сдается мне мы близко от области, в которой плавное сползание может превратиться в довольно быстрый нырок со 140 на 130 (1-2 дня).

Такова сейчас рабочая гипотеза по рынку.

p.s. удобные графики на смартлабе: http://smart-lab.ru/g/

Далекое эхо Margin

- 31 октября 2012, 17:41

- |

Обрастя некоторым количеством знаний, пытаюсь воспроизвести идеи известных тредеров (да простит меня margin:))

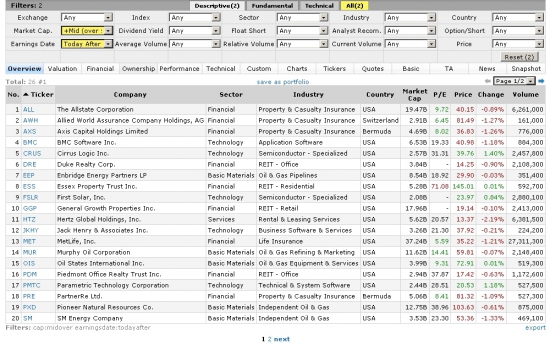

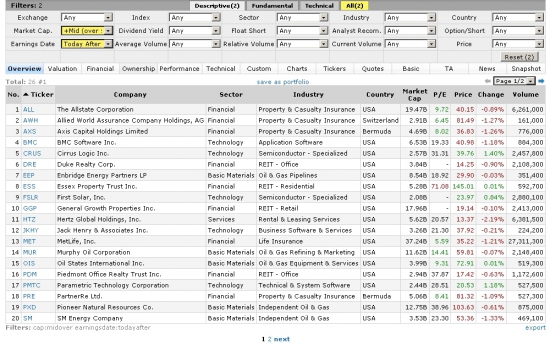

Итого, скринером ищем сегодняшние квартальные отчеты по американским стокам, имеющие заметную капиталлизацию.

По истории каждого инструмента выбираем те у которых наиболее распространен гэп на квартальных отчетах. По какойто причине мне больше всех понравился BMC(производитель ПО)

Смотрим график

( Читать дальше )

Итого, скринером ищем сегодняшние квартальные отчеты по американским стокам, имеющие заметную капиталлизацию.

По истории каждого инструмента выбираем те у которых наиболее распространен гэп на квартальных отчетах. По какойто причине мне больше всех понравился BMC(производитель ПО)

Смотрим график

( Читать дальше )

Опционы: легко и просто или ловушка?

- 31 октября 2012, 15:17

- |

Сейчас на фортс есть опционы на фьючерс ММВБ MIX-9.13M160913CA xxxxx со сроком экспирации 16.09.2013. Допустим, что Сегодня фьючерс на ммвб MXU3 торгуется по 139800 (т.е. со скидкой к индексу). Я пишу допустим, потому что в стакане нет маркетмейкера.

Получается, что я сейчас могу купить call и put опционы со страйком 140000 и держать их до 16.09.2013.

Если цена фьючерса MXU3 (MIX 9.2013) вырастет, например, 1 февраля 2013 до 160000, то я могу потребовать исполнить опционы по цене 140000.

( Читать дальше )

Получается, что я сейчас могу купить call и put опционы со страйком 140000 и держать их до 16.09.2013.

Если цена фьючерса MXU3 (MIX 9.2013) вырастет, например, 1 февраля 2013 до 160000, то я могу потребовать исполнить опционы по цене 140000.

( Читать дальше )

Что ждет позиции по уже открытым контрактам на индекс в процессе его замены?

- 31 октября 2012, 13:19

- |

— Проезжая через станцию и будучи голоден в рассуждении чего бы покушать я не мог найти постной пищи. Дьякон Духов.

— Лопай, что дают.

А.П.Чехов, Жалобная книга

В связи с началом расчета индексов Московской биржи 18.12.2012, о которой я писал ранее здесь, по новой методике произойдет, по сути, замена базисного актива по уже открытым позициям в срочных контрактах со сроками H3 (март 2013) и далее. Согласитесь, выглядит забавным, когда вы открыли позиции исходя из действующей спецификации, а затем она была изменена, и ваш фьючерс или опцион стал производной от цены уже совсем иного базисного актива. Предусмотрены ли такие изменения и каков порядок переноса старых позиций?

Ответ весьма прост и угадывается в действующих спецификациях, например п. 8.4 спецификации фьючерсного контракта на индекс РТС:

8.4. С момента вступления в силу изменений и дополнений в настоящую спецификацию условия существующих обязательств по ранее заключенным Контрактам считаются измененными с учетом таких изменений и дополнений.

Мило, не правда ли? Мы заменили базисный актив (по сути обязательства биржи по его расчету), но вы не волнуйтесь, все ваши обязательства остаются в силе. Одностороннее изменение условий договора или только у меня «кипит наш разум возмущенный»?

— Лопай, что дают.

А.П.Чехов, Жалобная книга

В связи с началом расчета индексов Московской биржи 18.12.2012, о которой я писал ранее здесь, по новой методике произойдет, по сути, замена базисного актива по уже открытым позициям в срочных контрактах со сроками H3 (март 2013) и далее. Согласитесь, выглядит забавным, когда вы открыли позиции исходя из действующей спецификации, а затем она была изменена, и ваш фьючерс или опцион стал производной от цены уже совсем иного базисного актива. Предусмотрены ли такие изменения и каков порядок переноса старых позиций?

Ответ весьма прост и угадывается в действующих спецификациях, например п. 8.4 спецификации фьючерсного контракта на индекс РТС:

8.4. С момента вступления в силу изменений и дополнений в настоящую спецификацию условия существующих обязательств по ранее заключенным Контрактам считаются измененными с учетом таких изменений и дополнений.

Мило, не правда ли? Мы заменили базисный актив (по сути обязательства биржи по его расчету), но вы не волнуйтесь, все ваши обязательства остаются в силе. Одностороннее изменение условий договора или только у меня «кипит наш разум возмущенный»?

крупные покупки 155-ых ноябрьских колов

- 30 октября 2012, 18:53

- |

Если ничего не путаю, то прошли крупные покупки 155-ых колов с ноябрьской экспирацией.

Волатильность конкретно на этом страйке сильно задрали вверх. Открытые позиции по этому страйку тоже сильно вырасли.

К чему бы это?)

Помогите вниз опустить волу… предлагаю продать его и купить 145-150-ые).

Волатильность конкретно на этом страйке сильно задрали вверх. Открытые позиции по этому страйку тоже сильно вырасли.

К чему бы это?)

Помогите вниз опустить волу… предлагаю продать его и купить 145-150-ые).

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- алроса

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- золото

- инвестиции

- индекс мб

- инфляция

- китай

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- си

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- юмор

- яндекс

Новости тг-канал

Новости тг-канал