COT

Высокий оптимизм Юрлиц в серебре

- 12 июля 2024, 09:30

- |

Для начала обратимся к чистым позициям в активе.

Чистые позиции — это разница покупок и продаж.

Если больше нуля, то покупок больше.

Если меньше нуля — больше продаж.

1) Чистые позиции Юридических лиц по фьючерсу серебра с января 2020.

Заметно, что Юридические лица начали наращивать чистые позиции — впервые за 4 года они превысили ноль, что говорит о превалирующих покупках и оптимизме Юридических лиц. Особенно это заметно по сравнению с июнем 2021 — ноябрём 2021, когда чистые позиции достигали исторически низких значений.

Тем не менее, этот график не дает полной картины. Чтобы уловить сильные изменения в чистых позициях, мы воспользуемся индикатором RSI.

( Читать дальше )

- комментировать

- ★1

- Комментарии ( 0 )

Юрлица рекордно скупают платину

- 10 июля 2024, 10:58

- |

Команда MSCinsider анализирует движения средств на рынке. На этой неделе мы хотим рассмотреть три металла, совершившие сильные скачки за последнее время. Начали мы в понедельник с золота, потом будет серебро, а сегодня — платина.

Для начала обратимся к чистым позициям в активе.

Чистые позиции — это разница покупок и продаж.

Если больше нуля, то покупок больше.

Если меньше нуля — больше продаж.

1) Чистые позиции Юридических лиц по фьючерсу платины с января 2020.

Здесь видно, что чистые позиции превышают все значения за 4 года. Это значит, что Юридические лица в большей степени смотрят на актив оптимистично. Особенно это заметно по сравнению с периодом начала 2020 — конца 2021, когда чистые позиции достигали исторически низких значений.

Тем не менее, этот график не дает полной картины. Чтобы уловить сильные изменения в чистых позициях, мы воспользуемся индикатором RSI.

2) График сигналов Юридических лиц по фьючерсу платины с июля 2023.

( Читать дальше )

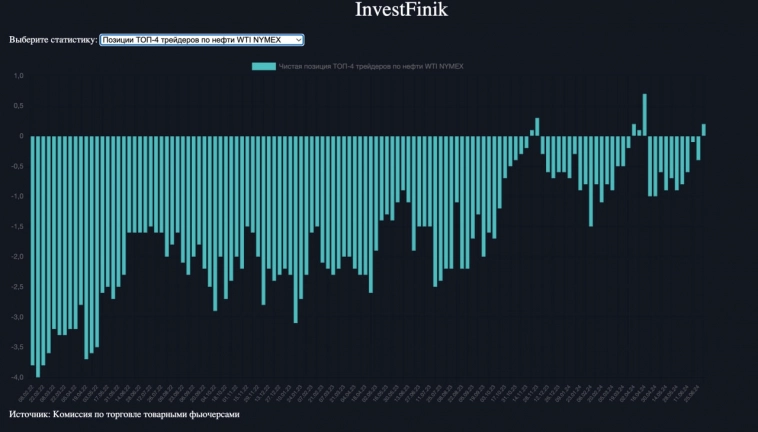

Крупные игроки перестали играть на понижение нефти

- 09 июля 2024, 10:39

- |

К 02 июля хедж-фонды увеличили чистые длинные позиции по нефти до 249,1 тыс. контрактов, чего не было с октября 2023 г.

Кроме того, ТОП-4 трейдера на NYMEX заняли нейтральную позицию по нефти и уже не ставят на падение котировок, как делали это в 2022 и 2023 гг.

Ссылка на пост

РЕКОРДНЫЙ ОПТИМИЗМ ЮРЛИЦ В ЗОЛОТЕ

- 08 июля 2024, 18:25

- |

Команда mscinsider анализирует движения средств на рынке. На этой неделе мы хотим рассмотреть три металла, совершившие сильные скачки за последнее время. Начнём мы с Золота, а дальше — серебро и платина.

Для начала обратимся к чистым позициям в активе.

Чистые позиции — это разница покупок и продаж.

Если больше нуля, то покупок больше.

Если меньше нуля — больше продаж.

1) Чистые позиции юридических лиц по фьючерсу золота с января 2020.

Здесь видно, что чистые позиции превышают все значения за 4 года. Это значит, что Юридические лица в большей степени смотрят на актив оптимистично, что подтверждается значительным ростом цены металла с начала года.

Тем не менее, этот график не дает нам полной картины. Чтобы уловить сильные изменения в чистых позициях, мы воспользуемся индикатором RSI по этим позициям.

2) График сигналов юридических лиц по фьючерсу золота с июля 2023.

Зелёный цвет — оптимизм юрлиц по активу

Красный цвет — пессимизм юрлиц по активу

( Читать дальше )

РЕКОРДНЫЕ ПРОДАЖИ ФИЗЛИЦ В ГАЗПРОМЕ. КАК МЕНЯЛОСЬ ПОВЕДЕНИЕ В ПОСЛЕДНИЕ 5 ЛЕТ?

- 28 июня 2024, 15:39

- |

Акционеры ПАО Газпром отказались выплачивать дивиденды за 2023 год. Сегодня мы разберём поведение физических лиц во фьючерсе компании за последние 5 лети что изменилось за последние месяцы.

Посмотрим на график лонг (длинных, покупных) и шорт (коротких, продающих) позиций за период с апреля 2019 по апрель 2024.

Как видно на графике, Физические лица почти всё время вставали в лонг-позиции, по объёму значительно превышая шорт. При этом, покупки и продажи за всё это время почти не приближались друг к другу, держа сильный разрыв. Лишь несколько раз продажи незначительно превысили покупки.

Однако, с начала 2024 года цена актива постепенно падала. В мае 2024 цена упала ещё сильнее. И только ближе к концу мая Физлица начинают наращивать объём продаж.

( Читать дальше )

ЮРИДИЧЕСКИЕ ЛИЦА И ЗОЛОТО. ЧТО ПРОИСХОДИТ?

- 27 июня 2024, 16:38

- |

Друзья, мы продолжаем изучать поведение игроков на российском рынке! Сегодня разбираем золото.

В золоте действительно интересная ситуация в плане сентимента.

🟡Желтый график — это разница покупок и продаж юридических лиц (чистые позиции). Как можно увидеть на графике, длинных позиций больше, чем коротких.

🟣Фиолетовый график — это разница количества лиц, держащих покупные и продажные позиции. Как можно увидеть на графике, юридических лиц, стоящих в позициях шорт больше,чем лиц,стоящих в лонг!

( Читать дальше )

АКЦИИ И ОБЛИГАЦИИ. ЧТО ДЕЛАЮТ ЮРЛИЦА И ФИЗЛИЦА В ТРЁХ ОСНОВНЫХ ИНДЕКСАХ МБ?

- 26 июня 2024, 14:58

- |

Друзья, мы команда MSCinsider и мы анализируем открытый интерес на российском рынке. Сегодня разбираем три основных Индекса на Московской Бирже: ММВБ, РТС и ОФЗ (RGBI) — и поведение Юридических и Физических лиц по отношению к ним.

Открытый интерес — внимание участников рынка к активу, желание вкладываться в него и как-либо взаимодействовать с ним.

ИНДЕКС ММВБ

Сначала рассмотрим количество лонг (покупных) и шорт (продажных) позиций.

Ввиду экспирации, открытый интерес упал до значений марта 2024, перед сильным ростом ОИ. С начала марта по середину мая шёл рост Индекса.

При этом, с начала года настроение Юрлиц постепенно сменялось на пессимистичное, что видно на графике чистых позиций.

Чистые позиции — разница между количество лонг и шорт договоров. Положительное значение может указывать на оптимизм во фьючерсе, а отрицательное — на пессимизм. В пике чистые позиции достигли исторического минимума.

( Читать дальше )

ЗОЛОТО У ЮРЛИЦ. ПОВЕДЕНИЕ С 2022 ГОДА

- 20 июня 2024, 16:58

- |

Сегодня мы рассматриваем особенности открытого интереса Юридических лиц во фьючерсе золота. Сначала посмотрим на открытые позиции.

1) График позиций.

Зелёная линия — лонг-позиции (покупка и ожидание роста);

Оранжевая линия — шорт-позиции (продажа и ожидание падения).

За последний год замечен рост открытого интереса, а сейчас количество покупок близится к рекордным за три года. Но наиболее показательным будет следующий график — чистых позиций,разницы лонг и шорт.

2) График чистых позиций.

( Читать дальше )

EUR/RUB У ЮРЛИЦ. ЧТО ИЗМЕНИЛОСЬ?

- 18 июня 2024, 10:55

- |

Друзья, это команда MSCinsider. Мы исследуем открытый интерес участников на российском рынке. Сегодня мы разбираем, какие изменения произошли во фьючерсе EUR/RUB c 12 июня.

На бирже юридические и физические лица могут покупать и продавать во фьючерсах. Чистые позиции — это разница между покупками и продажами у юридических или физических лиц.

С начала 2024 у юрлиц был тренд на повышение чистых позиций, относительно 2023 года — медленно росли покупки. 17 июня резко упало количество шорт-позиций, из-за чегочистые позиции приблизились к нулевой отметке — одной из немногих с 2022 года.

С таким сокращением продающих позиций, на падении цены фьючерса вышел сигнал об оптимизме юрлиц.

( Читать дальше )

USD/RUB У ЮРЛИЦ. ПОМЕНЯЛОСЬ ЛИ СООТНОШЕНИЕ?

- 17 июня 2024, 17:47

- |

Друзья, мы анализируем открытый интерес на российском рынке. Сегодня мы разберём USD/RUB и его изменение после введённых санкций.

На бирже есть покупки и продажи физических и юридических лиц во фьючерсах. Чистые позиции — это разница покупок и продаж юридических или физических лиц.

Юридические лица продолжают держать чистые позиции на рекордно низких значениях за два года. Значительное падение началось в начале 2024 и за пару месяцев чистые позиции сравнялись со значениями сентября 2022.

При этом видно — с начала года тренд Юридических лиц держался на продажу фьючерса доллара. Иногда — редкие моменты покупок.

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- алроса

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- золото

- инвестиции

- индекс мб

- инфляция

- китай

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- натуральный газ

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- юмор

- яндекс

Новости тг-канал

Новости тг-канал