SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

контанго

Указующий перст не подвёл!

- 30 апреля 2020, 11:48

- |

Спасибо Кукл!

Благодаря этому указателю удалось перепрыгнуть в следующий контракт с минимальным разрывом 70 центов.

Да, шортистики, у меня сложная синтетическая позиция, в которую входит лонг по нефти, мне всё-равно куда она пойдёт, вся проблема только в контанго. Одной проблемой меньше.

Благодаря этому указателю удалось перепрыгнуть в следующий контракт с минимальным разрывом 70 центов.

Да, шортистики, у меня сложная синтетическая позиция, в которую входит лонг по нефти, мне всё-равно куда она пойдёт, вся проблема только в контанго. Одной проблемой меньше.

- комментировать

- ★1

- Комментарии ( 5 )

Инвест-идея на нефть для простых людей

- 24 апреля 2020, 18:22

- |

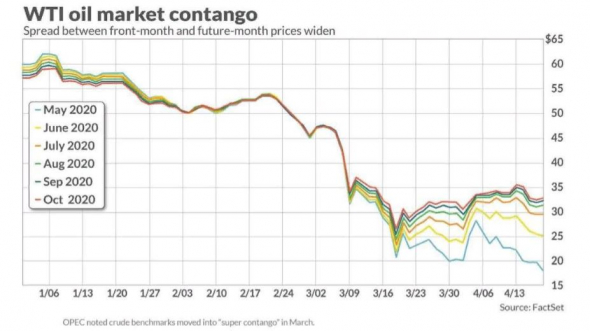

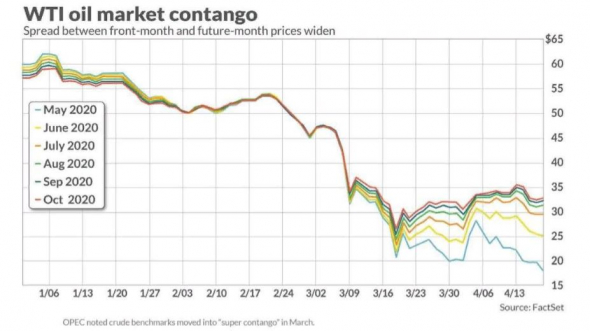

Нефтяной рынок преподнес много сюрпризов даже тем кто долго торгует на этом рынке. Впервые нефть торговалась по отрицательным ценам, что привело к убыткам у многих инвесторов, которые не могли себе представить такие события.

Такая ситуация создает не рыночные условия, которые можно использовать для получения прибыли с низким риском.

Сейчас я говорю о контанго(это разница цен между поставками на нефть)

в стандартных условиях разница составляет около 0.5-1$.

( Читать дальше )

Такая ситуация создает не рыночные условия, которые можно использовать для получения прибыли с низким риском.

Сейчас я говорю о контанго(это разница цен между поставками на нефть)

в стандартных условиях разница составляет около 0.5-1$.

Сейчас картина другая, контанго между июнем и августом достигал значение в 15$.

Профессиональные трейдеры могут использовать опционы, календарные фьючерсные спреды. Но все это требует навыков и возможных управлений позицией такие как ролловер и т.д.

Однако есть способ заработать на контанго простому инвестору, без особых усилий.

Для этого нужно купить фонд на нефть USO — который в структуре имеет ближайшие фьючерсы и соответственно подвержен контанго и продать USL — фонд который имеет 12 фьючерсов и малое влияние контанго.

Таким образом, можно заработать именно на контанго.

( Читать дальше )

Нефть BRENT. Рынок Смотрит Вверх. Нефтяное Бикини.

- 21 апреля 2020, 12:08

- |

Да-да. И это не шутки.

Кто-то постарается плюнуть в меня, кто-то чихать на меня хотел. Без маски.

Милые Девушки даже захотят дать мне. В смысле, в морду… В смысле, в мою...

Дорогие мои, это сейчас расценивается как покушение. Не надо...

Почему я так написал? А вот почему.

Давайте посмотрим на цены фьючерсов Брента по месяцам. Данные — с сайта Мосбиржи.

Что видим? Правильно. Чёткое, устойчивое контанго!

Мой Любимый Проницательный Читатель давно знает:

Цены на разные серии выстраиваются так, чтобы трейдеру, стоящему в ПРАВИЛЬНОМ направлении, было МАКСИМАЛЬНО НЕВЫГОДНО перекладываться из контракта в контракт с целью удержания долгосрочной позиции.

Это говорит о том, что истинный рынок уверен В ДОЛГОСРОЧНОМ РОСТЕ.

( Читать дальше )

С "козлами" не играю или как я хотел спекульнуть на нефти!))))

- 20 апреля 2020, 11:06

- |

Наблюдая за колебанием нефти и информационным шумом, появилось мнение, что я знаю куда пойдет нефть в долгосрочном плане, решил, а не закупиться ли мне сырьем в долгую. Загрузил фьючерсные контракты с 5 месяца по 12, посмотрел на контанго и сказал НЕТ, НЕТ и НЕТ!) В эту лотерею очень тяжело выиграть, реальные пацаны нефтью спекулируют, покупают танкерами, а их издержки за хранение должен оплачивать я, выступая контрагентом по их хеджу. Нет уж! Забыл про нефть. Хочешь по взрослому спекулировать нефтью и золотом, то нужно покупать физическое золото и нефть, а так развод на ровном месте. Очень редко заходил на рынок расчетных фьючерсов и опционов, сегодня зашел и лишний раз убедился, что в таком виде он вообще не нужен, и брокер может смело меня от него отключать из за отсутствия квалификации, необходимой для ЦБ. Как тут не переделать песенку Шнура- С козлами я не играю, нефть я на Московской бирже не покупаю!)))

Где купить нефть без затрат на Контанго?

- 18 апреля 2020, 00:09

- |

Где купить нефть без затрат на Контанго?

ПЛЮСАНИТЕ! !!!

ПЛЮСАНИТЕ! !!!

Как суперюрики двигают рынки

- 17 апреля 2020, 19:08

- |

Американский фонд инвестирющий в нефтяные фьючерсы, получив миллиарды новых денег от инвесторов в свой ETF, в погоне за низкой стоимостью WTI, перекладывается в последющие контракты, и добивает еле дышащий фьючерс близко к его экспирации, заодно генерирует заголовки по обновлению минимумов прошлого века.

U.S. Oil Fund to Move Giant WTI Position as Market Sours

By Alex Longley and Javier Blas

(Bloomberg) — The $3.8 billion U.S. Oil Fund, which

accounts for nearly 25% of all outstanding contracts in the

most-traded West Texas Intermediate crude futures, said it will

alter some of its position, citing market and regulatory

conditions.

The exchange-traded fund, which normally holds WTI futures

for the nearest month, will now move 20% of its contracts to the

second-traded month. The change takes effect today and will be

in place until further notice, it said in a filing with the U.S.

Securities and Exchange Commission.

The shift, announced late on Thursday, coincided with sharp

movements in the price relationship between the June and July

WTI contracts, traders said.

“As a result of these changes, USO may not be able to meet

its investment objective,” according to the filing.

As of Thursday the fund held almost 150,000 June Nymex WTI

contracts, which is more than a quarter of the total

( Читать дальше )

Почему нефть может перейти к росту

- 02 апреля 2020, 18:52

- |

Продолжаем тему календарных спредов. Пост 1 и Пост 2

Сегодняшнее заявление Трампа вызвало рост нефти, что привело к резкому снижению величины спреда

Это месячный спред, снижение сегодня на 35%

А это 9-месячный c наложенной на него ценой нефти (левая шкала). Прямая зависимость между ростом цены нефти и снижением спреда и наоборот.

( Читать дальше )

Сегодняшнее заявление Трампа вызвало рост нефти, что привело к резкому снижению величины спреда

Это месячный спред, снижение сегодня на 35%

А это 9-месячный c наложенной на него ценой нефти (левая шкала). Прямая зависимость между ростом цены нефти и снижением спреда и наоборот.

( Читать дальше )

Контанго в нефти и рубль

- 26 марта 2020, 21:21

- |

На данный момент контанго в нефти 28,60-26,37=2,23, а это 8%.

Схлопнится ли контанго к 1 апреля?

Если нет, то рубль может укрепится на 8%, а это 6 рублей, от текущих будет 72

Схлопнится ли контанго к 1 апреля?

Если нет, то рубль может укрепится на 8%, а это 6 рублей, от текущих будет 72

Споры о календарном спреде в нефти

- 10 сентября 2019, 10:18

- |

Тут споры разыгрались о спреде в нефте, а точнее о том, что дескать наблюдающаяся бэквордация в стоимости нефтяных контрактов Brent на Московской Бирже свидетельствует о неминуемом падении цен на нефть. Ну если было бы так, то было бы совсем всё просто))

Я давно и много писал на эту тему на Смарт-лабе. Слежу за спредом уже более 5 лет. Чётких сигналов он не даёт — не грааль! Но как фильтр ложных предположений работает отлично. На самом деле более важно резкое изменение величины спреда, а не его фактическое значение.

Прежде чем вникать стоит определиться с понятиями. На Рынке принято считать спред так (ближайший контракт — дальний контракт). Я например привык считать его наоборот (дальний-ближний), так исторически сложилось у меня потому-что сперва я тоже переоценивал важность контанго/бэквордации. При таком (не совсем правильном) расчёте всё просто, когда дальний контракт дороже, то мы получаем положительное число — то есть контанго, и наоборот. Подробнее об этом можно прочитать вот

( Читать дальше )

Я давно и много писал на эту тему на Смарт-лабе. Слежу за спредом уже более 5 лет. Чётких сигналов он не даёт — не грааль! Но как фильтр ложных предположений работает отлично. На самом деле более важно резкое изменение величины спреда, а не его фактическое значение.

Прежде чем вникать стоит определиться с понятиями. На Рынке принято считать спред так (ближайший контракт — дальний контракт). Я например привык считать его наоборот (дальний-ближний), так исторически сложилось у меня потому-что сперва я тоже переоценивал важность контанго/бэквордации. При таком (не совсем правильном) расчёте всё просто, когда дальний контракт дороже, то мы получаем положительное число — то есть контанго, и наоборот. Подробнее об этом можно прочитать вот

( Читать дальше )

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- алроса

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- золото

- инвестиции

- индекс мб

- инфляция

- китай

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- натуральный газ

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- юмор

- яндекс

Новости тг-канал

Новости тг-канал