3-НДФЛ

Инвестиционный НАЛОГОВЫЙ ВЫЧЕТ / З-НДФЛ / Возврат налога онлайн - пошаговая инструкция

- 24 января 2022, 11:08

- |

Друзья, всем привет.

Вот и пришло время заполнять декларацию З-НДФЛ, чтобы получить инвестиционный налоговый вычет. Показываю пошагово всю инструкцию от входа в личный кабинет ФНС до отправки документов. Также оговариваю какие именно документы необходимы для получения налогового вычета, в том числе по иностранным акциям. Самый подробный кейс по налоговому вычету.

- комментировать

- ★6

- Комментарии ( 4 )

Как я декларацию за 2021 год подавал

- 19 января 2022, 13:01

- |

Ух, на этот раз было чуть сложнее, чем обычно. Это ежегодный пост-инструкция о том, как я подал декларацию для получения вычета по ИИС, а также для передачи сведений о полученных доходах за рубежом — дивидендов от иностранных компаний.

Пост за прошлый год на смарт-лабе: smart-lab.ru/blog/670409.php

Подавал через официальный сайт налоговой. Там надо найти раздел Жизненные ситуации — Подать декларацию 3-НДФЛ. Почему это в жизненных ситуациях — не спрашивайте. Сам не понимаю.

( Читать дальше )

Получение вычета по ИИС тип А в 2022 году

- 13 января 2022, 12:28

- |

Наступил 2022 год, а это значит, что самое время позаботиться о возврате вычетов, которые нам полагаются по закону.

Сегодня подробно разберем вопрос о том, как получить вычет по ИИС тип А по новой упрощенной схеме, которая заработала с 2022 года, а также через заполнение формы 3-НДФЛ.

( Читать дальше )

Разъяснение от ФНС: обязательно подавайте убыточную декларацию

- 08 сентября 2021, 16:47

- |

Год назад мы уже писали здесь про обязательность подачи убыточной декларации для инвесторов. Но тогда возникли споры о трактовке кодекса, и даже некоторые профессионалы рынка заявляли о ненужности подачи убыточной 3-НДФЛ.

Наш налоговый консультант 2 ранга из команды НДФЛ Гуру решил поставить точку в спорах, сделав запрос в налоговую службу с целью прояснить данный вопрос.

Отметим, что речь пойдет в основном для инвесторов зарубежных брокеров типа Interactive Brokers, Exante или Freedom Finance (Белиз, Кипр).

Официальное разъяснение ФНС

Прикладываем ответ налоговой службы:

( Читать дальше )

Про возврат НДФЛ при наличии сальдированных убытков

- 02 июля 2021, 07:45

- |

Схема заполнения 3-НДФЛ, описаная тут https://smart-lab.ru/blog/681923.php, работает.

НДФЛ уже вернули.

Обзор фичи будущей версии Investbook 2021.5

- 27 мая 2021, 23:38

- |

1. Таблица "Срочный рынок" отображает доходность (вариационную маржу) по каждому контракту за каждый день владения.

2. Таблица "Портфель" отображает суммированную вариационную маржу по каждому срочному контракту, например доход по Si-3.21 = итого 1000 руб, Si-6.21 = итого 500 руб без разбивки по дням, с учетом текущей котировки.

В версии 2021.5 добавляется новая таблица «Портфель трейдера», которая будет отображает прибыль, полученную по группе контрактов, например всех фьючерсов и опционов Si с любой датой экспирации.

Таблица показывает итоговую прибыль и полезна, если вы:

— используете опционные стратегии, например стрэддл, стрэнгл и др., составленные из нескольких контрактов одной группы;

— переносите позицию из экспирируемого контракта в следующий контракт, например из Si-6.21 в Si-9.21;

( Читать дальше )

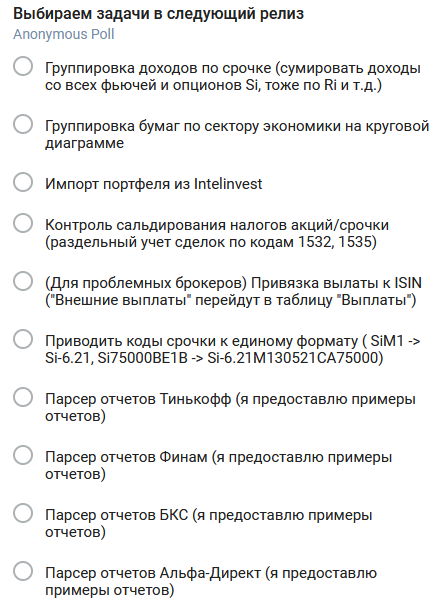

Investbook. Голосование на фичи следующего релиза

- 04 мая 2021, 14:28

- |

Прямо сейчас и до ближайших выходных проводится общее собрание пользователей. На собрании обсуждаются функционал, который пользователи хотели бы видеть в следующей версии приложения. Вы можете поучаствовать и предложить свои фичи, участвовать в развитии продукта «под себя». Функционал будет выбран посредством голосования. Все, включая разработчиков, имеют равные голоса.

Ссылка на голосование.

Топ запрошенных инвесторами тем

Релиз журнала сделок Investbook 2021.4.1

- 04 мая 2021, 01:01

- |

— Исправлено отображение «Доходности, %» валютных активов в таблице Портфель.

— ВТБ Брокер: доработан парсер Активов (учтены вариации в формате отчета брокера).

— Уралсиб Брокер: для долларовых облигаций исправлено сохранение котировок.

Подробнее о возможностях.

Ссылка на GitHub для скачивания установщика/апдейтера.

Страница софта на Smartlab.

Telegram чат технической поддержки.

Investbook — это локальное (десктопное) бесплатное приложение для ведение журнала сделок с возможностью парсинга отчетов брокера (альтернатива ручному внесению сделок в журнал). Поддерживаются парсеры отчетов брокеров ВТБ, ПСБ, Уралсиб, Сбербанк по остальным брокерам сделки можно вводить вручную.

InterActiveBrokers, дивиденды: готовим данные для налоговой декларации 3НДФЛ

- 26 апреля 2021, 11:45

- |

Для тех счастливчиков, кто получал дивиденды через InterActiveBrokers и немного знаком с Python, выкладываю несколько строк кода, который приведет (почти) данные из Activity-Annual этого брокера в вид, дружелюбный для переноса в российскую декларацию.

# -*- coding: utf-16 -*-

import os

import pandas as pd

import xml.etree.ElementTree as et

import lxml.html as lh

import numpy as np

#%%

path_curencies_rates = os.path.join('..//', 'Market_Data')# folder where data is kept

# RUB against USD and EUR

rub_USD_2020 = 'USD_RUB_exchange_rate_20200101-20201231.xlsx'

rub_EUR_2020 = 'EUR_RUB_exchange_rate_20200101-20201231.xlsx'

# dataframe where indicies are dates of 2020 and columns are rates RUB_USD and RUB_EUR

# all dates of 2020

dates = pd.date_range(start='1/1/2020', end='12/31/2020')

rub_currencies_rates = pd.DataFrame(index=dates, columns=['EUR', 'USD'])

# USD

df_rub_USD_CBRF = pd.read_excel(os.path.join(path_curencies_rates, rub_USD_2020), index_col=1)

df_rub_USD_CBRF = df_rub_USD_CBRF[['curs']]

# EUR

df_rub_EUR_CBRF = pd.read_excel(os.path.join(path_curencies_rates, rub_EUR_2020), index_col=1)

df_rub_EUR_CBRF = df_rub_EUR_CBRF[['curs']]

rub_currencies_rates.USD = df_rub_USD_CBRF.curs

rub_currencies_rates.EUR = df_rub_EUR_CBRF.curs

# fill empty dates

rub_currencies_rates.EUR = pd.DataFrame.ffill(rub_currencies_rates.EUR)

rub_currencies_rates.USD = pd.DataFrame.ffill(rub_currencies_rates.USD)

<br /><br />#%%

annual_activity_statement = 'Activity-Annual_2020_2020.htm'

table_name = 'Dividends' # table that contains dividends only

report_full = lh.parse(annual_activity_statement)

parent = report_full.xpath(".//div[contains(text(), '{}')]".format(table_name))[0].getnext()

element = parent.getchildren()[0].getchildren()[0]

html = et.tostring(element)

div_df = pd.read_html(html)[0]

div_df.Amount = pd.to_numeric(div_df.Amount, errors='coerce')

div_df.Date = pd.to_datetime(div_df.Date, errors='coerce').dt.date

div_df = div_df.dropna(subset=['Date'])

div_df = div_df[div_df.Amount.notnull()]

# If nominated in EUR, taxation was NOT applyed

div_df['Currency'] = np.where(div_df.Description.str.contains('EUR'), 'EUR', 'USD')

div_df['Taxes_paid'] = np.where(div_df.Description.str.contains('EUR'), 0, (div_df.Amount*0.1).round(decimals=2))

eur_rub_dict = rub_currencies_rates.EUR.to_dict()

usd_rub_dict = rub_currencies_rates.USD.to_dict()

# eur_rub_dict

div_EUR = div_df[div_df.Currency=='EUR']

div_EUR['rate_RUB'] = div_EUR['Date'].map(eur_rub_dict)

div_USD = div_df[div_df.Currency=='USD']

div_USD['rate_RUB'] = 0

div_USD['rate_RUB'] = div_USD['Date'].map(usd_rub_dict)#rub_currencies_rates.USD

div_total = pd.concat([div_EUR, div_USD], axis=0)

div_total['RUS_tax'] = div_total.Amount * 0.13

div_total['Taxes_TO_pay'] = ((div_total.RUS_tax - div_total.Taxes_paid) * div_total.rate_RUB).round(decimals=2)

div_total.Taxes_TO_pay.sum().round(decimals=1)

div_total.Description = div_total.Description.str.split(' Cash').str[0]

for i, d in div_total.Date.iteritems():

ds = d.strftime('%d.%m.%Y')

div_total.at[i, 'Date'] = ds

#%%

# To fill in field `'ОКСМ'` of Rus Tax Form ISIN will be used,

# it consists of two alphabetic characters, which are the ISO 3166-1 alpha-2 code for the issuing country.

# DataBase is `'country_ISO_codes.csv'`

country_codes = pd.read_csv('country_ISO_codes.csv')

country_codes = dict(zip(country_codes['alpha-2'], country_codes['country-code']))

def assign_country_code(name, country_codes):

'''

Returns a country numeric ICO code.

Two first symbols of ISIN represent Country ISO-3166 Alpha Code.

Parameters:

name : string, field Description from IBKR report;

country_codes : dictionary, keys are ISO Alpha Codes, values are corresponding ISO Num Codes.

'''

if '(' and ')' in name:

start = name.find('(') + 1

end = name.find(')')

isin = name[start : end]

country_Alpha_code = isin[0:2]

try:

country_Num_code = country_codes[country_Alpha_code]

except Exception as e:

country_Num_code = name

return country_Num_code

return name

div_total['Country_Num_Code'] = div_total['Description'].apply(assign_country_code, country_codes=country_codes)

#%%

# get all attributes of Rus Tax Form as a list

path_to_form = 'Tax_form_2020_draft_20210419.xml'

tree = et.parse(path_to_form)

root = tree.getroot()

for el in root.iter('ДоходИстИно'):

for child in el[0:1]:

attributes_Rus_Tax_Form = list(child.attrib.keys())

# DataFrame Rus Tax Form with indices from div_total

df_rus_tax_form = pd.DataFrame(index=div_total.index, columns=attributes_Rus_Tax_Form)

# fill all fields in with data from corresponing columns

# do some calculations as well

df_rus_tax_form['ОКСМ'] = div_total.Country_Num_Code

df_rus_tax_form['НаимИстДох'] = div_total.Description

df_rus_tax_form['КодВалют'] = np.where(div_total.Currency=='EUR', '978', '840')

df_rus_tax_form['КодВидДох'] = '22' # check it out

df_rus_tax_form['КурсВалютДох'] = div_total.rate_RUB

df_rus_tax_form['ДатаДох'] = div_total.Date

df_rus_tax_form['ДатаУплНал'] = div_total.Date

df_rus_tax_form['ДоходИноВал'] = div_total.Amount

df_rus_tax_form['ДоходИноРуб'] = (df_rus_tax_form['ДоходИноВал'] * df_rus_tax_form['КурсВалютДох']).round(decimals=2)

df_rus_tax_form['КурсВалютНал'] = div_total.rate_RUB

df_rus_tax_form['НалУплИноВал'] = div_total.Taxes_paid

df_rus_tax_form['НалУплИноРуб'] = (df_rus_tax_form['НалУплИноВал'] * df_rus_tax_form['КурсВалютДох']).round(decimals=2)

df_rus_tax_form['НалЗачРФОбщ'] = (df_rus_tax_form['ДоходИноРуб'] * 0.13).astype(int)

df_rus_tax_form['НалогЗачРФОбщ'] = df_rus_tax_form['НалУплИноРуб'].astype(int)

# all data in a xml-object should be str

form_to_export = df_rus_tax_form.applymap(str)

# create a root

income_abroad = et.Element('ДоходИстИно')

tree = et.ElementTree(income_abroad)

# add children with a relevant tag

# each child has attributes that is a dict representing a row from DataFrame

for i, r in form_to_export.iterrows():

d = r.to_dict()

et.SubElement(income_abroad, tag='РасчДохНалИно', attrib=d)

tree.write('rus_tax_form_experiment.xml', encoding='WINDOWS-1251')

Файлы USD_RUB_exchange_rate_20200101-20201231.xlsx EUR_RUB_exchange_rate_20200101-20201231.xlsxможно скачать с сайта ЦБ.

Tax_form_2020_draft_20210419.xml — моя 3-НДФЛ, сохраненная из налогового личного кабинета.

country_ISO_codes.csv — коды стран, файлом могу поделиться.

За критику и правки буду благодарен.

- bitcoin

- brent

- eurusd

- forex

- gbpusd

- gold

- imoex

- ipo

- nasdaq

- nyse

- rts

- s&p500

- si

- usdrub

- wti

- акции

- алготрейдинг

- алроса

- аналитика

- аэрофлот

- банки

- биржа

- биткоин

- брокеры

- валюта

- вдо

- волновой анализ

- волны эллиотта

- вопрос

- втб

- газ

- газпром

- гмк норникель

- дивиденды

- доллар

- доллар рубль

- евро

- золото

- инвестиции

- индекс мб

- инфляция

- китай

- кризис

- криптовалюта

- лукойл

- магнит

- ммвб

- мобильный пост

- мосбиржа

- московская биржа

- мтс

- натуральный газ

- нефть

- новатэк

- новости

- обзор рынка

- облигации

- опрос

- опционы

- отчеты мсфо

- офз

- оффтоп

- прогноз

- прогноз по акциям

- путин

- раскрытие информации

- ри

- роснефть

- россия

- ртс

- рубль

- рынки

- рынок

- санкции

- сбер

- сбербанк

- северсталь

- сигналы

- смартлаб

- сущфакты

- сша

- технический анализ

- торговля

- торговые роботы

- торговые сигналы

- трамп

- трейдинг

- украина

- фондовый рынок

- форекс

- фрс

- фьючерс

- фьючерс mix

- фьючерс ртс

- фьючерсы

- цб

- цб рф

- экономика

- юмор

- яндекс

Новости тг-канал

Новости тг-канал